Know How to Spend Bitcoin: A Guide to Using Crypto

Know how to spend Bitcoin: it’s a question that’s on the minds of many as the world embraces digital currencies. Bitcoin, the pioneering cryptocurrency, has captured the imagination of millions, but the transition from holding to spending can seem daunting.

This guide will unravel the mysteries of Bitcoin spending, empowering you to confidently navigate the world of crypto commerce.

From understanding the fundamentals of Bitcoin transactions to exploring the diverse options for spending it, we’ll cover everything you need to know. We’ll delve into the different types of Bitcoin wallets, compare popular providers, and Artikel the pros and cons of each.

You’ll learn about various methods for acquiring Bitcoin, including exchanges, peer-to-peer platforms, and Bitcoin ATMs. We’ll also explore the growing number of online and offline businesses that accept Bitcoin payments, showcasing the increasing adoption of this innovative currency.

Understanding Bitcoin Spending

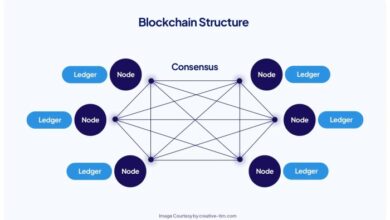

Bitcoin, a decentralized digital currency, has gained immense popularity, and with it, the need to understand how to spend it effectively. Unlike traditional fiat currencies, Bitcoin transactions operate on a blockchain, a distributed ledger that records every transaction publicly and immutably.

This unique system brings both advantages and challenges to spending Bitcoin.

Bitcoin Transactions

Bitcoin transactions differ significantly from traditional fiat currency transactions. They are processed through a decentralized network of computers called miners, who verify and add transactions to the blockchain. This process, known as mining, involves solving complex mathematical problems, which consumes significant computational power and energy.

- Decentralization:Bitcoin transactions are not controlled by any central authority, such as a bank or government. This ensures greater privacy and security, as there is no single point of failure.

- Immutability:Once a Bitcoin transaction is confirmed on the blockchain, it cannot be reversed or altered. This ensures the integrity and transparency of the system.

- Fees:Bitcoin transactions typically involve small fees, paid to miners as an incentive to process transactions. These fees can vary depending on the network congestion and the transaction size.

Methods for Spending Bitcoin

There are several methods for spending Bitcoin, each with its own advantages and disadvantages:

- Online Platforms:Many online platforms allow users to buy goods and services using Bitcoin. These platforms typically convert Bitcoin to fiat currency before processing the transaction. Popular examples include Amazon, Overstock, and Expedia.

- Point-of-Sale (POS) Systems:Some merchants now accept Bitcoin payments directly through POS systems. These systems allow customers to pay for goods and services using their Bitcoin wallets.

- Peer-to-Peer (P2P) Exchanges:P2P exchanges allow individuals to buy and sell Bitcoin directly from other users. This method can be more private and flexible than traditional exchanges, but it also carries a higher risk of fraud.

Security Considerations

Spending Bitcoin requires careful attention to security.

- Wallet Security:It is crucial to secure your Bitcoin wallet with a strong password and enable two-factor authentication.

- Phishing Scams:Be wary of phishing scams that attempt to steal your Bitcoin by tricking you into revealing your wallet information.

- Malware:Avoid downloading or clicking on suspicious links that could contain malware designed to steal your Bitcoin.

