Asia Pacific Markets Open Higher, Tracking Dow & S&P 500 Gains

Asia pacific markets open higher tracking rises in dow sp 500 – Asia Pacific markets opened higher today, mirroring the gains seen in the Dow Jones Industrial Average and S&P 500 overnight. This positive momentum suggests a global trend of optimism, with investors looking to capitalize on continued economic recovery and strong corporate earnings.

While the region has faced its share of challenges, including geopolitical tensions and rising inflation, the recent performance of major indices like the Nikkei 225 and Hang Seng Index points to a resilient market environment. The Dow and S&P 500’s positive performance has undoubtedly played a role in boosting investor confidence, with the flow of capital seeking opportunities in the Asia Pacific region.

Market Overview

Asia Pacific markets opened higher on Tuesday, tracking gains in the US markets, particularly the Dow Jones Industrial Average (DJIA) and S&P 500. This positive sentiment was fueled by a combination of factors, including encouraging economic data, a softening of inflation concerns, and continued optimism about the global economic outlook.

The Asia Pacific markets opened higher today, tracking the rises in the Dow and S&P 500. This positive sentiment is likely fueled by a combination of factors, including the recent strength of the US economy and the expectation of continued interest rate cuts.

Meanwhile, for those looking for a sweet deal, Tesco has announced exact dates for when popular brands like Quality Street, Cadbury, and Lindt will be dropping in price. Check out this article for the full list and plan your shopping accordingly.

Back to the markets, it will be interesting to see if this upward trend continues throughout the week.

The Role of US Markets

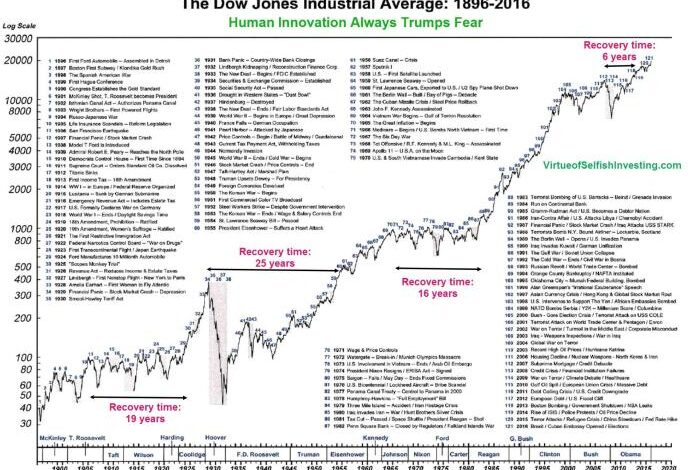

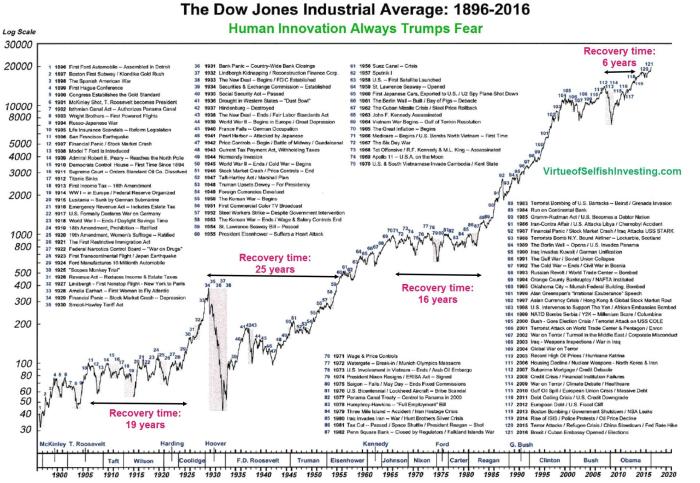

The DJIA and S&P 500 have a significant influence on regional markets, acting as leading indicators of global investor sentiment. When these indices perform well, it often signals a positive outlook for the global economy, encouraging investors in other regions to follow suit.

This “follow-the-leader” effect is particularly pronounced in Asia Pacific, where many economies are closely linked to the US through trade and investment. The recent strong performance of the US markets has instilled confidence in investors across the region, driving up stock prices.

