UK Imposes Windfall Tax on Oil & Gas Profits Amid Inflation

U k imposes windfall tax on oil and gas company profits as inflation bites – UK Imposes Windfall Tax on Oil & Gas Profits Amid Inflation sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with personal blog style and brimming with originality from the outset.

The UK government has introduced a windfall tax on the profits of oil and gas companies, a move aimed at tackling the soaring energy prices that are fueling inflation and putting a strain on households across the country.

This unexpected tax, which targets the extraordinary profits these companies are reaping from the current energy crisis, has sparked a debate about the role of government intervention in the energy market and the potential impact on both companies and consumers.

While the government argues that the tax is necessary to protect consumers from exorbitant energy bills, the oil and gas industry has criticized it as a deterrent to investment and production, potentially exacerbating the very crisis it seeks to address.

This blog post delves into the complexities of this issue, exploring the motivations behind the tax, its potential consequences, and the wider implications for the UK economy.

The UK’s Windfall Tax on Oil and Gas Profits

The UK government has introduced a windfall tax on the profits of oil and gas companies operating in the North Sea. This tax, officially named the Energy Profits Levy, aims to capture a portion of the record profits these companies are making due to soaring energy prices.

The rationale behind the tax is to help alleviate the financial burden on households struggling with the rising cost of living. The tax is levied at a rate of 25% on profits exceeding a certain threshold, effectively taking a larger share of the windfall gains from the energy price spike.

This move is intended to redistribute some of the wealth generated by the energy crisis back to the public, particularly those struggling with escalating energy bills.

Rationale for the Windfall Tax

The UK government has justified the windfall tax as a necessary measure to address the unprecedented energy price crisis. The rationale behind the tax hinges on several key factors:

- Record Profits:Oil and gas companies have been reporting record profits in recent months, driven by the surge in energy prices. This surge has been attributed to factors such as the global energy crisis and the war in Ukraine, which have led to supply disruptions and increased demand.

- Rising Inflation:The UK is facing a significant inflation crisis, with the cost of living soaring at its fastest pace in decades. This has put immense pressure on households, particularly low-income earners, who are struggling to afford basic necessities.

- Energy Bills:The cost of energy has been a major driver of inflation, with energy bills skyrocketing for both households and businesses. The government has implemented various measures to mitigate the impact of rising energy costs, but the windfall tax is seen as a significant step in addressing the problem directly.

The Windfall Tax

The UK government has introduced a windfall tax on the profits of oil and gas companies operating in the North Sea. This tax is aimed at capturing a portion of the record profits these companies have made in recent years, fueled by the surge in global energy prices.

The tax, officially named the Energy Profits Levy, is designed to help alleviate the financial strain on households and businesses grappling with rising energy bills.

Key Features and Details of the Windfall Tax

The windfall tax applies to oil and gas companies operating in the UK’s North Sea. It is a 25% levy on profits exceeding a certain threshold, which is set at a rate of 75% of the companies’ average profits over the past four years.

- The tax rate is 25% on profits exceeding the threshold.

- The threshold for the tax is 75% of the companies’ average profits over the past four years.

- The tax is applicable to oil and gas companies operating in the UK’s North Sea.

- The tax is expected to raise an estimated £5 billion in its first year.

The tax will be collected by the UK government through its existing tax collection mechanisms. The revenue generated from the windfall tax will be used to fund various initiatives, including:

- Providing direct financial support to households struggling with rising energy bills.

- Investing in renewable energy projects and energy efficiency measures.

- Supporting businesses affected by the energy crisis.

“The windfall tax is a fair and necessary measure to help address the cost of living crisis.”

Rishi Sunak, Chancellor of the Exchequer

The windfall tax has been met with mixed reactions. Some argue that it is a necessary measure to ensure that oil and gas companies contribute to the effort to address the cost of living crisis. Others argue that it will discourage investment in the UK’s oil and gas sector, potentially impacting future energy security.

