Stocks Making Biggest Moves Premarket: Yamana, Credit Suisse, Unilever & More

Stocks making the biggest moves premarket yamana gold credit suisse unilever and more – Stocks making the biggest moves premarket: Yamana Gold, Credit Suisse, Unilever, and more – these names are grabbing headlines this morning, signaling a volatile start to the trading day. The pre-market session is often a harbinger of what’s to come, and today’s early action is sending ripples across various sectors.

From the surging gold mining sector to the troubled waters of banking, the pre-market movers are painting a picture of a market grappling with diverse challenges and opportunities.

As we delve into the details of these specific stocks, we’ll uncover the driving forces behind their dramatic movements, explore the implications for their respective industries, and gain insights into the broader market trends that are shaping the early hours of trading.

Pre-Market Movers

The pre-market trading session is off to a lively start, with several stocks making significant moves. These early shifts can provide insights into the potential direction of the market and highlight companies that are attracting investor attention.

Top Pre-Market Movers

The following stocks are experiencing notable price changes in pre-market trading:

- Yamana Gold (AUY): The gold mining company is surging in pre-market trading, up over 10%. This jump follows the announcement of a merger agreement with Gold Fields, a move that could create a global gold giant. The deal, expected to be finalized in the second half of 2023, aims to unlock value for shareholders and streamline operations.

This positive development is driving investor enthusiasm, leading to the stock’s significant pre-market gains.

- Credit Suisse (CS): The embattled Swiss bank is facing a challenging period, and its stock is down sharply in pre-market trading. This decline reflects ongoing concerns about the bank’s financial stability and the impact of recent scandals. Investors are closely monitoring the situation, and the stock’s pre-market performance suggests a cautious outlook.

- Unilever (UL): The consumer goods giant is experiencing a mixed bag in pre-market trading, with its stock trading slightly down. This minor dip comes after the company announced its full-year results, which included a modest increase in sales but a decline in profit.

While Unilever remains a major player in the consumer goods sector, investors appear to be taking a wait-and-see approach, leading to the stock’s muted pre-market performance.

Yamana Gold

Yamana Gold, a leading gold mining company, saw a significant surge in its stock price during the pre-market trading session. This move likely stems from a combination of factors, including recent news and market sentiment surrounding the gold sector.

Factors Influencing Yamana Gold’s Stock Price Surge

The recent surge in Yamana Gold’s stock price can be attributed to several factors.

- Strong Q2 2023 Earnings:Yamana Gold reported strong second-quarter earnings, exceeding analysts’ expectations. The company’s revenue and earnings per share (EPS) surpassed estimates, signaling positive financial performance and investor confidence.

- Increased Gold Prices:Gold prices have been on an upward trajectory recently, driven by factors such as inflation, geopolitical uncertainty, and safe-haven demand. This upward trend in gold prices benefits gold mining companies like Yamana Gold, as their revenue is directly tied to the price of gold.

- Positive Market Sentiment:The broader market sentiment towards gold mining companies has been positive, fueled by the increasing demand for gold as a safe-haven asset. This sentiment has likely contributed to the surge in Yamana Gold’s stock price.

Impact on Yamana Gold’s Future Prospects

The recent surge in Yamana Gold’s stock price reflects a positive outlook on the company’s future prospects. The strong Q2 2023 earnings demonstrate the company’s ability to generate revenue and profits in a challenging economic environment. Moreover, the ongoing upward trend in gold prices presents a favorable environment for gold mining companies like Yamana Gold.

Comparison with Other Gold Mining Companies, Stocks making the biggest moves premarket yamana gold credit suisse unilever and more

Compared to other gold mining companies, Yamana Gold’s recent performance has been relatively strong. The company’s strong earnings and positive market sentiment have positioned it favorably within the sector. However, it’s important to note that the gold mining industry is cyclical, and future performance can be influenced by various factors, including global economic conditions and the price of gold.

Credit Suisse

Credit Suisse, a global financial institution, has been facing a series of challenges in recent years, leading to a significant decline in its stock price. The bank’s struggles have raised concerns about its financial stability and the potential implications for the broader financial system.

