Did Buffett & Munger See BYDs One Problem?

Analysis did buffett and munger see byds one problem – Did Buffett & Munger See BYD’s One Problem? This question has been circulating in the investment world, as the legendary investors Warren Buffett and Charlie Munger have long been admirers of BYD, the Chinese electric vehicle and battery giant. Their investment in BYD has been a remarkable success, but some analysts have questioned whether they overlooked a potential roadblock for the company.

BYD’s rise to prominence has been fueled by its commitment to sustainability and its impressive product portfolio. However, the company faces challenges in a highly competitive market, with other EV manufacturers vying for market share. The question is, did Buffett and Munger recognize these potential hurdles and factor them into their investment strategy?

Buffett and Munger’s Investment Philosophy

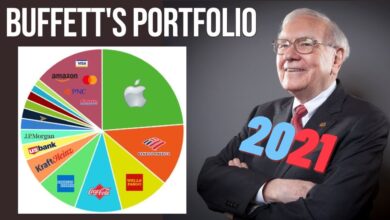

Warren Buffett and Charlie Munger, renowned investors and business leaders, have shaped the world of investing with their unique philosophy. Their approach, known as value investing, emphasizes the importance of identifying undervalued companies with strong fundamentals and holding them for the long term.

Core Principles of Value Investing

Value investing, as championed by Buffett and Munger, is based on the principle of finding companies whose intrinsic value is higher than their current market price. This approach emphasizes a long-term perspective and focuses on the fundamental aspects of a business rather than short-term market fluctuations.

- Focus on Intrinsic Value:Value investors like Buffett and Munger prioritize understanding the true worth of a company, its intrinsic value, which is based on its future earnings potential and asset value. This involves analyzing financial statements, industry trends, and the company’s competitive advantage.

- Long-Term Perspective:Value investors are patient and believe in holding investments for the long term, allowing time for their intrinsic value to be recognized by the market. They are not swayed by short-term market volatility or emotional biases.

- Margin of Safety:Value investors aim to purchase stocks at a significant discount to their intrinsic value, creating a margin of safety. This cushion protects them from potential errors in their analysis and provides room for future growth.

- Focus on Quality:Buffett and Munger emphasize investing in companies with strong management, a durable competitive advantage, and a solid track record of profitability. They believe that a company’s quality is as important as its price.

Identifying Undervalued Companies

Buffett and Munger have developed a systematic approach to identifying undervalued companies with strong fundamentals. They use a combination of qualitative and quantitative analysis to evaluate businesses, considering factors such as:

- Financial Analysis:They meticulously examine a company’s financial statements, looking for consistent profitability, strong cash flow, and a healthy balance sheet. They also pay attention to key metrics like return on equity, debt-to-equity ratio, and earnings per share.

- Competitive Advantage:They seek companies with a sustainable competitive advantage, which allows them to generate above-average profits over an extended period. This could include factors like brand recognition, strong customer loyalty, or a unique product or service offering.

- Management Quality:They prioritize companies with competent and ethical management teams who have a proven track record of success. They believe that a strong management team is crucial for long-term value creation.

- Industry Analysis:They carefully analyze the industry in which a company operates, considering factors like growth potential, competition, and regulatory environment. They aim to invest in industries with long-term growth prospects and favorable industry dynamics.

Examples of Buffett and Munger’s Investment Philosophy in Action, Analysis did buffett and munger see byds one problem

Buffett and Munger have a long history of successful investments, demonstrating the effectiveness of their value investing approach. Some notable examples include:

- Coca-Cola:Buffett first invested in Coca-Cola in 1988, recognizing its strong brand, global reach, and consistent profitability. The investment has generated significant returns for Berkshire Hathaway over the years.

- American Express:In 1964, Buffett invested in American Express after the company faced a major crisis due to the Salad Oil Scandal. He saw an opportunity to buy a quality business at a discounted price, and the investment proved highly successful.

- Geico:Buffett’s investment in Geico, a car insurance company, exemplifies his focus on finding undervalued businesses with strong competitive advantages. Geico’s low-cost model and efficient operations have driven significant growth and profitability.

BYD’s Business Model and Growth Strategy

BYD, a Chinese multinational company, has established itself as a leading player in the electric vehicle (EV) and battery markets. Its vertically integrated business model and aggressive growth strategy have propelled it to prominence, attracting attention from renowned investors like Warren Buffett and Charlie Munger.

