Senate Passes Democrats Climate, Health, and Tax Bill: A Win for Biden

Senate passes democrats sweeping climate health and tax bill delivering win for biden – Senate Passes Democrats’ Climate, Health, and Tax Bill: A Win for Biden. This monumental legislation, a culmination of months of negotiations and political maneuvering, marks a significant victory for President Biden and the Democratic Party. The bill tackles a wide range of issues, from climate change and healthcare to taxes and economic development, offering a glimpse into the future direction of the nation.

The bill’s passage was not without its challenges, facing fierce opposition from Republicans and navigating a complex legislative landscape. However, Democrats managed to secure enough votes to pass the bill, a testament to their commitment to addressing these critical issues.

This victory has far-reaching implications for the country, shaping policy for years to come.

The Bill’s Provisions

The Senate’s passage of the Inflation Reduction Act, a sweeping climate, health, and tax bill, marks a significant step towards addressing key national priorities. The bill, which passed along party lines, includes a wide range of provisions aimed at reducing greenhouse gas emissions, lowering healthcare costs, and generating revenue through tax changes.

This legislation represents a culmination of months of negotiation and debate, ultimately reflecting a compromise between competing interests. Understanding the bill’s provisions is crucial for gauging its potential impact on various sectors of the economy and society.

Climate Investments

The bill allocates substantial funds towards climate action, aiming to reduce carbon emissions and promote clean energy technologies. This section Artikels the key provisions related to climate change mitigation and adaptation.

The Senate’s passage of the Democrats’ sweeping climate, health, and tax bill is a major win for President Biden, but it’s not the only political news making headlines. With Wyoming and Alaska holding elections, it’s worth keeping an eye on key races, as outlined in 6 things to watch in Wyoming and Alaska elections CNN politics.

These races could have implications for the national political landscape, especially as the Democrats try to build on their recent momentum.

- Renewable Energy Tax Credits:The bill extends and expands tax credits for renewable energy sources, such as solar, wind, and geothermal power. These credits are designed to incentivize investment in clean energy projects, lowering costs and increasing adoption.

- Clean Vehicle Tax Credits:The bill provides tax credits for the purchase of electric vehicles (EVs), encouraging the transition towards a more sustainable transportation sector. This includes credits for both new and used EVs, with income limitations for eligibility.

- Clean Energy Manufacturing:The bill includes investments in domestic clean energy manufacturing, aiming to bolster the US supply chain and reduce reliance on foreign sources for critical components. This includes tax credits for the production of solar panels, wind turbines, and other clean energy technologies.

- Climate Change Mitigation:The bill provides funding for various climate change mitigation programs, including efforts to reduce methane emissions from oil and gas operations, invest in carbon capture technologies, and support climate-resilient infrastructure projects.

Healthcare Provisions

The bill includes provisions aimed at lowering healthcare costs and expanding access to affordable healthcare.

- Prescription Drug Pricing:The bill allows Medicare to negotiate lower prices for certain prescription drugs, a long-sought policy change aimed at reducing drug costs for seniors. This provision has the potential to significantly impact drug prices, with implications for both pharmaceutical companies and consumers.

- Extension of Affordable Care Act Subsidies:The bill extends Affordable Care Act (ACA) subsidies for three years, ensuring continued affordability of health insurance for millions of Americans. This provision is crucial for maintaining access to affordable healthcare, particularly for low- and middle-income individuals.

- Cap on Out-of-Pocket Insulin Costs:The bill caps out-of-pocket insulin costs for Medicare beneficiaries at $35 per month. This provision is designed to address the high cost of insulin for people with diabetes, providing much-needed relief for those struggling to afford this essential medication.

Tax Provisions

The bill includes a number of tax provisions aimed at generating revenue and promoting economic growth.

- Corporate Minimum Tax:The bill imposes a 15% minimum tax on large corporations, aiming to ensure that companies with significant profits pay their fair share of taxes. This provision is intended to address concerns about corporate tax avoidance and generate revenue for government programs.

- Increased IRS Enforcement:The bill provides funding to the Internal Revenue Service (IRS) to enhance tax enforcement efforts, aiming to increase tax compliance and reduce tax evasion. This provision is expected to generate significant revenue for the government, but also raises concerns about potential impacts on taxpayers.

- Energy Efficiency Tax Credits:The bill provides tax credits for energy-efficient home improvements, such as insulation, windows, and heat pumps. These credits are designed to incentivize energy efficiency upgrades, reducing energy consumption and lowering household energy bills.