Current Challenges Faced by Credit Suisse

The current challenges faced by Credit Suisse can be categorized into several key areas:

- Financial Losses and Legal Issues:Credit Suisse has incurred substantial financial losses in recent years due to a combination of factors, including investments in Archegos Capital Management and Greensill Capital. The bank has also faced numerous legal investigations and settlements related to alleged misconduct and regulatory breaches.

It’s been a wild ride for the markets lately, with pre-market moves on stocks like Yamana Gold, Credit Suisse, and Unilever making headlines. While those big names grab the attention, it’s important to remember the impact on the smaller players, especially tech startups navigating these uncertain times.

For insights on how to navigate this volatile landscape, check out this insightful interview with Madrona’s Tim Porter on wild times for tech startups making sense of the uncertainty with madronas tim porter. Whether it’s the big players or the startups, the market’s volatility makes it clear that staying informed is more crucial than ever.

These losses and legal issues have significantly eroded investor confidence and impacted the bank’s profitability.

- Reputation Damage:The scandals and legal issues surrounding Credit Suisse have tarnished its reputation, making it difficult to attract and retain clients, particularly high-net-worth individuals and institutional investors. The bank’s reputation for ethical conduct and risk management has been severely damaged, making it challenging to rebuild trust with its stakeholders.

- Capital Adequacy and Liquidity Concerns:Despite recent efforts to raise capital, Credit Suisse’s capital adequacy remains a concern, particularly given the bank’s exposure to risky assets and the potential for further losses. The bank’s liquidity position has also been under scrutiny, raising concerns about its ability to meet short-term obligations.

- Regulatory Pressure:Credit Suisse faces intense regulatory scrutiny and pressure from authorities worldwide. The bank is subject to numerous investigations and regulatory actions related to its past conduct, which has increased its compliance costs and potential liabilities.

Potential Strategies to Address the Crisis

Credit Suisse has implemented a number of strategies to address its challenges, including:

- Restructuring and Cost-Cutting:The bank has embarked on a major restructuring effort, including job cuts and asset sales, to reduce costs and improve efficiency. This strategy aims to streamline operations, enhance profitability, and improve its financial position.

- Strengthening Risk Management:Credit Suisse has taken steps to strengthen its risk management framework, including hiring new executives and implementing stricter controls. The bank is also seeking to reduce its exposure to risky assets and improve its overall risk profile.

- Building Trust and Reputation:Credit Suisse is focused on rebuilding trust with its clients and stakeholders. This includes engaging in open communication, addressing past misconduct, and demonstrating a commitment to ethical conduct and compliance.

- Capital Raising:The bank has raised capital through various means, including share sales and debt issuance, to strengthen its financial position and reduce its dependence on external funding. These capital-raising efforts aim to provide the bank with a stronger financial foundation to weather future challenges.

Long-Term Implications of the Crisis

The crisis at Credit Suisse has had a significant impact on the bank’s financial stability and its long-term prospects. The bank’s reputation has been severely damaged, and it faces significant challenges in regaining investor confidence. The crisis has also raised concerns about the bank’s ability to compete effectively in the global financial services industry.The long-term implications of the crisis will depend on the effectiveness of Credit Suisse’s restructuring efforts and its ability to rebuild trust with its stakeholders.

The market’s been a rollercoaster lately, with stocks like Yamana Gold, Credit Suisse, and Unilever making headlines. It’s easy to get caught up in the drama, especially when you feel like you’ve been wronged by a particular investment. But remember, it’s important to stay grounded and focused on your long-term goals.

Sometimes, the best approach is to learn from your mistakes and move forward. If you’re struggling with the emotional side of investing, check out this insightful article on how to stay right when you’ve been wronged. It might offer some valuable perspectives to help you navigate these turbulent times.

Ultimately, the market will always have its ups and downs, but staying focused on your strategy and keeping a cool head can help you ride the waves.

If the bank can successfully address its challenges and restore its reputation, it may be able to regain its position as a leading global financial institution. However, if the crisis continues to escalate, Credit Suisse may face further challenges, including potential regulatory action or even a takeover by another financial institution.

