Council Post: Impress Investors with These 9 Tips

Council post trying to impress a potential investor keep these nine tips in mind – Council Post: Impress Investors with These 9 Tips – Securing funding is a crucial step for any startup or business looking to grow. But with so many entrepreneurs vying for investor attention, how can you make your pitch stand out?

The answer lies in crafting a compelling narrative that highlights your company’s unique value proposition, showcases your team’s expertise, and presents a solid financial plan.

This guide delves into nine essential tips to help you impress potential investors, from building trust and credibility to engaging visuals and strategic use of data. Whether you’re a seasoned entrepreneur or just starting out, these strategies can help you secure the funding you need to take your business to the next level.

Crafting a Compelling Narrative

A compelling narrative is the cornerstone of attracting investors. It’s not just about showcasing your product or service; it’s about painting a picture of a future where your business thrives, creating value for both your company and your investors. This narrative should be clear, concise, and infused with passion, highlighting the unique value proposition of your business and its potential for significant returns.

The Unique Value Proposition

The unique value proposition (UVP) is the core of your business’s appeal. It’s what sets you apart from the competition and answers the crucial question: “Why should investors choose your company?” A compelling UVP should be clear, concise, and memorable.

It should communicate the core benefits your business offers to customers and how it solves a specific problem or meets a specific need.

For example, a UVP for a SaaS company might be: “We provide a cloud-based platform that automates marketing tasks, saving businesses time and resources while driving increased sales.”

Demonstrating Traction and Growth

Investors are drawn to companies that show signs of success. This is where demonstrating traction and growth becomes crucial. It’s about providing concrete evidence that your business is gaining momentum and has the potential to scale.

- Customer Acquisition:Showcase metrics like customer acquisition cost (CAC) and customer lifetime value (CLTV). A low CAC and high CLTV indicate efficient customer acquisition and strong customer loyalty.

- Revenue Growth:Share your revenue figures, highlighting consistent growth over time. This demonstrates the company’s ability to generate revenue and scale its operations.

- Market Share:Quantify your market share and demonstrate your position within the competitive landscape. This shows investors that your business is a viable player in a growing market.

Market Opportunity and Competitive Advantage

Investors want to see a clear understanding of the market opportunity and how your business is positioned to capitalize on it. Highlighting your competitive advantage within the market is essential.

- Market Size and Growth:Quantify the market opportunity and demonstrate its potential for growth. This shows investors that there is a large enough market for your business to thrive.

- Competitive Landscape:Analyze your competitors and identify your unique strengths and differentiators. This helps investors understand your competitive advantage and your ability to succeed in the market.

- Market Penetration Strategy:Artikel your plan for expanding your market share and reaching new customers. This demonstrates your strategic thinking and your ability to execute on your growth plans.

Showcasing Your Team’s Expertise

A company’s success hinges on the strength of its team, and a compelling narrative is incomplete without showcasing the expertise and experience that drives it. Investors look for teams that possess a deep understanding of the market, a proven track record of success, and a shared passion for the company’s mission.

Experience and Qualifications

The founding team and key personnel are the backbone of your company. Investors want to see a blend of experience and expertise.

When pitching your startup to investors, remember that passion is contagious. Show them you’re invested in the success of your idea, just like you’d invest in the professional development of your teachers. Read up on the latest in educational research, like the science of coaching teachers edsurge news , to demonstrate your understanding of the market and your commitment to innovation.

This level of preparedness will leave a lasting impression on your potential investors.

- Founder Backgrounds:Highlight the relevant experience of each founder. Did they hold leadership positions in similar industries? Do they have a strong academic background in a related field? This demonstrates their understanding of the market and their ability to navigate the challenges ahead.

- Key Personnel:Showcase the expertise of your core team. Do you have experienced engineers, marketing specialists, or finance professionals? Detail their specific skills and how they contribute to the company’s success.

Industry Knowledge and Track Record

Investors seek teams that can demonstrate a deep understanding of the industry they operate in.

