S&P 500 Nears Bear Market: Investors Have Nowhere to Hide

Investors have nowhere to hide as sp 500 nears bear market territory – S&P 500 Nears Bear Market: Investors Have Nowhere to Hide. The S&P 500, a benchmark for the U.S. stock market, is teetering on the edge of a bear market, with investors bracing for a potential downturn. This is a period of heightened volatility and uncertainty, as investors grapple with rising inflation, interest rate hikes, and geopolitical tensions.

The market’s downward trajectory is fueled by a confluence of factors, including the Federal Reserve’s aggressive monetary policy tightening, the ongoing war in Ukraine, and supply chain disruptions.

The looming threat of a bear market has sent shockwaves through the investment community, prompting investors to reassess their risk tolerance and adjust their portfolios. While the market’s direction is unpredictable, understanding the current landscape and potential consequences of a bear market is crucial for making informed investment decisions.

Current Market Conditions

The S&P 500, a benchmark index representing the performance of 500 large-cap U.S. companies, is currently hovering near bear market territory. This signifies a decline of 20% or more from its recent peak, raising concerns among investors.

With the S&P 500 teetering on the edge of bear market territory, investors are scrambling for safe havens. It’s a tough time to be in the market, but it’s also a time to reflect on what we’ve learned. Elon Musk’s recent push for a return to the office at Tesla, while controversial, highlights the complexities of the modern workplace, which is a topic I explored in detail in this recent article, 3 things Elon Musk got right about the return to the office and some he got wrong.

As investors grapple with uncertainty, understanding the evolving nature of work and its impact on the economy is more important than ever.

Factors Contributing to Market Volatility

The market’s volatility and potential decline are influenced by several factors, including:

- Inflation and Interest Rate Hikes:The Federal Reserve’s aggressive interest rate hikes aim to curb inflation, but they also increase borrowing costs for businesses and consumers, potentially slowing economic growth and impacting corporate earnings.

- Geopolitical Tensions:The ongoing war in Ukraine, escalating tensions between the U.S. and China, and other geopolitical uncertainties contribute to market anxiety and investor uncertainty.

- Supply Chain Disruptions:Ongoing supply chain disruptions, exacerbated by the pandemic and geopolitical events, continue to affect businesses, leading to higher prices and potential production delays.

- Recession Fears:Concerns about a potential recession are rising as inflation remains high and interest rates increase, creating a challenging economic environment.

Historical Bear Markets and Their Impact on Investors, Investors have nowhere to hide as sp 500 nears bear market territory

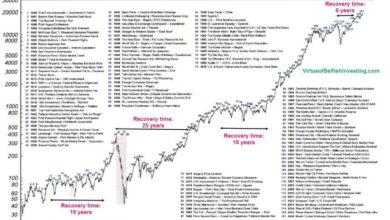

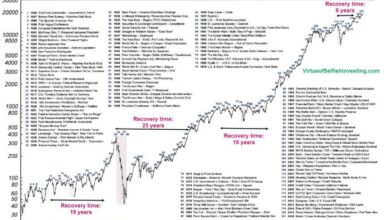

History provides insights into the impact of bear markets on investors. The 2008 financial crisis, triggered by the housing market collapse and subsequent credit crunch, resulted in a significant decline in the S&P 500, with the index dropping over 50% from its peak.

The 2020 COVID-19 pandemic also led to a sharp market downturn, though the recovery was relatively swift.

Bear markets are a normal part of the market cycle, and while they can be unsettling, they also present opportunities for long-term investors.

Investor Sentiment and Behavior

The looming threat of a bear market has sent shockwaves through the investment community, creating a palpable sense of unease and uncertainty. Investors are grappling with the potential for significant portfolio losses, prompting a reassessment of their strategies and a heightened focus on risk management.

It’s a tough time for investors, with the S&P 500 flirting with bear market territory. While the world feels like it’s crumbling around us, there’s at least one bright spot: India just opened a revolutionary liquid mirror telescope , which promises to offer incredible insights into the universe.

Perhaps the cosmos holds some answers for navigating these turbulent financial waters.

Investor Sentiment

Investor sentiment is a gauge of the overall mood and expectations of market participants. It is often reflected in market indicators like the VIX volatility index, which measures investor fear and uncertainty. Currently, investor sentiment is characterized by a mix of fear and caution, with many investors feeling apprehensive about the market’s direction.

This sentiment is driven by several factors, including:

- Rising inflation: Persistent inflation has eroded purchasing power and forced investors to contend with higher interest rates, impacting the attractiveness of equities.

- Geopolitical tensions: The ongoing war in Ukraine and escalating tensions between the US and China have created a volatile geopolitical environment, further fueling market uncertainty.

- Aggressive monetary policy: The Federal Reserve’s aggressive interest rate hikes aimed at curbing inflation have raised concerns about a potential economic slowdown, which could negatively impact corporate earnings and stock valuations.

Risk Mitigation Strategies

Investors are adopting various strategies to mitigate risk and protect their portfolios in the face of a potential bear market. Some of the most common approaches include:

- Reducing equity exposure: Investors are shifting their portfolios away from stocks and toward more conservative assets like bonds, cash, and gold. This strategy aims to reduce potential losses in the event of a market downturn.

- Increasing cash holdings: Holding more cash provides investors with greater flexibility to buy assets at lower prices during a market correction or to weather any potential economic storm.

- Diversifying portfolios: Spreading investments across different asset classes, sectors, and geographies can help reduce overall portfolio risk. This strategy aims to mitigate the impact of any single investment performing poorly.

