The Fed Wont Say the R Word: Is a Recession Looming?

The fed wont say the r word – The Fed won’t say the “R word,” but the whispers of a potential recession are growing louder. Despite mounting economic pressures, the Federal Reserve remains hesitant to explicitly declare a recession, sparking questions about their communication strategy and the true state of the US economy.

Is the Fed playing a cautious game, or are they simply ignoring the elephant in the room?

This article delves into the Fed’s communication strategy, analyzing the reasons behind their reluctance to use the “R word” and its impact on market sentiment. We’ll explore key economic indicators, the Fed’s current monetary policy, and the role of consumer confidence in shaping economic expectations.

Ultimately, we’ll consider the potential implications of a looming recession and what the future holds for the US economy.

The Fed’s Monetary Policy and Its Impact: The Fed Wont Say The R Word

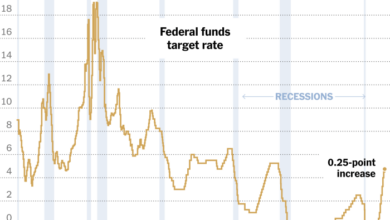

The Federal Reserve (Fed) plays a crucial role in managing the U.S. economy by setting monetary policy. This policy involves adjusting interest rates and the money supply to influence inflation, economic growth, and unemployment. The Fed’s current monetary policy stance is focused on taming inflation, which has been running at elevated levels for much of the past year.

The Fed’s reluctance to utter the “R-word” (recession) feels like a carefully choreographed dance around reality, much like how the food world mourned the passing of the legendary Diana Kennedy, a woman who brought Mexican cuisine to life with passion and authenticity.

While we try to stay optimistic, the economic indicators are hard to ignore, and the Fed’s silence on the matter only amplifies the uncertainty.

The Fed’s Current Monetary Policy Stance

The Fed has been aggressively raising interest rates since March 2022, aiming to cool down the economy and curb inflation. This tightening of monetary policy has resulted in higher borrowing costs for businesses and consumers, which can slow down economic activity and reduce demand.

The Fed’s target federal funds rate, which is the rate at which banks lend to each other overnight, has risen significantly from near zero in early 2022 to a range of 5.00% to 5.25% in June 2023.

The Fed is playing a dangerous game of semantics, refusing to utter the dreaded “R” word even as the economy falters. While they may be reluctant to officially declare a recession, the latest data, which shows the U.S. economy shrinking again in the second quarter , is painting a stark picture of economic weakness.

The Fed’s reluctance to acknowledge the reality of the situation only serves to erode public confidence and further exacerbate the growing anxieties about a potential recession.

