Bidens Student Debt Forgiveness Plan Blocked by Federal Judge

Bidens student debt forgiveness plan to remain blocked federal judge orders – Biden’s student debt forgiveness plan to remain blocked federal judge orders: A recent ruling has thrown a wrench into the Biden administration’s ambitious plan to provide widespread student loan forgiveness. The plan, which aimed to cancel up to $20,000 in student loan debt for millions of Americans, has been met with legal challenges, and a federal judge has now put a temporary hold on its implementation.

This decision has sparked a wave of reactions, with some celebrating the victory for taxpayers and others expressing disappointment and frustration for those hoping for debt relief.

The judge’s decision is based on legal arguments surrounding the legality of the plan under the HEROES Act, a law that allows the Secretary of Education to modify student loan programs during a national emergency. The plaintiffs in the lawsuit argue that the Biden administration exceeded its authority under the HEROES Act by using it to implement such a sweeping debt forgiveness program.

The judge’s ruling, while only temporary, highlights the complex legal landscape surrounding student debt relief and the challenges facing the Biden administration in fulfilling its campaign promise.

Biden’s Student Loan Forgiveness Plan: Bidens Student Debt Forgiveness Plan To Remain Blocked Federal Judge Orders

President Biden’s student loan forgiveness plan, announced in August 2022, aimed to provide relief to borrowers struggling with student loan debt. This plan, which has been met with both support and opposition, is a significant policy initiative with the potential to impact millions of Americans.

Overview of the Plan

The plan proposed to forgive up to $20,000 in student loan debt for borrowers who meet specific income requirements. The plan included two main components:

- Forgiveness of up to $10,000 in federal student loan debt for individuals earning less than $125,000 per year or households earning less than $250,000 per year.

- An additional $10,000 in forgiveness for Pell Grant recipients who meet the income criteria.

Rationale for the Plan

The Biden administration cited several reasons for proposing the student loan forgiveness plan. These reasons included:

- Addressing Student Debt Burden:The plan aimed to alleviate the financial burden of student loan debt, which has become a significant challenge for many Americans, particularly younger generations. The average student loan debt in the United States is over $37,000.

- Boosting the Economy:The administration argued that reducing student loan debt could stimulate the economy by freeing up borrowers’ disposable income, allowing them to spend more on goods and services.

- Promoting Social Equity:The plan targeted Pell Grant recipients, who are disproportionately from low-income backgrounds, to address disparities in access to higher education and economic opportunity.

Estimated Cost and Impact on the Federal Budget, Bidens student debt forgiveness plan to remain blocked federal judge orders

The estimated cost of the student loan forgiveness plan is significant. The Congressional Budget Office (CBO) projected that the plan would cost approximately $400 billion over ten years. This cost would be borne by the federal government, potentially impacting the federal budget deficit.

It’s frustrating to see Biden’s student debt forgiveness plan remain blocked by a federal judge, especially when we’re bombarded with news about other issues, like the suspicious behaviour on the tube London underground. It feels like the government is more focused on addressing the sensational, rather than the systemic problems that affect millions of Americans.

Hopefully, the legal challenges against the student debt forgiveness plan will be resolved soon, so we can see some relief for those struggling with debt.

Potential Economic and Social Benefits

The plan’s proponents argued that the economic and social benefits of student loan forgiveness would outweigh the costs. They highlighted potential benefits such as:

- Increased Consumer Spending:By freeing up borrowers’ income, the plan could lead to increased consumer spending, boosting economic growth.

- Improved Credit Scores:Loan forgiveness could improve borrowers’ credit scores, making it easier for them to access loans and other financial products.

- Reduced Financial Stress:Eliminating student loan debt could reduce financial stress for borrowers, allowing them to focus on other financial goals, such as saving for retirement or buying a home.

The Legal Challenge

The Biden administration’s student loan forgiveness plan has faced significant legal challenges, with several lawsuits filed by Republican-led states and other parties. The plaintiffs argue that the plan is illegal and exceeds the authority of the executive branch. These lawsuits have halted the implementation of the plan, leaving millions of borrowers in limbo.

Arguments Against the Plan

The plaintiffs have raised several legal arguments against the plan, focusing on its legality under the HEROES Act and the Administrative Procedure Act. They argue that the plan violates the separation of powers principle and that the president lacks the authority to cancel such a significant amount of student loan debt.

The HEROES Act

The plaintiffs contend that the HEROES Act, which grants the Secretary of Education authority to modify student loan programs during a national emergency, does not authorize the president to cancel student loan debt. They argue that the HEROES Act is limited to modifying existing programs, not creating new ones, and that the plan’s broad cancellation program constitutes a new program.

- The HEROES Act, passed in 2003, was intended to provide flexibility in student loan programs during national emergencies, such as the COVID-19 pandemic.