Choosing a Bitcoin Wallet

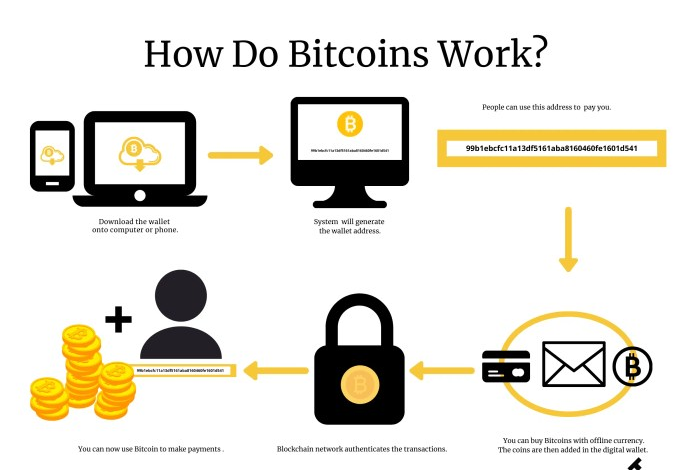

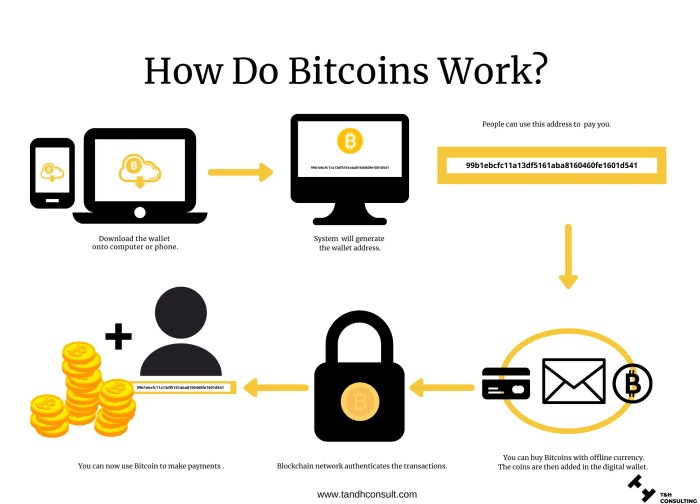

A Bitcoin wallet is an essential tool for storing, managing, and transacting your Bitcoins. It’s not a physical wallet; instead, it’s a software program that allows you to interact with the Bitcoin blockchain. Choosing the right Bitcoin wallet is crucial for securing your funds and ensuring a smooth user experience.

This section will explore different types of Bitcoin wallets, compare popular providers, and guide you in selecting the best wallet for your needs.

Types of Bitcoin Wallets

Bitcoin wallets come in various forms, each with its strengths and weaknesses. Understanding these types is vital for making an informed decision.

- Hardware Wallets:Hardware wallets are physical devices that store your private keys offline, providing the highest level of security. They resemble USB drives and are often considered the most secure option for storing large amounts of Bitcoin. These wallets are not connected to the internet, making them resistant to hacking and malware.

Popular examples include Ledger Nano S and Trezor.

- Software Wallets:Software wallets are applications that run on your computer or mobile device. They offer convenience and accessibility but require careful security measures. Desktop wallets, like Electrum and Exodus, provide more advanced features and control, while mobile wallets, like Mycelium and Breadwallet, prioritize portability.

Software wallets are susceptible to malware and hacking, so it’s crucial to choose reputable providers and implement strong security practices.

- Web Wallets:Web wallets are online services that allow you to access your Bitcoin funds from any internet-connected device. They are convenient but pose higher security risks as your private keys are stored on a server controlled by the wallet provider. Examples include Coinbase and Blockchain.com.

Although convenient, these wallets are susceptible to hacks and data breaches, making them less secure than hardware or software wallets.

- Paper Wallets:Paper wallets are a unique approach to storing Bitcoin offline. They involve printing your private keys and public addresses on a piece of paper, which can be stored in a safe place. While highly secure, paper wallets are not as convenient as other options and require careful handling to prevent damage or loss.

Comparing Bitcoin Wallet Providers

Choosing the right Bitcoin wallet provider depends on your individual needs and priorities. Here’s a comparison of some popular providers, highlighting their features, security measures, and user experience.

Learning how to spend Bitcoin can feel like navigating a whole new world. There are so many options, from buying everyday goods to investing in exciting new ventures. It’s a bit like how the world of Tally Youngblood changes in uglies 2 what happens in the sequel pretties , where she discovers a whole new society beyond the seemingly perfect Pretty Town.