The Fed’s Balancing Act

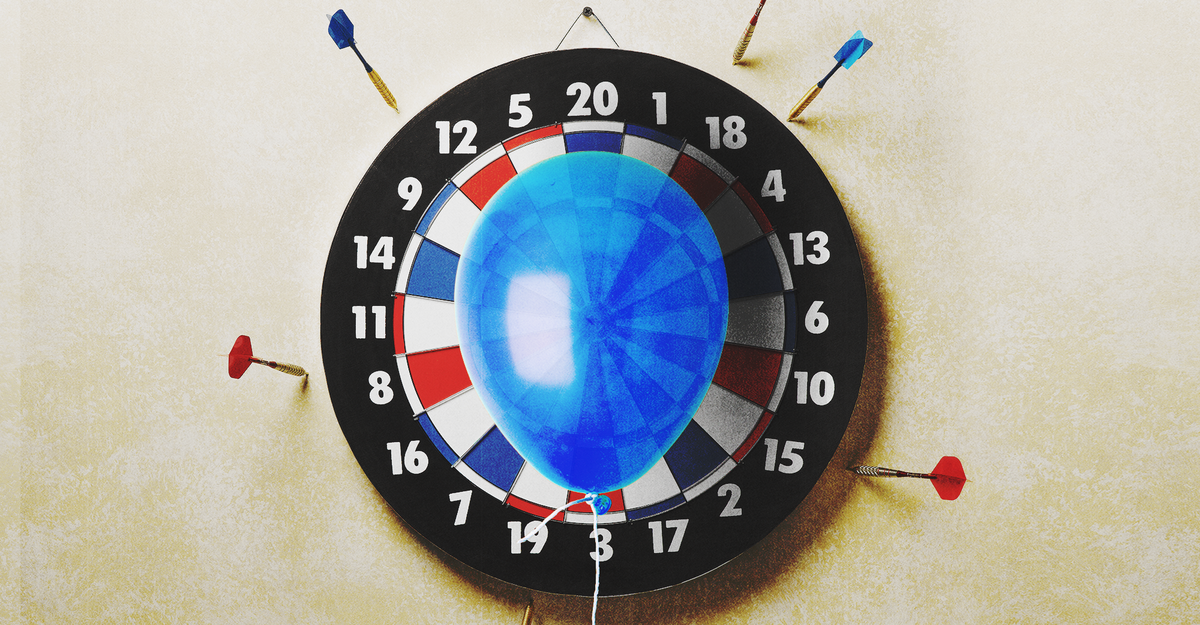

The Fed faces a delicate balancing act in trying to control inflation without stifling economic growth. Raising interest rates too aggressively could push the economy into a recession, while doing too little could allow inflation to spiral out of control.

The Fed’s decisions are influenced by a variety of factors, including economic data, inflation expectations, and financial market conditions.

It’s fascinating how the Fed’s reluctance to utter the “R” word is juxtaposed against the news of a “commando network coordinating the flow of weapons in Ukraine,” as reported by officials here. While the Fed grapples with inflation, a hidden network is quietly ensuring the Ukrainian resistance has the means to fight.

Perhaps this is a testament to the power of decentralized action in the face of uncertainty.

The Potential Consequences of the Fed’s Actions, The fed wont say the r word

The Fed’s actions have a significant impact on various sectors of the economy. For example, higher interest rates can make it more expensive for businesses to borrow money, which could lead to slower investment and job growth. They can also make it more difficult for consumers to afford homes and other big-ticket items, potentially dampening consumer spending.

The Role of Consumer Confidence and Business Sentiment

The health of an economy is not solely determined by monetary policy. Consumer confidence and business sentiment play a crucial role in shaping economic activity. These psychological factors influence spending, investment, and overall economic growth.

The Impact of Consumer Confidence and Business Sentiment on Economic Activity

Consumer confidence reflects how optimistic consumers are about the economy’s future. When consumers are confident, they are more likely to spend money, leading to increased demand for goods and services. Conversely, low consumer confidence can lead to decreased spending and economic slowdown.

Business sentiment reflects the optimism of businesses about the future. When businesses are confident, they are more likely to invest in new projects, hire new employees, and expand operations. This leads to increased economic activity and job creation.

The Fed’s Communication Strategy and Its Influence on Sentiment

The Federal Reserve (Fed) plays a significant role in shaping consumer and business sentiment through its communication strategy. Clear and consistent communication about its monetary policy goals and intentions can help to build confidence and stability in the economy. For example, if the Fed communicates its intention to keep interest rates low for an extended period, it can signal its commitment to supporting economic growth and boost consumer and business confidence.

Conversely, ambiguous or conflicting messages from the Fed can lead to uncertainty and volatility in the markets, which can negatively impact sentiment.

The Potential for a Self-Fulfilling Prophecy in Terms of Recessionary Fears

Recessionary fears can create a self-fulfilling prophecy. If consumers and businesses become overly pessimistic about the economy’s future, they may reduce their spending and investment, leading to a decline in economic activity and potentially triggering a recession. This is because a decrease in spending and investment can lead to job losses, lower wages, and further reductions in consumer confidence, creating a vicious cycle.

Wrap-Up

While the Fed’s silence on the “R word” may offer a glimmer of hope, the economic landscape remains complex and uncertain. Navigating the potential for a recession requires careful analysis of economic indicators, understanding the Fed’s monetary policy, and monitoring the shifts in consumer and business sentiment.

As we move forward, the Fed’s actions and communication will be critical in shaping the economic trajectory and guiding us through this period of uncertainty.