3 Stocks Warren Buffett Just Bought: Worth Adding to Your Portfolio?

3 stocks warren buffett just bought that deserve a place in your portfolio – 3 Stocks Warren Buffett Just Bought: Worth Adding to Your Portfolio? This title alone probably caught your attention, right? We all know Warren Buffett is a legendary investor, and his moves often send ripples through the market. So, what are these three stocks that have earned a spot in his portfolio, and why should you consider them for your own?

Buffett’s investing style is all about long-term value. He doesn’t chase quick profits or jump on trendy investments. He meticulously analyzes companies, looking for those with strong fundamentals, sustainable competitive advantages, and a solid track record of success. The three stocks he recently purchased fit this mold perfectly, and their potential for future growth is undeniable.

Warren Buffett’s Investment Philosophy: 3 Stocks Warren Buffett Just Bought That Deserve A Place In Your Portfolio

Warren Buffett, widely regarded as one of the most successful investors of all time, has developed a unique and highly effective investment philosophy that has consistently delivered exceptional returns over decades. His approach, often referred to as value investing, focuses on identifying undervalued companies with strong fundamentals and holding them for the long term.

Key Investment Principles, 3 stocks warren buffett just bought that deserve a place in your portfolio

Buffett’s investment philosophy is rooted in a set of core principles that guide his decision-making. These principles emphasize a long-term perspective, a focus on intrinsic value, and a disciplined approach to investing.

- Long-Term Perspective:Buffett believes in investing for the long haul, typically holding stocks for years or even decades. He avoids short-term speculation and focuses on companies with a durable competitive advantage and a sustainable business model.

- Focus on Intrinsic Value:Buffett’s primary goal is to identify companies whose market value is significantly below their intrinsic value. Intrinsic value represents the true worth of a company based on its future earnings potential, assets, and competitive position. He seeks companies with a strong track record of profitability and a clear path to future growth.

- Margin of Safety:Buffett emphasizes the importance of buying stocks at a significant discount to their intrinsic value. This “margin of safety” provides a buffer against unforeseen risks and potential downturns in the market.

- Circle of Competence:Buffett advocates for investing only in businesses that he fully understands. He believes in staying within his “circle of competence,” which refers to industries and companies that he has extensive knowledge and experience in.

- Patience and Discipline:Value investing requires patience and discipline. Buffett emphasizes the importance of waiting for the right investment opportunities and avoiding emotional decisions. He believes in holding on to winning investments for the long term, even when market sentiment is negative.

Understanding a Company’s Business Model and Competitive Advantage

A key element of Buffett’s investment philosophy is the importance of thoroughly understanding a company’s business model and its competitive advantage. He seeks companies that possess a sustainable competitive advantage, which allows them to generate above-average profits over an extended period.

- Sustainable Competitive Advantage:Buffett looks for companies with unique characteristics that make them difficult for competitors to replicate. These characteristics can include strong brand recognition, economies of scale, proprietary technology, or a dominant market position.

- Durable Business Model:Buffett favors companies with a business model that is adaptable and resilient to changes in the market environment. He seeks businesses that can generate consistent profits regardless of economic conditions.

- Management Quality:Buffett places great importance on the quality of a company’s management team. He looks for managers with integrity, competence, and a long-term vision for the business. He believes that strong management is crucial for sustainable growth and value creation.

Examples of Buffett’s Successful Investments

Buffett’s investment track record is filled with numerous examples of successful investments that have generated significant returns over the long term. These investments illustrate the power of his value investing approach.