Just like Tally’s journey, exploring Bitcoin takes time, research, and a willingness to embrace the unknown.

| Provider | Features | Security Measures | User Experience |

|---|---|---|---|

| Ledger Nano S | Offline storage, multi-coin support, user-friendly interface | PIN protection, recovery seed phrase, hardware security module | Easy to use, secure, and reliable |

| Trezor Model T | Offline storage, large color touchscreen, advanced security features | PIN protection, recovery seed phrase, hardware security module | Advanced features, robust security, but more expensive |

| Electrum | Desktop wallet, multi-signature support, advanced features | Strong encryption, multi-factor authentication, hardware wallet integration | Powerful features, but more technical for beginners |

| Exodus | Desktop and mobile wallet, user-friendly interface, multi-coin support | Encryption, multi-factor authentication, secure storage | Beginner-friendly, visually appealing, but less advanced features |

| Mycelium | Mobile wallet, advanced features, privacy-focused | Strong encryption, multi-signature support, hardware wallet integration | Powerful features, but may be complex for some users |

| Breadwallet | Mobile wallet, simple interface, focused on security | Encryption, PIN protection, recovery seed phrase | Easy to use, secure, and reliable |

| Coinbase | Web wallet, exchange services, user-friendly interface | Two-factor authentication, secure storage, regulatory compliance | Convenient, but less secure than other options |

| Blockchain.com | Web wallet, exchange services, advanced features | Two-factor authentication, secure storage, regulatory compliance | User-friendly, but less secure than other options |

Pros and Cons of Different Wallet Types

Each type of Bitcoin wallet has its advantages and disadvantages. This table summarizes the key factors to consider when choosing a wallet.

| Wallet Type | Pros | Cons |

|---|---|---|

| Hardware Wallets | Highest security, offline storage, resistant to hacking and malware | More expensive, less convenient than software wallets, potential for physical damage or loss |

| Software Wallets | Convenient, accessible from any device, advanced features | Susceptible to malware and hacking, requires careful security measures |

| Web Wallets | Easy to use, accessible from any device, convenient for small amounts | Less secure than other options, susceptible to hacks and data breaches |

| Paper Wallets | Highly secure, offline storage, resistant to hacking and malware | Not as convenient as other options, requires careful handling to prevent damage or loss |

Choosing the Right Wallet for You

The best Bitcoin wallet for you depends on your individual needs and preferences. Consider the following factors:

- Security:If you’re storing a large amount of Bitcoin, prioritize security by choosing a hardware wallet or paper wallet. For smaller amounts, software or web wallets may suffice, but implement strong security measures.

- Convenience:Software and web wallets offer the most convenience, while hardware wallets require more effort to set up and use. Paper wallets are the least convenient option.

- Features:Some wallets offer advanced features, such as multi-signature support or hardware wallet integration. Consider which features are important to you.

- User Experience:Choose a wallet with a user interface that you find intuitive and easy to navigate. Some wallets are more beginner-friendly than others.

- Cost:Hardware wallets are generally more expensive than software or web wallets. Paper wallets are the most cost-effective option.

Acquiring Bitcoin

Acquiring Bitcoin is the first step towards joining the world of decentralized finance. There are various methods to get your hands on this digital currency, each with its own set of advantages and disadvantages. Understanding these methods will help you choose the best option for your needs and comfort level.

Exchanges

Exchanges are platforms that allow you to buy and sell Bitcoin using fiat currency, such as US dollars or euros. They are the most popular method for acquiring Bitcoin, offering a wide selection of coins and trading pairs. The process of buying Bitcoin on an exchange is straightforward:

1. Choose an exchange

Research and select an exchange that meets your requirements, considering factors like fees, security, and supported payment methods.

2. Create an account

Register an account with the exchange and verify your identity.

3. Fund your account

Deposit fiat currency into your exchange account using a bank transfer, debit card, or other supported methods.

