Mercedes Stock Plunge: Whats Behind the Drop?

What is behind the huge drop in Mercedes share prices? This question has been on the minds of many investors and automotive enthusiasts alike. Mercedes-Benz, a name synonymous with luxury and performance, has seen its stock take a significant hit in recent months.

While the automotive industry faces challenges, there are specific factors unique to Mercedes that have contributed to this decline.

This article delves into the intricacies of the Mercedes stock drop, exploring the complex interplay of market trends, economic headwinds, company-specific challenges, and the ever-evolving electric vehicle landscape. By examining these factors, we can gain a better understanding of the forces driving Mercedes’ stock performance and what the future holds for this iconic brand.

Recent Market Trends and Performance

Mercedes-Benz’s stock price has experienced a significant drop in recent months, raising concerns among investors. To understand this decline, it’s crucial to examine the historical performance of the stock and identify the key factors that have contributed to the recent downward trend.

Historical Performance

Mercedes-Benz’s stock performance over the past year has been marked by volatility. While the stock initially showed strong gains, it has experienced a sharp decline in recent months.

- In the first quarter of 2023, Mercedes-Benz’s stock price reached a high of over €80 per share. This surge was driven by strong demand for luxury vehicles and the company’s successful transition to electric vehicles.

- However, the stock price began to decline in the second quarter, primarily due to concerns about the global economic outlook and rising inflation. The company’s profit margins also came under pressure due to supply chain disruptions and rising raw material costs.

- In the third quarter, the stock price continued to decline, reaching a low of around €50 per share. This further decline was attributed to the ongoing global chip shortage, which impacted the company’s production capacity and sales.

Key Factors Influencing Stock Price, What is behind the huge drop in mercedes share prices

Several key factors have influenced Mercedes-Benz’s stock price in recent months, contributing to the overall decline. These factors include:

- Global Economic Outlook:Concerns about a potential global recession and rising inflation have weighed on investor sentiment. The uncertainty surrounding the economic outlook has led to a decrease in demand for luxury vehicles, impacting Mercedes-Benz’s sales and profitability.

- Supply Chain Disruptions:The ongoing global chip shortage and other supply chain disruptions have continued to impact Mercedes-Benz’s production capacity and sales. The company has been forced to cut production and delay deliveries, impacting its financial performance.

- Rising Raw Material Costs:The rising costs of raw materials, including steel, aluminum, and semiconductors, have eroded Mercedes-Benz’s profit margins. The company has been unable to fully pass on these increased costs to consumers, impacting its profitability.

- Competition:The luxury automotive market is highly competitive, with established players like BMW and Audi, as well as new entrants like Tesla, vying for market share. Mercedes-Benz is facing increased competition, which is putting pressure on its pricing and sales.

Significant Events and Announcements

Several significant events and announcements have also contributed to the drop in Mercedes-Benz’s share prices. These include:

- The company’s announcement of a significant investment in electric vehicle production:While this investment signals a commitment to the future of electric mobility, it has also raised concerns about the company’s short-term profitability. Investors are worried about the high costs associated with transitioning to electric vehicles.

- The ongoing war in Ukraine:The war has disrupted supply chains and created uncertainty in the global economy, negatively impacting the automotive industry, including Mercedes-Benz.

- The company’s announcement of a new restructuring plan:This plan aims to streamline operations and improve efficiency, but it has also raised concerns about potential job cuts and cost-cutting measures. Investors are worried about the impact of these measures on the company’s long-term growth prospects.

Economic Factors and Global Market Conditions: What Is Behind The Huge Drop In Mercedes Share Prices

The automotive industry is heavily influenced by global economic conditions. Factors such as inflation, interest rates, and supply chain disruptions can significantly impact the demand for vehicles, production costs, and overall profitability of automakers like Mercedes-Benz.

Impact of Global Economic Conditions on the Automotive Industry

The automotive industry is cyclical, meaning it tends to mirror the broader economic trends. When the economy is strong, consumers are more likely to purchase new vehicles, driving up demand and boosting sales. Conversely, during economic downturns, consumer spending typically decreases, leading to a decline in vehicle purchases.

Inflation, Interest Rates, and Supply Chain Disruptions

Rising inflation can negatively impact Mercedes-Benz by increasing production costs, particularly for raw materials and components. This can lead to higher vehicle prices, potentially reducing consumer demand. Higher interest rates can also impact demand, as financing becomes more expensive for consumers, making car purchases less attractive.

The recent drop in Mercedes share prices is a reflection of the global automotive industry’s struggles, with rising costs and supply chain issues taking a toll. It’s a stark reminder that even luxury brands aren’t immune to these challenges. While the industry grapples with these issues, Kelly Osbourne’s recent reflection on her 7 rehab stays during her addiction battle kelly osbourne reflects on 7 rehab stays during addiction battle highlights the importance of resilience and finding strength in difficult times.