Political Context and Significance

The passage of the Inflation Reduction Act, a sweeping climate, health, and tax bill, marks a significant victory for President Biden and the Democratic Party. The bill’s passage was a testament to the Democrats’ ability to navigate a deeply divided Congress and overcome significant opposition from Republicans.The bill’s journey through the legislative process was fraught with challenges.

The Democrats faced a narrow majority in the Senate, meaning that every vote was crucial. Additionally, the bill’s provisions were met with fierce opposition from Republicans, who argued that it would increase inflation and harm the economy.

Key Players and their Roles

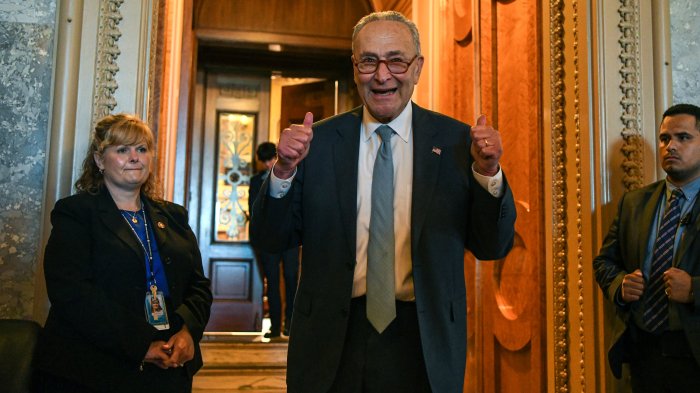

The success of the bill can be attributed to the strategic maneuvering of key figures within the Democratic Party. President Biden played a critical role in rallying support for the bill and pushing it through Congress. Vice President Kamala Harris cast the tie-breaking vote in the Senate, ensuring the bill’s passage.

Senate Majority Leader Chuck Schumer was instrumental in navigating the bill through the Senate, overcoming procedural hurdles and securing the necessary votes.The bill’s passage also highlights the importance of party unity. Despite some differences among Democrats, they ultimately came together to support the bill, demonstrating the party’s commitment to its core priorities.

The bill’s passage is a significant victory for the Democratic Party, solidifying its position on key issues such as climate change, healthcare, and taxation.

It’s a big week for politics, with the Senate passing Democrats’ sweeping climate, health, and tax bill, a major win for Biden. But let’s be honest, sometimes even the most important news can’t compete with the sheer cuteness of these tortoise shaped cakes at Lady Wong.

Those adorable little faces are almost too precious to eat, but I’m sure I’ll find a way! Anyway, back to the news… this bill is a significant step forward, addressing climate change, lowering healthcare costs, and investing in clean energy.

Significance of the Bill in the Context of Biden’s Agenda

The Inflation Reduction Act represents a major victory for President Biden’s agenda. The bill addresses key priorities of the Biden administration, including combating climate change, lowering healthcare costs, and reducing the federal deficit. The bill’s passage is a significant step forward in realizing Biden’s vision for a more sustainable, equitable, and prosperous America.The bill’s passage is also a testament to Biden’s ability to navigate a divided Congress and achieve legislative victories.

The bill’s passage is a significant achievement for Biden, demonstrating his commitment to tackling key challenges facing the nation.

Impact on the Political Landscape

The bill’s passage is likely to have a significant impact on the political landscape. The bill’s provisions are likely to be popular with voters, particularly those who support policies that address climate change and healthcare costs. This could benefit Democrats in the upcoming midterm elections, potentially helping them retain control of Congress.The bill’s passage could also have implications for the 2024 presidential election.

The bill’s success could bolster Biden’s standing with voters, potentially giving him a stronger chance of re-election. Conversely, the bill’s passage could also motivate Republicans to mobilize their base and challenge Biden in the 2024 election.

Economic Implications

The Inflation Reduction Act of 2022 carries significant economic implications, potentially impacting inflation, job creation, economic growth, and the long-term sustainability of the US economy. The bill’s provisions, including investments in renewable energy, climate change mitigation, and healthcare, aim to stimulate economic activity while addressing pressing societal challenges.

Impact on Inflation

The bill’s impact on inflation is a complex issue with mixed perspectives. Proponents argue that the bill’s investments in renewable energy and clean technologies will reduce dependence on fossil fuels, potentially lowering energy prices and easing inflationary pressures. They also highlight the bill’s provisions to reduce prescription drug costs, which could benefit consumers and lower healthcare expenses.

