Throwing Money at Technology: A Risky Business Strategy?

Throwing money at technology is a phrase often used to describe companies that invest heavily in technological development, hoping to gain a competitive edge. It’s a strategy that can be both exhilarating and terrifying, promising rapid growth and innovation but also carrying the risk of financial ruin.

History is filled with examples of companies that have embraced this approach, some with resounding success, others with disastrous consequences. From the rise of Silicon Valley giants like Apple and Google to the fall of tech startups that failed to find a market for their products, the path of throwing money at technology is paved with both triumph and tragedy.

The Concept of “Throwing Money at Technology”

The phrase “throwing money at technology” is a common idiom used to describe a strategy where companies invest heavily in technological advancements without a clear plan or a well-defined return on investment. While this approach can sometimes lead to breakthroughs, it can also be a risky gamble, potentially resulting in financial losses and wasted resources.This approach often involves pouring large sums of money into developing new technologies, acquiring cutting-edge companies, or building extravagant research facilities.

It’s often associated with a sense of urgency and a belief that rapid technological progress is the key to success.

Examples of Companies that Have Adopted This Approach

Many companies throughout history have embraced the “throw money at technology” strategy, with varying degrees of success. Some notable examples include:

- General Motors:In the 1980s, General Motors invested heavily in robotics and automation, aiming to revolutionize its manufacturing processes. While some of these initiatives were successful, others proved costly and ultimately unsuccessful, leading to significant financial losses for the company.

- Yahoo!:In the late 1990s and early 2000s, Yahoo! acquired numerous startups and invested heavily in internet-related technologies. While some of these investments paid off, others were ultimately deemed unsuccessful, and the company faced a decline in market share.

- Microsoft:Microsoft’s acquisition of Nokia’s mobile phone business in 2014 was a significant investment in the mobile technology market. Despite initial hopes, the venture ultimately failed to achieve its objectives, leading to significant financial losses for Microsoft.

These examples illustrate the potential risks and uncertainties associated with the “throw money at technology” approach. While some companies have achieved success with this strategy, others have experienced significant setbacks and financial losses.

Situations Where “Throwing Money at Technology” Might Be a Valid Strategy

While the “throw money at technology” approach can be risky, there are situations where it might be a valid strategy:

- Emerging Technologies:In rapidly evolving fields like artificial intelligence, quantum computing, or biotechnology, investing heavily in research and development can be crucial for establishing a competitive advantage. Companies like Google, Amazon, and Facebook have invested heavily in AI research, aiming to capitalize on the potential of this transformative technology.

It’s easy to get caught up in the hype of throwing money at the latest tech, hoping it’ll solve all our problems. But sometimes, the real solution lies in addressing the underlying issues. As the US intensifies the war of words with its rivals, maybe we should be investing in diplomacy and understanding, not just the next shiny gadget.

After all, a world where technology solves everything is a world where we’ve stopped thinking critically about the problems we’re trying to solve.

- Disruptive Innovation:Companies facing disruptive innovation from competitors might need to invest heavily in new technologies to remain competitive. For example, traditional media companies like newspapers and television networks have invested heavily in digital platforms and streaming services to adapt to the rise of online content.

- Strategic Acquisitions:Acquiring promising startups or companies with cutting-edge technologies can be a strategic move to gain access to new capabilities and accelerate innovation. This strategy is often employed by large corporations to expand their product portfolios or enter new markets.

It’s important to note that even in these situations, a well-defined strategy and careful risk management are essential. Simply throwing money at technology without a clear plan and a focus on tangible outcomes is unlikely to lead to long-term success.

Advantages and Disadvantages of “Throwing Money at Technology”

The idea of “throwing money at technology” often evokes images of lavish research labs, cutting-edge prototypes, and the promise of revolutionary breakthroughs. However, like any investment strategy, it comes with its own set of advantages and disadvantages that require careful consideration.

Sometimes, it feels like we throw money at technology without really understanding what we’re buying. We want the shiny new gadget, the cutting-edge software, but do we truly grasp the implications? Take, for example, the vast potential of artificial intelligence in the Middle East, a region rich in history and culture.