4. Place an order

Select the desired Bitcoin amount and place an order to buy it.

5. Receive your Bitcoin

Once the order is executed, the Bitcoin will be credited to your exchange wallet.

Peer-to-Peer Platforms

Peer-to-peer (P2P) platforms connect buyers and sellers of Bitcoin directly, allowing for more flexibility in terms of payment methods and prices. These platforms typically involve a third-party escrow service to ensure secure transactions.Here’s how to buy Bitcoin on a P2P platform:

1. Choose a platform

Select a P2P platform with a good reputation and favorable terms.

2. Create an account

Register an account and verify your identity.

3. Find a seller

Browse through listings from sellers offering Bitcoin and choose one that meets your needs.

4. Initiate the transaction

Contact the seller to discuss payment details and proceed with the transaction.

5. Receive your Bitcoin

Once the payment is confirmed, the seller will release the Bitcoin to your wallet.

Bitcoin ATMs

Bitcoin ATMs are physical machines that allow you to buy and sell Bitcoin using cash. They are becoming increasingly common, offering a convenient option for those who prefer to deal with cash.To buy Bitcoin from an ATM:

1. Locate a Bitcoin ATM

Use a Bitcoin ATM finder website or app to locate an ATM near you.

2. Select the amount

Enter the amount of Bitcoin you wish to purchase.

3. Insert cash

Insert cash into the ATM according to the instructions.

4. Provide your wallet address

Enter your Bitcoin wallet address to receive the purchased Bitcoin.

5. Receive your Bitcoin

The Bitcoin will be deposited into your wallet shortly after the transaction is complete.

Mining

Bitcoin mining is the process of verifying and adding new transactions to the Bitcoin blockchain. Miners use specialized hardware to solve complex mathematical problems, earning Bitcoin as a reward for their efforts.The process of mining Bitcoin involves:

1. Setting up a mining rig

Purchase and assemble a mining rig with powerful hardware, including a graphics processing unit (GPU) or application-specific integrated circuit (ASIC).

Knowing how to spend Bitcoin effectively is crucial, and it’s important to consider the wider context of consumer protection. A recent food safety warning for Ez Noble Sushi highlights the importance of transparency and clear labeling in all areas of our lives, including how we spend our money.

By being informed consumers, we can make responsible choices and ensure our well-being while exploring the world of cryptocurrency.

2. Joining a mining pool

Join a mining pool to increase your chances of finding a block and earning rewards.

3. Start mining

Run your mining rig and start solving mathematical problems to verify transactions and earn Bitcoin.

Other Methods

Besides the methods mentioned above, there are other ways to acquire Bitcoin, such as:* Gifting:Receiving Bitcoin as a gift from someone.

Earning Bitcoin

Participating in Bitcoin-related activities, such as playing games or completing tasks, to earn Bitcoin rewards.

Trading

Engaging in trading activities on exchanges to profit from price fluctuations.

Comparison of Methods

| Method | Advantages | Disadvantages ||—|—|—|| Exchanges | Convenient, wide selection of coins, fast transactions | High fees, potential security risks || Peer-to-Peer Platforms | Flexible payment methods, competitive prices | Potential scams, slower transactions || Bitcoin ATMs | Easy to use, cash-based transactions | Limited availability, higher fees || Mining | Secure, decentralized, earn Bitcoin rewards | High costs, technical expertise required || Other Methods | Varies depending on the method | Varies depending on the method |

Spending Bitcoin Online

The ability to spend Bitcoin online has revolutionized how we make purchases, offering a new level of convenience and financial freedom. With Bitcoin’s decentralized nature, users can transact directly with merchants without relying on intermediaries, potentially leading to faster processing times and lower fees.

Figuring out how to spend Bitcoin can feel like a puzzle sometimes, but with the right tools and resources, it’s surprisingly straightforward. The news about the secret service official at the center of testimony about Trump’s actions on January 6th retiring reminds us that even the most complex situations can have surprising outcomes.

