Federal Judge Blocks Bidens Student Loan Plan

Federal judge delivers another blow to bidens student loan handout plan good cause exists – Federal Judge Blocks Biden’s Student Loan Plan: “Good Cause” Exists sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with personal blog style and brimming with originality from the outset.

In a major setback for President Biden’s student loan forgiveness program, a federal judge has blocked the administration’s plan, citing a lack of “good cause” for the widespread debt cancellation. This ruling, delivered in a Texas court, throws the future of the program into uncertainty, leaving millions of borrowers wondering if they will ever see relief from their student loan burdens.

The Ruling and its Context: Federal Judge Delivers Another Blow To Bidens Student Loan Handout Plan Good Cause Exists

A federal judge in Texas has dealt a significant blow to President Biden’s plan to forgive student loan debt, ruling that the administration’s program exceeded its authority under the HEROES Act. The ruling, issued on November 10, 2023, could significantly impact millions of borrowers who were hoping for relief from their student loan burdens.

The judge’s decision highlights the ongoing legal battle surrounding the Biden administration’s efforts to address the student loan crisis. It underscores the complex legal and political considerations involved in implementing such a large-scale program.

The Judge’s Ruling

The ruling, issued by Judge Mark Pittman in the U.S. District Court for the Northern District of Texas, found that the Biden administration’s plan to forgive up to $20,000 in student loan debt for millions of borrowers exceeded the authority granted to the Secretary of Education under the HEROES Act.

The HEROES Act, passed in 2003, allows the Secretary of Education to modify student loan programs in response to national emergencies, including wars and natural disasters. The Biden administration argued that the COVID-19 pandemic qualified as a national emergency and that the student loan forgiveness program was necessary to address the economic hardship caused by the pandemic.However, Judge Pittman disagreed, finding that the HEROES Act did not give the Secretary of Education the authority to cancel student loan debt on such a broad scale.

He argued that the act was intended to make minor adjustments to existing loan programs, not to fundamentally change them.

Legal Arguments Presented by Both Sides

The Biden administration argued that the HEROES Act gave the Secretary of Education broad authority to modify student loan programs in response to national emergencies. They cited the act’s language, which allows the Secretary to “waive or modify any statutory or regulatory provision” related to student loans, as well as the unprecedented nature of the COVID-19 pandemic.The plaintiffs, a group of six states led by Missouri, argued that the Biden administration’s plan exceeded the authority granted by the HEROES Act.

They argued that the act was intended to make minor adjustments to existing programs, not to fundamentally change them. They also argued that the program would have a significant economic impact on states, as they would lose revenue from student loan payments.

Timeline of Key Events Leading Up to the Ruling

- August 2022:President Biden announces a plan to forgive up to $20,000 in student loan debt for millions of borrowers.

- September 2022:The Department of Education releases guidance on the program.

- October 2022:A group of six states led by Missouri files a lawsuit challenging the legality of the program.

- November 2023:Judge Mark Pittman rules that the Biden administration’s plan to forgive student loan debt exceeds its authority under the HEROES Act.

Legal Precedents and Legal Frameworks

The judge’s decision is based on the legal framework established by the HEROES Act, as well as on previous court rulings related to the act. The judge cited several cases in his decision, including

- United States v. Virginia*, which held that the HEROES Act was intended to make minor adjustments to existing programs, not to fundamentally change them. He also cited

- Arizona v. United States*, which held that the Secretary of Education could not unilaterally change the terms of student loans.

The judge’s decision is likely to be appealed to a higher court, and the ultimate outcome of the legal challenge remains uncertain.

The “Good Cause” Argument

The judge’s decision hinges on the legal concept of “good cause,” which is central to the government’s ability to modify or cancel federal loan programs. This concept determines whether the government can make changes to existing programs without violating the rights of borrowers who have already entered into agreements.The judge’s ruling emphasizes that the government must have a compelling reason to make significant changes to existing loan programs, particularly when those changes directly affect the financial obligations of borrowers.

The judge argues that the Biden administration’s plan to forgive student loans, without a clear and demonstrable “good cause,” violates the rights of taxpayers who are ultimately responsible for covering the cost of these programs.

The Judge’s Interpretation of “Good Cause”

The judge’s interpretation of “good cause” centers on the notion that the government’s actions must be demonstrably justified and serve a clear public purpose. In this case, the judge argues that the Biden administration failed to establish a compelling reason for forgiving student loans, particularly given the significant financial burden it would place on taxpayers.

