UK SMEs: Feeling the Squeeze After Months of Growth

Bursting the balloon u k smes feeling squeezed after months of double digit sales growth – The UK SME landscape, once bursting with double-digit sales growth, now finds itself facing a harsh reality. After months of seemingly unstoppable momentum, the balloon has burst, leaving many businesses feeling squeezed. This sudden shift has brought challenges and uncertainty, forcing SMEs to adapt to a new economic climate.

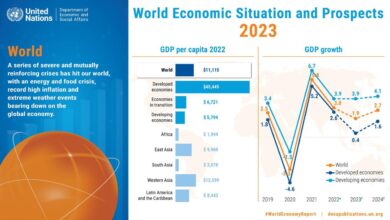

The reasons for this slowdown are complex and multifaceted. Global economic factors like inflation and supply chain disruptions have played a significant role. Government policies and regulations have also contributed to the challenges faced by UK SMEs. This economic turbulence has created a new normal, forcing businesses to rethink their strategies and find ways to survive and thrive in a more competitive environment.

The UK SME Landscape

The UK’s SME sector was humming along before the recent economic slowdown. Fueled by a post-pandemic rebound and a generally favorable business climate, many SMEs were experiencing strong growth and contributing significantly to the UK economy.

Key Growth Sectors

The UK’s SME landscape prior to the burst was characterized by strong growth in several key sectors. These included:

- Technology:The UK has a thriving tech scene, with a high concentration of innovative startups and scaleups. This sector was particularly buoyant, attracting significant investment and creating new jobs.

- E-commerce:The pandemic accelerated the shift to online shopping, benefiting many e-commerce businesses. SMEs in this sector saw significant growth in sales and customer acquisition.

- Healthcare:The UK’s aging population and increasing demand for healthcare services led to growth in the healthcare sector, including a rise in innovative healthcare startups.

- Renewable Energy:The UK’s commitment to reducing carbon emissions and transitioning to renewable energy sources spurred growth in the renewable energy sector, particularly in solar, wind, and energy efficiency solutions.

Challenges and Opportunities

Despite the positive economic backdrop, UK SMEs faced a number of challenges:

- Competition:The UK market is highly competitive, especially in the digital age, making it difficult for SMEs to stand out and attract customers.

- Talent Acquisition:Finding and retaining skilled workers is a major challenge for many SMEs, particularly in sectors like technology and healthcare.

- Access to Finance:Securing funding can be a hurdle for SMEs, especially for startups and businesses in early stages of development.

- Regulation:The UK’s regulatory environment can be complex and burdensome for SMEs, particularly for businesses operating in sectors like healthcare and financial services.

However, UK SMEs also had access to a number of opportunities:

- Government Support:The UK government provides a range of support programs for SMEs, including grants, loans, and tax breaks.

- Digital Technologies:The rapid adoption of digital technologies, such as cloud computing and e-commerce platforms, provided opportunities for SMEs to improve efficiency, reach new customers, and compete with larger businesses.

- Global Markets:The UK’s position as a global hub for trade and investment provided opportunities for SMEs to expand into international markets.

Successful UK SMEs

Many UK SMEs were thriving before the recent slowdown. Some notable examples include:

- Monzo:This digital bank, founded in 2015, disrupted the UK banking industry with its innovative mobile-first approach and gained a large customer base.

- Deliveroo:This food delivery platform, launched in 2013, revolutionized how people order food and became a major player in the UK’s on-demand economy.

- Gousto:This recipe box company, founded in 2012, grew rapidly by offering convenient and affordable meal solutions to busy consumers.

- Oakley:This renewable energy company, established in 2009, successfully developed and implemented innovative solar energy solutions for residential and commercial customers.