Just like with Bitcoin, there’s always a new piece of information to learn, and sometimes the most unexpected developments lead to the most satisfying solutions.

However, it’s essential to understand the intricacies of spending Bitcoin online, including the merchants who accept it, the benefits and challenges involved, and the process of making a purchase.

Popular Online Merchants and Platforms, Know how to spend bitcoin

A growing number of online merchants and platforms accept Bitcoin payments. These include popular e-commerce stores, marketplaces, and service providers.

- E-commerce Stores:Many well-known online retailers, such as Overstock.com, Newegg, and Microsoft, accept Bitcoin payments. These stores offer a wide range of products, from electronics and clothing to home goods and furniture.

- Marketplaces:Platforms like eBay and Etsy allow users to buy and sell goods and services using Bitcoin. These marketplaces provide a diverse range of products, from antiques and collectibles to handmade crafts and digital artwork.

- Service Providers:Bitcoin is increasingly accepted by service providers, such as VPN services, web hosting companies, and online gaming platforms. These services offer various digital products and services, catering to a wide range of user needs.

Benefits and Challenges of Using Bitcoin for Online Purchases

Using Bitcoin for online purchases offers several benefits, but it also presents unique challenges.

- Benefits:

- Faster Transactions:Bitcoin transactions are typically processed faster than traditional payment methods, especially for international purchases.

- Lower Fees:Bitcoin transactions can have lower fees compared to credit card or bank transfers, especially for international transactions.

- Privacy and Security:Bitcoin transactions are pseudonymous, offering a level of privacy that traditional payment methods may not provide.

- Global Reach:Bitcoin can be used to make purchases from merchants anywhere in the world, making it a convenient option for international transactions.

- Challenges:

- Price Volatility:The value of Bitcoin can fluctuate significantly, which can impact the price of purchases.

- Limited Merchant Acceptance:While the number of merchants accepting Bitcoin is growing, it is still limited compared to traditional payment methods.

- Technical Complexity:Understanding the technical aspects of Bitcoin, such as wallets and transactions, can be challenging for some users.

- Security Risks:Bitcoin wallets are vulnerable to hacking and theft, so it’s essential to take proper security measures.

Process of Making an Online Purchase with Bitcoin

Making an online purchase with Bitcoin involves a few steps:

- Select a Merchant:Choose a merchant that accepts Bitcoin payments. Many online stores will clearly display their Bitcoin acceptance policy.

- Add Items to Cart:Add the desired items to your shopping cart, as you would with any other online purchase.

- Proceed to Checkout:When you reach the checkout page, select Bitcoin as your payment method.

- Enter Bitcoin Address:The merchant will provide you with a Bitcoin address, which is a unique identifier for their wallet.

- Send Bitcoin:Use your Bitcoin wallet to send the required amount of Bitcoin to the merchant’s address.

- Transaction Confirmation:Once the transaction is broadcast to the Bitcoin network, it will be confirmed by miners. This process typically takes a few minutes to an hour, depending on the network’s congestion.

- Order Confirmation:Once the transaction is confirmed, the merchant will receive the payment and confirm your order.

Transaction Fees

Bitcoin transactions typically involve small fees, known as “transaction fees,” which are paid to miners to process and verify transactions. These fees are usually a few cents or dollars, depending on the network’s congestion. Some merchants may also charge additional fees for accepting Bitcoin payments.

It’s essential to check the merchant’s policies regarding fees before making a purchase.

Spending Bitcoin Offline: Know How To Spend Bitcoin

While Bitcoin is often associated with online transactions, its use in physical stores is steadily increasing, opening up a world of possibilities for both consumers and merchants. This section explores the evolving landscape of Bitcoin spending offline, highlighting the locations, trends, and benefits associated with this growing trend.