The judge emphasized that the administration’s justification for the plan, which focused on the economic benefits of student loan forgiveness, was not sufficient to meet the “good cause” standard.

The Implications for Future Student Loan Forgiveness Programs

The judge’s ruling has significant implications for future student loan forgiveness programs. It establishes a high bar for the government to meet in order to justify such programs. The ruling suggests that future programs will need to be carefully designed and justified, with a clear demonstration of “good cause” that outweighs the financial burden on taxpayers.

It seems like every day there’s a new legal challenge to Biden’s student loan forgiveness plan, and this time a federal judge has ruled that the administration didn’t have the authority to implement it. This feels like a constant tug-of-war between the government and its citizens.

Speaking of legal battles, the implications of Reggie Bush’s NIL lawsuit against the NCAA, USC, and the Pac-12 are huge. What Reggie Bush’s NIL lawsuit means for NCAA, USC, and Pac-12 is a whole other can of worms, but it shows how the legal landscape is changing when it comes to college athletics and compensation.

It’s interesting to see how these legal challenges are impacting the way we think about higher education and college sports. The student loan forgiveness plan is just one piece of the puzzle, and it’s important to keep an eye on how these issues continue to evolve.

This could make it more difficult for future administrations to implement broad-based student loan forgiveness programs.

The Impact on Borrowers

This ruling throws a wrench into the lives of millions of borrowers who were eagerly anticipating potential loan forgiveness. The ramifications extend beyond just the financial aspects, affecting the borrowers’ overall planning and outlook.

The news about the federal judge’s decision on Biden’s student loan plan is certainly a hot topic, but it’s hard to ignore the dire situation unfolding in Kyiv, where residents are being advised to stay indoors due to record levels of air pollution.

You can read more about the situation here. While the student loan debate is significant, it’s a stark reminder that we’re facing global challenges that demand our attention and action.

Groups of Borrowers Potentially Affected

This ruling will have a direct impact on various groups of borrowers, particularly those who had been relying on the Biden administration’s loan forgiveness plan.

The federal judge’s ruling on Biden’s student loan plan is a major setback for the administration, but it’s not the only legal battle going on right now. Speaking of legal battles, you might be interested in the complex legal history of Robert F.

Kennedy Jr.’s relationship with Cheryl Hines, which you can explore further on this blog. The student loan issue, like many others, has a long and complicated history, and it’s fascinating to see how it plays out in the courts.

- Borrowers with Loans Under the Public Service Loan Forgiveness (PSLF) Program:These borrowers, many of whom work in public service jobs, were expecting loan forgiveness after 10 years of qualifying payments. This ruling could potentially derail their plans, forcing them to continue making payments for a longer period.

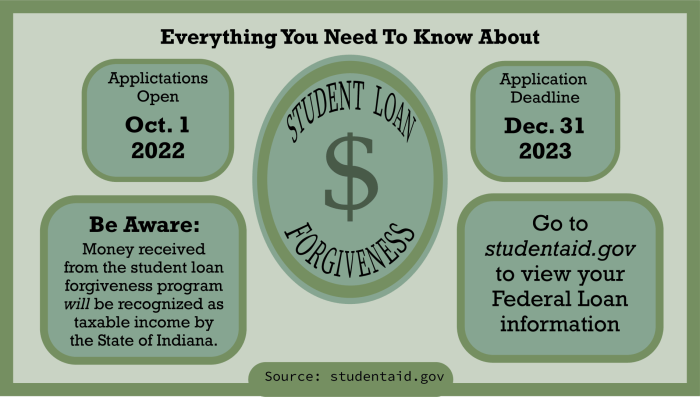

- Borrowers Who Had Already Applied for Forgiveness:Borrowers who had submitted applications for forgiveness under the Biden plan may face delays or outright denials. This uncertainty adds to the financial burden and creates a sense of instability.

- Borrowers Who Had Adjusted Their Financial Plans Based on Forgiveness:Some borrowers had already adjusted their financial plans based on the expectation of loan forgiveness. They may have made major purchases, started saving for retirement, or taken on new financial commitments. The loss of this anticipated relief could significantly impact their financial stability.

Financial and Logistical Consequences

The ruling could lead to a number of financial and logistical consequences for borrowers whose loans are not forgiven.

