Cryptocurrency Mining Still Booms Despite Price Drops

Cryptocurrency mining is still on the rise despite huge price drops. This might seem counterintuitive, but the reality is that the allure of mining remains strong. Despite the recent volatility in the crypto market, miners are driven by a belief in the long-term potential of blockchain technology and the potential for future growth.

The underlying technology, the blockchain, continues to evolve, leading to innovations that are making mining more efficient and accessible. This ongoing development, coupled with the growing adoption of cryptocurrencies globally, keeps the mining industry thriving even during market downturns.

The fluctuations in cryptocurrency prices have, of course, impacted the profitability of mining operations. Miners have had to adapt their strategies, adjusting factors like hardware, energy consumption, and even joining mining pools to maximize their chances of success. While the challenges are real, the resilience of the mining community is evident in their ability to navigate these turbulent waters.

The Enduring Appeal of Cryptocurrency Mining

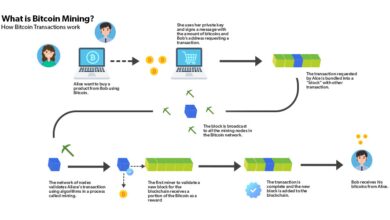

Cryptocurrency mining, a process that involves verifying and adding transactions to a blockchain, has become an integral part of the digital currency landscape. Despite significant price fluctuations in the cryptocurrency market, mining remains a compelling activity for many individuals and organizations.

This article delves into the reasons behind this enduring appeal, exploring the fundamentals of mining, the factors driving its continued growth, and the impact of successful mining operations.

The Fundamentals of Cryptocurrency Mining

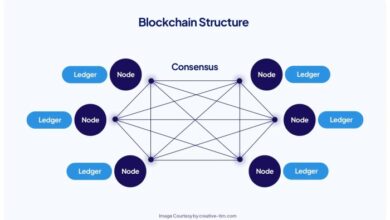

Cryptocurrency mining is a decentralized process that ensures the security and integrity of a blockchain network. Miners use specialized hardware to solve complex mathematical problems, which are designed to be computationally intensive. When a miner successfully solves a problem, they are rewarded with a certain amount of cryptocurrency.

It’s fascinating to see how cryptocurrency mining continues to thrive even amidst dramatic price fluctuations. It’s a bit like trying to analyze the long lasting legacy of a short term prime minister – you need to look beyond the immediate headlines and consider the underlying fundamentals.

The same goes for crypto mining; the technology itself is still evolving, and its potential impact on the future of finance is undeniable.

This process, known as “proof-of-work,” is crucial for maintaining the integrity of the blockchain, as it prevents malicious actors from manipulating the network.

Factors Driving Continued Interest in Cryptocurrency Mining

Several factors contribute to the ongoing interest in cryptocurrency mining, despite price fluctuations.

Potential for Future Growth

The cryptocurrency market is still in its early stages of development, and there is significant potential for future growth. As the adoption of cryptocurrencies increases, the demand for mining services is likely to rise, creating opportunities for miners to profit from their efforts.

Technological Advancements

Continuous advancements in hardware and software are making cryptocurrency mining more efficient and cost-effective. The development of specialized mining chips, known as ASICs, has significantly increased the speed and efficiency of mining operations.

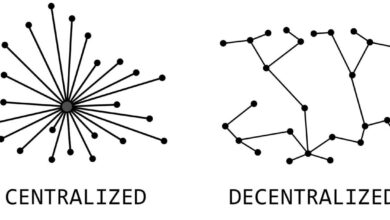

Decentralization and Security

Cryptocurrency mining plays a crucial role in ensuring the decentralization and security of blockchain networks. By distributing the mining process across a large network of miners, it becomes difficult for any single entity to gain control of the network.

Real-World Examples of Successful Cryptocurrency Mining Operations

Several successful cryptocurrency mining operations have emerged, demonstrating the potential of this industry.

Bitmain

Bitmain is a leading manufacturer of ASIC mining chips and a major cryptocurrency mining operation. The company has established a significant presence in the mining industry, contributing to the development of advanced mining hardware and the expansion of the global mining network.

