Remembering Tom Alberg: How an Understated Investor Shaped Seattle Tech

Remembering tom alberg how an understated investor had an outsized impact on seattle tech – Remembering Tom Alberg: How an understated investor had an outsized impact on Seattle tech sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

Tom Alberg, a name that might not immediately ring a bell for those outside the tech world, was a quiet force behind the rise of Seattle’s tech scene. He wasn’t known for flashy presentations or aggressive deal-making, but his patient, long-term approach to investing helped shape some of the world’s most iconic companies.

Alberg’s journey began in the early days of the tech industry, where he honed his investment instincts and developed a unique philosophy that emphasized building relationships and nurturing innovation. This philosophy, which he applied to companies like Microsoft and Amazon, would become the foundation of his remarkable success.

His story is a testament to the power of understated influence and the lasting impact of a genuine commitment to building a thriving ecosystem.

Tom Alberg

Tom Alberg, a name synonymous with Seattle’s tech boom, wasn’t always an investor. His journey began in the realm of engineering, a foundation that laid the groundwork for his remarkable success in the world of venture capital.

Early Career and Influences

Alberg’s early career wasn’t directly tied to the tech industry. He earned a degree in Electrical Engineering from the University of Washington, a testament to his analytical mind and technical prowess. After graduation, he joined Boeing, a company known for its aerospace innovations, where he worked as a software engineer.

Remembering Tom Alberg, the quiet Seattle investor who had a profound impact on the city’s tech scene, reminds me of the power of long-term vision. He understood that building a company wasn’t just about maximizing short-term returns, but fostering innovation and creating lasting value.

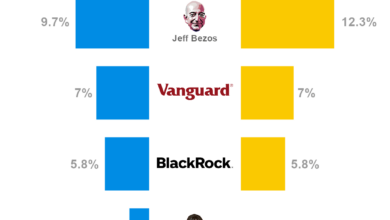

It’s a stark contrast to the current debate about stock buybacks and dividends, which have become a $1.5 trillion political target, as highlighted in this recent article stock buybacks and dividends become a 1 5 trillion political target. While Alberg’s approach might seem old-fashioned in today’s fast-paced world, his legacy serves as a reminder that true success often comes from focusing on the long game, not just the next quarterly report.

This experience exposed him to the intricacies of technology and the importance of problem-solving, skills that would later prove invaluable in his investment decisions.

Early Investments and Shaping the Tech Landscape

While at Boeing, Alberg’s entrepreneurial spirit began to stir. He saw the potential of technology to transform industries and took his first steps into the world of investing. His early investments, though not publicly known, were characterized by a focus on emerging technologies and promising startups.

These early experiences honed his understanding of the tech landscape, teaching him the importance of identifying emerging trends and backing companies with strong fundamentals.

Investment Philosophy in the Early Years

Alberg’s early investment philosophy was rooted in a deep understanding of technology and a belief in the power of innovation. He sought out companies with strong teams, innovative products, and a clear vision for the future. His approach was characterized by patience and a long-term perspective, recognizing that success in the tech industry often takes time.

He believed in supporting entrepreneurs and providing them with the resources they needed to succeed.

Alberg’s Impact on Seattle Tech

Tom Alberg’s influence on the Seattle tech scene is undeniable. He played a pivotal role in nurturing and growing some of the region’s most iconic companies, shaping the landscape of innovation and entrepreneurship. His investment strategy, characterized by a long-term vision and a deep understanding of the potential of emerging technologies, has left an enduring mark on the city’s tech ecosystem.

Alberg’s Contributions to Seattle Tech’s Rise

Alberg’s investment philosophy was rooted in building lasting relationships with founders and fostering a collaborative environment. This approach, combined with his keen eye for identifying promising technologies, proved instrumental in the success of companies like Microsoft and Amazon. He was an early investor in both companies, providing crucial capital and guidance during their formative years.

Remembering Tom Alberg, the quiet giant of Seattle tech, reminds me of a line from star wars 25 chilling quotes about the dark side : “The dark side of the Force is a pathway to many abilities some consider to be unnatural.” Tom, in his understated way, used his power to nurture and grow companies, shaping the very fabric of Seattle’s tech landscape.

He was a master of the “unnatural” – building something from nothing, defying the odds, and leaving a legacy that will inspire generations to come.

His unwavering support for these startups helped them navigate the challenges of early growth and establish themselves as industry leaders. Alberg’s influence extended beyond these two giants. He was also an active investor in other Seattle-based companies, including Expedia, Tableau Software, and Zillow.

Remembering Tom Alberg, the quiet investor who left a giant mark on Seattle tech, reminds me of the power of subtle impact. Like how a sprinkle of store-bought granola, the crispy crunchy topping your cake needs , can elevate a dessert from good to amazing, Alberg’s understated approach yielded remarkable results.

His influence, like a dash of that perfect granola, was just what Seattle tech needed to reach new heights.

His investments in these diverse businesses contributed to the diversification and growth of the Seattle tech scene, solidifying its reputation as a hub for innovation and entrepreneurship.

Alberg’s Investment Strategies

Alberg’s investment strategy was marked by a focus on long-term value creation and a commitment to building relationships with founders. He believed in supporting companies for the long haul, providing not just capital but also mentorship and guidance. This approach fostered trust and collaboration, creating a strong foundation for growth.

One of his key strategies was to invest in companies with strong fundamentals and a clear vision for the future. He sought out founders with a passion for their work and a deep understanding of their markets. This approach helped him identify companies with the potential to disrupt industries and create lasting value.

Alberg also emphasized the importance of building a collaborative ecosystem. He actively connected founders and entrepreneurs, fostering a spirit of collaboration and shared learning. This approach helped create a vibrant and supportive environment for startups to thrive.