Unilever

Unilever, a multinational consumer goods giant, has been making headlines in the pre-market, with its stock experiencing notable movement. The company’s diverse portfolio spans a wide range of products, including food, beverages, personal care, and home care items. To understand the driving forces behind Unilever’s pre-market performance, we need to delve into its recent financial performance, key business segments, and the factors influencing its stock movement.

Unilever’s Recent Financial Performance

Unilever’s recent financial performance has been marked by both positive and challenging aspects. In its latest earnings report, the company reported a revenue increase, indicating strong demand for its products. However, the company also faced headwinds from rising input costs and supply chain disruptions, impacting profitability.

Factors Contributing to Unilever’s Pre-Market Stock Movement

Several factors could be contributing to Unilever’s pre-market stock movement. These include:

- Recent Earnings Report:The release of Unilever’s latest earnings report, with its revenue growth and profitability challenges, could be influencing investor sentiment and driving stock movement.

- Market Conditions:Overall market conditions, including investor appetite for consumer staples stocks, could be playing a role in Unilever’s stock performance.

- Strategic Initiatives:Unilever’s ongoing strategic initiatives, such as its focus on sustainability and its efforts to streamline its portfolio, could be perceived by investors as positive or negative, influencing stock movement.

Unilever’s Future Growth Prospects

Unilever’s future growth prospects depend on several factors, including:

- Consumer Demand:The company’s ability to cater to evolving consumer preferences and demand for its products will be crucial for future growth.

- Innovation and Product Development:Unilever’s success in developing innovative products and adapting to changing consumer trends will be critical for maintaining its market share and driving growth.

- Cost Management:Effectively managing costs, including raw materials, manufacturing, and distribution, will be essential for profitability and sustainable growth.

Unilever’s Competitive Landscape

Unilever operates in a highly competitive landscape, facing competition from both large multinational companies and smaller, niche players. Key competitors include:

- Procter & Gamble:A major player in consumer goods, offering a wide range of products that overlap with Unilever’s portfolio.

- Nestle:A global food and beverage giant, competing with Unilever in areas such as coffee, chocolate, and infant nutrition.

- Colgate-Palmolive:A leading oral care and personal care company, directly competing with Unilever in these segments.

Market Trends

The pre-market movements of stocks like Yamana Gold, Credit Suisse, and Unilever are often influenced by a confluence of factors, including broader market trends, economic indicators, geopolitical events, and investor sentiment. Understanding these drivers is crucial for investors seeking to navigate the pre-market session effectively.

Economic Indicators

Economic indicators play a significant role in shaping market sentiment and influencing stock prices. For example, the release of strong economic data, such as a positive GDP report or a decline in unemployment, can boost investor confidence and lead to a rise in stock prices.

Conversely, weak economic data can trigger a sell-off as investors become more cautious.

- Inflation Data:Inflation data, such as the Consumer Price Index (CPI) and the Producer Price Index (PPI), are closely watched by investors. High inflation can lead to concerns about rising interest rates, which can dampen economic growth and negatively impact stock prices.

- Interest Rate Decisions:Central bank decisions on interest rates also have a major impact on stock markets. When central banks raise interest rates, it becomes more expensive for businesses to borrow money, which can slow down economic activity and potentially lead to a decline in stock prices.

It’s a wild morning in the stock market, with Yamana Gold, Credit Suisse, and Unilever making big moves pre-market. This kind of volatility makes me think about the “bad vibes economy,” a term coined to describe the current market sentiment.

With so much uncertainty swirling around, it’s no surprise to see investors reacting quickly to any news, big or small. It’ll be interesting to see how these stocks perform throughout the day, and whether the “bad vibes” continue to linger.

- Employment Data:Job creation and unemployment figures are important indicators of economic health. Strong employment data typically suggests a robust economy, which can support stock prices. Conversely, weak employment data can raise concerns about economic growth and potentially lead to a decline in stock prices.

Investor Perspective

The pre-market movements of Yamana Gold, Credit Suisse, and Unilever reflect a dynamic interplay of investor sentiment and market forces. Understanding the factors driving these movements is crucial for investors seeking to capitalize on potential opportunities or mitigate risks.

