Terra Network Soars: Up Over 20% in 30 Days

What is Terra Network rises over 20 in the last 30 days? This question is on everyone’s mind as the Terra ecosystem continues to surge. This isn’t just a fleeting trend; it’s a testament to the strength and innovation of Terra’s underlying technology and its rapidly expanding user base.

The recent price surge isn’t just a reflection of market sentiment; it’s a tangible indicator of the real-world adoption and utility of Terra’s stablecoins, DeFi protocols, and the ever-growing ecosystem of projects built on its blockchain.

Let’s dive deeper into the key drivers behind Terra’s remarkable growth, explore the factors contributing to its price surge, and analyze the potential challenges and opportunities that lie ahead. This journey will uncover the unique features of Terra, its strengths, and the potential it holds for the future of decentralized finance.

Recent Price Surge Analysis

The recent surge in Terra’s price has attracted significant attention within the cryptocurrency market. Understanding the factors driving this price increase is crucial for investors and stakeholders alike. This analysis explores the key drivers behind Terra’s price surge, compares its performance with other prominent cryptocurrencies, and examines the potential implications for the Terra ecosystem.

Factors Contributing to Terra’s Price Surge, What is terra network rises over 20 in the last 30 days

Several factors have contributed to the recent price surge of Terra.

- Growing Adoption of Terra’s Stablecoin (UST):Terra’s stablecoin, UST, has witnessed a significant increase in adoption. Its use in DeFi protocols and as a means of payment within the Terra ecosystem has contributed to its growing popularity.

- Expansion of the Terra Ecosystem:The Terra ecosystem has been actively expanding, with the addition of new decentralized applications (dApps), protocols, and partnerships. This growth has attracted more users and developers to the platform, leading to increased demand for LUNA.

- Increased Institutional Interest:Institutional investors have shown growing interest in Terra, recognizing its potential for growth and its unique features. This institutional participation has injected significant capital into the market, driving up the price of LUNA.

- Positive Market Sentiment:Overall positive sentiment in the cryptocurrency market has also contributed to Terra’s price surge. As the market recovers from recent downturns, investors are looking for promising projects with strong fundamentals, and Terra has emerged as a strong contender.

Price Performance Comparison with Other Cryptocurrencies

Comparing Terra’s price performance with other major cryptocurrencies provides insights into its relative strength.

Terra Network’s recent surge, climbing over 20% in the last 30 days, has been fueled by a combination of factors, including its growing ecosystem and the ongoing development of its stablecoin, UST. It’s interesting to note that this rise coincides with the Japanese Yen’s historic weakness, hitting a 20-year low.

This article explores the reasons behind the Yen’s decline and its potential implications , which could have ripple effects on global markets and impact the future of Terra Network’s growth.

- Outperformance Against Bitcoin and Ethereum:Terra has significantly outperformed Bitcoin and Ethereum in recent months. This outperformance can be attributed to its unique features and its focus on DeFi and stablecoins, which have gained traction in the market.

- Comparison with Other Stablecoin Projects:Terra’s price performance has also been favorable compared to other stablecoin projects. Its focus on a decentralized and interoperable ecosystem has given it an edge over its competitors.

Potential Impact of the Price Surge on the Terra Ecosystem

The price surge of Terra has significant implications for its ecosystem.

- Increased Network Activity:The price surge has led to increased network activity, with more transactions and user engagement. This growth in activity is a positive sign for the long-term sustainability of the Terra ecosystem.

- Attracting New Developers and Investors:The price surge has also attracted new developers and investors to the Terra ecosystem. This influx of talent and capital can further fuel innovation and growth.

- Enhanced Liquidity:The price surge has enhanced the liquidity of LUNA, making it easier for users to buy and sell the token. This increased liquidity is essential for the smooth functioning of the Terra ecosystem.