Locations Accepting Bitcoin Payments

The number of brick-and-mortar businesses accepting Bitcoin payments is steadily growing. From coffee shops and restaurants to electronics stores and even real estate agencies, a diverse range of businesses are embracing Bitcoin as a payment method.

- Retail Stores:Many independent retailers, particularly those catering to tech-savvy customers, are starting to accept Bitcoin. These stores often offer discounts or incentives for Bitcoin payments to encourage adoption.

- Restaurants and Cafes:Bitcoin-friendly eateries are becoming increasingly common, allowing customers to pay for their meals with cryptocurrency. Some restaurants even offer exclusive Bitcoin-only menus or special promotions.

- Travel and Hospitality:Hotels, airlines, and travel agencies are also embracing Bitcoin, offering travellers the convenience of booking and paying for their trips using cryptocurrency.

- Service Providers:Businesses offering services such as hair salons, car repairs, and even legal services are beginning to accept Bitcoin as a form of payment.

The Growing Trend of Bitcoin Adoption in Physical Retail Stores

The adoption of Bitcoin in physical retail stores is driven by several factors:

- Increased Consumer Demand:As Bitcoin adoption grows, more consumers are seeking to use it for everyday purchases. This demand is driving retailers to offer Bitcoin as a payment option to cater to their customer base.

- Lower Transaction Fees:Bitcoin transactions typically involve lower fees compared to traditional credit card processing, making it an attractive option for merchants.

- Security and Privacy:Bitcoin transactions are secure and offer a level of privacy that traditional payment methods may not provide.

- Global Reach:Bitcoin can be used to make payments across borders, making it an ideal option for businesses with an international customer base.

Examples of Businesses Offering Discounts or Incentives for Bitcoin Payments

To encourage Bitcoin adoption, some businesses offer discounts or incentives for customers who pay with cryptocurrency:

- Percentage Discounts:Some businesses offer a percentage discount on purchases made with Bitcoin, such as 5% or 10% off the total bill.

- Loyalty Programs:Certain businesses offer loyalty programs that reward customers with Bitcoin for their purchases or provide exclusive discounts and benefits to Bitcoin users.

- Bitcoin-Only Deals:Some businesses offer special deals or promotions exclusively for customers who pay with Bitcoin, attracting crypto enthusiasts and promoting Bitcoin adoption.

Making a Purchase with Bitcoin at a Physical Store

The process of making a purchase with Bitcoin at a physical store is relatively straightforward:

- Choose a Bitcoin Wallet:Select a Bitcoin wallet that supports offline payments. Popular options include hardware wallets, mobile wallets, and desktop wallets.

- Confirm the Merchant Accepts Bitcoin:Ensure that the store you are purchasing from accepts Bitcoin payments. Check their website or ask an employee.

- Scan the QR Code:The merchant will typically provide a QR code that you can scan using your Bitcoin wallet.

- Enter the Amount:Enter the amount you wish to pay in Bitcoin.

- Confirm the Transaction:Review the transaction details and confirm the payment.

- Receive Confirmation:Once the transaction is complete, you will receive a confirmation message on your Bitcoin wallet.

Bitcoin Security and Best Practices

In the world of Bitcoin, security is paramount. Your Bitcoin holdings are only as secure as the measures you take to protect them. Understanding and implementing robust security practices is crucial to safeguarding your digital assets from theft or loss.

Safeguarding Private Keys and Wallets

Your private key is the foundation of your Bitcoin security. It’s a unique code that grants you access to your Bitcoin holdings. Without it, you cannot access your Bitcoin, making it essential to keep your private keys safe.

- Store private keys offline:The safest approach is to store your private keys offline, ideally on a physical device like a hardware wallet or a piece of paper. This prevents hackers from accessing your keys remotely.

- Use strong passwords:When using a software wallet, ensure you create a strong and unique password for your wallet. Avoid using easily guessable passwords.

- Enable two-factor authentication (2FA):2FA adds an extra layer of security by requiring a second authentication factor, typically a code sent to your phone, in addition to your password.