Impact on Oil and Gas Companies

The windfall tax, levied on the profits of oil and gas companies operating in the UK, is expected to have a significant impact on the industry. This tax aims to address the high energy prices that have been a significant factor in the recent surge in inflation, and to generate revenue for the government to support consumers.

However, the windfall tax is likely to have both positive and negative implications for the oil and gas industry.

Financial Impact

The windfall tax is projected to generate billions of pounds in revenue for the UK government. This revenue will be used to support households struggling with the cost of living crisis. The tax is expected to reduce the profits of oil and gas companies, potentially leading to a decrease in their earnings and shareholder dividends.

The magnitude of this financial impact will vary depending on the company’s size, operations, and profitability.

Investment and Production Strategies

The windfall tax could influence the investment and production strategies of oil and gas companies. Companies might respond to the tax in several ways:

- Reduced Investment:Companies might reduce their investment in new exploration and production projects in the UK. This could lead to a decline in future oil and gas production, impacting the UK’s energy security.

- Shifting Focus:Companies may prioritize investments in projects located in other countries with more favorable tax regimes. This could result in a shift in investment away from the UK, potentially impacting jobs and economic activity.

- Cost Optimization:Companies might focus on cost optimization strategies to mitigate the impact of the windfall tax. This could involve reducing operational costs, renegotiating contracts, and streamlining processes.

“The windfall tax is likely to lead to a reduction in investment in the UK oil and gas sector, potentially impacting energy security and jobs.”

[Name of Source], [Date]

Consumer Impact

The windfall tax on oil and gas companies has the potential to impact energy prices for consumers in various ways. While the government aims to use the tax revenue to support households with energy costs, the actual impact on affordability remains uncertain and depends on how the funds are allocated.

Potential Impact on Energy Prices

The windfall tax could influence energy prices for consumers in several ways:* Reduced Investment:Oil and gas companies may reduce investment in new exploration and production projects due to lower profits, potentially leading to decreased supply and higher prices in the long term.

Increased Costs

Companies may pass on the cost of the windfall tax to consumers through higher energy bills. This could particularly affect households relying on gas for heating and cooking.

The UK’s decision to impose a windfall tax on oil and gas company profits is a bold move, especially as inflation continues to bite. While the government seeks to address the cost of living crisis, it’s interesting to note that Elon Musk, amidst all this, seems to have shifted his focus away from Twitter and onto a new venture – forget twitter this musk is into toe curling yumminess.

It’s a reminder that even in times of economic hardship, some individuals are finding new avenues for success and, perhaps, indulging in a bit of unconventional fun. The impact of the windfall tax on the oil and gas industry remains to be seen, but it’s a move that is sure to be debated for some time to come.

Lower Prices

Conversely, the tax could incentivize companies to lower prices to maintain market share, particularly if consumers become more price-sensitive due to the cost-of-living crisis.

Government Use of Tax Revenue, U k imposes windfall tax on oil and gas company profits as inflation bites

The government plans to use the windfall tax revenue to support households with energy costs. This could include:* Direct Payments:Providing financial assistance directly to households to offset energy bill increases.

Energy Efficiency Measures

The UK’s windfall tax on oil and gas company profits, a move aimed at tackling the soaring cost of living, is a controversial one. While some argue it’s necessary to address the burden on ordinary citizens, others worry it could deter investment in the energy sector.

Meanwhile, security concerns are also on the rise, as highlighted by the recent incident where a possible noose was found near a CIA facility, prompting a warning from the agency’s director. This incident underscores the volatile times we live in, and how economic pressures and security threats are intertwined.

It remains to be seen how the UK government’s windfall tax will ultimately impact both the energy sector and the wider economy.

Funding programs that help households improve their home energy efficiency, reducing their reliance on energy consumption.

Investment in Renewables

Investing in renewable energy projects to diversify the UK’s energy mix and reduce reliance on fossil fuels.