Challenges and Risks

While Terra’s recent price surge is promising, it’s essential to acknowledge the challenges and risks that lie ahead for the network. Understanding these potential obstacles is crucial for investors and users to make informed decisions.

Regulatory Landscape

The regulatory landscape for cryptocurrencies is rapidly evolving, and this poses a significant challenge to Terra’s growth. Governments worldwide are grappling with how to regulate cryptocurrencies, with varying approaches and levels of scrutiny.

- Increased scrutiny:As Terra’s ecosystem expands, it may attract greater regulatory attention, particularly in areas like stablecoin issuance and DeFi protocols. This scrutiny could lead to stricter regulations, potentially impacting Terra’s operations and user experience.

- Uncertainty:The lack of clear and consistent global regulations creates uncertainty for Terra and its users. This uncertainty can hinder investment, innovation, and adoption.

- Compliance Costs:Complying with evolving regulations can be costly for Terra, potentially impacting its profitability and competitive advantage.

Competitive Landscape

Terra faces intense competition in the blockchain and cryptocurrency space, with numerous other projects vying for market share and user adoption.

The Terra network has been on a tear lately, rising over 20% in the past 30 days. This growth might be due to the increasing popularity of decentralized finance (DeFi) applications built on the Terra blockchain. It’s interesting to see how this trend aligns with the growing interest in online education, as platforms like whats so great about online teaching offer flexibility and accessibility for those wanting to learn about DeFi and blockchain technology.

This shift towards online learning could further fuel the growth of the Terra network, as more individuals become interested in exploring the world of decentralized finance.

- Emerging competitors:New blockchain projects and stablecoins are constantly emerging, posing a threat to Terra’s dominance. These competitors may offer innovative features, lower fees, or stronger community support, potentially attracting users away from Terra.

- Established players:Established players like Ethereum and Binance Smart Chain have strong developer ecosystems and user bases, providing stiff competition to Terra. They are constantly innovating and improving their platforms, making it challenging for Terra to maintain its competitive edge.

- Decentralization vs. Centralization:Terra’s reliance on centralized entities like Terraform Labs for governance and development raises concerns about its long-term decentralization. This can be a point of contention compared to fully decentralized projects, potentially impacting user trust and adoption.

Security Risks

The decentralized nature of blockchain technology makes it susceptible to various security risks, including hacks, exploits, and malicious attacks.

- Smart contract vulnerabilities:Smart contracts, the core of Terra’s DeFi protocols, can contain vulnerabilities that malicious actors can exploit. Exploits could lead to financial losses for users and damage Terra’s reputation.

- Network attacks:Terra’s network, like any blockchain, is vulnerable to attacks like 51% attacks, where a malicious actor gains control of a majority of the network’s hashrate. Such attacks could compromise the integrity of the network and disrupt its operations.

- User error:Users can be susceptible to phishing scams, malware, and other forms of social engineering. These risks can lead to the loss of funds and damage user trust in Terra.

Scalability and Performance

As Terra’s user base and transaction volume grow, it faces challenges related to scalability and performance.

- Transaction throughput:Terra’s network can only handle a limited number of transactions per second. As usage increases, transaction times could become longer and fees could rise, impacting user experience and adoption.

- Network congestion:Increased transaction volume can lead to network congestion, slowing down transaction confirmations and increasing fees. This can discourage users and impact the network’s efficiency.

- Gas fees:Terra’s gas fees, which are paid to miners for processing transactions, can fluctuate based on network activity. High gas fees can make it expensive for users to interact with the network, potentially limiting adoption.

Sustainability and Adoption

Terra’s long-term sustainability and widespread adoption depend on various factors, including community engagement, ecosystem development, and user experience.

The Terra network has been on a roll lately, gaining over 20% in value over the last 30 days. It’s exciting to see this kind of growth in the crypto world, especially when you consider the current state of the market.

While the Terra network is making waves in the digital realm, it’s also interesting to see what’s happening in the real world, like the first-of-its-kind special election in Alaska with 48 house candidates. It’s a reminder that even amidst the virtual world, real-world events still shape our lives.

