Americans Feel Uneasy as Economic Concerns Grow: CBS News Poll

Americans feel uneasy as economic concerns grow cbs news poll – Americans Feel Uneasy as Economic Concerns Grow: CBS News Poll – A recent CBS News poll reveals a nation grappling with economic anxiety, with inflation and the cost of living topping the list of concerns. This unease is palpable, manifesting in Americans’ spending habits, financial decisions, and even their outlook on the future.

The poll paints a stark picture of a nation struggling to make ends meet. Rising prices for everyday necessities, from groceries to gasoline, are squeezing household budgets, forcing many Americans to make difficult choices. The impact of inflation is particularly acute for low-income households, who are disproportionately affected by rising costs.

This economic uncertainty is casting a shadow over consumer confidence, leading to a cautious approach to spending and a sense of unease about the future.

Economic Concerns Driving Unease

A recent CBS News poll revealed a palpable sense of unease among Americans, driven by a range of economic concerns. The poll, conducted in late 2023, highlighted the anxieties surrounding inflation, the cost of living, and the overall state of the economy.

These concerns are not merely abstract worries but are having a tangible impact on Americans’ daily lives, shaping their financial decisions, spending habits, and even their outlook on the future.

The Impact of Economic Concerns on Americans’ Daily Lives

The CBS News poll unveiled a multitude of economic concerns that are weighing heavily on Americans’ minds. These concerns are not isolated incidents but are interconnected, creating a complex web of anxieties that permeate various aspects of daily life.

- Inflation:The poll revealed that inflation remains a top concern for Americans. The persistent rise in prices for essential goods and services, from groceries to gasoline, is eroding purchasing power and forcing families to make difficult choices. Many Americans are struggling to keep up with the rising cost of living, leading to increased stress and financial hardship.

- Cost of Living:The high cost of housing, healthcare, and education are further exacerbating the financial strain on many Americans. The poll found that a significant portion of Americans are struggling to afford basic necessities, leading to a sense of economic insecurity.

- Job Security:Concerns about job security are also prevalent, particularly in the face of economic uncertainty. The poll indicated that many Americans are worried about losing their jobs or facing wage stagnation, further contributing to their anxieties about the future.

Examples of Economic Concerns Manifesting in People’s Behaviors and Decisions

The economic concerns identified in the CBS News poll are not merely abstract worries but are having a tangible impact on Americans’ behaviors and decisions. These anxieties are manifesting in various ways, from everyday spending habits to long-term financial planning.

The latest CBS News poll paints a picture of a nation grappling with economic anxieties, and it’s easy to see why. Inflation is soaring, and the cost of living is making it harder for many to make ends meet.

It’s a stark reminder of the struggles women faced before Roe v. Wade, when access to safe and legal abortions was limited, forcing many to turn to dangerous and clandestine means, as detailed in this fascinating article: inside the secret network of women who performed abortions before roe.

The current economic climate, with its focus on personal finances, might make us think twice about the challenges women faced in the past and the importance of ensuring access to reproductive healthcare.

- Reduced Spending:Many Americans are cutting back on discretionary spending in response to rising prices and economic uncertainty. This is evident in the decline in retail sales and the increased popularity of budget-friendly shopping strategies.

- Increased Savings:The poll found that Americans are prioritizing savings in an effort to build a financial cushion against potential economic downturns. This shift towards saving is reflected in the increased deposits in bank accounts and the growing popularity of investment vehicles.

- Delayed Major Purchases:The economic anxieties are also leading many Americans to delay major purchases such as cars, homes, and vacations. The fear of financial instability is prompting them to prioritize essential needs and postpone non-essential expenditures.

The Role of the Government

As Americans grapple with rising economic concerns, the government’s response and potential solutions have become central to the national conversation. The government’s role in addressing economic challenges is multifaceted, involving a range of policies and interventions aimed at stimulating growth, stabilizing markets, and providing support to individuals and businesses.

Government Responses and Effectiveness

The government has implemented various measures to address economic concerns, including fiscal policies, monetary policies, and regulatory interventions. Fiscal policies involve adjusting government spending and taxation to influence the economy. For instance, during economic downturns, the government may increase spending on infrastructure projects or provide tax breaks to businesses to encourage investment and job creation.

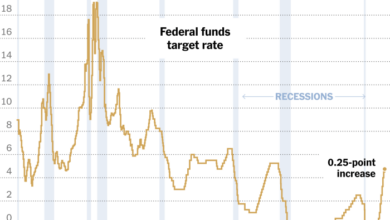

Monetary policies, controlled by the Federal Reserve, involve adjusting interest rates and managing the money supply to influence inflation and economic growth. The Fed can lower interest rates to make borrowing cheaper and stimulate spending, or raise rates to control inflation.

