Chobanis IPO Curdles Amid Cooling Market

Chobani plans curdle once hyped ipo dropped amid cooling market – Chobani’s IPO Curdles Amid Cooling Market, a tale of high expectations and a market that’s lost its appetite. The Greek yogurt giant, once a darling of the investment world, has postponed its highly anticipated IPO, a move that reflects the shifting tides of the market and the challenges facing the food and beverage industry.

The initial public offering was expected to be a major event, but the cooling market and investor sentiment have cooled the enthusiasm surrounding Chobani’s debut.

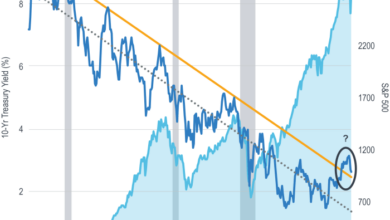

This postponement is a sign of the times, with many companies re-evaluating their plans amidst a volatile market. The cooling market is a global phenomenon, driven by factors like rising inflation, interest rate hikes, and geopolitical uncertainty. This economic downturn has made investors more cautious, leading to a decline in IPO activity and a shift in investor sentiment towards safer, more established companies.

Chobani’s IPO Performance: Chobani Plans Curdle Once Hyped Ipo Dropped Amid Cooling Market

Chobani, the popular yogurt brand, had been gearing up for an initial public offering (IPO) in 2023, aiming to capitalize on its strong brand recognition and market position. However, the company’s IPO plans were put on hold due to a combination of factors, including a cooling market and shifting investor sentiment.The decision to postpone the IPO highlights the challenging market conditions that many companies are facing.

While Chobani had been experiencing strong growth and profitability, the overall market environment for IPOs has become increasingly volatile.

The Chobani IPO saga is a reminder that even the most hyped companies can struggle in a cooling market. While Chobani navigates these turbulent waters, the NASCAR world is heating up as Tyler Reddick and Kyle Larson lead the charge into the playoffs.

Check out the latest power rankings to see who’s poised to take home the checkered flag. It’s a stark contrast to the financial world, where Chobani’s plans have curdled, illustrating the volatility of the market.

Market Conditions and Investor Sentiment

The IPO market in 2023 has been characterized by heightened volatility and a decline in investor appetite for new listings. Rising interest rates, concerns about inflation, and a potential recession have led to a pullback in risk appetite, making investors more cautious about allocating capital to new ventures.The decline in investor sentiment has also been influenced by the performance of recent IPOs.

Many companies that went public in 2021 and early 2022 have seen their share prices decline significantly, eroding investor confidence in the IPO market. This trend has made it more challenging for companies like Chobani to attract the necessary investor interest and achieve a favorable valuation.

It’s been a rough week for Chobani, with their highly anticipated IPO getting put on ice due to the cooling market. It’s a reminder that even the biggest names can struggle in tough economic times. Meanwhile, across the pond, Scotland is making positive strides with their “Calum’s Law” on child restraint, taking a huge step towards safer roads for kids scotland takes huge step towards calums law on child restraint.

Hopefully, both Chobani and the families in Scotland will see brighter days ahead.

Impact of the Cooling Market on Chobani’s Valuation

The cooling market has undoubtedly impacted Chobani’s valuation prospects. Investors are likely to demand a higher risk premium for companies entering the public market during a period of economic uncertainty. This means that Chobani may need to accept a lower valuation than it initially hoped for, which could affect its ability to raise the desired amount of capital.For instance, if Chobani had initially aimed for a valuation of $5 billion, the current market conditions might force them to accept a lower valuation of $4 billion.

It seems like the market is cooling down, and even the most hyped IPOs are feeling the chill. Chobani’s plans to go public have apparently curdled, but hey, at least some people are finding love in unexpected places. Remember Big Ed from “90 Day Fiancé”?

Well, he’s now engaged to a fan he met at a signing event, according to this article. Maybe Chobani should take a page out of Big Ed’s book and focus on finding the right partner, even if it’s not the traditional IPO route.

After all, sometimes love, or a successful partnership, can be found in the most unexpected places.

This would mean that they would need to issue more shares to raise the same amount of capital, diluting the ownership of existing shareholders.

Comparison with Other Recent Food and Beverage IPOs

Chobani’s decision to postpone its IPO mirrors the experiences of other food and beverage companies that have recently attempted to go public. For example, Beyond Meat, a plant-based meat company, saw its share price plummet after its 2019 IPO, reflecting the challenges of navigating a volatile market.