Perhaps this political shake-up will lead to some interesting changes in the state, just as the Terra network is making its mark in the blockchain space.

- Community engagement:A strong and active community is crucial for Terra’s success. Active community members can contribute to development, advocacy, and user support, fostering a vibrant ecosystem.

- Ecosystem development:Terra’s ecosystem needs to grow and evolve to attract and retain users. This involves building new applications, integrating with other projects, and providing a comprehensive user experience.

- User experience:A user-friendly and accessible platform is essential for widespread adoption. Terra needs to ensure its products and services are easy to use, secure, and reliable.

Investment Considerations: What Is Terra Network Rises Over 20 In The Last 30 Days

Investing in Terra requires a thorough understanding of its unique features, potential risks, and long-term prospects. This section explores key factors to consider before making any investment decisions.

Key Investment Factors

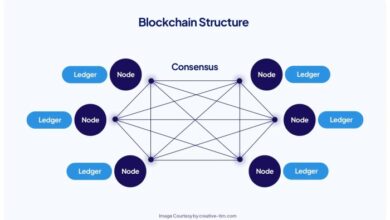

- Technology and Ecosystem:Terra’s innovative Proof-of-Stake (PoS) consensus mechanism and its robust DeFi ecosystem, including the Anchor Protocol and Mirror Protocol, offer significant potential for growth.

- Adoption and Usage:Terra’s stablecoins, particularly UST, have gained widespread adoption in the DeFi space, indicating a growing demand for its services.

- Community and Governance:Terra boasts a vibrant and active community that plays a vital role in its governance and development.

- Market Cap and Liquidity:Terra’s market capitalization and liquidity have grown significantly, indicating investor confidence and potential for future growth.

- Team and Partnerships:Terra’s team comprises experienced professionals with a strong track record in the blockchain industry. The platform also enjoys strategic partnerships with major players in the DeFi space.

Risks and Rewards

Investing in Terra comes with both potential risks and rewards.

- Volatility:Like most cryptocurrencies, Terra’s price can be highly volatile, subject to market fluctuations and external factors.

- Regulatory Uncertainty:The regulatory landscape for cryptocurrencies is evolving rapidly, and Terra may face regulatory challenges in the future.

- Competition:Terra faces competition from other stablecoin platforms and DeFi protocols, which could impact its market share and growth potential.

- Smart Contract Security:As with any blockchain platform, there is always a risk of security vulnerabilities in Terra’s smart contracts.

- Potential for Devaluation:While Terra’s stablecoins aim to maintain a stable value, they are not immune to potential devaluation due to market forces or unexpected events.

Despite these risks, Terra offers significant potential for growth and rewards for investors. Its innovative technology, robust ecosystem, and strong community support have driven its recent price surge.

Long-Term Outlook

Predicting the long-term price and market capitalization of any cryptocurrency is challenging, but several factors suggest a positive outlook for Terra:

- Continued Adoption:As DeFi continues to grow, Terra’s stablecoins and DeFi protocols are likely to see increased adoption, driving demand and price appreciation.

- Expansion of Ecosystem:Terra is actively developing new protocols and applications, further expanding its ecosystem and attracting new users.

- Institutional Interest:Growing interest from institutional investors could lead to increased investment in Terra and its ecosystem.

However, it’s crucial to remember that Terra’s long-term success depends on several factors, including regulatory developments, competition, and the overall health of the cryptocurrency market.

Last Recap

The recent surge in Terra’s price is a powerful signal of the growing confidence in its ecosystem. As the Terra Network continues to evolve and innovate, it’s poised to play a pivotal role in the future of decentralized finance.

While challenges and risks remain, the potential rewards for early adopters are undeniable. The future of Terra is bright, and its impact on the broader cryptocurrency landscape is only just beginning to unfold.