Bitcoin & Crude Oil: Investing in the Unconventional

Bitcoin and crude oil how are these commodities for investment – Bitcoin & Crude Oil: How are these commodities for investment sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. In a world of constant financial evolution, understanding the dynamics of unconventional assets like Bitcoin and crude oil is more crucial than ever.

This exploration delves into the complexities of these seemingly disparate commodities, examining their unique characteristics, market forces, and potential as investment vehicles.

Bitcoin, the revolutionary digital currency, has captured the imagination of investors and tech enthusiasts alike. Meanwhile, crude oil, the lifeblood of global energy markets, remains a cornerstone of the global economy. While their origins and applications differ significantly, these two commodities share a common thread: volatility.

This inherent unpredictability presents both risks and opportunities for those seeking to navigate the turbulent waters of investment.

Bitcoin and Crude Oil: Bitcoin And Crude Oil How Are These Commodities For Investment

Bitcoin and crude oil are two very different assets, but they both have the potential to be valuable investments. Bitcoin is a digital currency that is decentralized and secure, while crude oil is a commodity that is essential for transportation and energy production.

Both assets have experienced significant price volatility in recent years, making them attractive to investors seeking high returns. However, it is important to understand the factors that could influence the future price of these assets before making any investment decisions.

Future Outlook for Bitcoin, Bitcoin and crude oil how are these commodities for investment

Bitcoin’s price has been volatile in recent years, but it has also shown a strong upward trend. This is due to a number of factors, including increasing adoption of Bitcoin as a payment method, growing institutional investment, and the limited supply of Bitcoin.

Several factors could influence the future price of Bitcoin:* Regulation:Governments around the world are still working to regulate Bitcoin and other cryptocurrencies. Clearer regulations could increase investor confidence and drive up prices. Conversely, stricter regulations could stifle innovation and lead to lower prices.

Adoption

The more people and businesses that use Bitcoin, the higher its demand and price will be. Increased adoption could come from factors like the development of new Bitcoin applications, increased merchant acceptance, and greater awareness of Bitcoin’s benefits.

Competition

Bitcoin faces competition from other cryptocurrencies, as well as from traditional financial assets. If other cryptocurrencies become more popular or traditional assets offer higher returns, it could put downward pressure on Bitcoin prices.

Technology

Bitcoin’s price could be influenced by advancements in blockchain technology, which could make Bitcoin more efficient or secure. On the other hand, security breaches or technical issues could also lead to price declines.

Future Outlook for Crude Oil

Crude oil prices have been volatile in recent years, influenced by factors such as global economic growth, geopolitical events, and technological advancements. Several factors could influence the future price of crude oil:* Global Economic Growth:As global economic growth slows, demand for crude oil is likely to decrease, leading to lower prices.

Conversely, strong economic growth could lead to higher demand and prices.

Geopolitical Events

Geopolitical events, such as wars or political instability in oil-producing regions, can disrupt supply chains and lead to price spikes.

Technological Advancements

Technological advancements, such as the development of alternative energy sources, could reduce demand for crude oil and lead to lower prices.

OPEC Policy

The Organization of the Petroleum Exporting Countries (OPEC) plays a significant role in influencing crude oil prices. OPEC’s production quotas and other policies can affect the supply of oil and, consequently, its price.

Environmental Concerns

Growing concerns about climate change and environmental pollution could lead to a decline in demand for fossil fuels, including crude oil.