Similarly, Oatly, a plant-based milk company, experienced a significant decline in its share price after its 2021 IPO.These examples highlight the difficulties that food and beverage companies face in attracting investors during periods of market uncertainty. While Chobani’s brand recognition and market position are strong, the current market conditions make it difficult to achieve a favorable valuation and attract the necessary investor interest.

Chobani’s Business Strategy

Chobani, the leading Greek yogurt brand, has carved a significant niche in the competitive dairy market. Its success can be attributed to a well-defined business model, strategic growth initiatives, and a strong focus on product innovation and market expansion. This section delves into the key aspects of Chobani’s business strategy, examining its competitive landscape, growth strategies, financial performance, and the potential impact of the delayed IPO on its long-term growth prospects.

Chobani’s Core Business Model and Competitive Landscape

Chobani’s core business model revolves around producing and distributing high-quality, natural Greek yogurt. The company distinguishes itself from competitors by focusing on:

- Natural Ingredients:Chobani’s yogurt is made with simple ingredients, typically milk, live and active cultures, and sometimes fruit or flavorings. This aligns with consumer preferences for healthier, minimally processed food.

- Product Innovation:Chobani continuously introduces new flavors, formats, and product lines to cater to diverse consumer needs and preferences. This includes options like blended yogurt, dairy-free alternatives, and yogurt-based snacks.

- Strong Brand Identity:Chobani has cultivated a strong brand identity built on values of authenticity, quality, and health. The brand’s commitment to sustainability and ethical sourcing further enhances its appeal to environmentally conscious consumers.

Chobani operates in a highly competitive market with established players like Dannon, Yoplait, and Stonyfield. However, Chobani has successfully differentiated itself through its focus on natural ingredients, product innovation, and brand authenticity.

Growth Strategies: Product Innovation and Market Expansion

Chobani employs a multi-pronged growth strategy that encompasses both product innovation and market expansion.

- Product Innovation:Chobani constantly introduces new flavors, formats, and product lines to cater to evolving consumer preferences. This includes introducing dairy-free alternatives, plant-based yogurt options, and yogurt-based snacks.

- Market Expansion:Chobani has expanded its geographic reach beyond the US, targeting international markets with high growth potential. The company has also expanded into new product categories, such as plant-based milk and dairy-free yogurt alternatives.

These strategic initiatives have helped Chobani maintain its market leadership and capture new market share.

Financial Performance and Key Metrics, Chobani plans curdle once hyped ipo dropped amid cooling market

Chobani’s financial performance has been impressive, with consistent revenue growth and profitability. Key financial metrics include:

- Revenue Growth:Chobani has experienced sustained revenue growth over the years, driven by strong demand for its products.

- Market Share:Chobani holds a significant market share in the Greek yogurt category, solidifying its position as a leading player.

- Profitability:Chobani has demonstrated strong profitability, reflecting its efficient operations and effective cost management.

These financial metrics indicate Chobani’s robust financial performance and its ability to generate consistent returns.

Impact of Delayed IPO on Long-Term Growth Prospects

The delayed IPO could potentially impact Chobani’s long-term growth prospects in several ways.

- Access to Capital:A successful IPO would have provided Chobani with significant capital to fuel further expansion and innovation. The delay could limit access to this capital, potentially slowing down growth initiatives.

- Market Valuation:The delay could negatively impact Chobani’s market valuation, making it more challenging to attract future investments and partnerships.

- Investor Confidence:The delayed IPO might raise concerns among investors about Chobani’s future prospects, potentially affecting its ability to secure future funding.

However, it is important to note that Chobani’s strong brand, loyal customer base, and proven track record of innovation provide a solid foundation for future growth. The company’s ability to navigate the current market conditions and adapt to evolving consumer preferences will be crucial in determining its long-term success.

The Future of the Food and Beverage Industry

The food and beverage industry is a dynamic and ever-evolving sector, constantly adapting to changing consumer preferences, technological advancements, and global economic trends. It faces numerous challenges, from rising costs and supply chain disruptions to evolving consumer demands for healthier and more sustainable options.

However, amidst these challenges, significant opportunities for growth exist, particularly in the yogurt market.

Consumer Preferences and Health Trends

Consumer preferences play a crucial role in shaping the food and beverage industry. Health and wellness are increasingly becoming central to consumer decision-making, driving demand for products that are perceived as healthy, natural, and sustainable. The yogurt market, in particular, has benefited from this trend, with consumers seeking out products that offer a source of protein, probiotics, and other nutritional benefits.