The Burst

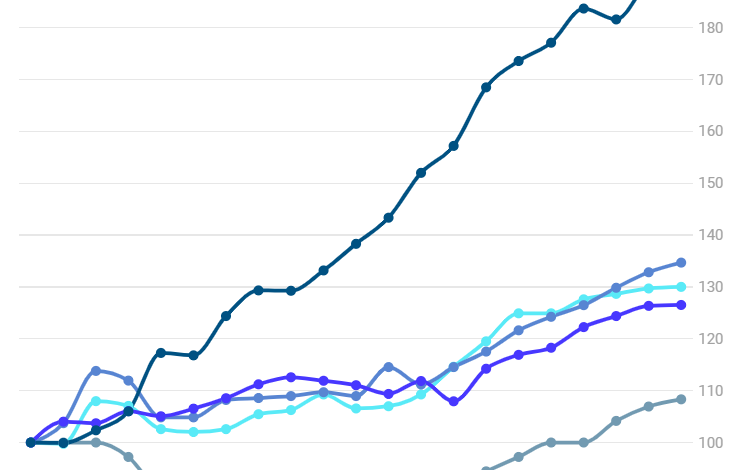

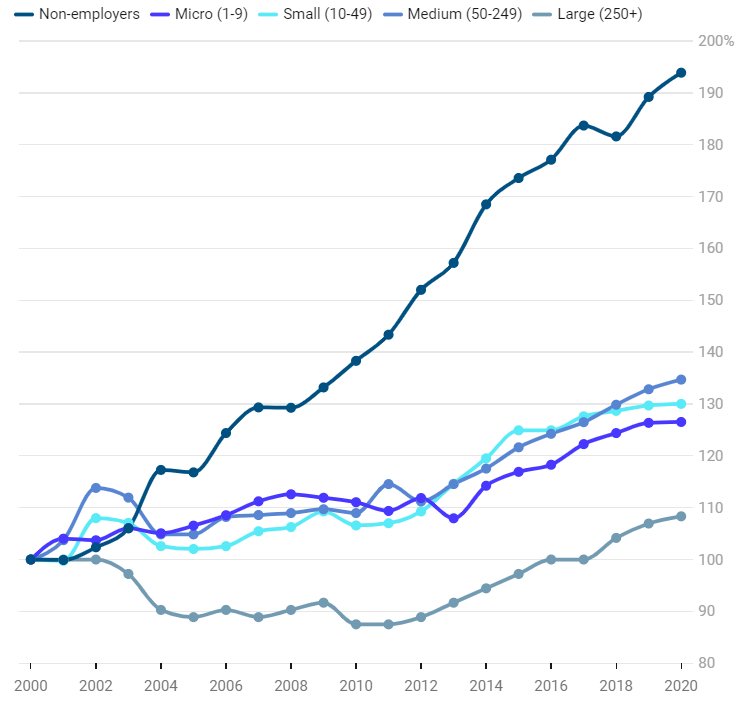

The rapid sales growth experienced by UK SMEs in the aftermath of the pandemic was a welcome sign of economic recovery. However, this surge was short-lived, and many businesses are now facing a stark reality: the balloon has burst. Sales growth has slowed significantly, and some companies are even experiencing declines.

This sudden shift has left many SMEs feeling squeezed, questioning the sustainability of their growth trajectory and grappling with the challenges of a changing economic landscape.

Global Economic Factors

The burst in SME sales growth can be attributed to a confluence of factors, with global economic conditions playing a significant role. Rising inflation has eroded consumer purchasing power, leading to a decline in demand for non-essential goods and services.

It’s a tough pill to swallow for UK SMEs after months of double-digit sales growth, only to find themselves feeling squeezed by rising costs and economic uncertainty. But remember, successful entrepreneurs are known for their resilience and adaptability, traits often honed through tough times.

Check out these 11 mindset traits of successful entrepreneurs to see how you can weather the storm and come out stronger on the other side. These traits can help you find innovative solutions, re-evaluate your strategies, and navigate these challenging times, reminding you that even when the balloon bursts, you can still find a way to soar.

The surge in prices for raw materials and energy has also increased input costs for businesses, squeezing profit margins. Supply chain disruptions caused by the pandemic, the war in Ukraine, and other geopolitical events have further compounded these challenges, leading to production delays and increased costs.

It’s a tough time for UK SMEs, especially after months of double-digit sales growth. Rising costs are squeezing margins, and the recent spike in fuel prices is only adding to the pressure. It’s like the dream of the open road, a symbol of freedom and opportunity, is colliding with the harsh reality of 5 a gallon gas.

This is forcing many businesses to re-evaluate their operating costs and find ways to stay afloat in this turbulent economic climate.

- Inflation:The UK inflation rate reached a 40-year high in 2022, eroding consumer spending power. This has particularly impacted SMEs in sectors like retail and hospitality, which rely heavily on discretionary spending.

- Supply Chain Disruptions:The pandemic and geopolitical events have led to widespread supply chain disruptions, making it more difficult and expensive for businesses to source raw materials and components. This has resulted in production delays and higher input costs, affecting both SMEs and their customers.

Feeling the Squeeze

The UK’s SME landscape is facing a period of intense pressure, as the rapid growth seen in recent years has abruptly slowed. The “burst” has left many businesses struggling to adapt to the new economic reality, with rising costs, declining consumer confidence, and a tightening of credit markets creating a perfect storm for SMEs.

Impact on UK SMEs

The impact of the slowdown on UK SMEs is multifaceted, affecting various aspects of their operations and growth prospects.

The UK’s SME boom might be bursting, with many feeling squeezed after months of double-digit sales growth. The global economic landscape is shifting, with factors like rising inflation and the war in Ukraine playing a part. It’s interesting to see how this relates to the recent weakening of the Japanese yen, which is at its weakest in 20 years, as explained in this analysis of the situation.

The yen’s decline could have knock-on effects for UK businesses, especially those with international operations. This just adds to the growing list of challenges facing UK SMEs, who are navigating a volatile economic climate.