Outcome Summary

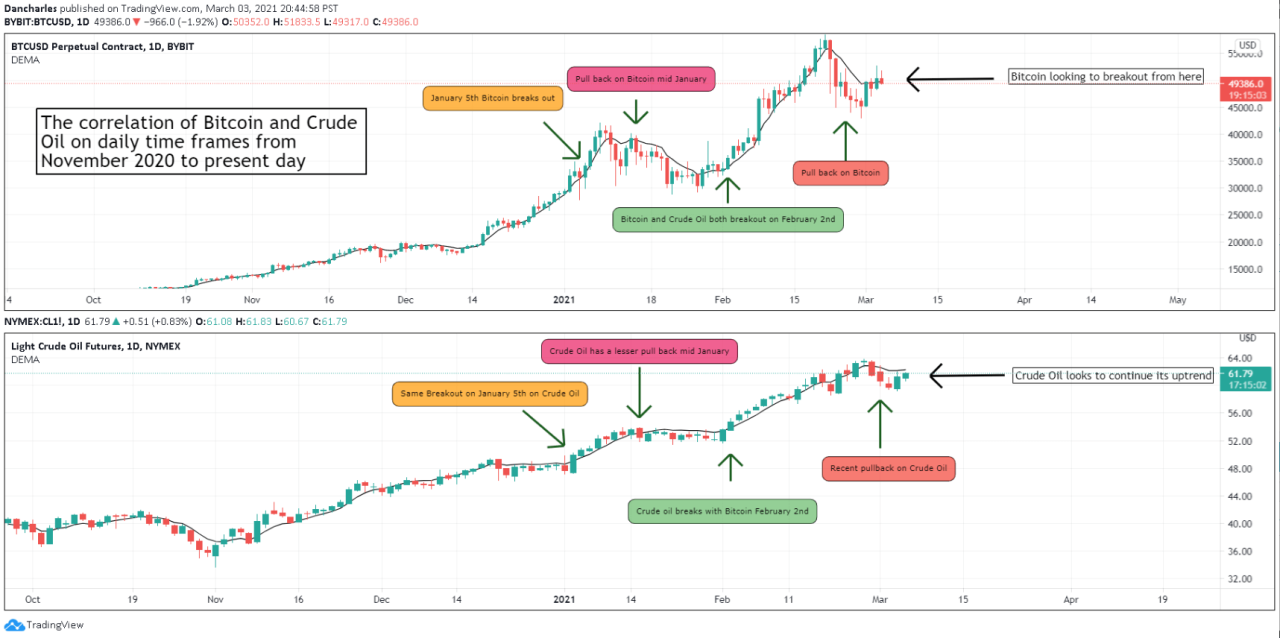

As we’ve explored, Bitcoin and crude oil offer a fascinating glimpse into the future of investment. Their inherent volatility, driven by diverse factors like technological innovation, geopolitical events, and global demand, creates a landscape of both risk and reward. While the future remains uncertain, understanding the nuances of these commodities, their potential correlations, and the opportunities for diversification can empower investors to make informed decisions in this dynamic market.

Ultimately, the key lies in carefully considering your risk tolerance, conducting thorough research, and staying informed about the evolving landscape of these unconventional assets.

Bitcoin and crude oil are both volatile commodities that can offer significant returns, but also carry considerable risk. While the market can be unforgiving, it’s important to remember that even when you feel you’ve been wronged, staying true to your investment strategy is crucial.

This article provides valuable insights on how to navigate such situations. Ultimately, whether you’re investing in bitcoin, crude oil, or any other asset, staying grounded and informed is key to long-term success.

Bitcoin and crude oil are both volatile commodities, attracting investors seeking high returns. While their price fluctuations can be daunting, it’s important to remember that true investment success comes from a long-term perspective and a willingness to adapt to changing market conditions.

As the article forget the great resignation bring on the great reimagination argues, we’re in a time of rapid change, requiring innovative thinking and a willingness to embrace new possibilities. This same approach applies to investing in volatile commodities like bitcoin and crude oil, where staying informed and flexible can lead to greater success.

Bitcoin and crude oil are both volatile commodities, making them exciting but risky investments. While researching these markets, I stumbled across a heartbreaking story about a Columbia graduate student brutally beaten in Manhattan, and his mother’s desperate search for answers.

The article highlights the harsh realities of urban life, reminding us that even amidst the world of finance and commodities, human tragedy can strike unexpectedly. Back to the markets, both bitcoin and crude oil offer potential for high returns, but require careful analysis and risk management.