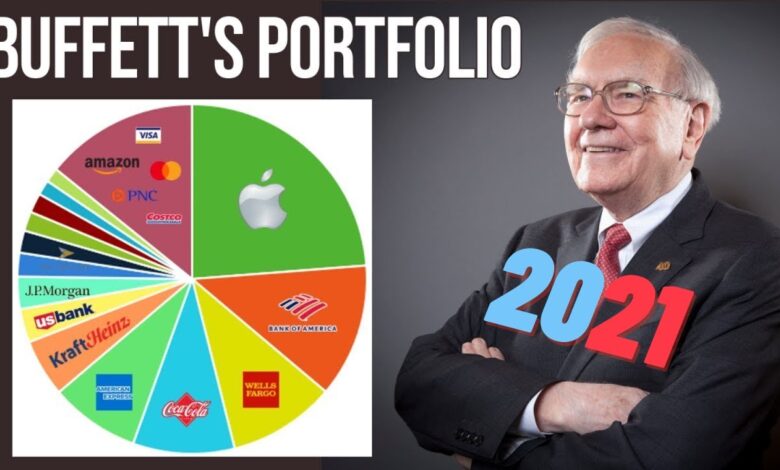

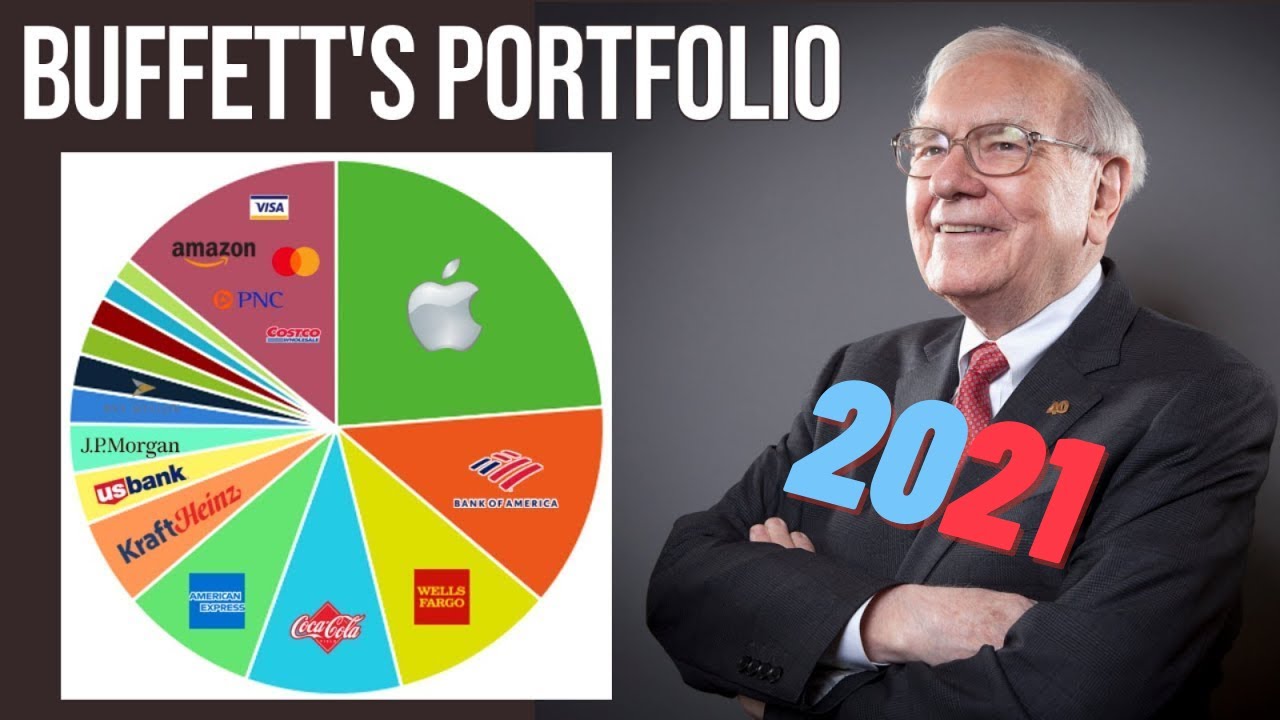

- Coca-Cola (KO):Buffett began investing in Coca-Cola in 1988, and it has become one of Berkshire Hathaway’s largest holdings. Coca-Cola’s strong brand recognition, global reach, and consistent profitability have made it a highly successful investment for Buffett.

- American Express (AXP):Buffett invested in American Express in 1964 after the company was hit by a major fraud scandal. He recognized the value of the company’s brand and its potential for recovery. American Express has since become one of Buffett’s most profitable investments.

- Apple (AAPL):Buffett began investing in Apple in 2016, recognizing the company’s dominant position in the smartphone market and its potential for future growth. Apple has become one of Berkshire Hathaway’s largest holdings, generating significant returns for Buffett.

Final Thoughts

Investing in the same stocks as Warren Buffett isn’t a guaranteed path to riches, but it’s a solid starting point for any investor seeking to build a portfolio that can weather market storms and generate long-term returns. Remember, diversification is key, and these stocks should be considered alongside other investments that align with your individual risk tolerance and financial goals.

So, dive into the details of these companies, understand their strengths and weaknesses, and decide if they deserve a place in your own portfolio. It might just be the start of a journey to financial success.

Warren Buffett’s recent stock purchases are always worth paying attention to, and his latest picks are no exception. These companies represent solid investments with strong fundamentals, and their potential for growth is undeniable. It’s almost as exciting as the news that a galapagos tortoise thought extinct for 100 years has been found alive ! Just like these resilient creatures, these stocks are built to last, making them worthy additions to any well-rounded portfolio.

Warren Buffett’s recent stock purchases are always worth a look, and his latest picks are no exception. While studying these potentially lucrative investments, I was also struck by the news that senators announce bipartisan legislation to help veterans exposed to burn pits , which is a positive step for those who served our country.

Getting back to Buffett’s picks, I’m particularly interested in their potential for long-term growth, which is something I always prioritize in my own portfolio.

Warren Buffett’s recent stock picks, like Apple, Coca-Cola, and Chevron, are tempting, but let’s not forget the bigger picture. The fight to control elections, as highlighted in this article on how influential election deniers have fueled a fight to control elections , is a far more pressing issue.

While those stocks might bring returns, a healthy democracy is the foundation for any investment strategy. So, let’s be informed citizens and invest in the future, not just our portfolios.