- Market Research:Highlight your team’s thorough research into the market landscape. Have you conducted comprehensive studies to identify market trends, competitive analysis, and potential growth opportunities? This demonstrates your team’s strategic thinking and their ability to navigate a dynamic market.

- Past Successes:If your team has a track record of success in previous ventures or roles, showcase it. For example, if a founding member previously launched a successful startup in a similar space, this demonstrates their ability to build and scale a business.

Passion and Commitment

Investors are drawn to teams that are passionate about their vision and committed to its success.

- Mission Statement:Ensure your mission statement is clear and compelling. It should reflect the team’s values and the impact they want to make.

- Personal Stories:Share personal stories that illustrate the team’s passion for the company’s mission. Did a founder experience a personal challenge that led to the creation of the company? Are there team members who have dedicated years to researching this particular problem?

These stories humanize the team and showcase their commitment.

Presenting a Solid Financial Plan: Council Post Trying To Impress A Potential Investor Keep These Nine Tips In Mind

A robust financial plan is the bedrock of any successful business venture, particularly when seeking investment. It demonstrates your understanding of the market, your company’s potential, and your ability to manage resources effectively. This plan should be a clear and concise roadmap, outlining your financial projections, funding needs, and the anticipated return on investment for your investors.

Financial Projections

A detailed financial projection for the next 3-5 years is essential. It should include revenue, expenses, and profitability. This projection should be based on realistic assumptions and supported by market research and industry data. For example, if your company is in the SaaS industry, you could base your projections on the growth rate of the SaaS market, the average customer acquisition cost (CAC), and the average customer lifetime value (CLTV) in the industry.

A clear and well-structured financial projection will give investors confidence in your ability to manage your company’s finances effectively.

Funding Needs and Utilization

Clearly explain your company’s funding needs and how the investment will be utilized. This section should detail the specific uses of the funds, such as product development, marketing, or expansion. For example, you could specify that a portion of the investment will be used to develop a new product feature, while another portion will be used to hire additional sales and marketing personnel.

A transparent explanation of your funding needs will demonstrate your responsible approach to managing resources.

Exit Strategy and Return on Investment

Discuss your company’s exit strategy and potential return on investment for investors. This could include a potential acquisition by a larger company, an initial public offering (IPO), or a buyback by the company’s founders. You should also provide a realistic timeline for each exit strategy and a clear explanation of how investors will benefit from their investment.

A well-defined exit strategy will give investors confidence in your ability to generate a return on their investment.

Transparency and Open Communication

Transparency and open communication are crucial for building trust with investors. By being upfront about your company’s vision, challenges, and plans, you demonstrate your commitment to transparency and create a foundation for a strong and lasting partnership.

Sharing Your Vision and Long-Term Goals

Investors are interested in understanding where your company is headed and how they can contribute to its success. Clearly articulating your company’s vision and long-term goals provides investors with a roadmap of your aspirations. This vision should be well-defined and ambitious, outlining your plans for growth, expansion, and innovation.

For instance, you could highlight your target market, key milestones, and anticipated impact on the industry.

Being Transparent About Challenges and Risks

No company is without challenges. Investors understand this and value honesty. Be upfront about the challenges your company faces and the potential risks involved. This transparency demonstrates your awareness and proactive approach to navigating potential hurdles. For example, you might discuss the competitive landscape, regulatory hurdles, or technological advancements that could affect your business.

It’s essential to Artikel how you plan to address these challenges, whether through strategic partnerships, technological innovation, or market diversification.

Maintaining Open Communication

Open communication is the cornerstone of a successful investor relationship. Provide regular updates on your company’s progress, highlighting key milestones and achievements. This could include financial performance, product development, market expansion, or team growth. Being responsive to investor inquiries and providing clear and concise information builds trust and fosters a collaborative relationship.

Regular communication can be achieved through email, phone calls, investor reports, or even online platforms dedicated to investor relations.