Comparison of Alberg’s Investment Approach with Other Seattle Venture Capitalists

| Venture Capitalist | Investment Strategy | Key Focus |

|---|---|---|

| Tom Alberg | Long-term value creation, relationship building, collaborative ecosystem | Strong fundamentals, visionary founders, disruptive technologies |

| Madrona Venture Group | Early-stage investments, sector expertise, strong network | Software, cloud computing, healthcare, consumer products |

| Founders’ Co-op | Seed-stage investments, founder-centric approach, community building | Emerging technologies, disruptive innovations, high-growth potential |

Alberg’s Legacy: Remembering Tom Alberg How An Understated Investor Had An Outsized Impact On Seattle Tech

Tom Alberg’s impact on Seattle’s tech scene went far beyond the dollars he invested. His approach to venture capital was refreshingly different, prioritizing long-term partnerships and shunning the hype-driven investment strategies common in Silicon Valley. This understated approach, often described as “patient capital,” became a defining characteristic of Alberg’s legacy, shaping the landscape of Seattle’s tech industry.

Alberg’s Investment Philosophy

Alberg’s investment philosophy was rooted in the belief that building lasting businesses required more than just financial capital. He sought to build deep relationships with entrepreneurs, providing not just funding but also guidance, mentorship, and connections. This long-term perspective set him apart from many venture capitalists who often focused on short-term gains and quick exits.

“I’m not looking for a quick flip,” Alberg once said. “I want to build companies that will be around for a long time.”

This approach, combined with his aversion to hype-driven investments, allowed Alberg to identify companies with real potential, even when they were not the hottest names in the market. He believed in the power of slow, steady growth and saw value in companies that were building sustainable businesses, not just chasing the next big trend.

Examples of Alberg’s Impact

Alberg’s investment philosophy can be seen in the success of many Seattle-based tech companies. One notable example is Amazon, which Alberg invested in early on, recognizing its potential to revolutionize e-commerce. His support and guidance helped Amazon navigate its early years and build a foundation for its future success.

Another example is Tableau Software, a data visualization company that Alberg invested in when it was still a small startup. He saw the potential of Tableau’s technology and provided the company with the resources and support it needed to grow into a leading player in the data analytics space.

Timeline of Alberg’s Most Significant Investments, Remembering tom alberg how an understated investor had an outsized impact on seattle tech

- 1994:Alberg invests in Amazon, recognizing its potential to revolutionize e-commerce. This investment, along with his guidance and mentorship, played a crucial role in Amazon’s early growth and its eventual rise to become one of the largest companies in the world.

- 2003:Alberg invests in Tableau Software, a data visualization company. His support and guidance helped Tableau grow into a leading player in the data analytics space, eventually going public in 2013.

- 2007:Alberg invests in Redfin, a real estate technology company. His investment helped Redfin develop its innovative platform and become a major player in the real estate industry.

- 2010:Alberg invests in Convoy, a trucking technology company. His investment helped Convoy build its platform and disrupt the traditional trucking industry.

Alberg’s legacy is not just about the financial returns he generated. It is about the impact he had on the lives of entrepreneurs and the communities they built. His “understated” approach to venture capital, prioritizing long-term partnerships and sustainable growth, left an indelible mark on Seattle’s tech scene, shaping the city into a global hub of innovation.

The Alberg Principle

Tom Alberg’s investing philosophy, often referred to as the “Alberg Principle,” transcended the typical venture capitalist approach. It was rooted in a deep understanding of the Seattle tech ecosystem and a belief in fostering long-term growth rather than chasing quick returns.

This principle remains relevant today, offering valuable lessons for entrepreneurs and investors navigating the ever-changing landscape of technology.

Key Lessons from Alberg’s Career

Alberg’s career exemplifies the power of patience, long-term vision, and building strong relationships. His approach was not about maximizing short-term gains but about nurturing companies and their founders, allowing them to reach their full potential. He believed in supporting companies through their ups and downs, providing guidance and mentorship rather than just capital.

- Patience and Long-Term Vision:Alberg’s success was built on his ability to identify promising companies and invest in them for the long haul. He understood that building a successful company takes time, and he was willing to wait for the right opportunity to emerge.

This approach is particularly relevant today, as the tech industry is increasingly characterized by rapid innovation and disruption.

- Building Strong Relationships:Alberg was known for his ability to build strong relationships with entrepreneurs and fellow investors. He believed that trust and collaboration were essential to success, and he actively fostered a sense of community within the Seattle tech scene. This approach is increasingly important today, as the tech industry becomes more global and interconnected.

- Focus on the Fundamentals:Alberg was not swayed by hype or trends. He focused on investing in companies with strong fundamentals, a clear vision, and a talented team. This approach is essential for navigating the volatility of the tech industry and identifying companies with the potential for long-term success.

Characteristics of an “Alberg-Style” Investor

Alberg’s approach to investing is characterized by a set of key characteristics that can be emulated by aspiring investors:

- Long-term Perspective:“Alberg-style” investors prioritize long-term growth over short-term gains. They are willing to invest in companies that may take years to mature and are not afraid to ride out market fluctuations.

- Focus on People:They value the quality of the team and the founder’s vision above all else. They believe that a strong team with a clear vision is the foundation for a successful company.

- Collaborative Approach:They are willing to share their expertise and network to help companies succeed. They understand that success is a collaborative effort and are not afraid to bring in other investors and advisors.

- Patience and Resilience:They are prepared to weather the inevitable challenges that come with building a successful company. They are patient and resilient, understanding that setbacks are a part of the journey.