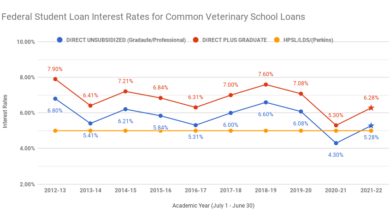

- Increased Monthly Payments:Without forgiveness, borrowers will have to continue making their monthly payments, potentially for a longer period. This could strain their budgets, especially for those with low incomes or high debt burdens.

- Higher Interest Costs:Borrowers who are not granted forgiveness will continue to accrue interest on their loans. This could significantly increase the overall cost of their loans, particularly over the long term.

- Difficulty in Saving and Investing:The financial burden of student loan debt can make it difficult for borrowers to save for retirement, buy a home, or start a business. The lack of forgiveness will exacerbate this challenge.

- Logistical Challenges:Borrowers may need to re-evaluate their financial plans and make adjustments to accommodate continued loan payments. This could involve seeking additional income, cutting back on expenses, or delaying major financial goals.

Borrowers’ Perspectives on the Ruling

The ruling has sparked a wave of frustration and uncertainty among borrowers who had been counting on loan forgiveness. Many borrowers have expressed their disappointment and concern about the ruling’s impact on their financial futures.

“This is a huge setback for borrowers who have been struggling with student loan debt for years. It’s incredibly frustrating to see our hopes for relief dashed,” said one borrower.

“I’m worried about how I’m going to afford my monthly payments now. I’m already stretched thin, and this ruling makes it even harder to make ends meet,” shared another borrower.

Political and Economic Ramifications

This ruling has sent shockwaves through the political landscape, with both sides reacting fiercely. The potential for a legal battle reaching the Supreme Court adds another layer of complexity to the situation, further amplifying the political stakes.

Political Reactions

The ruling has ignited a firestorm of reactions from both Democrats and Republicans. Democrats, largely supportive of Biden’s loan forgiveness plan, have expressed disappointment and concern about the potential impact on borrowers. They argue that the ruling undermines efforts to address the student debt crisis and could exacerbate economic hardship for many Americans.

Republicans, on the other hand, have welcomed the ruling, seeing it as a victory against what they perceive as an overreach of executive power. They argue that the plan was fiscally irresponsible and unfairly burdened taxpayers. They also point to the legal arguments regarding the legality of the plan, highlighting the judge’s interpretation of the HEROES Act.

Economic Impact

The ruling’s economic impact is multifaceted and potentially significant. While the immediate impact on the student loan market is unclear, the ruling could deter future government interventions in the market. This uncertainty could lead to higher interest rates for borrowers and potentially lower investment in education.

The ruling could also have broader economic implications, affecting consumer spending and the overall economy. With the prospect of loan forgiveness now uncertain, borrowers may face increased financial pressure, leading to reduced spending and potentially hindering economic growth.

Future of Federal Student Loan Policies

The ruling has significant implications for the future of federal student loan policies. It raises questions about the scope of executive power in addressing the student debt crisis and suggests a potential shift in approach towards legislative solutions. The ruling may also influence the direction of future student loan programs, potentially leading to a greater emphasis on affordability, transparency, and accountability.

Next Steps and Future Considerations

The recent legal setback for President Biden’s student loan forgiveness plan has left many wondering about the next steps in the process. The administration now faces a crucial decision: whether to appeal the ruling or pursue alternative strategies to achieve their goal of providing relief to borrowers.

Potential Legal Appeals

The Biden administration has several options for challenging the ruling. They could appeal the decision to a higher court, potentially the Fifth Circuit Court of Appeals, or even the Supreme Court. This route would prolong the legal battle and create further uncertainty for borrowers.

However, it could ultimately lead to a definitive ruling on the legality of the program.

Alternative Strategies, Federal judge delivers another blow to bidens student loan handout plan good cause exists

If the administration chooses not to appeal, they could explore alternative approaches to student loan forgiveness. One possibility is to implement a smaller-scale program, perhaps targeting specific groups of borrowers, such as those with the highest debt burdens. This approach might be less likely to face legal challenges, but it would also provide less relief to borrowers overall.

Unanswered Questions

The ruling has left several key questions unanswered. The most pressing is the future of the existing student loan pause, which is currently set to expire in October 2023. If the program is not extended or modified, millions of borrowers will face the prospect of resuming payments without the benefit of forgiveness.

Additionally, the ruling raises broader questions about the authority of the executive branch to implement significant changes to federal programs without congressional approval.