Just as Mercedes is navigating these economic headwinds, individuals like Kelly are finding ways to overcome their own personal battles, offering inspiration to us all.

Supply chain disruptions, such as those caused by the COVID-19 pandemic or geopolitical tensions, can create shortages of essential components, leading to production delays and reduced vehicle availability. This can ultimately affect Mercedes-Benz’s revenue and profitability.

Mercedes-Benz’s Stock Performance Compared to Other Major Automotive Companies

It’s important to compare Mercedes-Benz’s stock performance to other major automotive companies in the market to gain a better understanding of its relative performance. For example, during periods of economic uncertainty, some automakers might outperform others due to their product mix, geographic exposure, or cost-management strategies.

The recent drop in Mercedes share prices is likely due to a combination of factors, including the global chip shortage and the rising cost of raw materials. It’s interesting to note that while Mercedes is struggling, there’s a fascination with the upper class in other parts of the world, as author Bella Mackie points out in her article author bella mackie says americans romanticise upper class brits.

Perhaps the desire for luxury is driving the fascination with the upper class, even as economic realities put pressure on car companies like Mercedes.

Company-Specific Factors

Mercedes-Benz’s recent share price decline can be attributed to a combination of factors specific to the company’s performance and strategic direction. These factors include financial performance, product portfolio, and market challenges.

Recent Financial Performance

Mercedes-Benz’s financial performance has been mixed in recent years. While the company has continued to generate significant revenue, its profitability has been under pressure due to factors such as rising costs for raw materials, labor, and logistics, as well as increased investments in electric vehicles and digital technologies.

In 2022, Mercedes-Benz reported a revenue of €152.8 billion, representing a 12% increase from the previous year. However, the company’s operating profit declined by 20% to €13.3 billion, primarily due to the impact of supply chain disruptions, rising inflation, and the ongoing transition to electric vehicles.

Product Portfolio and Competitive Position

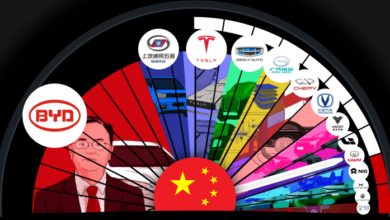

Mercedes-Benz has a long-standing reputation for producing luxury vehicles known for their quality, performance, and innovation. However, the company faces increasing competition from other luxury car manufacturers, such as BMW, Audi, and Tesla, which are aggressively investing in electric vehicles and advanced technologies.

Mercedes-Benz’s product portfolio includes a wide range of vehicles, from compact sedans and SUVs to high-performance sports cars and luxury limousines. The company has been actively expanding its electric vehicle lineup, with models like the EQS sedan and EQB SUV.

However, the company’s electric vehicle sales have been lagging behind those of Tesla and other rivals, which have established a stronger presence in the EV market.

The recent drop in Mercedes share prices is likely due to a combination of factors, including the global chip shortage impacting production and rising inflation putting pressure on consumer spending. However, it’s also worth considering the broader economic landscape, as exemplified by the recent news that congress defunds controversial total information program.

This move signals a shift in political priorities, which could further impact the automotive industry and contribute to the decline in Mercedes’ stock value.

Challenges and Risks

Mercedes-Benz faces several challenges and risks in the coming years. These include:

- Competition from Electric Vehicle Manufacturers:The rapid growth of electric vehicle manufacturers like Tesla and the increasing adoption of electric vehicles by traditional carmakers pose a significant threat to Mercedes-Benz’s market share in the luxury segment.

- Changing Consumer Preferences:Consumer preferences are shifting towards electric vehicles, SUVs, and connected cars, requiring Mercedes-Benz to adapt its product portfolio and invest heavily in research and development to stay competitive.

- Supply Chain Disruptions:Global supply chain disruptions and the ongoing semiconductor shortage have impacted Mercedes-Benz’s production and sales, leading to delays and higher costs.

- Economic Uncertainty:Global economic uncertainty, including rising inflation, interest rates, and geopolitical tensions, could negatively impact consumer demand for luxury vehicles.

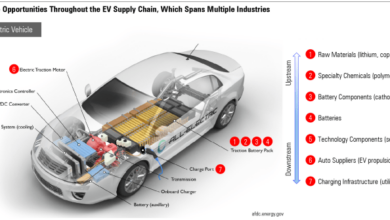

Electric Vehicle Transition

Mercedes-Benz, a renowned luxury car manufacturer, is navigating the rapidly evolving automotive landscape, with the transition to electric vehicles (EVs) at the forefront of its strategy. This shift presents both opportunities and challenges for the company, requiring a careful balance of innovation, investment, and adaptation.