However, critics argue that the bill’s spending could exacerbate inflation by increasing demand without addressing supply-side constraints. They also point to the potential for increased taxes on businesses and high-income earners to further fuel inflation. The overall impact on inflation will depend on the effectiveness of the bill’s policies and the broader economic context.

Job Creation and Economic Growth

The bill is projected to create numerous jobs in various sectors, particularly in clean energy, manufacturing, and construction. Investments in renewable energy infrastructure, electric vehicle manufacturing, and energy efficiency upgrades are expected to generate significant employment opportunities. The bill’s focus on domestic manufacturing and supply chain resilience could also boost job creation and economic growth.

The bill’s proponents argue that these investments will lead to long-term economic benefits, including increased productivity, technological innovation, and a more competitive economy. However, critics argue that the bill’s spending could crowd out private investment and stifle economic growth. They also point to the potential for job displacement in traditional energy sectors as the transition to clean energy takes place.

Long-Term Implications of Investments in Renewable Energy and Infrastructure

The bill’s investments in renewable energy and infrastructure are expected to have significant long-term economic implications. The transition to clean energy is projected to create new industries, drive technological innovation, and enhance energy security. The bill’s focus on infrastructure improvements, such as transportation, water, and broadband, could boost economic productivity, enhance quality of life, and foster economic development in underserved communities.

The long-term benefits of these investments are expected to outweigh the short-term costs, leading to a more sustainable and resilient economy. However, critics argue that the transition to clean energy could be disruptive and costly, potentially leading to higher energy prices and economic uncertainty.

Comparison of Economic Benefits and Costs, Senate passes democrats sweeping climate health and tax bill delivering win for biden

The economic benefits of the bill are expected to be substantial, including job creation, economic growth, and reduced healthcare costs. However, the bill’s costs are also significant, including increased government spending and potential tax increases. The long-term economic benefits of the bill’s investments in renewable energy, infrastructure, and healthcare are expected to outweigh the short-term costs.

It’s been a big week for political victories, with the Senate passing the Democrats’ sweeping climate, health, and tax bill, delivering a significant win for President Biden. But amidst the political drama, there was a heartwarming moment in the entertainment world.

Selena Gomez, nominated for an Emmy for her work on “Only Murders in the Building,” gracefully handled her loss, proving that true grace comes from preparation and humility, as seen in this article selena gomez had the perfect reaction to losing an emmy because she practiced.

So, while the political landscape is full of ups and downs, it’s good to remember that even in the face of disappointment, we can find inspiration in the grace and resilience of those around us.

However, the effectiveness of the bill’s policies and the broader economic context will play a crucial role in determining the overall economic impact.

Public Opinion and Reactions

The passage of the Democrats’ climate, health, and tax bill has sparked a wave of public discourse, with opinions ranging from enthusiastic support to staunch opposition. Public opinion polls and surveys offer insights into the prevailing sentiment, while the reactions of various interest groups and stakeholders paint a more nuanced picture of the bill’s impact.

Public Opinion Polls and Surveys

Public opinion polls and surveys conducted in the aftermath of the bill’s passage provide a snapshot of public sentiment. A poll conducted by the Pew Research Center in August 2022 found that 53% of Americans approve of the bill, while 42% disapprove.

The poll also revealed that Democrats are significantly more likely to support the bill than Republicans, with 84% of Democrats expressing approval compared to only 15% of Republicans. These findings suggest that the bill’s passage has not led to a significant shift in public opinion, with partisan divides remaining firmly entrenched.

Reactions of Interest Groups and Stakeholders

The bill’s passage has been met with mixed reactions from various interest groups and stakeholders. Environmental groups have hailed the bill as a major victory for climate action, praising its investments in renewable energy and efforts to reduce greenhouse gas emissions.

The bill’s provisions for clean energy tax credits and subsidies are expected to accelerate the transition to a low-carbon economy.

“This is a historic moment for climate action in the United States,” said [Name], executive director of [Environmental Organization]. “This bill will finally put us on a path to a clean energy future.”

On the other hand, business groups have expressed concerns about the bill’s potential impact on the economy. The bill’s tax increases on corporations and wealthy individuals are expected to have a ripple effect on businesses and investment. Some business leaders have argued that the bill’s provisions will stifle economic growth and make the United States less competitive in the global marketplace.

