Crypto Investor Sues Elon Musk for $258 Billion, Alleging Dogecoin Pyramid Scheme

Crypto investor sues elon musk for 258 billion alleging dogecoin pyramid scheme. This lawsuit, filed by a disgruntled Dogecoin investor, has sent shockwaves through the cryptocurrency world. The plaintiff alleges that Elon Musk, through his public pronouncements and actions, orchestrated a massive pyramid scheme using Dogecoin, ultimately causing the investor significant financial losses.

The case hinges on Musk’s influence over the cryptocurrency market and his ability to manipulate the price of Dogecoin through his social media presence.

The lawsuit, which seeks $258 billion in damages, claims that Musk’s tweets and actions, which often promoted Dogecoin, were intentionally misleading and designed to inflate the price of the cryptocurrency for his personal gain. The plaintiff argues that Musk, despite knowing Dogecoin had no intrinsic value, used his influence to convince investors to buy into the cryptocurrency, only to see its value plummet after Musk’s interest waned.

This lawsuit is likely to set a precedent for future legal battles surrounding cryptocurrency regulation and the responsibility of influencers in the market.

Background of the Lawsuit

The lawsuit, filed in a federal court in Manhattan, alleges that Elon Musk orchestrated a “pyramid scheme” through his promotion of Dogecoin, a cryptocurrency that he has publicly endorsed on numerous occasions. The plaintiff, Keith Johnson, claims that he lost millions of dollars after investing in Dogecoin based on Musk’s statements and actions.

The lawsuit argues that Musk’s tweets and public appearances regarding Dogecoin were intentionally misleading, creating a false impression of the cryptocurrency’s value and potential for profit. Johnson asserts that Musk, with his immense influence, manipulated the market by promoting Dogecoin to his massive social media following, ultimately causing substantial financial harm to investors who relied on his statements.

The Plaintiff’s Perspective

Keith Johnson, a resident of Florida, claims to have invested a substantial amount of money in Dogecoin, believing it to be a legitimate investment based on Musk’s repeated endorsements. Johnson argues that Musk’s actions and statements, which he describes as “fraudulent and misleading,” directly influenced his investment decisions.

He claims that Musk’s public pronouncements, coupled with his significant social media presence, artificially inflated the price of Dogecoin, leading to significant losses for investors like himself. Johnson’s motivations for filing the lawsuit are multifaceted. He aims to recover his financial losses and hold Musk accountable for his alleged actions.

He also seeks to warn other potential investors about the risks associated with investing in cryptocurrencies, particularly those promoted by individuals with significant influence.

Timeline of Key Events

- 2019:Elon Musk begins publicly expressing his support for Dogecoin on Twitter, referring to it as his “favorite cryptocurrency.” This marks the beginning of Musk’s involvement in the Dogecoin community and his subsequent influence on its market value.

- 2021:Musk’s public pronouncements about Dogecoin intensify, with him repeatedly tweeting about the cryptocurrency and even announcing that Tesla would accept Dogecoin as payment for some of its merchandise. This surge in public attention leads to a significant increase in the price of Dogecoin, attracting new investors who believe in its potential.

- May 2021:Musk appears on the popular comedy show “Saturday Night Live” and refers to Dogecoin as a “hustle,” a statement that initially caused a decline in the cryptocurrency’s price. However, Musk’s influence remains strong, and the price quickly rebounds.

- December 2021:The price of Dogecoin peaks at an all-time high, reaching a value of nearly $0.70, before experiencing a significant decline. This volatility and subsequent downturn lead to significant losses for many Dogecoin investors, including Keith Johnson.

Elon Musk’s Public Statements about Dogecoin

Elon Musk has consistently made public statements about Dogecoin, often on his Twitter account, which has a massive following. These statements have had a significant impact on the cryptocurrency’s price, leading to both gains and losses for investors.

The recent lawsuit against Elon Musk alleging Dogecoin as a pyramid scheme is a reminder that the world of crypto is a wild ride. But just like how for Chef Nikhil Abuvala, travel is the best cooking teacher , experiencing diverse cultures and cuisines can broaden our perspectives, so too can navigating the complex landscape of crypto.

