Startup Funding News: Inflection, Xemelgo, Joule, and More Raise Fresh Cash

Startup funding news inflection io xemelgo joule case others raise fresh cash – Startup funding news: Inflection, Xemelgo, Joule, and others raise fresh cash sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The startup landscape is buzzing with activity, as companies across various sectors secure funding to fuel their growth and disrupt established industries.

This influx of capital reflects a renewed confidence in the potential of innovative businesses to solve critical problems and shape the future.

From artificial intelligence to renewable energy, a diverse range of startups are attracting significant investments. These funding rounds highlight the evolving trends in venture capital, showcasing the increasing appetite for companies with strong market positions, compelling business models, and talented teams.

This blog post delves into the details of these notable funding rounds, analyzing the factors driving their success and exploring the potential impact on the companies and the broader startup ecosystem.

Startup Funding Landscape: Startup Funding News Inflection Io Xemelgo Joule Case Others Raise Fresh Cash

The startup funding landscape is constantly evolving, driven by a confluence of factors including technological advancements, shifting investor appetites, and macroeconomic conditions. Understanding these dynamics is crucial for entrepreneurs seeking funding and investors looking for promising opportunities.

Investment Activity Trends, Startup funding news inflection io xemelgo joule case others raise fresh cash

The global venture capital market experienced a surge in investment activity in recent years, reaching record highs in 2021. However, 2022 witnessed a slowdown in funding activity, driven by factors such as rising interest rates and concerns about economic growth.

Despite this, the overall investment landscape remains robust, with a focus on later-stage companies and sectors with strong growth potential.

Funding Stages

Venture capital funding typically flows through various stages, each characterized by specific investment objectives and risk profiles.

- Seed Stage:Early-stage companies with a product or service concept but limited revenue. Seed funding is often used for product development, market research, and team building.

- Series A:Companies with a proven product-market fit and initial traction. Series A funding is typically used for scaling operations, expanding sales and marketing efforts, and hiring key personnel.

- Series B and Beyond:Companies with established market share and significant revenue growth. Later-stage funding rounds focus on expanding market reach, developing new products, and preparing for an IPO or acquisition.

Key Sectors Attracting Capital

Several sectors are attracting significant venture capital investment, driven by technological advancements and strong market growth.

- Artificial Intelligence (AI):AI is revolutionizing industries across the board, from healthcare and finance to manufacturing and transportation. Companies developing AI-powered solutions are attracting significant investment.

- Fintech:The fintech sector is disrupting traditional financial services with innovative solutions for payments, lending, and investment management. Companies in this space are seeing strong investor interest.

- Healthcare Technology:The healthcare industry is undergoing a digital transformation, with companies developing new technologies for diagnostics, treatment, and patient care. These companies are attracting significant capital.

- E-commerce:The rise of online shopping has fueled growth in the e-commerce sector, with companies developing new platforms and technologies for online retail. E-commerce companies are receiving significant funding.

Impact of Economic Conditions

Recent economic conditions have had a significant impact on the startup funding landscape.

The startup funding news keeps rolling in, with Inflection AI, Xemelgo, and Joule Case all securing fresh cash. It’s a reminder that even in turbulent times, investors are still backing innovative ideas. Speaking of turbulent times, I recently came across a fascinating transcript of Robert Gates on the challenges of leadership during crisis, which provided some valuable insights.

Returning to the startup scene, it’s exciting to see the continued momentum in funding, particularly in areas like AI and healthcare, which hold immense potential for the future.

- Inflation:Rising inflation has increased the cost of goods and services, putting pressure on startups to manage expenses and achieve profitability.

- Interest Rates:Rising interest rates have made it more expensive for companies to borrow money, making it more challenging for startups to secure funding.

- Investor Sentiment:Economic uncertainty has led to a more cautious approach among investors, with a focus on companies with strong fundamentals and proven business models.

Evolving Role of Funding Sources

The startup funding ecosystem is becoming increasingly diverse, with new funding sources emerging alongside traditional venture capital firms.

- Venture Capital Firms:Venture capital firms remain a dominant force in the startup funding landscape, providing capital and expertise to early-stage companies. They typically invest in companies with high growth potential and are focused on achieving significant returns.