Building Trust and Credibility

Building trust and credibility is paramount in attracting investors. Investors want to feel confident in your company’s ability to deliver on its promises. They need to believe in your team, your strategy, and your commitment to success.

Trying to impress a potential investor can feel like navigating a minefield, but remember, honesty and transparency are key. Just like the impact of conspiracy theories, as seen in the tragic case of the Sandy Hook shooting , misinformation can quickly erode trust.

So, focus on presenting your vision clearly, backed by solid data, and let your passion shine through – that’s the best way to win over any investor.

Positive Testimonials, Council post trying to impress a potential investor keep these nine tips in mind

Testimonials from existing investors, customers, or partners can provide powerful evidence of your company’s value proposition. These testimonials can be in the form of written statements, video endorsements, or even case studies that demonstrate the positive impact your company has had on others.

- Include quotes from satisfied customers about their experience with your product or service.

- Highlight testimonials from investors who have already invested in your company and are happy with their returns.

- Share case studies that illustrate how your company has helped other businesses achieve their goals.

Awards and Recognitions

Awards, recognitions, and media coverage can serve as a strong indicator of your company’s credibility. These accolades demonstrate that your company has been recognized by independent third parties for its achievements and contributions.

- Mention any awards or recognitions your company has received for innovation, growth, or social impact.

- Share any positive media coverage your company has received in industry publications or mainstream media.

- Highlight any industry certifications or accreditations your company holds that demonstrate your commitment to quality and standards.

Strong Corporate Governance and Ethical Business Practices

Investors are increasingly looking for companies that prioritize strong corporate governance and ethical business practices. Demonstrating a commitment to these principles can build trust and confidence among investors.

- Clearly Artikel your company’s governance structure and processes, including board composition, audit procedures, and conflict of interest policies.

- Highlight any initiatives your company undertakes to promote diversity, equity, and inclusion within your organization.

- Showcase your commitment to environmental sustainability and social responsibility through concrete actions and initiatives.

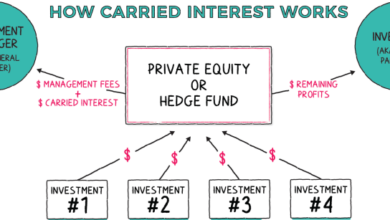

Engaging Visuals and Design

Investors are visual creatures. They want to see a clear, compelling story that showcases your vision and potential. This is where engaging visuals and design come into play. A well-designed presentation or document can make a significant difference in how your pitch is received.

It can help you capture attention, convey complex information effectively, and leave a lasting impression.

The Importance of Visual Storytelling

Visuals are essential for storytelling. They help you break down complex information into digestible chunks and create a more engaging experience for your audience.

“A picture is worth a thousand words.”

This proverb holds true in the context of investor pitches. A well-chosen image or chart can quickly convey a concept that might take paragraphs to explain in text.

It’s all about making a strong first impression when you’re trying to win over a potential investor. Think of it like a high-stakes game of chess, where every move counts. Remember that article about Peter Navarro, the former Trump White House advisor, getting a grand jury subpoena in the January 6th investigation ?

He’s definitely facing a challenging situation, and it’s a good reminder that sometimes, even with the best planning, unexpected events can throw a wrench into your plans. But with the right strategy and preparation, you can navigate those unexpected turns and come out on top.

So, stick to your nine tips and keep that investor’s attention!

Using Visuals Effectively

- High-Quality Images: Choose images that are relevant to your business and visually appealing. Avoid using stock photos that look generic or unprofessional.

- Charts and Graphs: Use charts and graphs to illustrate key data points and trends. Make sure they are easy to understand and visually appealing.

- Infographics: Infographics can be a great way to present complex information in a visually engaging way. They can be used to explain your business model, highlight key metrics, or showcase your competitive advantage.

Maintaining a Consistent Brand Identity

Consistency is key when it comes to design. Use a consistent brand identity throughout your presentation or document. This includes your logo, color scheme, fonts, and overall aesthetic.