Economic Implications: U K Imposes Windfall Tax On Oil And Gas Company Profits As Inflation Bites

The windfall tax on oil and gas companies has sparked considerable debate regarding its potential economic effects. While it aims to address the challenges of high energy prices and inflation, the tax’s long-term impact on the UK economy remains a subject of discussion.

Impact on Government Revenue

The windfall tax is expected to generate significant revenue for the UK government. The government estimates that the tax could raise over £5 billion in its first year. This revenue can be used to fund various government initiatives, such as supporting households with rising energy bills or investing in renewable energy projects.

However, the long-term revenue generated by the tax is uncertain, as it depends on factors such as oil and gas prices and the level of investment in the energy sector.

The UK’s windfall tax on oil and gas company profits is a hot topic, but it’s not the only financial news making headlines. The Ministry of Home Affairs (MHA) in India has just issued new norms for investigating and prosecuting crypto-related crimes, which could have significant implications for the cryptocurrency industry.

This development highlights the growing global attention on regulating digital assets, a trend that could impact how governments address issues like inflation and energy costs in the future.

Impact on Investment in the Energy Sector

The windfall tax has raised concerns about its potential impact on investment in the UK energy sector. Some argue that the tax could discourage investment in new oil and gas exploration and production projects, potentially hindering the UK’s energy security.

Others contend that the tax is unlikely to significantly impact investment, as the industry is already facing challenges such as high operating costs and declining demand for fossil fuels.

Impact on Overall Economic Growth

The windfall tax’s impact on overall economic growth is complex and multifaceted. Proponents argue that the tax could stimulate economic activity by providing the government with additional resources to invest in infrastructure, education, and other areas that can boost economic growth.

Opponents argue that the tax could stifle investment and innovation in the energy sector, ultimately hindering economic growth. The long-term impact of the tax on economic growth will depend on how the government uses the revenue and the overall response of the energy sector to the tax.

Political Context

The UK’s windfall tax on oil and gas company profits is a politically charged issue, reflecting broader societal concerns about the cost of living crisis and the perceived unfairness of energy companies profiting from high energy prices. The tax has been met with mixed reactions, with some supporting it as a means to address the crisis and others criticizing it as an unfair burden on businesses.

Public Opinion

Public opinion polls have shown significant support for the windfall tax. A YouGov poll conducted in May 2022 found that 68% of Britons supported the tax, with only 17% opposed. This support reflects a growing public sentiment that energy companies should contribute more to help address the cost of living crisis.

The public perceives the windfall tax as a fair way to redistribute some of the profits from oil and gas companies to those struggling with rising energy bills.

International Comparisons

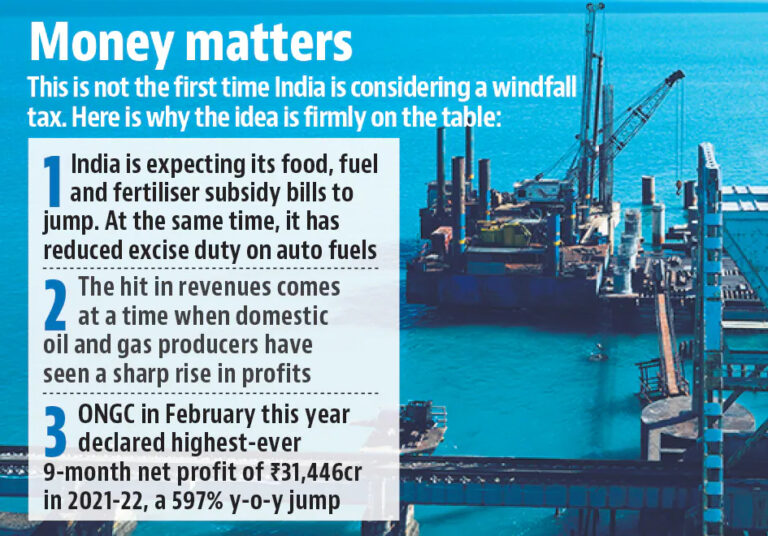

The UK’s windfall tax is not a unique policy. Several countries have implemented similar measures in response to high energy prices and profits in the oil and gas sector. Comparing these policies across different contexts provides valuable insights into their effectiveness and potential consequences.