Individual vs. Institutional Investors

While the overall sentiment among investors is cautious, there are some notable differences in how individual and institutional investors are responding to the potential bear market.

The market’s volatility is making investors nervous, and with the S&P 500 nearing bear market territory, it’s clear that there’s nowhere to hide. While the stock market might be a roller coaster ride, it’s a good time to remember the value of your employees, especially those who have been with you for a long time.

As Adam Grant says in his article, want to hang on to veteran employees nows the time for retention raises says adam grant , retention raises can be a powerful tool for keeping your team motivated and engaged, even during tough economic times.

In the end, your employees are your most valuable asset, and investing in them can help you weather any storm.

- Individual investors: Individual investors tend to be more emotional and reactive to market fluctuations. They may be more prone to panic selling during a downturn, which can exacerbate market declines. Some individual investors may also be tempted to chase returns by investing in high-risk assets, which could expose them to greater losses.

- Institutional investors: Institutional investors, such as hedge funds, pension funds, and mutual funds, generally have a more long-term perspective and a more disciplined approach to investing. They are less likely to panic sell during a market downturn and may even see it as an opportunity to buy undervalued assets.

They also have access to sophisticated analytical tools and resources that enable them to make more informed investment decisions.

Potential Impacts of a Bear Market: Investors Have Nowhere To Hide As Sp 500 Nears Bear Market Territory

A bear market, characterized by a sustained decline of 20% or more in a major stock market index, can have significant economic and social consequences. While investors may experience losses in their portfolios, the ripple effects can extend far beyond the financial markets.

Economic Consequences

A bear market can significantly impact the overall economy, affecting various sectors and industries.

- Reduced Consumer Spending:As stock prices fall, investors may feel less wealthy, leading to reduced consumer spending. This decline in spending can hurt businesses, especially those in consumer discretionary sectors like retail, travel, and entertainment.

- Slower Economic Growth:A bear market can lead to a slowdown in economic growth as businesses invest less, and consumers spend less. This can result in job losses, reduced production, and lower overall economic activity.

- Increased Unemployment:Businesses may lay off workers to cut costs during a downturn. This can lead to higher unemployment rates, impacting household incomes and further reducing consumer spending.

- Financial Market Volatility:Bear markets are often accompanied by increased volatility in financial markets, making it challenging for businesses to access capital and invest in growth. This can further exacerbate the economic downturn.

Social Consequences

Beyond economic impacts, bear markets can also have social consequences, affecting individuals and communities.

- Increased Stress and Anxiety:The uncertainty and potential financial losses associated with a bear market can lead to increased stress and anxiety for individuals, especially those heavily invested in the stock market.

- Social Unrest:High unemployment and economic hardship can contribute to social unrest and political instability. This can lead to protests, strikes, and other forms of social disruption.

- Reduced Confidence:A bear market can erode public confidence in the economy and financial markets, making it harder for businesses to operate and invest in the future.

Impact on Industries and Sectors

Different industries and sectors are affected differently by bear markets.

- Cyclical Industries:Cyclical industries, such as manufacturing, retail, and construction, are often more vulnerable to downturns as their performance is closely tied to the overall economic cycle. During a bear market, demand for their products and services may decline, leading to lower profits and job losses.

- Financials:Financial institutions, including banks, insurance companies, and investment firms, can be significantly impacted by a bear market. They may experience higher loan defaults, reduced investment returns, and increased regulatory scrutiny.

- Energy:The energy sector is also vulnerable to economic downturns, as demand for oil and gas can decline during recessions. This can lead to lower prices, reduced investment, and job losses in the industry.

- Technology:While the technology sector is often seen as more resilient, it can still be affected by a bear market. Investors may become more risk-averse, leading to lower valuations and reduced investment in technology companies.

Impact on Individual Investors

Bear markets can have a significant impact on individual investors.

- Portfolio Losses:The most immediate impact of a bear market is the potential for portfolio losses. As stock prices decline, investors may experience a decrease in the value of their investments.

- Reduced Retirement Savings:For those saving for retirement, a bear market can significantly impact their retirement savings. This can lead to delays in retirement plans and a reduction in the amount of money available for retirement.

- Increased Risk Aversion:Bear markets can lead to increased risk aversion among investors, making them more cautious about investing in stocks and other risky assets.

Impact on Businesses

Bear markets can have a significant impact on businesses, both large and small.

- Reduced Investment:During a bear market, businesses may find it more difficult to raise capital for investment. This can lead to reduced growth and expansion plans.

- Lower Profits:Reduced consumer spending and slower economic growth can lead to lower profits for businesses, especially those in cyclical industries.

- Increased Financial Stress:Bear markets can increase financial stress for businesses, especially those with high debt levels or limited cash reserves.

Impact on the Overall Economy

Bear markets can have a significant impact on the overall economy, leading to a decline in economic activity, job losses, and reduced consumer spending.

- Recessions:In severe cases, bear markets can contribute to economic recessions. This occurs when there is a sustained period of economic decline, characterized by falling GDP, rising unemployment, and reduced consumer spending.

- Reduced Investment:A bear market can lead to reduced investment in businesses and infrastructure, slowing down economic growth and innovation.

- Increased Government Spending:Governments may need to increase spending during a bear market to stimulate economic growth and support struggling businesses and individuals.

Closing Summary

Navigating a bear market requires a strategic approach, combining diversification, risk management, and a long-term perspective. While a bear market can be a challenging period for investors, it also presents opportunities for those who are prepared and disciplined. By understanding the dynamics of a bear market, investors can make informed decisions and position themselves to weather the storm, potentially emerging stronger on the other side.