Riot Blockchain

Riot Blockchain is a publicly traded company that operates large-scale cryptocurrency mining facilities. The company has invested heavily in mining infrastructure, enabling it to generate significant revenue from mining operations.

Marathon Digital Holdings

Marathon Digital Holdings is another publicly traded company focused on cryptocurrency mining. The company has a large fleet of mining machines and has established partnerships with major mining hardware manufacturers.These real-world examples demonstrate the growing influence of cryptocurrency mining on the industry.

It’s fascinating to see how cryptocurrency mining continues to boom despite the recent market dips. The dedication of miners is truly remarkable, and it’s a reminder that even in the face of volatility, the underlying technology continues to evolve. It’s a stark contrast to the political landscape, where tragedies like the Uvalde shooting are forcing states like California and New York to take action, as seen in this recent article.

Perhaps the resilience of the crypto world can offer a glimmer of hope for finding solutions to complex issues like gun violence. After all, innovation and perseverance are key to progress in both the digital and physical worlds.

As the cryptocurrency market continues to evolve, the role of mining is likely to become even more prominent.

The Impact of Price Drops on Mining Operations

Cryptocurrency mining is a resource-intensive endeavor that relies heavily on the profitability of mining operations. The price of cryptocurrencies, particularly Bitcoin, plays a pivotal role in determining the financial viability of mining. When prices plummet, mining operations face significant challenges, impacting their profitability and sustainability.

The Relationship Between Cryptocurrency Prices and Mining Profitability

The profitability of cryptocurrency mining is directly linked to the price of the mined cryptocurrency. The revenue generated from mining is determined by the amount of cryptocurrency mined and its market value. As cryptocurrency prices fluctuate, the profitability of mining operations can experience dramatic swings.

It’s fascinating how cryptocurrency mining continues to boom despite the wild swings in market value. It reminds me of how things change over time, even in institutions like the Supreme Court. Justice Jackson, a former law clerk, now returns to a transformed court, justice jackson a former law clerk returns to a transformed supreme court , facing a landscape vastly different from her days as a clerk.

Just like with crypto, adaptation and resilience are key to navigating the shifting tides of power and influence.

For example, if the price of Bitcoin drops from $50,000 to $30,000, miners will see a 40% reduction in their revenue, assuming the amount of Bitcoin mined remains constant. This reduction in revenue can significantly impact a miner’s profitability, especially when considering the fixed costs associated with mining, such as electricity, hardware maintenance, and infrastructure.

Strategies for Adapting to Fluctuating Market Conditions

Miners employ various strategies to adapt to volatile market conditions and maintain profitability. These strategies often involve adjustments to hardware, energy consumption, and mining pools.

Hardware Adjustments

- Upgrading to More Efficient Hardware:Miners may upgrade their mining rigs to newer, more efficient models that consume less energy while maintaining or increasing hash rate. This can help offset the impact of lower cryptocurrency prices by reducing operating costs.

- Selling Less Efficient Hardware:When prices decline, miners may sell older, less efficient mining hardware to recoup some of their investment and reduce operating costs. This strategy helps them stay competitive and maintain profitability in a challenging market.

Energy Consumption Adjustments

- Optimizing Mining Operations:Miners can optimize their mining operations to reduce energy consumption. This may involve using energy-efficient cooling systems, adjusting fan speeds, and optimizing mining software settings.

- Shifting to Lower-Cost Energy Sources:Miners may explore alternative energy sources, such as hydroelectric power or solar energy, to reduce their electricity costs. This strategy can significantly impact profitability, especially in regions with high electricity prices.

Mining Pool Adjustments

- Joining Larger Mining Pools:Joining larger mining pools increases the chances of finding a block and earning rewards, even when prices are low. This strategy can help distribute the risk and reduce the impact of price fluctuations.

- Switching to Different Mining Pools:Miners may switch to different mining pools that offer more favorable terms, such as lower fees or higher block rewards, to maximize profitability in a volatile market.