- The plaintiffs argue that the HEROES Act only allows for modifications to existing programs, not the creation of new programs, and that the Biden administration’s plan goes beyond modifying existing programs.

- They cite the language of the HEROES Act, which states that the Secretary of Education can “modify” existing programs, but not create new ones.

The Administrative Procedure Act

The plaintiffs also argue that the plan violates the Administrative Procedure Act (APA), which requires federal agencies to follow certain procedures when making rules and regulations. They claim that the administration failed to follow the APA’s notice-and-comment rulemaking process, which requires agencies to provide public notice and an opportunity for comment before finalizing a rule.

- The APA requires federal agencies to follow specific procedures when making rules and regulations.

- The plaintiffs argue that the Biden administration did not follow the APA’s notice-and-comment rulemaking process, which requires agencies to provide public notice and an opportunity for comment before finalizing a rule.

- They claim that the administration’s failure to follow this process makes the plan illegal.

Legal Precedents

The legal challenges to the plan raise questions about the scope of the president’s authority under the HEROES Act and the APA. The plaintiffs cite several legal precedents to support their arguments, while the administration relies on other precedents to defend the plan’s legality.

- The plaintiffs point to cases such as INS v. Chadha, which established that Congress cannot delegate its legislative power to the executive branch.

- The administration, however, argues that the HEROES Act gives the Secretary of Education the authority to make modifications to student loan programs during a national emergency, and that this authority includes the power to cancel debt.

- The administration also cites cases such as Chevron U.S.A., Inc. v. Natural Resources Defense Council, Inc., which gives deference to agency interpretations of ambiguous statutes.

The Federal Judge’s Ruling

The federal judge’s ruling against President Biden’s student loan forgiveness plan has cast a significant shadow over the future of the program. The judge, appointed by former President Donald Trump, sided with six Republican-led states that challenged the plan’s legality, arguing that the Biden administration exceeded its authority in implementing it.

Key Findings of the Ruling

The judge’s ruling hinges on the legal argument that the HEROES Act, a law passed after the 9/11 attacks, does not grant the Education Secretary the power to cancel billions of dollars in student loan debt. The judge determined that the HEROES Act was intended to address emergencies related to military service, not economic hardship.

It’s hard to believe that while a federal judge is blocking Biden’s student debt forgiveness plan, another kind of injustice is unfolding. A trans woman was tragically killed in Georgia just a day after an anti-LGBTQ law was passed. This heartbreaking news highlights the urgent need for action, not just on student debt, but on protecting the rights of all Americans.

It’s a stark reminder that we have a long way to go before everyone is truly equal.

This interpretation significantly limits the scope of the Education Secretary’s authority to modify student loan programs.

It’s a bummer that Biden’s student debt forgiveness plan is on hold, but hey, at least we’ve got some metal news to distract us! Rob Halford from Judas Priest just named the next two metal acts he thinks should be inducted into the Rock & Roll Hall of Fame – check out who they are here.

Hopefully, the judge will rule on the student loan forgiveness plan soon, but in the meantime, let’s crank up the volume and celebrate some heavy metal!

Impact of the Ruling on the Plan’s Future

The ruling has effectively halted the implementation of the student loan forgiveness plan, leaving its future uncertain. While the Biden administration has appealed the decision, the legal battle is likely to continue for months, if not years. The outcome of this legal challenge will determine whether the plan is permanently blocked or allowed to proceed.

Potential Consequences for Student Borrowers

The ruling has left millions of borrowers in a state of limbo, unsure of their repayment obligations. While the Biden administration has extended the pause on student loan payments until at least June 2024, the ruling raises serious questions about the future of the program.

Borrowers who were expecting loan forgiveness may now face the prospect of resuming payments, potentially leading to increased financial strain.

Political and Social Reactions

The federal judge’s ruling blocking Biden’s student loan forgiveness plan has sparked a wave of reactions across the political and social spectrum. While the administration expressed disappointment, student advocacy groups decried the decision, and Republican lawmakers celebrated the outcome.

The ruling’s impact on the political landscape, particularly in the context of the upcoming elections, remains to be seen.

Reactions of Stakeholders

The ruling has triggered a range of reactions from various stakeholders, each with their own perspectives on the implications of the decision.

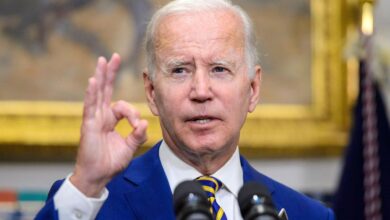

Biden Administration

The Biden administration expressed disappointment with the ruling, emphasizing its commitment to providing student debt relief. The administration has stated its intention to appeal the decision, highlighting the importance of the program for millions of borrowers.