Investor Sentiment and Stock Prices

Investor sentiment plays a pivotal role in shaping stock prices. Positive sentiment, driven by factors such as strong earnings reports, favorable industry trends, or positive news announcements, can lead to increased demand for a stock, pushing its price higher. Conversely, negative sentiment, fueled by concerns about a company’s financial performance, regulatory issues, or unfavorable market conditions, can lead to decreased demand and lower stock prices.

“Investor sentiment is a powerful force in the stock market, often driving short-term price fluctuations.”

Impact of Investor Actions

Investors’ actions, driven by their sentiment, have a direct impact on stock prices. When investors are optimistic about a company’s future prospects, they are more likely to buy its stock, increasing demand and driving the price higher. Conversely, when investors are pessimistic, they may sell their shares, decreasing demand and pushing the price down.

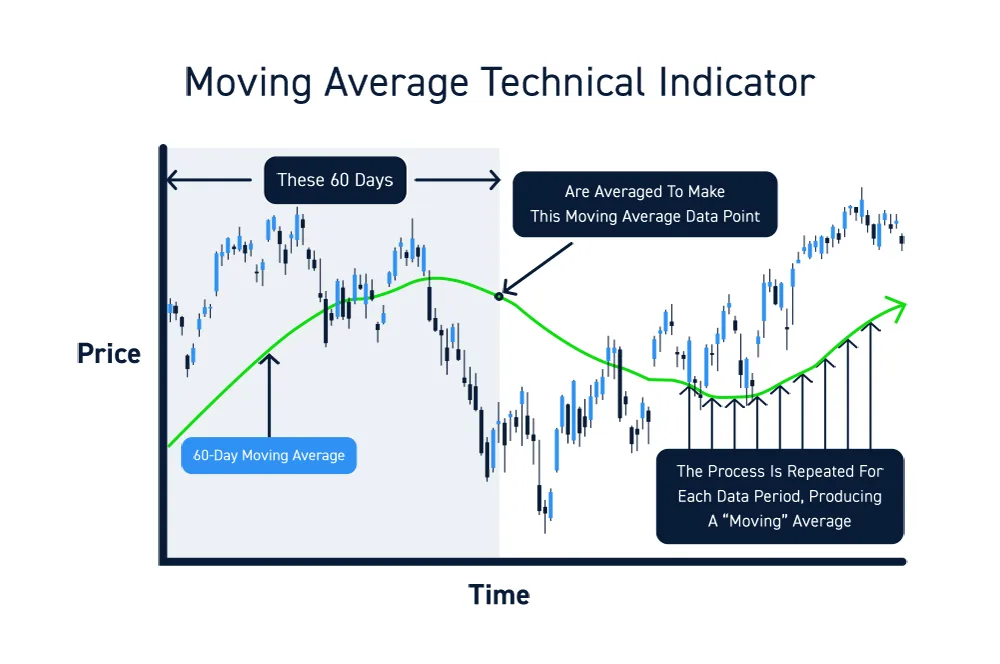

Short-Term and Long-Term Perspectives

Investors often adopt different perspectives based on their investment goals and time horizons. Short-term investors, focused on quick profits, may be more susceptible to market volatility and sentiment swings. They might buy or sell stocks based on short-term news events or technical indicators, leading to rapid price fluctuations.Long-term investors, on the other hand, focus on a company’s fundamental value and its long-term growth potential.

They are less likely to be swayed by short-term market fluctuations and may hold their investments for extended periods, even during periods of market volatility.

“Long-term investors often adopt a ‘buy and hold’ strategy, focusing on companies with strong fundamentals and a track record of growth.”

Final Summary: Stocks Making The Biggest Moves Premarket Yamana Gold Credit Suisse Unilever And More

The pre-market session is a fascinating microcosm of the broader market landscape. While it’s too early to tell how these early movers will ultimately perform, the pre-market activity provides valuable insights into the factors driving investor sentiment and the potential trajectory of the market.

Whether you’re a seasoned trader or a curious observer, understanding the pre-market dynamics can give you a head start in navigating the ever-evolving world of finance.