What the Strong Dollar Means for You: Impact on Your Life

What the strong dollar means for you is a topic that impacts everyone, from consumers to businesses and investors. A strong dollar, essentially a dollar that’s worth more compared to other currencies, can have a ripple effect across the globe.

Think of it like a domino effect: when one piece falls, others follow. This shift in value can influence everything from the price of your morning coffee to the cost of a vacation abroad. But understanding the nuances of a strong dollar is crucial, as it can present both opportunities and challenges.

This blog post will explore the multifaceted impact of a strong dollar, delving into how it affects consumers, businesses, investors, and global trade. We’ll uncover the advantages and disadvantages of this economic phenomenon, providing you with a comprehensive understanding of its implications.

So, buckle up and join me on this journey as we unravel the mysteries of a strong dollar and its significance in our interconnected world.

The Strong Dollar: What The Strong Dollar Means For You

A strong dollar is a situation where the value of the US dollar rises relative to other major currencies. This can have significant implications for the global economy, influencing trade, investment, and economic growth. Understanding the dynamics of a strong dollar is crucial for businesses, investors, and individuals alike.

The Impact of a Strong Dollar on the Global Economy

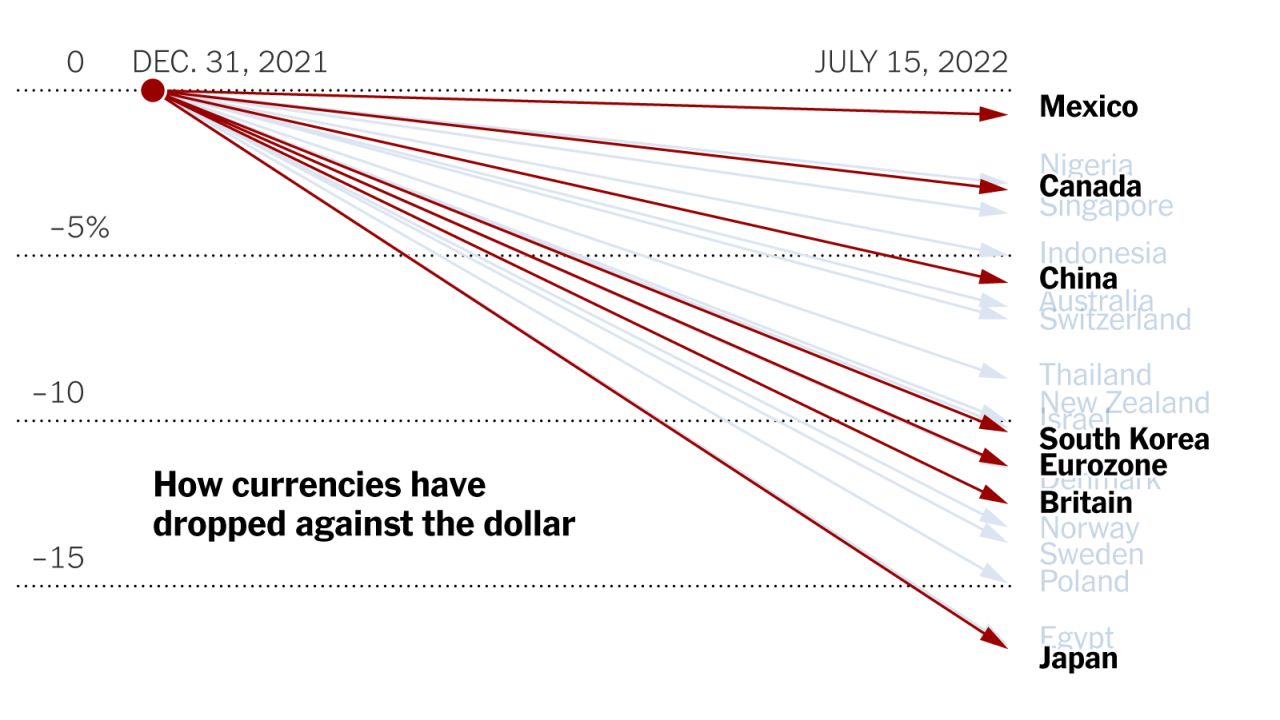

A strong dollar makes US exports more expensive for foreign buyers and imports cheaper for US consumers. This can benefit US consumers by lowering the cost of imported goods, but it can hurt US businesses that export their products or compete with imports.