It’s a space where innovation and risk intertwine, making it crucial to approach investments with a healthy dose of skepticism and research.

“Dogecoin is my favorite cryptocurrency. It’s a good thing,”

The news of a crypto investor suing Elon Musk for $258 billion, alleging Dogecoin is a pyramid scheme, has been making headlines. While this legal battle unfolds, it’s a good reminder that true happiness doesn’t come from chasing financial gains.

Science says the more of this you give the happier you’ll be, hint it’s not money , but rather from things like meaningful relationships, personal growth, and contributing to something bigger than yourself. Perhaps this lawsuit, while a significant financial claim, will also spark a broader conversation about what truly matters in life.

“Tesla will accept Doge as payment for merchandise,”

“Dogecoin is the people’s crypto,”

These statements, among many others, have been cited by the plaintiff as evidence of Musk’s deliberate efforts to manipulate the market and mislead investors. The lawsuit argues that Musk’s public pronouncements, coupled with his significant influence, created a false impression of Dogecoin’s value and potential for profit, leading to substantial financial harm for investors.

Dogecoin and its Nature

Dogecoin, a cryptocurrency often associated with memes and its playful Shiba Inu mascot, has gained significant attention in recent years. Despite its lighthearted origins, Dogecoin has become a popular choice for investors and enthusiasts, sparking discussions about its potential and the risks involved.

Dogecoin’s History and Origins, Crypto investor sues elon musk for 258 billion alleging dogecoin pyramid scheme

Dogecoin was created in 2013 by software engineers Billy Markus and Jackson Palmer. Inspired by the popular “Doge” meme, they aimed to develop a fun and accessible cryptocurrency, distinct from the more serious Bitcoin. Dogecoin’s early adoption was driven by its community-driven nature, with users participating in online forums and social media to promote the cryptocurrency.

The news cycle is full of wild stories these days, from the crypto investor suing Elon Musk for $258 billion alleging Dogecoin was a pyramid scheme, to the heartwarming tribute to culinary icon Diana Kennedy in the food world remembers the one and only diana kennedy.

It’s a stark reminder that even amidst the chaos of financial scandals, there’s still beauty and inspiration to be found in the world. And while the outcome of the Dogecoin lawsuit remains to be seen, it’s clear that the cryptocurrency market is still a wild ride.

Its rapid growth in popularity was further fueled by its low transaction fees and a relatively easy mining process, making it accessible to a wider audience.

Dogecoin’s Technological Underpinnings

Dogecoin is based on the Litecoin blockchain, which is a fork of the Bitcoin blockchain. It utilizes the Scrypt algorithm for mining, making it more accessible for users with average computer hardware. Dogecoin’s transaction speed is faster than Bitcoin’s, and its block time is approximately 1 minute.

The cryptocurrency’s total supply is not capped, unlike Bitcoin, which has a finite supply of 21 million coins. This means that new Dogecoins are continuously being mined, potentially impacting its value over time.

Understanding Cryptocurrencies

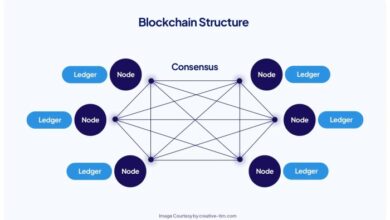

Cryptocurrencies are digital or virtual currencies that operate independently of central banks and governments. They rely on cryptography for security and use decentralized networks to record transactions. The decentralized nature of cryptocurrencies means that they are not subject to the same regulations as traditional currencies.

Dogecoin, like other cryptocurrencies, utilizes blockchain technology. A blockchain is a distributed, immutable ledger that records all transactions. Each block in the chain contains a set of transactions, and once a block is added to the chain, it cannot be altered or removed.

Investing in Dogecoin: Risks and Benefits

Investing in cryptocurrencies like Dogecoin involves both potential risks and benefits. Dogecoin’s value is highly volatile, subject to fluctuations based on market sentiment, news events, and speculation. The lack of intrinsic value, unlike traditional assets like gold or real estate, makes Dogecoin susceptible to market manipulation and price bubbles.