“Consistency breeds trust.”

By maintaining a consistent brand identity, you create a sense of professionalism and credibility. This can help you build trust with investors and make a positive impression.

Strategic Use of Data and Metrics

Data is the lifeblood of any successful business, and for a startup seeking investment, it’s essential to present a compelling narrative backed by solid data and metrics. Investors want to see that you understand your market, your customers, and the potential for growth, and that you’re using data to drive your decisions.

Demonstrating Market Understanding

Data-driven insights and market research are crucial to showcase your understanding of the market landscape. By presenting relevant data points, you can demonstrate your knowledge of market trends, competitor analysis, and the potential for your product or service.

For example, you could present data on the market size, growth rate, and key customer segments. You could also use data to highlight the unmet needs in the market that your product or service addresses.

Tracking Key Performance Indicators (KPIs)

Investors want to see that you’re tracking the right metrics and using them to measure your progress. This includes defining key performance indicators (KPIs) that are relevant to your business model and goals.

For example, if you’re a SaaS company, your KPIs might include monthly recurring revenue (MRR), customer churn rate, and average revenue per user (ARPU). By tracking these KPIs over time, you can demonstrate your company’s growth trajectory and identify areas for improvement.

Quantifying Impact

It’s not enough to simply state that your product or service is successful. You need to quantify its impact on the market and its users. This can be done by using data to show the tangible benefits of your product or service.

For example, you could present data on customer satisfaction, user engagement, or the impact your product has had on your customers’ bottom line. You could also use data to demonstrate the return on investment (ROI) that investors can expect from their investment in your company.

Concise and Effective Communication

Investors are bombarded with pitches every day, so making your presentation stand out requires a laser focus on clear and concise communication. Your message needs to be compelling, easily understood, and leave a lasting impression.

Crafting a Clear Narrative

A well-structured narrative is crucial for keeping your audience engaged. Start with a compelling hook that grabs their attention and sets the stage for your business idea. Then, logically progress through your key points, using transitions to connect ideas seamlessly.

Think of it as telling a story that highlights the value proposition of your venture.

Using Concise and Impactful Language

Avoid jargon and technical terms that might confuse your audience. Focus on using clear, concise language that everyone can understand. Every word should have a purpose, contributing to the overall message. Remember, less is more when it comes to delivering a powerful message.

Tailoring Communication to Your Audience

Investors come from diverse backgrounds with varying investment goals. Understanding your audience’s needs and motivations is key to tailoring your communication effectively. For example, a venture capitalist might be interested in high-growth potential, while an angel investor might prioritize social impact.

Tailoring your message to their specific interests will resonate more powerfully.

Follow-up and Relationship Building

After delivering your pitch, it’s crucial to maintain momentum and nurture the relationships you’ve established with potential investors. Following up effectively and building strong connections can significantly increase your chances of securing funding.

Thank Investors for Their Time and Interest

Expressing gratitude for investors’ time and interest demonstrates professionalism and respect. A personalized thank-you note or email acknowledging their participation in the presentation shows that you value their input and are committed to building a lasting relationship.

Follow Up With Investors After the Presentation

Following up promptly after the presentation allows you to address any questions or concerns raised by investors. It also provides an opportunity to reiterate key points and further clarify aspects of your business plan.

Build Strong Relationships With Investors

Building strong relationships with investors requires ongoing communication and engagement. Provide regular updates on your company’s progress, milestones achieved, and future plans. Engaging in meaningful conversations, responding to inquiries promptly, and demonstrating transparency fosters trust and confidence.

“Building strong relationships with investors is an ongoing process that requires dedication, transparency, and consistent communication.”

Ultimate Conclusion

Remember, securing funding is a marathon, not a sprint. By following these tips, you can create a compelling pitch that resonates with investors and sets your company on a path for success. Don’t underestimate the power of a well-crafted narrative, a strong team, and a clear financial plan.

With these elements in place, you’ll be well on your way to securing the investment you need to achieve your goals.