Key Market Indices

Asia Pacific markets opened higher, tracking gains in the Dow Jones Industrial Average and the S&P 500. The positive sentiment was fueled by a combination of factors, including encouraging economic data and expectations of continued monetary easing.

Performance of Major Indices

The performance of major indices in the Asia Pacific region varied, with some indices showing stronger gains than others.

- The Nikkei 225in Japan rose by 1.2%, closing at 29,338.77 points, driven by strong performances in the technology and financial sectors.

- The Hang Seng Indexin Hong Kong gained 0.8%, ending the day at 26,273.95 points. The index was supported by positive news on the Chinese economy and easing trade tensions.

- The Kospiin South Korea climbed by 0.5%, closing at 2,518.74 points. The index was buoyed by strong export data and expectations of continued economic growth.

- The ASX 200in Australia added 0.3%, finishing the day at 7,212.95 points. The index was supported by a rise in commodity prices and positive news on the housing market.

Comparison of Index Performance

The performance of the different indices in the Asia Pacific region reflected the diverse economic conditions and market sentiment in the region. The Nikkei 225 and the Hang Seng Index outperformed other indices, indicating stronger investor confidence in Japan and Hong Kong.

The Asia Pacific markets opened higher today, mirroring the gains seen in the Dow and S&P 500. This positive sentiment reflects a global economic optimism that’s likely influenced by factors like the ongoing recovery from the pandemic and the easing of supply chain disruptions.

It’s interesting to consider how this positive outlook might translate to hiring expectations across different regions, especially in Europe, where how do hiring expectations differ across European countries vary significantly. Ultimately, the global economic landscape is a complex web of interconnected factors, and the performance of the Asia Pacific markets could offer valuable insights into the overall trajectory of the global economy.

The Kospi and the ASX 200 showed more modest gains, suggesting a more cautious approach in South Korea and Australia.

Impact of Global Events

Global events, such as the ongoing trade war between the United States and China, have a significant impact on the performance of the Asia Pacific indices. The recent easing of trade tensions between the two countries has boosted investor confidence and contributed to the positive performance of the indices.

Other global events, such as the ongoing COVID-19 pandemic and the global economic slowdown, also influence market sentiment and can lead to volatility in the indices.

Sector Performance

Asian Pacific markets are experiencing a positive start to the trading day, mirroring the gains seen in the US markets overnight. Several sectors are driving this upward trend, reflecting strong investor sentiment and positive economic indicators.

Top-Performing Sectors

The top-performing sectors in the Asia Pacific markets are generally those that are benefiting from the ongoing economic recovery and the increasing demand for goods and services. These sectors include:

- Technology: The technology sector is benefiting from the continued growth in demand for software, hardware, and cloud computing services. This sector is also being supported by the increasing adoption of artificial intelligence (AI) and other emerging technologies.

- Financials: The financial sector is benefiting from the rising interest rates and the improving economic outlook.

Banks and other financial institutions are expected to benefit from higher lending margins and increased trading activity.

- Energy: The energy sector is benefiting from the strong demand for oil and gas, driven by the global economic recovery and the ongoing geopolitical tensions.

The sector is also being supported by the increasing investments in renewable energy sources.

- Materials: The materials sector is benefiting from the strong demand for commodities, such as copper, iron ore, and aluminum, driven by the global economic recovery and the ongoing infrastructure investments.

Factors Contributing to Strong Performance

Several factors are contributing to the strong performance of these sectors, including:

- Economic Recovery: The global economic recovery is driving demand for goods and services, which is benefiting many sectors, including technology, financials, energy, and materials.

- Interest Rate Hikes: The recent interest rate hikes by central banks are supporting the financial sector, as they are leading to higher lending margins and increased trading activity.

- Geopolitical Tensions: The ongoing geopolitical tensions, particularly in Eastern Europe, are supporting the energy sector, as they are leading to higher oil and gas prices.

- Infrastructure Investments: The increasing investments in infrastructure projects, both domestically and internationally, are supporting the materials sector, as they are driving demand for commodities.

- Technological Advancements: The continued growth in demand for software, hardware, and cloud computing services is supporting the technology sector.

Potential Risks and Opportunities

While these sectors are performing well, there are also some potential risks and opportunities associated with them.