More information on the Middle East can help us understand how technology can be used to preserve heritage and foster progress. But, ultimately, we must remember that technology is a tool, and its impact depends on the intentions and wisdom of its users.

Potential Benefits of Heavy Investment in Technology

Heavy investment in technology can be a powerful catalyst for growth and innovation. By channeling significant resources towards research and development, companies can accelerate their progress, potentially leading to market dominance and a competitive edge.

- Faster Development:Increased funding allows for the hiring of more skilled personnel, the acquisition of advanced equipment, and the exploration of diverse research avenues. This can significantly shorten the time it takes to develop and deploy new technologies. For example, companies like SpaceX have leveraged substantial investments to rapidly advance their space exploration capabilities, significantly reducing the cost of launching rockets and opening up new possibilities for commercial space travel.

- Market Dominance:By investing heavily in technology, companies can create barriers to entry for competitors. A strong technology portfolio can give them a significant advantage in terms of product features, performance, and cost efficiency. Amazon’s early investments in e-commerce infrastructure and logistics helped them establish a dominant position in online retail, setting a high bar for competitors to match.

- Innovation:When resources are plentiful, research teams can experiment with bolder ideas and pursue high-risk, high-reward projects. This can lead to groundbreaking discoveries and advancements that reshape entire industries. The development of the internet, for instance, was fueled by significant investments in research and infrastructure, ultimately revolutionizing communication and information access globally.

Potential Drawbacks of Heavy Investment in Technology

While throwing money at technology can be a potent strategy, it also carries inherent risks. Companies need to be mindful of the potential downsides, such as financial strain, technological failure, and neglecting other aspects of the business.

- Financial Risk:Heavy investments in technology can put a strain on a company’s finances, especially if the projects don’t yield the desired results. This can lead to debt, reduced profitability, and even bankruptcy if not managed carefully. The dot-com bubble of the late 1990s serves as a stark reminder of the financial risks associated with overinvesting in technology without a clear path to profitability.

- Technological Failure:Not all technological endeavors are successful. Even with substantial investment, there’s always a chance that projects will fail to meet expectations or deliver on their promises. This can result in wasted resources, missed opportunities, and damage to a company’s reputation.

The development of supersonic passenger jets in the 1960s and 1970s is a prime example of a technological failure that cost billions of dollars and ultimately failed to gain widespread adoption.

- Neglecting Other Business Aspects:Focusing too heavily on technology can lead to neglecting other critical aspects of the business, such as marketing, sales, and customer service. This can result in a lack of revenue, market share, and customer satisfaction, ultimately hindering the company’s overall success.

The rise of “tech giants” like Facebook and Google, which have faced criticism for prioritizing user engagement and data collection over privacy and ethical considerations, underscores the importance of maintaining a balanced approach to technology development and business operations.

Alternative Strategies for Technological Development

Throwing money at technology isn’t the only way to achieve technological advancement. Companies can adopt alternative strategies that focus on efficiency, collaboration, and strategic partnerships.

- Strategic Partnerships:Collaborating with other companies, research institutions, or government agencies can provide access to shared resources, expertise, and funding. This can be particularly beneficial for smaller companies that lack the resources to invest heavily in technology on their own. The development of the Global Positioning System (GPS), for instance, involved a collaborative effort between the U.S.

It’s tempting to think that throwing money at technology will solve all our problems, but the reality is far more complex. As we invest in advanced tools and systems, we also open ourselves up to new vulnerabilities. The FBI’s recent focus on digging deeper into the web fbi digs deeper into the web highlights the growing need for cybersecurity and responsible development.

It’s a reminder that simply throwing money at technology won’t guarantee safety or progress, we need to be smarter about how we build and use these tools.

Department of Defense, private companies, and international partners.

- Open Innovation:Engaging with the broader community through open-source software, crowdsourcing, and hackathons can leverage the collective intelligence of a diverse group of individuals. This can lead to innovative solutions and faster development cycles. The Linux operating system, a prime example of open-source innovation, has become a cornerstone of modern computing, thanks to the contributions of a global community of developers.