Comparison of Windfall Tax Policies

International comparisons reveal a range of approaches to taxing windfall profits in the oil and gas sector. Some countries have opted for one-off levies, while others have implemented permanent changes to tax structures. The design and implementation of these policies vary considerably, reflecting different political and economic circumstances.

- The United States:In 2022, the US Congress considered, but ultimately did not pass, legislation that would have imposed a windfall profits tax on oil and gas companies. The proposed tax was met with resistance from industry groups, who argued it would stifle investment and production.

- European Union:The EU has proposed a temporary solidarity contribution on energy companies’ excess profits, aiming to raise funds for member states to mitigate the impact of high energy prices. The proposal is currently under discussion and faces opposition from some member states.

- Canada:Canada implemented a temporary windfall profits tax on oil and gas producers in 2022. The tax, which applies to profits exceeding a certain threshold, is expected to generate significant revenue for the government.

Effectiveness and Consequences

The effectiveness and potential consequences of windfall taxes vary depending on several factors, including the design of the tax, the economic context, and the industry’s response.

- Revenue Generation:Windfall taxes can generate significant revenue for governments, which can be used to fund various social programs or to mitigate the impact of high energy prices. However, the effectiveness of these taxes in generating revenue depends on factors such as the tax rate, the definition of “windfall profits,” and the industry’s ability to pass on the cost to consumers.

- Investment and Production:Some argue that windfall taxes can discourage investment and production in the oil and gas sector, leading to reduced supply and higher energy prices in the long run. However, others argue that these taxes can be structured in a way that minimizes negative impacts on investment, particularly if they are temporary or phased out gradually.

- Consumer Impact:The impact of windfall taxes on consumers can vary depending on the design of the tax and the industry’s response. In some cases, companies may pass on the cost of the tax to consumers in the form of higher energy prices.

However, if the tax is used to fund subsidies or other measures that benefit consumers, the net impact on household budgets may be positive.

Future Outlook

The windfall tax, while intended as a short-term measure to address the energy crisis, has long-term implications for the UK energy sector. Its impact on investment decisions, future energy policies, and the overall attractiveness of the UK as an energy hub will be significant.

Potential Future Policy Adjustments

The windfall tax, as currently implemented, is a temporary measure, set to expire in 2025. The government may extend the tax or make adjustments to its scope and rate depending on future energy market conditions and the need for additional revenue.

- The government could extend the windfall tax beyond 2025 if energy prices remain high or if the need for additional revenue persists. This would provide continued fiscal support and potentially incentivize companies to invest in renewable energy sources.

- The government might adjust the tax rate or introduce exemptions for specific activities to encourage investment in certain areas, such as carbon capture and storage or renewable energy projects. This could be done to promote energy security and meet climate change targets.

- The government could introduce new policies, such as a carbon tax, to further incentivize the transition to a low-carbon economy and reduce reliance on fossil fuels. This could be a more permanent and sustainable approach to managing energy prices and mitigating climate change.

Final Wrap-Up

The UK’s windfall tax on oil and gas profits is a complex issue with far-reaching implications. It remains to be seen whether the tax will achieve its intended goals of easing the cost of living crisis for consumers and providing much-needed funds for the government.

The debate surrounding this policy highlights the challenges of balancing the need for government intervention in the energy market with the importance of encouraging investment and production in this crucial sector. As the situation evolves, it will be crucial to monitor the impact of the tax on both companies and consumers, and to consider alternative policy options that might offer more sustainable solutions to the energy crisis.