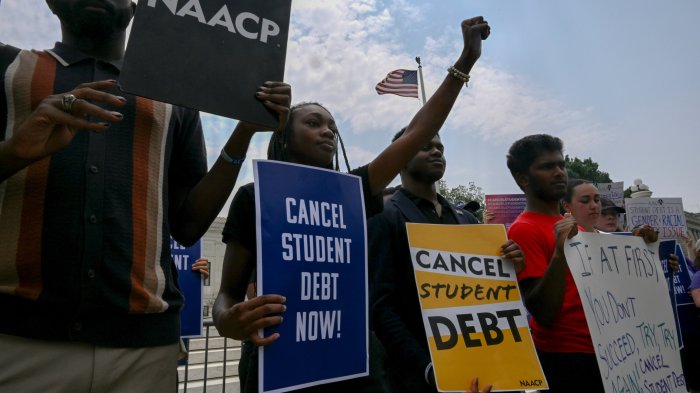

Student Advocacy Groups

Student advocacy groups have condemned the ruling, arguing that it denies much-needed relief to borrowers struggling with student loan debt. They see the ruling as a setback for efforts to make higher education more affordable and accessible.

Republican Lawmakers

Republican lawmakers have welcomed the ruling, arguing that the Biden administration’s student loan forgiveness plan was an overreach of executive power and an unfair burden on taxpayers. They view the ruling as a victory for fiscal responsibility and a rejection of the administration’s policy.

Future Prospects

The federal judge’s ruling blocking Biden’s student loan forgiveness plan has created significant uncertainty and left many borrowers in limbo. However, the Biden administration has several options to move forward and potentially implement some form of debt relief. The administration’s primary options include appealing the ruling, seeking legislative action, or pursuing alternative debt relief measures.

Each path presents its own challenges and opportunities, with implications for student debt policy and the broader economic and social landscape.

Appealing the Ruling

The Biden administration could appeal the federal judge’s ruling to a higher court, potentially the Fifth Circuit Court of Appeals or even the Supreme Court. This path would likely involve a lengthy legal process, potentially delaying any relief for borrowers.

Challenges

- The legal arguments presented by the plaintiffs challenging the plan are complex and involve questions of statutory interpretation and executive authority. The administration would need to convince the higher courts that the plan is legally sound.

- The Fifth Circuit Court of Appeals has a conservative leaning, which could make it challenging for the administration to overturn the lower court’s ruling.

- Even if the administration wins in the appellate courts, the case could eventually reach the Supreme Court, where the outcome is uncertain.

Opportunities

- An appeal could provide an opportunity for the administration to further refine its legal arguments and present a stronger case for the plan’s legality.

- A favorable ruling from a higher court could establish a legal precedent that supports the administration’s authority to implement student debt relief.

Legislative Action

The Biden administration could seek legislative action to pass a law that explicitly authorizes student loan forgiveness. This path would require working with Congress to secure bipartisan support, which could be difficult given the current political climate.

Challenges

- Congress is deeply divided on the issue of student loan forgiveness, with Republicans generally opposed to broad-based debt relief. Securing bipartisan support for legislation would be challenging.

- Even if legislation were to pass, it would likely face legal challenges from those opposed to student loan forgiveness.

- The legislative process can be lengthy and unpredictable, potentially delaying any relief for borrowers.

Opportunities

- Legislative action could provide a more secure legal foundation for student loan forgiveness, potentially reducing the risk of future legal challenges.

- Legislation could address some of the concerns raised by opponents of the plan, such as the cost of forgiveness and the potential impact on the economy.

Alternative Debt Relief Measures

The Biden administration could pursue alternative debt relief measures that are less controversial and may be less likely to face legal challenges. These measures could include:

Challenges

- Alternative measures may not provide as much relief as the original plan, leaving many borrowers with significant debt burdens.

- These measures could be perceived as a compromise or a step back from the administration’s original commitment to broad-based debt relief.

Opportunities

- Alternative measures could provide some relief for borrowers while the administration pursues other options, such as appealing the ruling or seeking legislative action.

- These measures could help to build support for broader student loan forgiveness by demonstrating the administration’s commitment to addressing the issue.

Long-Term Implications

The outcome of the legal battle over Biden’s student loan forgiveness plan will have significant long-term implications for student debt policy and the broader economic and social landscape.

Challenges

- A ruling against the plan could set a precedent that limits the ability of future administrations to implement similar debt relief measures.

- The ruling could discourage borrowers from taking on student loans, potentially leading to a decline in access to higher education.

- The ruling could exacerbate existing economic inequalities, as borrowers with student loan debt are disproportionately from low- and middle-income backgrounds.

Opportunities

- A favorable ruling could pave the way for more aggressive student debt relief measures in the future.

- The ruling could encourage policymakers to consider reforms to the student loan system, such as lowering interest rates or making college more affordable.