Regulatory interventions, such as changes to banking regulations or environmental policies, can impact economic activity by affecting business costs and investment decisions.The effectiveness of government responses to economic concerns is a subject of ongoing debate. Some argue that government intervention is essential to stabilize the economy and prevent crises, while others contend that excessive government involvement can stifle innovation and distort markets.

It’s no surprise that Americans are feeling uneasy as economic concerns grow, according to a recent CBS News poll. With rising inflation impacting everything from groceries to gas, people are understandably worried about their financial futures. President Biden is set to visit the Port of Los Angeles, a key gateway for goods entering the country, to highlight the global nature of inflation and the steps his administration is taking to address it.

biden to visit port of los angeles casting inflation as a global problem Whether his efforts will be enough to ease the concerns of Americans remains to be seen, but the issue is certainly top of mind for many.

The effectiveness of specific policies can vary depending on the nature of the economic challenge, the timing of the intervention, and the overall economic context. For example, while fiscal stimulus packages can be effective in boosting demand during recessions, they can also contribute to long-term debt accumulation if not implemented prudently.

Political Perspectives on Economic Challenges

Different political parties often hold contrasting perspectives on the causes of economic challenges and the appropriate government response. Generally, Democrats tend to favor more government intervention in the economy, supporting policies such as increased social spending, regulation of industries, and progressive taxation.

Republicans, on the other hand, typically advocate for lower taxes, deregulation, and limited government spending, believing that free markets are the best way to stimulate economic growth. These contrasting viewpoints can lead to political gridlock and make it challenging to implement comprehensive economic policies.

Potential Policy Solutions, Americans feel uneasy as economic concerns grow cbs news poll

Various stakeholders, including economists, policymakers, and industry leaders, have proposed a range of policy solutions to address economic concerns. Some common proposals include:

- Investing in infrastructure:This involves funding projects such as roads, bridges, and public transportation, which can create jobs, stimulate economic activity, and improve productivity.

- Promoting education and skills development:Investing in education and training programs can enhance the workforce’s skills and make it more competitive in the global economy.

- Encouraging innovation and technological advancement:Government support for research and development, as well as policies that promote entrepreneurship and innovation, can drive economic growth and create new industries.

- Addressing income inequality:Policies aimed at reducing income inequality, such as raising the minimum wage or expanding access to affordable healthcare, can boost consumer spending and support economic growth.

- Promoting trade and global economic integration:Free trade agreements and other policies that facilitate international trade can create new markets for goods and services, leading to increased economic activity and job creation.

The effectiveness of these policy solutions will depend on their specific implementation and the broader economic context. Finding a consensus on the best approach to address economic concerns requires careful consideration of the various perspectives and potential solutions.

Consumer Confidence and Spending: Americans Feel Uneasy As Economic Concerns Grow Cbs News Poll

The recent CBS News poll reveals a significant correlation between Americans’ economic anxiety and their spending patterns. As economic concerns rise, consumers tend to tighten their belts, leading to a decline in discretionary spending. This behavior is driven by a sense of uncertainty about the future and a desire to save for potential economic hardship.

Key Indicators of Consumer Confidence

Consumer confidence is a crucial indicator of the health of the economy. It reflects consumers’ perceptions of the current economic situation and their outlook for the future. Several key indicators track consumer confidence, providing insights into their willingness to spend.

- The Consumer Confidence Index (CCI):This index, published by The Conference Board, measures consumer sentiment based on surveys that assess their views on current economic conditions, job prospects, and the outlook for the next six months. A decline in the CCI typically indicates a decrease in consumer confidence and spending.

The latest CBS News poll paints a grim picture of American sentiment, with a majority feeling uneasy about the economy. While many are grappling with rising costs, it’s also interesting to see how the debate on abortion rights is shaping up, especially with the article, will the pro abortion rights billionaires please stand up , highlighting the role of big money in this crucial issue.

Ultimately, the economic anxiety and the heated debate on abortion rights are intertwined, reflecting the deep divisions and anxieties that are impacting American society today.

- The University of Michigan Consumer Sentiment Index:This index, compiled by the University of Michigan’s Survey Research Center, gauges consumer sentiment by measuring their expectations about inflation, personal finances, and business conditions. A drop in this index often signals a decrease in consumer spending.