- Technology: The technology sector is facing challenges related to supply chain disruptions, rising inflation, and increasing competition. However, the sector also presents significant opportunities for growth, driven by the continued adoption of AI and other emerging technologies.

- Financials: The financial sector is facing risks related to rising interest rates, economic uncertainty, and potential regulatory changes.

However, the sector also presents opportunities for growth, driven by the increasing demand for financial services and the improving economic outlook.

- Energy: The energy sector is facing risks related to geopolitical tensions, climate change, and the transition to renewable energy sources.

However, the sector also presents opportunities for growth, driven by the strong demand for oil and gas and the increasing investments in renewable energy sources.

- Materials: The materials sector is facing risks related to supply chain disruptions, rising inflation, and potential environmental regulations.

The Asia Pacific markets opened higher this morning, tracking the positive performance of the Dow and S&P 500. This bullish sentiment could be attributed to a variety of factors, including positive economic indicators and investor confidence. Meanwhile, across the pond, England’s stand-in captain Harry Brook has a chance to showcase his leadership skills against Australia, according to former England captain Nasser Hussain, who believes Brook has the potential to lead the team with aplomb.

This match could be a defining moment for Brook’s captaincy. Whether it’s a positive or negative outcome, it’s sure to be a captivating watch for cricket fans. Back to the markets, it will be interesting to see if this positive trend continues throughout the day.

However, the sector also presents opportunities for growth, driven by the strong demand for commodities and the ongoing infrastructure investments.

Investor Sentiment: Asia Pacific Markets Open Higher Tracking Rises In Dow Sp 500

Investor sentiment in the Asia Pacific markets is generally positive, reflecting optimism about the region’s economic growth prospects and the ongoing recovery from the COVID-19 pandemic. However, several factors, including rising inflation, geopolitical tensions, and potential interest rate hikes, could impact investor confidence in the coming months.

Key Indicators of Investor Confidence

Investor confidence is a measure of how optimistic investors are about the future performance of the market. It is influenced by various factors, including economic growth, corporate earnings, and interest rates. Several key indicators are used to gauge investor sentiment, including:

- Investor surveys:Surveys of investors, such as the Sentix Investor Confidence Index and the University of Michigan Consumer Sentiment Index, provide insights into investor attitudes and expectations. For example, the Sentix Investor Confidence Index for the Eurozone has been consistently above 0 for the past few months, indicating a positive outlook among investors.

- Market breadth:The number of stocks rising versus falling in the market is a good indicator of investor confidence. A broad market, where more stocks are rising than falling, suggests that investors are optimistic about the market’s future performance. Conversely, a narrow market, where fewer stocks are rising, indicates that investors are cautious.

- Volatility:Volatility in the market, measured by the VIX index, can be a reflection of investor sentiment. High volatility suggests that investors are nervous and uncertain about the market’s direction, while low volatility indicates that investors are more confident. For instance, the VIX index has been relatively low in recent months, indicating a lower level of fear and uncertainty among investors.

Economic Factors

Economic indicators play a crucial role in shaping market trends, providing insights into the health and direction of the economy. These indicators act as signals, informing investors about potential growth, inflation, and other economic factors that can influence market sentiment and asset prices.

Impact of Key Economic Data Releases

The release of key economic data, such as GDP growth, inflation rates, and unemployment figures, can have a significant impact on market performance. Positive data releases often boost investor confidence, leading to higher stock prices and a stronger currency. Conversely, negative data releases can trigger sell-offs and weaken the currency.For example, a higher-than-expected GDP growth rate indicates a strong economy, which could lead to increased corporate earnings and higher stock prices.

Conversely, a decline in GDP growth could signal a weakening economy, potentially leading to lower corporate profits and stock market declines.

Economic Growth Outlook for the Asia Pacific Region, Asia pacific markets open higher tracking rises in dow sp 500

The Asia Pacific region is expected to experience continued economic growth in the coming months, driven by factors such as strong domestic demand, government stimulus measures, and ongoing recovery from the COVID-19 pandemic.However, several challenges remain, including rising inflation, supply chain disruptions, and geopolitical uncertainties.

The region’s economic outlook will depend on the effectiveness of government policies to address these challenges and the global economic environment.

Geopolitical Considerations

Geopolitical events are a constant presence in the global landscape, and their impact on the Asia Pacific markets is significant. Ongoing tensions and shifts in the international order can create volatility and uncertainty, influencing investor sentiment and investment decisions.