Challenges Faced by Miners in Different Geographic Locations

The challenges faced by miners can vary significantly depending on their geographic location, due to factors such as energy costs, regulatory environments, and access to infrastructure.

Energy Costs

- High Electricity Prices:Miners operating in regions with high electricity prices face a significant challenge in maintaining profitability, as energy costs represent a substantial portion of their operating expenses.

- Low Electricity Prices:Miners in regions with low electricity prices have a competitive advantage, as they can operate at a lower cost and remain profitable even when cryptocurrency prices are low.

Regulatory Environments

- Favorable Regulations:In regions with favorable regulations, miners can operate more freely and efficiently, contributing to a more robust mining ecosystem. These regions may attract more miners, leading to increased competition and potentially lower profitability.

- Unfavorable Regulations:Unfavorable regulations can create hurdles for miners, such as restrictions on energy consumption or taxation, leading to higher operating costs and reduced profitability.

Access to Infrastructure

- Reliable Infrastructure:Access to reliable internet connectivity, power grids, and cooling infrastructure is essential for efficient mining operations. Miners in regions with well-developed infrastructure have an advantage in terms of cost and reliability.

- Limited Infrastructure:Miners in regions with limited infrastructure may face higher costs and operational challenges, impacting their profitability and sustainability.

The Role of Technology in Cryptocurrency Mining

Cryptocurrency mining, the process of verifying and adding transactions to a blockchain, is a computationally intensive task that requires specialized hardware and software. Technological advancements have played a pivotal role in shaping the evolution of cryptocurrency mining, enabling its growth and influencing its efficiency.

Specialized Hardware

The development of specialized hardware, known as Application-Specific Integrated Circuits (ASICs), has significantly impacted cryptocurrency mining. ASICs are designed to perform a single task, in this case, solving complex cryptographic problems, with exceptional speed and efficiency. They offer significant performance advantages over general-purpose CPUs and GPUs, leading to a substantial increase in mining profitability.

- Increased Hashing Power:ASICs can perform trillions of calculations per second, enabling miners to solve complex cryptographic problems much faster than traditional hardware. This translates to higher mining rewards and increased profitability.

- Energy Efficiency:ASICs are designed for optimal energy efficiency, consuming less power than other hardware options. This reduced energy consumption can lead to lower operating costs and a more sustainable mining operation.

- Specialized Design:ASICs are tailored for specific cryptocurrency algorithms, providing specialized hardware optimized for maximum performance. This allows miners to target specific cryptocurrencies and maximize their mining output.

Mining Pools, Cryptocurrency mining is still on the rise despite huge price drops

Mining pools are collaborative efforts where multiple miners combine their computing power to increase their chances of successfully solving a block and earning rewards. These pools distribute the rewards based on each miner’s contribution, enabling smaller miners to participate and compete effectively.

- Increased Success Rate:Pooling resources increases the probability of solving a block, ensuring more consistent rewards for participants.

- Reduced Risk:Mining pools distribute the risk of not finding a block among all participants, reducing the volatility of individual miners’ earnings.

- Enhanced Stability:By pooling resources, miners can ensure a more stable and predictable income stream, regardless of individual mining performance fluctuations.

Ongoing Research and Development

The field of cryptocurrency mining is constantly evolving, with ongoing research and development efforts focused on improving efficiency and exploring alternative mining methods.

- Energy-Efficient Mining:Researchers are exploring new technologies and strategies to reduce the energy consumption of cryptocurrency mining. This includes optimizing mining algorithms, utilizing renewable energy sources, and developing more efficient hardware.

- Alternative Mining Methods:Researchers are investigating alternative mining methods that rely on less energy-intensive processes, such as proof-of-stake (PoS) consensus mechanisms. PoS eliminates the need for energy-intensive computations, making it a more sustainable and environmentally friendly option.

- Hardware Innovations:Advancements in hardware technology, such as the development of more efficient ASICs and GPUs, continue to drive improvements in mining performance and energy efficiency.