However, Dogecoin’s community-driven nature, low transaction fees, and accessibility have contributed to its popularity. Its widespread adoption has led to its use in online tipping, charitable donations, and even as a means of payment for goods and services.

Dogecoin’s Potential and Future

Dogecoin’s future remains uncertain, as it depends on various factors, including its adoption rate, technological advancements, and regulatory landscape. While it has gained significant traction in recent years, it faces competition from other cryptocurrencies and the evolving nature of the digital currency market.

Despite the risks associated with Dogecoin, its meme-driven popularity, low transaction fees, and community support have contributed to its continued relevance in the cryptocurrency space.

Legal Arguments and Precedents

The lawsuit against Elon Musk alleges that Dogecoin is a pyramid scheme, a serious accusation with legal implications. The plaintiff’s legal arguments focus on establishing Dogecoin’s lack of intrinsic value, its reliance on new investors for price growth, and Musk’s alleged role in perpetuating this scheme.

The plaintiff argues that Dogecoin, unlike traditional currencies, lacks intrinsic value and is solely dependent on speculation and new investors entering the market. This, according to the plaintiff, is a hallmark of a pyramid scheme, where early investors profit at the expense of later entrants.

The lawsuit also emphasizes Musk’s public pronouncements and actions, claiming he actively promoted Dogecoin while knowing it lacked real value, thereby manipulating the market and benefiting from the influx of new investors.

Relevant Legal Precedents

The plaintiff is likely to cite various legal precedents to support their claim, including:

- SEC v. Howey Co.(1946): This landmark case established the “Howey Test” to define investment contracts, which are subject to securities regulations. The test considers whether an investment involves an investment of money, in a common enterprise, with the expectation of profits solely from the efforts of others.

The plaintiff may argue that Dogecoin meets these criteria, as its value is dependent on Musk’s influence and the actions of other investors.

- SEC v. WJ Howey Co.(1946): This case further clarified the definition of a security, establishing that an investment contract is a security even if it involves the sale of tangible assets, like orange groves. This precedent could be relevant as the plaintiff argues that Dogecoin, despite being a digital asset, functions as a security.

- SEC v. Terraform Labs(2023): This recent case involved the collapse of the TerraUSD stablecoin and its associated cryptocurrency Luna. The SEC alleged that Terraform Labs engaged in a pyramid scheme, highlighting the risks associated with cryptocurrencies and the need for regulatory oversight.

This case could provide a strong legal framework for the plaintiff’s arguments.

Comparison with Existing Legal Frameworks

The lawsuit raises questions about the existing legal frameworks for cryptocurrency regulation. The plaintiff’s arguments highlight the lack of clarity regarding the legal status of cryptocurrencies and the need for stronger regulatory oversight.

- The Securities Act of 1933 and the Securities Exchange Act of 1934:These acts regulate the issuance and trading of securities, including investment contracts. The plaintiff may argue that Dogecoin should be classified as a security under these acts, subjecting it to regulatory oversight.

- The Commodity Exchange Act:This act regulates the trading of commodities, including digital assets. The plaintiff may argue that Dogecoin should be classified as a commodity under this act, subjecting it to different regulatory requirements.

- The CFTC’s Framework for Digital Asset Markets:This framework, released in 2021, provides guidance on the regulation of digital assets, including cryptocurrencies. The plaintiff may argue that the CFTC’s framework is insufficient to address the risks associated with cryptocurrencies, particularly in cases where there is alleged manipulation and lack of intrinsic value.

Final Conclusion: Crypto Investor Sues Elon Musk For 258 Billion Alleging Dogecoin Pyramid Scheme

The lawsuit against Elon Musk for his alleged role in a Dogecoin pyramid scheme is a landmark case that could have far-reaching consequences for the cryptocurrency industry. The outcome of this lawsuit will have significant implications for the future of Dogecoin, the role of influencers in the cryptocurrency market, and the broader landscape of cryptocurrency regulation.

This case will be closely watched by investors, regulators, and legal experts alike, as it could set a precedent for how cryptocurrency-related lawsuits are handled in the future.