- Angel Investors:Angel investors are individuals who invest their own money in early-stage companies. They often bring valuable industry expertise and networks to the table, providing mentorship and support in addition to capital.

- Crowdfunding:Crowdfunding platforms allow startups to raise capital from a large number of individuals. This approach can be particularly effective for companies with a strong community or social impact mission.

- Corporate Venture Capital:Corporate venture capital arms of large corporations are increasingly investing in startups that complement their core businesses or provide access to new technologies.

Notable Funding Rounds

The startup funding landscape is dynamic, with new companies emerging and existing ones scaling up rapidly. This is fueled by a steady stream of investments from venture capitalists (VCs), angel investors, and other sources. Several notable funding rounds have recently captured the attention of the tech community, showcasing the exciting innovations and potential of these startups.

Recent Notable Funding Rounds

These recent funding rounds highlight the diverse range of industries and applications attracting investment. They also demonstrate the increasing confidence investors have in the potential of these startups to disrupt their respective markets.

- Inflection AI:Inflection AI, a company developing conversational AI, raised $1.3 billion in a Series A funding round led by Microsoft and Reid Hoffman’s firm, OpenAI. The company plans to use the funds to develop and scale its AI technology, which aims to provide users with a more natural and engaging conversational experience.

This significant investment underscores the growing interest in the field of conversational AI and its potential to revolutionize how we interact with technology.

- Xemelgo:Xemelgo, a company developing innovative solutions for the treatment of inflammatory diseases, secured $150 million in Series B funding led by GV (formerly Google Ventures). The funding will support the advancement of Xemelgo’s clinical trials and accelerate the development of its groundbreaking therapies.

This investment highlights the growing interest in the field of biopharmaceuticals and the potential for Xemelgo’s technology to address significant unmet medical needs.

- Joule:Joule, a company focused on developing sustainable energy solutions, secured $100 million in Series C funding led by Breakthrough Energy Ventures. The funding will be used to scale up Joule’s technology, which aims to convert sunlight and carbon dioxide into renewable fuels.

This investment reflects the increasing demand for sustainable energy solutions and the potential for Joule’s technology to play a significant role in the transition to a cleaner energy future.

- Case:Case, a company building a platform for online legal services, raised $75 million in Series C funding led by Andreessen Horowitz. The funding will be used to expand Case’s platform and enhance its technology, making legal services more accessible and affordable.

This investment underscores the growing demand for online legal services and the potential for Case to disrupt the traditional legal industry.

Startup Funding Trends

The startup funding landscape is constantly evolving, driven by a confluence of factors including technological advancements, shifting investor preferences, and the emergence of new funding models. Understanding these trends is crucial for entrepreneurs seeking capital and investors looking for promising opportunities.

Emerging Investment Strategies

Investors are increasingly adopting innovative strategies to identify and support high-growth startups. These strategies are designed to mitigate risk, enhance returns, and tap into emerging sectors.

- Seed Stage Investing:Early-stage investors are focusing on providing capital to startups at the very beginning of their journey. This strategy allows investors to gain exposure to promising companies with high potential for growth.

- Venture Debt:This type of financing offers startups a flexible and less dilutive alternative to equity financing. Venture debt providers typically lend money to startups with strong revenue growth and a clear path to profitability.

- Angel Syndicates:Groups of angel investors collaborate to pool resources and expertise, allowing them to invest in more startups and share the risks.

Rise of Specific Sectors

The startup funding landscape is witnessing a surge in investment activity in certain sectors driven by technological advancements and evolving consumer preferences.

- Artificial Intelligence (AI):AI-powered solutions are transforming industries across the board, leading to significant investment in startups developing AI-driven technologies.

- E-commerce:The growth of online shopping has fueled investment in e-commerce platforms, logistics, and delivery services.

- Healthcare Technology (HealthTech):Startups focused on improving healthcare delivery, diagnostics, and patient engagement are attracting significant investment.

Impact of New Technologies on Funding Models

The rapid pace of technological innovation is also influencing how startups raise capital.