Impact of Emerging Technologies

Emerging technologies, such as quantum computing, have the potential to disrupt the cryptocurrency mining landscape. Quantum computers possess immense computational power, capable of solving complex cryptographic problems significantly faster than traditional computers.

“Quantum computing could potentially break the cryptographic algorithms used in Bitcoin and other cryptocurrencies, rendering current mining methods obsolete.”

While quantum computing is still in its early stages of development, its potential impact on cryptocurrency mining cannot be ignored. Researchers are exploring countermeasures and developing new cryptographic algorithms resistant to quantum attacks.

The Future of Cryptocurrency Mining: Cryptocurrency Mining Is Still On The Rise Despite Huge Price Drops

The cryptocurrency mining industry, despite recent price fluctuations, remains a dynamic and evolving sector. The future of mining is intertwined with various factors, including technological advancements, regulatory landscapes, and the broader evolution of the digital economy.

The Impact of Regulatory Changes on Cryptocurrency Mining

Regulatory changes play a significant role in shaping the future of cryptocurrency mining. Governments worldwide are grappling with how to regulate this nascent industry, with varying approaches leading to diverse outcomes.

- Increased Regulation:Some jurisdictions are implementing stricter regulations to address concerns related to energy consumption, financial stability, and illicit activities. This could involve licensing requirements, tax regulations, and limitations on mining operations. For example, China’s crackdown on cryptocurrency mining in 2021 led to a significant shift in mining activity to other regions.

- Favorable Regulations:Conversely, some regions are embracing cryptocurrency mining, offering incentives and creating favorable regulatory environments to attract investment and boost economic growth. For instance, countries like Iceland and Kazakhstan have become hubs for cryptocurrency mining due to their abundant renewable energy sources and supportive policies.

- International Collaboration:As cryptocurrency mining becomes increasingly globalized, international cooperation will be crucial to establish consistent regulations and prevent regulatory arbitrage. This will involve collaboration among nations to address cross-border challenges and ensure a level playing field for miners.

The Influence of Environmental Concerns on Cryptocurrency Mining

The energy consumption associated with cryptocurrency mining has raised significant environmental concerns.

- Energy Efficiency:The industry is actively exploring and implementing energy-efficient mining technologies, such as ASIC chips with lower power consumption and renewable energy sources. For example, companies like Bitmain and Canaan are continuously innovating to improve the energy efficiency of their mining hardware.

- Carbon Footprint Reduction:Miners are increasingly adopting sustainable practices, such as sourcing energy from renewable sources and implementing carbon offsetting programs. This shift towards sustainability is driven by both environmental concerns and the potential for cost savings.

- Green Mining Initiatives:Some projects are specifically focused on green mining, utilizing renewable energy sources like hydro, solar, and wind power to reduce the environmental impact of mining operations. For instance, the HydroMiner project in Iceland uses geothermal energy to power its mining operations.

The Role of Technology in the Future of Cryptocurrency Mining

Technological advancements will continue to drive innovation and shape the future of cryptocurrency mining.

- Hardware Evolution:Advancements in semiconductor technology, such as the development of more efficient and powerful ASIC chips, will lead to increased mining efficiency and lower energy consumption. This will also drive the adoption of new mining algorithms and protocols.

- Software Optimization:Software optimization, including improvements in mining pools and mining software, will enhance mining efficiency and profitability. This will involve optimizing mining strategies, reducing network latency, and enhancing security.

- Decentralized Mining:Emerging technologies like decentralized cloud mining platforms and distributed ledger technologies could revolutionize the mining landscape. This will allow for more accessible and efficient mining operations, potentially democratizing the industry.

Closing Notes

The future of cryptocurrency mining is intertwined with the evolution of the broader digital economy. As the adoption of cryptocurrencies continues to grow, so too will the demand for mining. While regulatory changes and environmental concerns pose challenges, the industry is actively seeking solutions to address these issues.

With ongoing technological advancements, the potential for innovation in mining is vast, promising to further enhance efficiency and sustainability. It’s clear that cryptocurrency mining, despite the ups and downs, remains a vital component of the evolving digital landscape, with a future full of potential.