A strong dollar might seem like good news for your travel plans, but it’s a double-edged sword. While it makes importing goods cheaper, it can also hurt American businesses competing globally. And with the u s economy shrinking again in second quarter reviving recession fears , the impact of a strong dollar could be felt even more keenly, potentially impacting jobs and investment.

So, while that European vacation might seem more affordable, the broader economic picture might be a bit more complex than it initially appears.

For example, a strong dollar can make it more difficult for US manufacturers to sell their products in foreign markets, potentially leading to job losses and reduced economic activity.

Historical Examples of Strong Dollar Trends

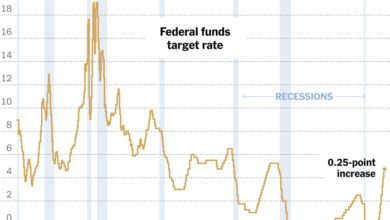

Throughout history, periods of strong dollar trends have often been associated with specific economic and political events. For instance, during the 1980s, the dollar strengthened significantly due to high US interest rates and strong economic growth. This led to a surge in imports and a trade deficit, contributing to a period of economic instability.

A strong dollar can make imported goods cheaper, which is great for consumers, but it can also hurt exporters who struggle to compete in global markets. This brings to mind a question: is free speech essential for democracy, or could it be its downfall?

This article explores the complexities of free speech and its potential impact on democratic societies. Ultimately, the impact of a strong dollar on your wallet depends on your individual circumstances, just as the implications of free speech are multifaceted and open to interpretation.

Conversely, during the 2008 financial crisis, the dollar weakened as investors sought safe havens in other currencies.

A strong dollar means travel is more affordable, and what better place to take advantage than the Ritz-Carlton Lake Tahoe ? Imagine soaking up the sun by the lake, hiking through the majestic pines, and indulging in gourmet meals – all while enjoying the luxury of this stunning resort.

A strong dollar means you can treat yourself to the trip of a lifetime, and the Ritz-Carlton Lake Tahoe is the perfect place to do it.

Factors Contributing to a Strong Dollar, What the strong dollar means for you

Several factors can contribute to a strong dollar, including:

- Interest Rates:When US interest rates rise relative to those in other countries, it becomes more attractive for foreign investors to invest in US assets, increasing demand for the dollar.

- Economic Growth:Strong economic growth in the US can attract foreign investment, leading to higher demand for the dollar.

- Political Stability:A stable and predictable political environment can boost investor confidence in the US economy, supporting the dollar’s value.

- Safe Haven Status:During times of global uncertainty, investors often seek safe haven assets, such as US Treasury bonds, leading to increased demand for the dollar.

The Impact on Global Trade

A strong dollar can significantly impact international trade patterns and global economic growth. When the dollar strengthens, it becomes more expensive for buyers in other countries to purchase goods and services from the United States, potentially leading to a decrease in American exports.

Conversely, it becomes cheaper for Americans to import goods from other countries, which could lead to an increase in imports.

The Impact on Trade Flows

A strong dollar can create imbalances in trade flows between countries. For instance, a strong dollar could make American goods and services less competitive in international markets, leading to a decline in exports. This could result in a trade deficit, where a country imports more goods and services than it exports.

Conversely, a weak dollar could make American goods and services more competitive in international markets, leading to an increase in exports.

The Consequences of a Prolonged Strong Dollar

A prolonged strong dollar can have several consequences for the global economy. It can lead to a decrease in global economic growth, as countries that rely heavily on exports may experience a decline in their economies. Additionally, a strong dollar can create tension between countries, as it can lead to accusations of currency manipulation.

Last Recap

A strong dollar is a complex economic phenomenon with far-reaching consequences. While it may offer advantages for consumers and businesses in certain aspects, it also presents challenges that need to be carefully considered. As we’ve seen, the impact of a strong dollar can be felt across various sectors, from purchasing power to global trade.

By understanding the intricate interplay of economic forces that influence the value of the dollar, we can navigate these complexities and make informed decisions about our finances and investments.