- The growing demand for plant-based alternatives is creating new opportunities for yogurt producers. Consumers are increasingly opting for dairy-free options made from ingredients such as almond milk, soy milk, and coconut milk. This shift is driven by dietary restrictions, environmental concerns, and a growing awareness of the potential health benefits of plant-based diets.

- The trend towards clean-label products, with minimal ingredients and no artificial additives, is another significant driver of growth in the yogurt market. Consumers are seeking products that are perceived as natural and wholesome, leading to increased demand for organic and non-GMO yogurts.

Emerging Technologies

Emerging technologies are revolutionizing the food and beverage industry, creating new opportunities for innovation and efficiency. These technologies are transforming everything from food production and processing to packaging and distribution.

- Precision fermentation, a technology that uses microorganisms to produce food ingredients, is creating new possibilities for developing sustainable and innovative yogurt products. This technology allows for the production of dairy proteins and other ingredients without the need for traditional animal agriculture, offering a more environmentally friendly alternative.

- Artificial intelligence (AI) is being used to optimize food production processes, predict consumer demand, and personalize product offerings. AI-powered systems can analyze vast amounts of data to identify trends and patterns, enabling companies to make more informed decisions and respond to changing consumer preferences.

- Blockchain technology is being used to improve transparency and traceability in the food supply chain. By tracking ingredients and products from farm to table, blockchain can help ensure food safety, prevent fraud, and build consumer trust.

The Impact of the Cooling Market

The cooling market, characterized by slowing economic growth and increased uncertainty, is a significant challenge for businesses across various sectors. This downturn is driven by a complex interplay of factors, including rising inflation, supply chain disruptions, geopolitical tensions, and changing consumer behavior.

Understanding the implications of this cooling market is crucial for businesses to adapt and thrive in the face of these challenges.

Impact on Businesses Across Sectors

The cooling market significantly impacts businesses across various sectors, forcing them to adapt their strategies to navigate the current economic landscape. Here are some key implications:

- Reduced Consumer Spending:As inflation erodes purchasing power, consumers are becoming more cautious with their spending, leading to decreased demand for non-essential goods and services. Businesses need to focus on value propositions and promotions to attract price-sensitive consumers.

- Supply Chain Disruptions:The ongoing global supply chain disruptions have led to increased costs and delays, impacting businesses’ ability to produce and deliver goods and services efficiently. Companies are seeking alternative suppliers, optimizing logistics, and building more resilient supply chains.

- Rising Interest Rates:Central banks around the world are raising interest rates to combat inflation, making borrowing more expensive for businesses. This can impact investment decisions, expansion plans, and overall business growth.

- Increased Competition:The cooling market can lead to increased competition as businesses fight for market share in a shrinking economy. Companies need to differentiate themselves through innovation, superior customer service, and strategic pricing to remain competitive.

Strategies for Navigating the Cooling Market

Companies are employing various strategies to navigate the current market conditions and mitigate the impact of the cooling market. These strategies include:

- Cost Optimization:Businesses are focusing on reducing operational costs by streamlining processes, negotiating better deals with suppliers, and implementing efficiency measures.

- Innovation and Product Differentiation:Companies are investing in research and development to create innovative products and services that meet evolving consumer needs and preferences.

- Customer Focus:Building strong customer relationships and providing exceptional customer service is crucial to retaining existing customers and attracting new ones.

- Strategic Partnerships:Collaborating with other businesses can provide access to new markets, resources, and expertise, helping companies overcome challenges and achieve growth.

Risks and Opportunities

The cooling market presents both risks and opportunities for businesses.

- Risks:

- Decreased Profitability:Reduced demand and rising costs can significantly impact a business’s profitability.

- Job Losses:Companies may be forced to reduce their workforce to manage costs and adapt to reduced demand.

- Increased Risk Aversion:Investors may become more risk-averse in a cooling market, making it harder for businesses to raise capital.

- Opportunities:

- Market Share Gains:Businesses that can adapt quickly and effectively to the changing market conditions can gain market share from competitors struggling to adjust.

- Innovation:The cooling market can drive innovation as businesses seek new ways to improve efficiency, reduce costs, and meet evolving consumer needs.

- Strategic Acquisitions:Companies with strong financial positions may see opportunities to acquire businesses at lower valuations, expanding their market reach and product offerings.