Common Security Risks and Threats

Bitcoin transactions are not immune to security risks. Understanding these threats is essential to proactively protecting your assets.

- Phishing scams:Scammers often use phishing emails or websites to trick users into revealing their private keys or login credentials.

- Malware attacks:Malware can be used to steal your private keys or compromise your wallet.

- Exchange hacks:Cryptocurrency exchanges are vulnerable to hacks, which can result in the loss of your funds.

- Social engineering:Attackers may use social engineering techniques to gain access to your private keys or trick you into sending them your Bitcoin.

Best Practices for Protecting Bitcoin Assets

Implementing best practices helps mitigate security risks and safeguard your Bitcoin holdings.

- Use a hardware wallet:Hardware wallets offer the highest level of security by storing your private keys offline, physically separated from your computer.

- Be cautious of phishing scams:Never click on suspicious links or provide your private keys to anyone.

- Keep your software up to date:Ensure your wallet software and operating system are updated regularly to patch vulnerabilities.

- Back up your wallet:Create backups of your wallet and store them in a safe place, separate from your primary wallet.

- Use strong and unique passwords:Avoid using the same password for multiple accounts, and ensure your passwords are complex and difficult to guess.

Security Tools and Measures

Several tools and measures can enhance Bitcoin security.

- Antivirus software:Install reputable antivirus software to protect your computer from malware.

- Firewall:Enable a firewall to block unauthorized access to your computer.

- VPN:Use a VPN to encrypt your internet traffic and protect your privacy.

- Multi-signature wallets:Multi-signature wallets require multiple private keys to authorize transactions, enhancing security.

Future of Bitcoin Spending

The future of Bitcoin spending is brimming with possibilities, driven by the rapid evolution of technology and the growing acceptance of digital currencies. As Bitcoin matures and integrates further into the global financial landscape, its impact on commerce and the way we spend money will be profound.

Emerging Technologies and Bitcoin Spending

Emerging technologies are poised to significantly enhance the convenience and accessibility of Bitcoin spending. The rise of decentralized finance (DeFi) platforms, for example, allows users to access financial services, including lending, borrowing, and trading, without relying on traditional intermediaries. This opens up new avenues for Bitcoin spending, enabling users to participate in a wider range of financial activities.Furthermore, the development of Lightning Network, a second-layer scaling solution for Bitcoin, is expected to significantly reduce transaction fees and increase transaction speeds.

This will make Bitcoin more viable for everyday spending, especially for small-value transactions.

Bitcoin’s Role in the Future of Finance and Commerce

Bitcoin is expected to play a pivotal role in the future of finance and commerce. Its decentralized nature, transparency, and security features make it an attractive alternative to traditional financial systems. As Bitcoin adoption grows, it could potentially disrupt traditional payment systems and empower individuals and businesses to transact more freely and securely.For example, Bitcoin’s immutability and transparency can enhance supply chain management by providing a secure and auditable record of transactions.

This could lead to greater efficiency and accountability in global trade.

Factors Driving Bitcoin Adoption as a Payment Method

Several factors are driving the adoption of Bitcoin as a payment method. One key factor is the increasing awareness and understanding of Bitcoin’s value proposition. As more people become familiar with its benefits, such as its decentralized nature and resistance to censorship, they are more likely to embrace it as a payment method.Another factor is the growing number of merchants accepting Bitcoin.

As more businesses adopt Bitcoin, it becomes more convenient for consumers to use it for everyday purchases.

Predictions and Insights on the Future of Bitcoin Spending

The future of Bitcoin spending is likely to be characterized by increased adoption, innovation, and integration with traditional financial systems. As Bitcoin matures and becomes more widely accepted, it could become a dominant force in global commerce.For instance, experts predict that Bitcoin’s adoption as a payment method could accelerate as central banks and governments around the world explore the potential of digital currencies.

This could lead to a more inclusive and accessible financial system, particularly for individuals and businesses in developing countries.