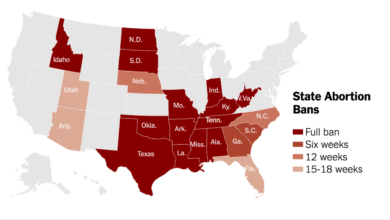

District Attorneys: Last Defense Against Abortion Bans?

District attorneys could be a last defense against abortion bans, standing as a potential bulwark against restrictive legislation that threatens reproductive rights. While traditionally tasked with upholding the law, their role in this complex legal landscape is far from straightforward.

Faced with potentially conflicting personal beliefs and the weight of public opinion, district attorneys must navigate a treacherous path, balancing their duty to the law with the ethical considerations surrounding abortion.

This article delves into the unique position of district attorneys in the face of abortion bans, exploring the legal, ethical, and societal implications of their decisions. We’ll examine the potential challenges they face, the ethical dilemmas they might encounter, and the public’s perception of their role in enforcing these controversial laws.

The Public’s Perspective on Abortion Bans: District Attorneys Could Be A Last Defense Against Abortion Bans

The public’s perspective on abortion bans is a complex and multifaceted issue, influenced by personal beliefs, cultural values, and political affiliations. Understanding public opinion is crucial for navigating the legal and social landscape surrounding abortion rights. This section explores the public’s stance on abortion bans, examining public opinion polls, the impact of district attorneys’ positions, and the potential for public activism.

Public Opinion Polls and Surveys, District attorneys could be a last defense against abortion bans

Public opinion polls and surveys provide valuable insights into the public’s views on abortion bans.

- A 2022 Gallup poll found that 80% of Americans believe abortion should be legal in at least some circumstances, with 39% believing it should be legal in all or most cases, and 41% believing it should be legal only in some cases.

- A 2023 Pew Research Center survey revealed that 61% of Americans believe abortion should be legal in all or most cases, while 38% believe it should be illegal in all or most cases.

- These polls indicate a majority of Americans support abortion rights, with a significant portion favoring legal abortion in all or most cases.

The Impact of District Attorneys’ Stances

The stance of district attorneys on abortion bans can significantly influence public perception.

- District attorneys who choose to prosecute individuals seeking or providing abortions are likely to face criticism and public opposition.

- Conversely, district attorneys who publicly state their commitment to protecting abortion rights may garner support from pro-choice advocates and the public.

- The public’s perception of district attorneys can be shaped by their actions and public statements regarding abortion bans, influencing their re-election prospects and public support.

Potential for Public Protests and Activism

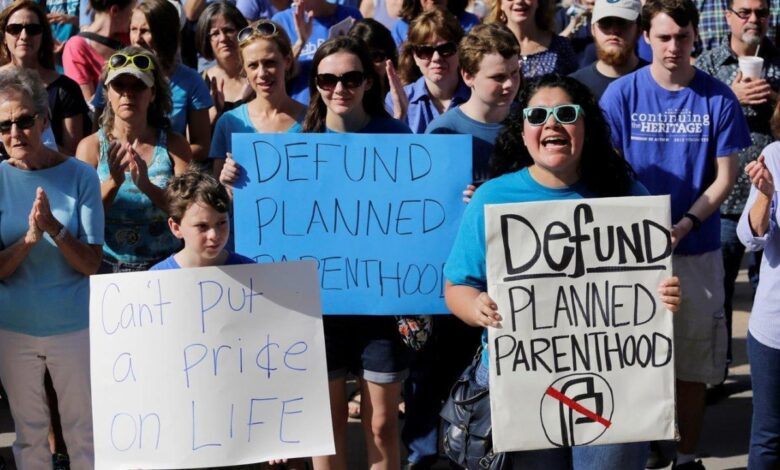

Abortion bans have sparked widespread public protests and activism.

- Pro-choice organizations and individuals have organized marches, rallies, and demonstrations to express their opposition to abortion restrictions.

- These protests aim to raise awareness, pressure lawmakers, and advocate for the protection of abortion rights.

- The potential for continued public activism and protest in response to abortion bans is significant, highlighting the passionate and vocal nature of the debate.

Conclusion

The issue of abortion bans and the role of district attorneys is a multifaceted one, raising critical questions about the balance of power, individual rights, and the ethical responsibilities of public officials. While the legal landscape surrounding abortion remains in flux, the actions of district attorneys will undoubtedly play a significant role in shaping the future of reproductive rights.

As we move forward, it’s essential to engage in open dialogue and thoughtful consideration of the complex issues at play, ensuring that the voices of all are heard and respected.

It’s unsettling to think about how easily access to healthcare can be taken away, and in the case of abortion rights, district attorneys could be a crucial line of defense. Just like how Sweet Lorens Inc. issued a voluntary allergy alert on undeclared gluten in their product , these officials have the power to act when basic rights are threatened.

While the focus is often on legislation, local officials can play a vital role in protecting access to reproductive healthcare.

It’s chilling to think about the potential consequences of these restrictive abortion bans. While some might believe they’ll simply stop women from seeking abortions, a recent CBS News poll shows most Texans think women will still seek abortions, even if it means risking their safety.

This underscores the importance of district attorneys, who could potentially act as a last line of defense against these draconian laws, ensuring that women’s health and safety remain paramount.

It’s becoming increasingly clear that district attorneys could be a crucial last line of defense against draconian abortion bans. While the national conversation swirls around the shrinking scope of the Democrats’ domestic agenda bill, as detailed in this article heres how democrats big domestic agenda bill has shrunk , the reality on the ground is that local prosecutors hold significant power to shape the enforcement of these laws.

They can choose to prioritize resources elsewhere, or even decline to prosecute cases that violate a woman’s right to choose. This local resistance could become a critical counterbalance to the growing tide of restrictions.