Mercedes-Benz’s EV Strategy

Mercedes-Benz has Artikeld a comprehensive strategy to become a leading player in the EV market. The company aims to offer a wide range of EVs across various segments, from compact hatchbacks to high-performance SUVs. Key aspects of its strategy include:

- Ambitious Production Targets:Mercedes-Benz has set ambitious targets for EV production, aiming to achieve a significant portion of its global sales from EVs by 2030.

- Dedicated EV Platforms:The company is developing dedicated EV platforms, such as the Mercedes-Benz Modular Architecture (MMA), to optimize vehicle design and performance for electric powertrains.

- Investment in Battery Technology:Mercedes-Benz is investing heavily in battery technology, including research and development, production facilities, and partnerships with battery manufacturers.

- Charging Infrastructure Development:The company is actively developing its own charging infrastructure and collaborating with other players to expand the availability of charging stations.

Comparison with Competitors

Mercedes-Benz faces stiff competition from established and emerging EV players. Its EV offerings are comparable to those of its rivals in terms of technology, performance, and range.

- Tesla:Tesla remains a dominant force in the EV market, known for its advanced technology, high-performance vehicles, and extensive charging network.

- Volkswagen Group:Volkswagen, through its various brands, is aggressively expanding its EV portfolio, offering a wide range of models across different price points and segments.

- BMW:BMW is also making significant strides in the EV market, introducing a growing number of electric models and focusing on luxury and performance.

Impact on Profitability and Market Share

The transition to EVs has the potential to significantly impact Mercedes-Benz’s profitability and market share.

- Potential for Increased Profitability:EVs can offer higher profit margins than traditional internal combustion engine (ICE) vehicles due to fewer moving parts and lower maintenance costs. However, this depends on the success of the EV market and the ability to achieve economies of scale in production.

- Risk to Market Share:If Mercedes-Benz fails to effectively adapt to the EV transition, it could lose market share to competitors that are more agile and focused on EVs. The company needs to ensure its EV offerings are competitive in terms of price, performance, and range.

Investor Sentiment and Market Expectations

The recent decline in Mercedes-Benz’s share price has significantly impacted investor sentiment, leading to a wave of pessimism. Analysts have revised their ratings and forecasts, reflecting the uncertainty surrounding the company’s future performance. However, several factors could potentially trigger a rebound in Mercedes-Benz’s stock price.

Analysts’ Ratings and Forecasts

Analysts’ ratings and forecasts for Mercedes-Benz have been significantly affected by the recent share price drop. Several factors have contributed to this shift in sentiment:

- Lowered Earnings Estimates:Analysts have revised their earnings estimates for Mercedes-Benz downward, reflecting concerns about the company’s ability to maintain profitability in the face of rising costs and slowing demand. For instance, Goldman Sachs recently lowered its price target for Mercedes-Benz shares, citing concerns about the company’s profitability in the face of rising raw material costs and supply chain disruptions.

- Increased Uncertainty:The ongoing global economic uncertainty and geopolitical tensions have also contributed to the downward pressure on Mercedes-Benz’s share price. Analysts are cautious about the company’s ability to navigate these challenging market conditions and maintain its market share. For example, Deutsche Bank recently downgraded its rating on Mercedes-Benz shares, citing concerns about the impact of the war in Ukraine on the company’s supply chain and demand in key markets.

- Concerns about Electric Vehicle Transition:The rapid transition to electric vehicles has also created uncertainty for Mercedes-Benz. Analysts are closely watching the company’s progress in this area and its ability to compete with Tesla and other established EV players. For instance, Morgan Stanley recently expressed concerns about Mercedes-Benz’s ability to scale its EV production and compete effectively in the rapidly growing electric vehicle market.

Potential Factors for a Rebound

Despite the current challenges, several factors could potentially lead to a rebound in Mercedes-Benz’s stock price:

- Improved Economic Outlook:A recovery in the global economy and easing of supply chain disruptions could boost demand for luxury vehicles, benefiting Mercedes-Benz. For example, if the global economy recovers faster than expected, demand for luxury vehicles could increase, leading to higher sales for Mercedes-Benz and potentially boosting its stock price.

- Stronger-than-Expected EV Performance:Mercedes-Benz’s success in the electric vehicle market could significantly impact its share price. If the company can successfully launch new EV models and gain market share, it could regain investor confidence and lead to a rebound in its stock price.

For instance, if Mercedes-Benz’s new electric SUV, the EQS, proves popular with consumers and achieves strong sales, it could demonstrate the company’s ability to compete effectively in the EV market and potentially boost investor confidence.

- Cost Reduction Measures:Mercedes-Benz’s efforts to reduce costs and improve efficiency could also contribute to a rebound in its stock price. If the company can successfully implement cost-cutting measures and improve its profitability, it could attract investors and lead to a higher share price.

For example, if Mercedes-Benz can successfully reduce its manufacturing costs through streamlining its supply chain and improving production efficiency, it could improve its profitability and potentially lead to a rebound in its stock price.