- Rising Costs:Inflation has driven up the cost of raw materials, energy, and labor, squeezing profit margins for businesses. This has forced many SMEs to raise prices, potentially impacting demand and customer loyalty.

- Declining Consumer Confidence:The economic uncertainty has led to a decline in consumer spending, with households tightening their belts in response to rising living costs. This has impacted sales for many SMEs, particularly those in discretionary sectors like retail and hospitality.

- Tightening Credit Markets:Banks and other financial institutions have become more cautious in lending to SMEs, as the economic outlook has become more uncertain. This makes it harder for businesses to access the capital they need to invest, expand, or even stay afloat.

- Supply Chain Disruptions:The global supply chain disruptions caused by the pandemic and geopolitical tensions have continued to impact SMEs, leading to delays, shortages, and higher costs.

Impact on Different Sectors

The slowdown has impacted different sectors and industries in varying degrees. For example, the hospitality and retail sectors have been particularly hard hit by declining consumer spending and reduced foot traffic. The construction industry has also faced challenges due to rising material costs and labor shortages.

Examples of UK SMEs Struggling to Adapt

Several examples illustrate the challenges faced by UK SMEs in adapting to the new economic reality.

- A small independent bakery in Londonhas been forced to raise prices due to soaring ingredient costs, leading to a decline in customer demand.

- A technology startup in Manchesterhas struggled to secure funding from investors who are becoming more risk-averse in the current economic climate.

- A family-run clothing retailer in Birminghamhas been forced to reduce staff hours due to a decline in sales, impacting its ability to offer the same level of customer service.

Strategies for Survival

The current economic climate presents significant challenges for UK SMEs. While many have enjoyed impressive sales growth in recent years, the landscape is shifting, and businesses need to adapt to survive. This section will explore strategies that UK SMEs can implement to navigate the current economic climate, focusing on cost optimization and efficiency improvements.

We will also examine successful adaptation strategies employed by other UK SMEs.

Cost Optimization and Efficiency Improvements

Cost optimization and efficiency improvements are crucial for UK SMEs to navigate the current economic climate. By identifying areas where expenses can be reduced and processes streamlined, businesses can maintain profitability and competitiveness.

- Streamlining Operations:Implementing lean management principles can help SMEs identify and eliminate waste in their operations. This could involve optimizing production processes, reducing inventory levels, and improving supply chain efficiency. For example, a manufacturing SME might implement a just-in-time inventory system to reduce storage costs and improve production flow.

- Technology Adoption:Embracing technology can significantly improve efficiency and reduce costs. This could include investing in automation solutions, cloud-based software, and data analytics tools. A retail SME might adopt an online ordering and delivery system to reduce staffing costs and improve customer service.

- Negotiating with Suppliers:SMEs should actively negotiate with suppliers to secure better pricing and payment terms. This could involve exploring alternative suppliers, consolidating purchases, or negotiating volume discounts. A food and beverage SME might negotiate with its packaging supplier to secure lower prices based on increased order volume.

- Energy Efficiency:Reducing energy consumption can significantly impact operating costs. This could involve implementing energy-saving measures such as upgrading lighting systems, installing insulation, and optimizing HVAC systems. A manufacturing SME might invest in energy-efficient machinery to reduce electricity consumption and lower operating costs.

Successful Adaptation Strategies, Bursting the balloon u k smes feeling squeezed after months of double digit sales growth

Several UK SMEs have successfully adapted to changing economic conditions by implementing innovative strategies. These examples provide valuable insights for other businesses navigating similar challenges.

- Diversifying Product and Service Offerings:SMEs can mitigate risks and expand their customer base by diversifying their product and service offerings. For example, a bakery might expand into catering services or offer online ordering and delivery options. This allows them to tap into new market segments and reduce reliance on a single product or service.

- Expanding into New Markets:Exploring new markets, both domestic and international, can provide growth opportunities for SMEs. This could involve developing new export strategies, targeting specific geographic regions, or catering to niche markets. A software development SME might target international clients to expand its customer base and diversify revenue streams.

- Embracing Digital Marketing:Utilizing digital marketing channels can be highly effective for SMEs to reach new customers and promote their products and services. This could involve optimizing websites for search engines, leveraging social media platforms, and utilizing targeted online advertising campaigns. A clothing retailer might utilize social media influencers to promote its products and reach a wider audience.

Final Thoughts: Bursting The Balloon U K Smes Feeling Squeezed After Months Of Double Digit Sales Growth

The future of UK SMEs is uncertain, but one thing is clear: adaptation is key to survival. Businesses that can identify new opportunities, optimize costs, and embrace innovative solutions will be better positioned to navigate the challenges ahead.

The path forward requires resilience, creativity, and a willingness to embrace change. While the current economic climate may be tough, it also presents opportunities for those who are prepared to adapt and evolve.