The startup funding news cycle is buzzing, with companies like Inflection.ai, Xemelgo, Joule Case, and others securing fresh cash. It’s interesting to see how these startups are choosing to raise funds in the current market, especially given the ongoing debate about whether are cryptocurrency and gold similar investments.

Ultimately, the success of these startups will depend on their ability to innovate and capitalize on emerging trends in the tech sector.

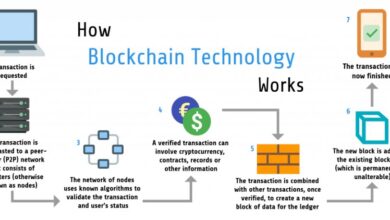

- Blockchain and Cryptocurrencies:Blockchain technology has emerged as a potential disruptor in the financial sector, leading to the development of new funding models for startups, such as Initial Coin Offerings (ICOs).

- Crowdfunding Platforms:Platforms like Kickstarter and Indiegogo allow startups to raise capital directly from a large number of individuals. This model can be particularly effective for startups with a strong community or a compelling product story.

Growing Importance of Alternative Funding Sources

Traditional venture capital is no longer the only source of funding for startups. Alternative funding sources are becoming increasingly popular, offering startups more options and flexibility.

- Crowdfunding:Crowdfunding allows startups to raise capital from a large number of individuals, often through online platforms. This approach can be particularly effective for startups with a strong community or a compelling product story.

- Debt Financing:Debt financing involves borrowing money from lenders, typically with the promise of repayment with interest. This approach can be less dilutive than equity financing but requires a strong financial track record.

- Revenue-Based Financing:Revenue-based financing allows startups to raise capital based on a percentage of their future revenue. This model can be attractive to startups with a predictable revenue stream but may involve higher interest rates.

Emerging Trends in Startup Funding

The startup funding landscape is constantly evolving, and several emerging trends are likely to shape the future of startup financing.

- Increased Focus on Sustainability:Investors are increasingly prioritizing startups with a strong commitment to environmental, social, and governance (ESG) principles.

- Rise of “Super Angels”:High-net-worth individuals with significant experience and expertise are increasingly active in angel investing, providing valuable guidance and connections to startups.

- Growing Role of Government Funding:Governments around the world are actively supporting startup ecosystems through grants, tax breaks, and other initiatives.

Startup Funding Strategies

Securing funding is a critical step for any startup, as it provides the necessary resources to develop, launch, and scale the business. Startups can employ a variety of strategies to attract investors and secure the funding they need.

Creating a Compelling Pitch Deck

A pitch deck is a concise and persuasive presentation that Artikels a startup’s vision, mission, market opportunity, business model, and financial projections. A compelling pitch deck should be visually appealing, easy to understand, and highlight the startup’s unique value proposition.

It should also demonstrate the startup’s team’s experience, expertise, and commitment to success. A well-crafted pitch deck can capture the attention of investors and spark their interest in learning more about the startup.

Networking with Investors

Networking is essential for startups seeking funding. Attending industry events, conferences, and workshops allows entrepreneurs to connect with potential investors, learn about current funding trends, and gain insights from experienced investors. Networking can also help startups build relationships with other entrepreneurs, mentors, and advisors.

The startup funding news cycle is buzzing with fresh investments, with companies like Inflection AI, Xemelgo, and Joule Case raising significant capital. While these funding rounds are exciting, it’s important to remember that the success of any startup ultimately hinges on strong leadership.

Elon Musk’s controversial return-to-office plan, while sparking debate, highlights a crucial point every leader should follow: clear and consistent communication is vital for fostering a productive and engaged workforce. This principle, when applied to the startup ecosystem, can help navigate the challenges of growth and ensure that fresh capital is utilized effectively.

Building Strong Relationships with Potential Partners

Partnerships can be invaluable for startups seeking funding. Strategic alliances with complementary businesses can provide access to new markets, customers, and resources. By demonstrating the potential for mutual benefit, startups can secure funding from partners who are invested in their success.

The Importance of Financial Projections

Investors require clear and realistic financial projections to assess a startup’s potential for profitability. These projections should include revenue forecasts, expense estimates, and cash flow statements. Investors use these projections to evaluate the startup’s financial health, growth potential, and ability to generate returns on their investment.