The Influence of Economic Climate on Consumer Behavior

The current economic climate significantly impacts consumer behavior. Rising inflation, interest rates, and concerns about a potential recession have prompted many Americans to adopt more cautious spending habits. This trend is evident in various areas:

- Delayed Purchases:Consumers are postponing major purchases, such as cars, homes, and appliances, due to concerns about affordability and potential economic hardship. This delay in spending can have a ripple effect on various industries.

- Shifting Spending Priorities:Consumers are increasingly prioritizing essential goods and services, such as groceries, healthcare, and utilities, while reducing spending on discretionary items, such as entertainment, travel, and dining out. This shift in spending priorities reflects a desire to conserve resources and prioritize basic needs.

- Increased Savings:Faced with economic uncertainty, consumers are opting to save more to build a financial buffer against potential economic downturns. This increased savings rate can impact overall economic growth by reducing consumer spending.

The Future of the Economy

The current economic climate is marked by uncertainty, with factors like inflation, interest rates, and geopolitical tensions influencing the trajectory of the economy. While the short-term outlook is clouded, long-term economic growth remains a possibility, contingent on several factors.

Factors Influencing Economic Growth

The potential for economic growth in the coming months and years depends on a confluence of factors, both positive and negative.

- Inflation:The Federal Reserve’s efforts to combat inflation through interest rate hikes could slow economic growth. However, a decline in inflation would boost consumer confidence and spending, contributing to economic expansion. The trajectory of inflation will be crucial in determining the future of the economy.

- Interest Rates:Higher interest rates can make borrowing more expensive, potentially slowing business investment and consumer spending. However, they can also help control inflation and stabilize the economy. The impact of interest rates on economic growth will depend on the magnitude and duration of the increases.

- Consumer Spending:Consumer spending is a significant driver of economic growth. Continued strong consumer demand, fueled by a robust job market and pent-up demand, could support economic expansion. However, rising inflation and interest rates could dampen consumer spending, impacting economic growth.

- Geopolitical Tensions:Geopolitical tensions, particularly the ongoing conflict in Ukraine, contribute to global economic uncertainty. The conflict has disrupted supply chains, increased energy prices, and fueled inflation, negatively impacting economic growth. A resolution to these tensions could provide a boost to the global economy.

- Technological Advancements:Technological advancements, such as artificial intelligence and automation, have the potential to drive economic growth by increasing productivity and creating new industries. However, they also raise concerns about job displacement and income inequality. The impact of technological advancements on economic growth will depend on how these challenges are addressed.

Potential Economic Scenarios

Based on the interplay of these factors, several economic scenarios are possible:

- Scenario 1: Soft Landing:The Federal Reserve successfully manages inflation through gradual interest rate increases, leading to a slowdown in economic growth but avoiding a recession. This scenario would be characterized by moderate inflation, steady job growth, and continued consumer spending.

- Scenario 2: Recession:The Federal Reserve’s efforts to combat inflation lead to a sharp economic downturn, characterized by declining GDP, rising unemployment, and increased financial stress. This scenario could be triggered by aggressive interest rate hikes, a sudden drop in consumer spending, or a major geopolitical event.

- Scenario 3: Stagflation:The economy experiences persistent inflation coupled with slow or stagnant growth. This scenario would be characterized by rising prices, limited job creation, and declining consumer confidence. Stagflation is often triggered by supply chain disruptions, geopolitical instability, or excessive government spending.

Implications for Americans

The economic outlook has significant implications for Americans, influencing their financial well-being, job security, and overall quality of life.

- Inflation:High inflation erodes purchasing power, making it harder for Americans to afford basic necessities. This can lead to increased financial stress and reduced consumer spending.

- Interest Rates:Higher interest rates increase the cost of borrowing, impacting home mortgages, car loans, and other forms of debt. This can make it more challenging for Americans to manage their finances and achieve their financial goals.

- Job Market:A slowdown in economic growth can lead to job losses and reduced hiring. This can increase unemployment and make it harder for Americans to find and maintain employment.

- Government Policies:Government policies, such as tax cuts, infrastructure spending, and social programs, can influence economic growth and impact the lives of Americans. The effectiveness of these policies in addressing economic challenges and promoting prosperity will be crucial.

Final Thoughts

The CBS News poll serves as a stark reminder of the economic challenges facing Americans today. Inflation, the cost of living, and the uncertain economic outlook are weighing heavily on the minds of many. As the nation navigates these turbulent economic waters, policymakers must address the concerns of everyday Americans and work towards a more stable and prosperous future.