- Lean Development:Adopting lean methodologies, such as agile development, can optimize resource allocation, prioritize high-value features, and focus on rapid iteration and customer feedback. This approach can be more efficient and cost-effective than large-scale, upfront investments. Companies like Spotify and Netflix have successfully employed lean development practices to rapidly adapt to evolving market demands and user preferences.

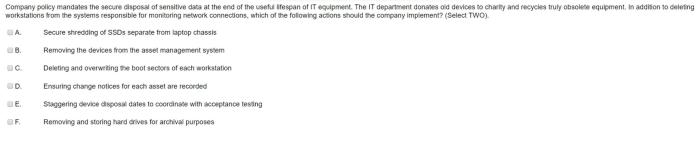

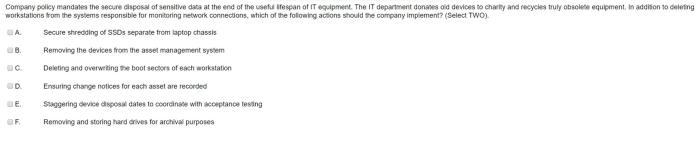

Factors Influencing the Effectiveness of “Throwing Money at Technology”

While throwing money at technology might seem like a straightforward approach, its effectiveness is heavily influenced by various factors. Understanding these factors is crucial for maximizing the chances of success and ensuring that investments yield the desired results.

Market Demand

The success of any technological innovation hinges on its ability to meet a real market need. A thorough understanding of the target market, its unmet needs, and the potential demand for the proposed technology is crucial. This involves conducting market research, analyzing competitor offerings, and identifying potential customer segments.

For example, if a company invests heavily in developing a revolutionary new smartphone but fails to consider the existing market saturation and consumer preferences, the chances of success are significantly reduced.

Competitive Landscape

The competitive landscape plays a critical role in determining the effectiveness of technology investments. Analyzing the competitive landscape involves understanding the strengths and weaknesses of existing competitors, their market share, and their technological capabilities. It also involves identifying potential disruptors and emerging technologies that could impact the market.

For instance, a company developing a new electric vehicle needs to consider the existing competition from established players like Tesla and the rapid advancements in battery technology from startups.

Internal Capabilities

Beyond external factors, the success of “throwing money at technology” also depends heavily on the internal capabilities of the organization. This includes the availability of skilled personnel, relevant expertise, and a robust infrastructure to support technology development and implementation. For example, a company investing in artificial intelligence needs to ensure it has access to data scientists, engineers, and the necessary computational resources to build and deploy effective AI models.

Strategy and Roadmap

A clear strategy and a well-defined roadmap for technology development are essential for ensuring that investments are directed towards the right areas and that progress is tracked effectively. The strategy should Artikel the company’s long-term vision for technology, its key objectives, and the steps required to achieve them.

The roadmap should provide a detailed timeline for technology development, milestones, and resource allocation. For instance, a company developing a new software platform should have a clear strategy outlining the target audience, the key features, and the planned release schedule.

Leadership and Management

Effective leadership and management are crucial for driving successful technological innovation. Strong leadership is needed to set the vision, prioritize investments, and create a culture of innovation. Effective management is essential for ensuring efficient resource allocation, project execution, and talent development.

For example, a company developing a new space exploration technology requires a visionary leader who can inspire the team, secure funding, and navigate the complex regulatory landscape.

Alternatives to “Throwing Money at Technology”

While “throwing money at technology” can sometimes be effective, it’s not always the most efficient or sustainable approach. There are alternative methods that can lead to more innovative and cost-effective solutions. These approaches often involve strategic partnerships, collaborative efforts, and lean development methodologies.

Strategic Partnerships

Strategic partnerships offer a valuable alternative to solely relying on internal resources and funding for technology development. They involve collaborating with other organizations, such as universities, research institutions, or even competitors, to leverage their expertise, resources, and networks.

- Advantages:

- Access to specialized knowledge and skills.

- Shared costs and risks.

- Faster development cycles.

- Increased market reach.