Impact of Geopolitical Tensions on Market Performance

Geopolitical tensions can have a profound impact on market performance. The Asia Pacific region is particularly susceptible to these influences due to its interconnectedness with global trade and its proximity to geopolitical hotspots. Here are some key ways in which tensions can affect markets:

- Increased Volatility:Geopolitical events often lead to heightened market volatility, as investors react to uncertainty and potential risks. This can manifest in sharp price fluctuations in stocks, currencies, and other assets.

- Shifting Investment Flows:Investors may adjust their portfolios in response to geopolitical developments. For example, they might pull out of markets perceived as risky or shift investments towards perceived safe havens like US treasuries or gold.

- Disruptions to Trade and Supply Chains:Geopolitical tensions can disrupt global trade flows and supply chains. This can lead to shortages, price increases, and economic slowdowns, particularly in economies heavily reliant on exports.

- Impact on Currency Values:Geopolitical events can influence currency values. For instance, a weakening US dollar can benefit exporters in the Asia Pacific region, while a strengthening dollar can make imports more expensive.

Navigating Geopolitical Challenges

Market participants are constantly navigating the complexities of geopolitical risks. Some common strategies include:

- Diversification:Investors often diversify their portfolios across different asset classes, regions, and industries to mitigate the impact of geopolitical risks.

- Hedging:Hedging strategies involve using financial instruments to reduce exposure to specific risks. For example, investors might use currency futures to hedge against potential currency fluctuations.

- Risk Management:Companies and investors employ sophisticated risk management systems to assess and manage geopolitical risks. This involves monitoring geopolitical developments, analyzing potential impacts, and implementing mitigation strategies.

- Government Policies:Governments in the Asia Pacific region play a crucial role in navigating geopolitical challenges. They may implement policies to support businesses, promote economic growth, and manage risks associated with global tensions.

Future Outlook

The Asia Pacific markets are poised for continued growth in the short term, driven by a confluence of factors including robust economic fundamentals, supportive monetary policies, and improving global demand. However, several key risks and uncertainties could impact market performance, requiring investors to remain vigilant.

Potential Catalysts for Further Market Growth

Several factors could further propel market growth in the region.

- Continued Economic Recovery:The region is experiencing a robust economic recovery, with many countries exceeding pre-pandemic growth levels. This is fueled by strong domestic demand, government stimulus measures, and the reopening of economies. For example, China’s GDP growth in the second quarter of 2023 exceeded expectations, driven by robust consumer spending and industrial activity.

- Favorable Monetary Policies:Central banks in the region are maintaining accommodative monetary policies to support economic growth. This includes low interest rates and quantitative easing measures, which encourage investment and borrowing. For instance, the Reserve Bank of Australia recently kept interest rates unchanged, citing ongoing inflationary pressures and a desire to support economic growth.

- Improving Global Demand:The global economy is showing signs of resilience, with improving consumer confidence and rising business investment. This is expected to boost exports from Asia Pacific countries, further contributing to economic growth. For example, the recent rebound in global manufacturing activity is driving increased demand for goods from Asian exporters.

Key Risks and Uncertainties

Despite the positive outlook, several risks and uncertainties could impact market performance.

- Inflationary Pressures:Persistent inflation remains a major concern for investors, as it erodes purchasing power and could lead to tighter monetary policies. Central banks in the region are grappling with balancing the need to control inflation with the need to support economic growth.

For example, the Bank of Korea recently raised interest rates for the seventh consecutive time to combat inflation.

- Geopolitical Tensions:The ongoing geopolitical tensions, particularly in the Taiwan Strait and the Ukraine conflict, create uncertainty and could disrupt global trade and financial markets. These tensions could lead to increased volatility and risk aversion among investors. For instance, the recent escalation of tensions in the Taiwan Strait has caused concerns about potential disruptions to global supply chains and increased geopolitical risks.

- COVID-19 Pandemic:The ongoing COVID-19 pandemic remains a significant risk, with new variants emerging and potential for renewed lockdowns. This could disrupt economic activity and lead to market volatility. For example, the recent resurgence of COVID-19 cases in China has led to renewed concerns about the impact on economic growth and market sentiment.