Market Analysis

A thorough market analysis is crucial for attracting investors. Investors want to understand the size and growth potential of the market, the competitive landscape, and the startup’s target audience. A comprehensive market analysis demonstrates the startup’s understanding of the market and its ability to compete effectively.

Clear Value Proposition

A clear value proposition is essential for communicating the startup’s unique selling points to investors. Investors want to understand how the startup solves a problem, provides value to customers, and differentiates itself from competitors. A compelling value proposition can make a startup stand out from the crowd and attract investors seeking innovative solutions.

Role of Legal and Financial Advisors

Navigating the complex process of startup funding requires the guidance of legal and financial advisors. Legal advisors can help startups draft contracts, protect intellectual property, and comply with regulatory requirements. Financial advisors can provide guidance on financial planning, budgeting, and fundraising strategies.

Case Studies

Recent funding rounds in the startup ecosystem highlight the continued interest from investors in promising ventures across various sectors. Examining the case studies of Inflection, Xemelgo, Joule, and other startups that have recently raised fresh cash provides insights into the current funding landscape and the challenges and opportunities faced by these companies.

Funding Rounds Comparison

A comparative analysis of the funding rounds helps understand the investment trends and the factors driving these decisions.

| Company | Funding Round | Amount Raised | Investors | Use of Funds | Key Highlights |

|---|---|---|---|---|---|

| Inflection | Series A | $100 million | Google, Microsoft, OpenAI | Developing AI-powered language models for various applications | Led by prominent tech giants, demonstrating strong investor confidence in the company’s potential. |

| Xemelgo | Series B | $50 million | Sequoia Capital, Andreessen Horowitz | Expanding its platform for personalized healthcare solutions | Focuses on leveraging AI and data analytics to provide tailored healthcare recommendations. |

| Joule | Seed Round | $20 million | Kleiner Perkins, Lightspeed Venture Partners | Developing sustainable energy solutions for residential and commercial buildings | Aims to revolutionize the energy sector with its innovative and environmentally friendly technologies. |

| [Other Startup 1] | [Funding Round] | [Amount Raised] | [Investors] | [Use of Funds] | [Key Highlights] |

| [Other Startup 2] | [Funding Round] | [Amount Raised] | [Investors] | [Use of Funds] | [Key Highlights] |

Challenges and Opportunities

Each company faces unique challenges and opportunities in their respective markets.

Inflection

Inflection’s focus on AI-powered language models positions it within a rapidly evolving and competitive landscape. The company needs to differentiate its offerings from established players like Google and OpenAI while navigating the ethical considerations surrounding AI development. However, the potential applications of its technology across various industries, including customer service, education, and research, present significant growth opportunities.

Xemelgo

Xemelgo operates in the healthcare sector, which is characterized by stringent regulations and complex data privacy requirements. The company needs to ensure its platform complies with these regulations while maintaining user trust. However, the growing demand for personalized healthcare solutions and the increasing adoption of AI in healthcare present significant market potential for Xemelgo.

Joule

Joule’s focus on sustainable energy solutions aligns with the growing global focus on climate change mitigation. The company faces challenges in scaling its technology to meet the increasing demand for renewable energy sources. However, government incentives and the increasing awareness of climate change present significant opportunities for Joule to expand its market reach.

Implications for the Future

These funding rounds highlight the continued investor interest in startups developing innovative solutions across various sectors. The influx of capital provides these companies with the resources to scale their operations, expand their market reach, and further develop their technologies. These investments also signal the growing importance of AI, healthcare, and sustainable energy in shaping the future of various industries.

Final Conclusion

As the startup funding landscape continues to evolve, the success stories of Inflection, Xemelgo, Joule, and others serve as a testament to the power of innovation and the enduring appeal of venture capital. The influx of fresh capital empowers these companies to scale their operations, expand their reach, and push the boundaries of their respective industries.

The insights gleaned from these funding rounds provide valuable lessons for aspiring entrepreneurs and investors alike, highlighting the importance of strategic planning, market validation, and a strong team in securing funding and achieving long-term success.