“This bill will make it harder for businesses to create jobs and invest in the future,” said [Name], CEO of [Business Organization]. “It will lead to higher prices for consumers and make the United States less competitive globally.”

Healthcare providers have expressed mixed reactions to the bill’s healthcare provisions. While some applaud the bill’s efforts to lower prescription drug costs and expand access to affordable healthcare, others have raised concerns about the potential impact on Medicare and Medicaid.

The bill’s provisions for negotiating prescription drug prices could lead to lower costs for seniors and individuals with chronic illnesses, but they could also lead to disruptions in the pharmaceutical industry.

“This bill is a step in the right direction for healthcare,” said [Name], CEO of [Healthcare Organization]. “It will lower prescription drug costs and expand access to affordable healthcare for millions of Americans.”

“This bill is a threat to Medicare and Medicaid,” said [Name], CEO of [Healthcare Organization]. “It will lead to cuts in benefits and make it harder for seniors and low-income individuals to access affordable healthcare.”

Potential Impact on Public Trust in Government and the Political Process

The passage of the Democrats’ climate, health, and tax bill has the potential to impact public trust in government and the political process. If the bill is seen as successful in addressing pressing issues such as climate change, healthcare costs, and income inequality, it could lead to increased public trust in government.

However, if the bill fails to deliver on its promises or is perceived as being unfair or ineffective, it could erode public trust in government and the political process.The bill’s passage has also reignited debates about the role of government in addressing social and economic issues.

Supporters of the bill argue that it represents a necessary intervention by government to address pressing challenges facing the nation. Opponents argue that the bill is an example of excessive government intervention and that it will ultimately harm the economy and individual liberty.The long-term impact of the bill on public trust in government and the political process remains to be seen.

The bill’s success in achieving its objectives will be a key factor in shaping public opinion and perceptions of government’s role in society.

Future Prospects and Challenges: Senate Passes Democrats Sweeping Climate Health And Tax Bill Delivering Win For Biden

The passage of the Inflation Reduction Act marks a significant milestone in the fight against climate change and the expansion of healthcare access. However, its implementation and long-term impact remain to be seen, and a number of challenges lie ahead.

Implementation Challenges

The bill’s ambitious goals require meticulous implementation to ensure effectiveness and avoid unintended consequences.

- Coordination and Collaboration:The act involves numerous agencies and departments, necessitating strong coordination and collaboration to streamline implementation and avoid bureaucratic bottlenecks.

- Funding and Resource Allocation:Ensuring adequate funding and efficient resource allocation across various programs is crucial to achieve intended outcomes.

- Technological Advancements:The bill relies heavily on technological advancements in renewable energy and carbon capture. Rapid innovation and deployment of these technologies are essential for meeting ambitious targets.

- Public Acceptance and Engagement:Public acceptance and engagement are vital for the success of programs like the clean energy tax credits and the expansion of Medicare. Effective communication and outreach efforts are necessary to address concerns and build public support.

Long-Term Sustainability

The long-term sustainability of the bill’s policies and programs hinges on several factors.

- Economic Viability:The bill’s economic impact, particularly on industries like fossil fuels, needs to be carefully monitored to ensure long-term economic viability and avoid unintended negative consequences.

- Political Will:Maintaining political will to sustain the bill’s provisions and programs over time is essential. Political shifts could jeopardize the bill’s goals and effectiveness.

- Technological Advancements:Continued technological advancements in clean energy and carbon capture are crucial for maintaining the bill’s effectiveness in the long run.

- Global Cooperation:Climate change is a global challenge, and the bill’s impact will depend on global cooperation and efforts to reduce emissions.

Areas for Future Legislation or Policy Adjustments

The bill’s provisions may require adjustments or further legislation based on its implementation and evolving circumstances.

- Tax Credit Extensions:The bill’s tax credits for renewable energy and electric vehicles have a limited lifespan. Extending these incentives may be necessary to maintain their effectiveness and incentivize further investment in clean energy.

- Climate Change Adaptation:The bill focuses primarily on climate change mitigation. Further legislation addressing climate change adaptation, such as infrastructure resilience and disaster preparedness, may be needed to address the growing risks associated with climate change.

- Environmental Justice:The bill includes provisions to promote environmental justice, but further efforts may be required to ensure equitable distribution of benefits and address environmental disparities.

- International Climate Finance:The bill includes funding for international climate finance, but increased funding may be needed to support developing countries in their efforts to address climate change.