- Disadvantages:

- Potential conflicts of interest.

- Challenges in coordinating and managing different teams.

- Risk of intellectual property disputes.

Strategic partnerships can be particularly beneficial when developing complex technologies that require specialized knowledge or when expanding into new markets. For example, a pharmaceutical company might partner with a university to develop a new drug, while a software company might partner with a hardware manufacturer to create a new product.

Open-Source Collaboration

Open-source collaboration is a collaborative approach where developers contribute to the development of software and other technologies by sharing their code and ideas freely. This approach encourages innovation and rapid development, as anyone can contribute and benefit from the project.

- Advantages:

- Faster development cycles due to collective efforts.

- Access to a wider range of expertise and perspectives.

- Reduced development costs as resources are shared.

- Increased transparency and accountability.

- Disadvantages:

- Challenges in coordinating and managing contributions.

- Potential for security vulnerabilities.

- Limited control over the direction of the project.

Open-source collaboration is often used in software development, where projects like Linux and Android have been highly successful. This approach is also increasingly being adopted in other fields, such as hardware design and biotechnology.

Lean Development Methodologies

Lean development methodologies focus on minimizing waste and maximizing efficiency in the development process. They emphasize iterative development, customer feedback, and continuous improvement.

- Advantages:

- Faster time to market.

- Reduced development costs.

- Increased customer satisfaction.

- Improved product quality.

- Disadvantages:

- Requires a strong commitment to continuous improvement.

- May not be suitable for complex or highly regulated projects.

- Can be challenging to implement effectively.

Lean development methodologies are widely used in software development, but they can also be applied to other industries, such as manufacturing and healthcare. Examples include Agile development, Scrum, and Kanban.

Case Studies and Examples

The effectiveness of “throwing money at technology” can be better understood by examining real-world examples of companies that have adopted this approach, both successfully and unsuccessfully. Analyzing these case studies helps us understand the factors that contribute to success or failure, allowing us to draw valuable insights into the strategy’s effectiveness.

Successful Case Studies

Companies that have successfully adopted the “throwing money at technology” approach often invest heavily in research and development, aiming to gain a competitive edge through technological advancements. These companies are often characterized by their willingness to take risks and invest in innovative technologies, even if the outcome is uncertain.

- Amazon: Amazon’s success story is often cited as a prime example of “throwing money at technology.” The company has consistently invested heavily in its technology infrastructure, leading to the development of groundbreaking services like Amazon Web Services (AWS), Kindle, and Prime.

This strategic approach has enabled Amazon to become a dominant force in e-commerce and cloud computing.

- Google: Google is another company that has reaped significant rewards from investing heavily in technology. Their investments in artificial intelligence (AI), machine learning, and search algorithms have propelled them to the forefront of the internet industry.

- Tesla: Tesla’s success is a testament to the power of “throwing money at technology” in the automotive industry. Elon Musk’s vision and relentless pursuit of innovation have led to the development of electric vehicles that are changing the landscape of transportation.

Unsuccessful Case Studies

While “throwing money at technology” can be a winning strategy, it’s not a guaranteed path to success. Many companies have failed to achieve their goals despite significant investments in technology. These failures often stem from a lack of strategic planning, inadequate market research, or an inability to adapt to changing market conditions.

- Nokia: Nokia, once a dominant player in the mobile phone market, failed to adapt to the rise of smartphones and Android. Despite significant investments in technology, Nokia couldn’t compete with the innovative offerings of companies like Apple and Samsung.

- Kodak: Kodak’s failure to embrace digital photography is a classic example of a company that was unable to adapt to technological change. Despite pioneering digital photography, Kodak clung to its film-based business model, ultimately leading to its downfall.

- Blockbuster: Blockbuster, the once-dominant video rental giant, failed to adapt to the rise of streaming services like Netflix. Despite investing in online rentals, Blockbuster was unable to compete with the convenience and affordability of streaming services.

Factors Contributing to Success or Failure, Throwing money at technology

The success or failure of “throwing money at technology” depends on various factors. The following table highlights some of the key factors that contribute to the effectiveness of this approach: