5 Student Loan Forgiveness Programs: Bidens Expansions

What to know about these 5 student loan forgiveness programs and how biden has expanded them cnn politics – Navigating the world of student loan forgiveness can feel like wading through a maze, especially with the recent expansions under President Biden. This post aims to shed light on five key programs, highlighting their eligibility, benefits, and how Biden’s policies have impacted them.

The weight of student loan debt is a heavy burden for many Americans, impacting their financial well-being and future prospects. Understanding the available forgiveness programs and how they’ve been expanded is crucial for those seeking relief.

Student Loan Forgiveness Programs in the US

Student loan debt has become a significant financial burden for many Americans, impacting their ability to save for the future, purchase homes, and start families. Student loan forgiveness programs offer relief by reducing or eliminating outstanding loan balances, providing much-needed financial stability for borrowers.The current economic climate, marked by high inflation and rising interest rates, has made student loan debt even more challenging to manage.

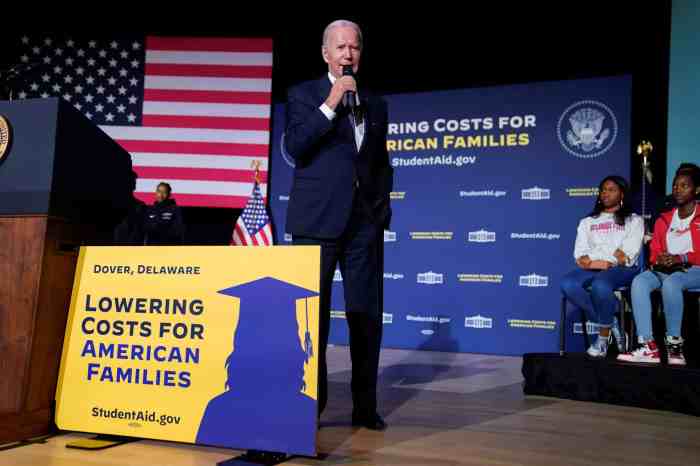

Borrowers are facing increased costs for everyday essentials, making it difficult to keep up with their loan payments. In response to these economic pressures, President Biden has taken steps to expand student loan forgiveness programs, providing much-needed relief to millions of Americans.

President Biden’s Expansion of Student Loan Forgiveness

President Biden has made student loan forgiveness a key part of his economic agenda, recognizing the significant impact of student debt on individuals and the economy as a whole. His administration has implemented several measures to expand existing programs and create new ones, providing borrowers with more opportunities for relief.One of the most significant actions taken by the Biden administration was the extension of the student loan payment pause, which was initially implemented during the COVID-19 pandemic.

This pause, which has been extended several times, has provided borrowers with temporary relief from making payments, allowing them to focus on other financial priorities.In addition to the payment pause, the Biden administration has also made changes to existing student loan forgiveness programs, making them more accessible to borrowers.

For example, the Public Service Loan Forgiveness (PSLF) program, which forgives loans for borrowers working in public service, has been streamlined to make it easier for borrowers to qualify.The Biden administration has also proposed new student loan forgiveness programs, including a plan to cancel up to $10,000 in student loan debt for borrowers who meet certain income requirements.

It’s a busy time for government action, with lots of news about student loan forgiveness programs and how Biden’s administration is expanding them. While that’s a big topic, it’s not the only thing on lawmakers’ minds. In California, they’re tackling a different kind of challenge with bills aimed at content regulation and child safety in social media.

These bills, if passed, could have a significant impact on how we use the internet, especially for young people. So, while we’re all watching the student loan news, it’s important to keep an eye on these other developments too.

This proposal has been met with mixed reactions, with some arguing that it is a necessary step to address the student debt crisis, while others believe it is unfair to taxpayers.

Five Key Student Loan Forgiveness Programs

The Biden administration has taken significant steps to address the student loan crisis in the United States. One of the most notable actions has been the expansion of existing student loan forgiveness programs and the introduction of new initiatives.

This blog post will provide an overview of five key student loan forgiveness programs that could offer relief to borrowers.

Public Service Loan Forgiveness (PSLF)

The Public Service Loan Forgiveness (PSLF) program forgives the remaining balance of your federal student loans after you’ve made 120 qualifying monthly payments while working full-time for a qualifying employer. PSLF was initially designed to encourage individuals to pursue careers in public service, but it has faced challenges in terms of implementation and eligibility requirements.

However, recent changes to the program have made it more accessible to borrowers. The PSLF program can be a significant benefit to borrowers who work in eligible public service roles, such as:

- Government employees at the federal, state, or local level

- Teachers

- Lawyers working for non-profit organizations

- Members of the military

- Employees of certain non-profit organizations

To qualify for PSLF, you must meet the following criteria:

- Have Direct Loans

- Work full-time for a qualifying employer

- Make 120 qualifying monthly payments

- Have a qualifying repayment plan

To apply for PSLF, you must submit a PSLF form to the Federal Student Aid website. The form requires you to provide information about your employment history, loan details, and repayment plan. You can track your progress toward PSLF through the Federal Student Aid website.

Teacher Loan Forgiveness Program

The Teacher Loan Forgiveness Program offers up to $17,500 in loan forgiveness to eligible teachers who have worked full-time for five consecutive years in a low-income school. This program is designed to encourage individuals to pursue careers in teaching in underserved communities.To qualify for the Teacher Loan Forgiveness Program, you must meet the following criteria:

- Be employed as a full-time teacher in a qualifying low-income school

- Have taught for at least five consecutive academic years

- Teach in a subject area that has a shortage of qualified teachers

- Hold a bachelor’s degree or higher

- Have a valid state teaching license

To apply for the Teacher Loan Forgiveness Program, you must submit a Teacher Loan Forgiveness application to the Federal Student Aid website. The application requires you to provide information about your employment history, loan details, and teaching license.

Income-Driven Repayment (IDR) Plans

Income-Driven Repayment (IDR) plans are designed to make student loan payments more affordable by basing your monthly payment amount on your income and family size. There are several different IDR plans available, including:

- Income-Based Repayment (IBR)

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

- Income-Contingent Repayment (ICR)

IDR plans can help borrowers reduce their monthly payments and potentially qualify for loan forgiveness after a certain period of time. The amount of loan forgiveness available under IDR plans varies depending on the plan and the borrower’s income.

Perkins Loan Cancellation

Perkins Loans are a type of federal student loan that was no longer available after June 30,

However, borrowers with Perkins Loans may be eligible for loan cancellation under certain circumstances, such as:

- Teaching in a low-income school

- Working for a non-profit organization

- Serving in the military

- Experiencing total and permanent disability

To apply for Perkins Loan cancellation, you must contact your loan servicer. The cancellation process may vary depending on the reason for cancellation.

Federal Student Loan Discharge

Federal student loan discharge is a process that allows borrowers to have their loans forgiven under certain circumstances. Some common reasons for federal student loan discharge include:

- Death of the borrower

- Total and permanent disability

- False certification of eligibility

- School closure

- Borrower fraud

To apply for federal student loan discharge, you must contact your loan servicer. The discharge process may vary depending on the reason for discharge.

It’s definitely a good time to learn about the 5 student loan forgiveness programs and how Biden has expanded them. It’s a big deal for many people. But sometimes it’s hard to focus on things like that when you read about the potential consequences of a global conflict, like how a large nuclear war could leave 5 billion people without enough to eat.

It’s a stark reminder that there are bigger issues in the world, but knowing your options for student loan relief can still be a powerful tool for your future.

Biden’s Expansion of Student Loan Forgiveness Programs: What To Know About These 5 Student Loan Forgiveness Programs And How Biden Has Expanded Them Cnn Politics

President Biden has made significant changes to student loan forgiveness programs since taking office, aiming to provide relief to borrowers struggling with debt. These changes have sparked debates about their effectiveness, fairness, and economic implications.

Key Changes Implemented by Biden

Biden’s administration has taken several steps to expand student loan forgiveness programs, including:

- Increased Income-Driven Repayment (IDR) Plan Caps:The Biden administration has significantly lowered monthly payments for borrowers under IDR plans. These plans tie monthly payments to a borrower’s income, allowing them to pay a manageable amount each month. Previously, borrowers under IDR plans could still accumulate substantial debt over time due to high interest rates.

The new caps aim to make IDR plans more affordable and prevent borrowers from falling further into debt.

- Expanded Eligibility for Public Service Loan Forgiveness (PSLF):The PSLF program forgives federal student loans for borrowers who work in public service for ten years. The Biden administration has made significant changes to the program, including waiving certain eligibility requirements and extending the program’s deadline. These changes have made it easier for public service workers to qualify for loan forgiveness.

- Paused Student Loan Payments:The Biden administration has repeatedly paused student loan payments and interest accrual during the COVID-19 pandemic. This pause has provided much-needed relief to borrowers, allowing them to use their money for other expenses. While the pause has been extended several times, it is set to expire in the near future.

Navigating the complex world of student loan forgiveness programs can be overwhelming, especially with recent expansions under the Biden administration. It’s important to understand the eligibility criteria, application processes, and potential benefits of each program. While researching this, I stumbled upon an interesting discussion about the sequel to the dystopian novel “Uglies,” uglies 2 what happens in the sequel pretties , which explores similar themes of societal control and individual choice.

Returning to the topic of student loan forgiveness, it’s crucial to stay informed about these programs and how they might impact your financial future.

- Proposed One-Time Student Loan Forgiveness:The Biden administration initially proposed a one-time forgiveness of up to $10,000 in student loan debt for borrowers. This proposal faced legal challenges and was ultimately blocked by the Supreme Court. However, the administration continues to explore other options for providing targeted loan forgiveness.

Impact on Borrowers, What to know about these 5 student loan forgiveness programs and how biden has expanded them cnn politics

Biden’s actions have had a significant impact on student loan borrowers, providing both benefits and challenges:

Benefits

- Reduced Monthly Payments:Lowering IDR plan caps has made monthly payments more affordable for many borrowers, providing them with more financial flexibility.

- Increased Access to Loan Forgiveness:Expanding PSLF eligibility has made it easier for public service workers to qualify for loan forgiveness, reducing their debt burden.

- Temporary Relief:The pause on student loan payments has provided borrowers with much-needed financial relief during a challenging economic period.

Challenges

- Uncertainty about Future of Loan Forgiveness:The legal challenges to the proposed one-time loan forgiveness and the potential end of the payment pause have created uncertainty for borrowers.

- Potential for Higher Interest Rates:The Biden administration’s actions have been criticized for potentially leading to higher interest rates for future borrowers, as the government may need to raise rates to offset the cost of loan forgiveness.

- Fairness Concerns:Some argue that loan forgiveness disproportionately benefits higher-income borrowers who may have already benefited from a college education, while lower-income borrowers who did not attend college may not receive any benefit.

Political and Economic Motivations

Biden’s actions on student loan forgiveness have been driven by a combination of political and economic motivations:

- Political Pressure:Student loan debt is a significant issue for many Americans, and Biden has faced pressure from both Democratic voters and progressive groups to address it.

- Economic Stimulus:The Biden administration argues that loan forgiveness can stimulate the economy by freeing up borrowers’ disposable income, allowing them to spend more and boost economic growth.

- Addressing Inequality:The Biden administration has argued that student loan forgiveness can help address economic inequality by reducing the burden of debt for low- and middle-income borrowers.

Potential Benefits and Drawbacks of Student Loan Forgiveness

Student loan forgiveness programs have become a hot topic in recent years, with proponents arguing that they offer a lifeline to borrowers struggling with debt while critics express concerns about their fairness and potential economic consequences. It’s important to understand both sides of the argument to make informed decisions about these programs.

Potential Benefits of Student Loan Forgiveness

Student loan forgiveness programs offer several potential benefits, including:

- Reduced Debt Burden:Perhaps the most obvious benefit is the reduction of debt for borrowers. This can free up money for other essential expenses, such as housing, food, and healthcare, improving their overall financial well-being. For example, a borrower with $50,000 in student loan debt who receives forgiveness could save hundreds of dollars each month on loan payments, significantly easing their financial burden.

- Increased Economic Mobility:By reducing debt, student loan forgiveness can increase economic mobility. Borrowers can save more, invest in their future, and pursue opportunities that were previously out of reach due to their debt burden. For example, a borrower with significant student loan debt may be hesitant to start a business or change careers, fearing the financial risk.

Forgiveness could empower them to pursue these opportunities, potentially leading to higher earnings and greater financial security.

- Improved Access to Higher Education:Student loan forgiveness programs can encourage more people to pursue higher education, knowing that their debt burden will be reduced or eliminated. This can benefit both individuals and society, as a more educated workforce can lead to increased productivity and economic growth.

For example, a potential student may be hesitant to take on substantial debt for a graduate degree. Forgiveness programs could incentivize them to pursue advanced education, leading to higher earning potential and career advancement.

Potential Drawbacks of Student Loan Forgiveness

While student loan forgiveness programs have potential benefits, they also come with potential drawbacks:

- Concerns About Fairness:One common concern is that student loan forgiveness programs are unfair to those who have already paid off their loans or who chose not to pursue higher education. This argument suggests that those who made different choices should not be penalized by subsidizing the debt of others.

For example, a person who worked through college and avoided taking out loans may feel that they are being unfairly burdened by having to contribute to the cost of forgiving loans for others.

- Impact on the Economy:Another concern is the potential impact of student loan forgiveness on the economy. Critics argue that forgiving loans could lead to higher inflation, as borrowers spend more money, and could discourage future borrowers from taking out loans, leading to a decrease in investment in education.

For example, a large-scale student loan forgiveness program could potentially lead to a surge in consumer spending, putting upward pressure on prices and contributing to inflation.

- Cost of Implementing Programs:Implementing student loan forgiveness programs can be expensive. The government would need to allocate significant resources to fund these programs, potentially diverting funds from other important priorities. For example, a program forgiving $10,000 per borrower could cost the government hundreds of billions of dollars, potentially impacting other government programs and services.

Future Outlook for Student Loan Forgiveness

The future of student loan forgiveness programs in the United States remains uncertain, subject to a complex interplay of political, legal, and economic factors. While the Biden administration has taken steps to expand existing programs, the overall direction of these policies is far from settled.

Potential Policy Changes

The future of student loan forgiveness programs hinges on the policy decisions of the Biden administration and Congress. The administration has already taken steps to expand existing programs, such as the Public Service Loan Forgiveness (PSLF) program, and has proposed new programs, such as the cancellation of up to $10,000 in student loan debt per borrower.

However, these efforts have faced legal challenges and opposition from Republicans in Congress.

- Legislative Action:Congress could pass legislation to expand or limit student loan forgiveness programs. For example, some lawmakers have proposed legislation to cap the amount of student loan debt that can be forgiven or to require borrowers to make payments for a certain period of time before becoming eligible for forgiveness.

- Executive Action:The Biden administration could use executive orders to expand student loan forgiveness programs. However, these actions could face legal challenges from opponents who argue that the president lacks the authority to make such changes.

- Changes to Existing Programs:The administration could also make changes to existing student loan forgiveness programs, such as the PSLF program, to make them more accessible or to expand eligibility criteria.

Legal Challenges

The legal landscape surrounding student loan forgiveness is complex and evolving. Opponents of student loan forgiveness have argued that it is unfair to taxpayers who did not benefit from higher education and that it could incentivize future borrowing. These arguments have been used to challenge the legality of the Biden administration’s proposed forgiveness programs.

- Constitutional Challenges:Some legal challenges have focused on whether the president has the authority to cancel student loan debt through executive action. These challenges argue that the president’s power is limited to enforcing laws passed by Congress.

- Administrative Law Challenges:Other challenges have focused on whether the Biden administration has followed proper procedures in implementing its student loan forgiveness programs. These challenges argue that the administration has failed to provide sufficient notice and opportunity for public comment.

Political Landscape

The political landscape surrounding student loan forgiveness is highly polarized. Democrats generally support expanding student loan forgiveness programs, while Republicans are more likely to oppose such measures. This divide has made it difficult to pass comprehensive legislation on student loan forgiveness.

- Bipartisan Support:Despite the overall partisan divide, there is some bipartisan support for targeted student loan forgiveness programs, such as those for borrowers who work in public service or who have disabilities.

- Public Opinion:Public opinion polls have shown that a majority of Americans support some form of student loan forgiveness. However, there is no consensus on the best way to implement such programs.