Buffett and Munger saw BYD’s potential, but they also saw a problem: navigating the complex and ever-changing landscape of the auto industry. This requires leadership skills that go beyond traditional management, skills like adaptability, strategic thinking, and effective communication, all of which are crucial for success in the 21st century workplace.

To learn more about these essential leadership skills and how to develop them, check out this insightful article: 10 most important leadership skills for the 21st century workplace and how to develop them. These skills are not just important for leading companies like BYD, but for anyone who wants to thrive in today’s dynamic environment.

Core Business Operations and Product Offerings

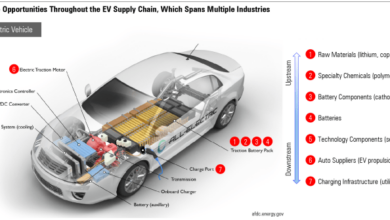

BYD’s core business operations span a diverse range of industries, including automobiles, batteries, electronics, and solar energy. The company’s product portfolio encompasses a wide array of offerings, catering to various market segments.

- Electric Vehicles (EVs):BYD manufactures a comprehensive range of EVs, including passenger cars, buses, trucks, and forklifts. The company’s EV offerings are known for their affordability, performance, and advanced technology. BYD’s EV models are gaining popularity in both domestic and international markets, particularly in China, Europe, and South America.

- Batteries:BYD is a leading manufacturer of lithium-ion batteries, which are used in its own EVs as well as for other applications, such as energy storage systems and consumer electronics. The company’s battery technology is considered highly competitive, with a focus on safety, performance, and longevity.

- Electronics:BYD has a strong presence in the electronics industry, producing components for smartphones, tablets, and other devices. The company’s expertise in electronics manufacturing contributes to its EV production capabilities, enabling it to integrate advanced technologies into its vehicles.

- Solar Energy:BYD is also involved in the solar energy sector, manufacturing solar panels and providing solutions for residential and commercial applications. The company’s solar energy business complements its EV and battery operations, offering a comprehensive suite of clean energy solutions.

Competitive Landscape and Market Position

BYD operates in a highly competitive landscape, facing competition from established global players like Tesla, Volkswagen, and Toyota, as well as other emerging Chinese EV manufacturers. However, BYD has carved out a distinct position for itself by leveraging its vertically integrated business model, strong manufacturing capabilities, and cost-effective production strategies.

- Vertical Integration:BYD’s vertically integrated business model gives it a significant advantage. The company controls the entire value chain, from battery production to vehicle assembly, enabling it to optimize costs and ensure quality control. This vertical integration also allows BYD to quickly adapt to market changes and introduce new technologies.

- Manufacturing Expertise:BYD has a long history of manufacturing excellence, having established itself as a leading electronics manufacturer before entering the EV market. This expertise in manufacturing has enabled the company to produce high-quality EVs at competitive prices.

- Cost-Effectiveness:BYD’s cost-effective production strategies, including its focus on local sourcing and efficient manufacturing processes, have enabled it to offer EVs at more affordable price points compared to some of its competitors. This has made BYD’s vehicles attractive to a wider range of consumers.

Expansion Plans and Growth Potential

BYD is aggressively pursuing expansion plans, aiming to further solidify its position as a global EV leader. The company is investing heavily in research and development, expanding its manufacturing capacity, and entering new markets.

- Global Expansion:BYD is expanding its presence in international markets, targeting key regions like Europe, South America, and Southeast Asia. The company is establishing manufacturing facilities and sales networks in these regions to cater to growing demand for EVs.

- New Product Development:BYD is constantly developing new EV models, incorporating advanced technologies such as autonomous driving, connectivity, and renewable energy integration. The company is also expanding its product portfolio to include electric buses, trucks, and other commercial vehicles.

- Battery Technology:BYD is investing heavily in battery technology, aiming to develop next-generation batteries with higher energy density, longer lifespan, and faster charging times. This focus on battery technology will be crucial for BYD’s future growth, as it aims to become a leading provider of battery solutions for the EV industry.

Buffett and Munger’s analysis of BYD highlighted a potential problem with their rapid growth – the lack of a robust safety net for their employees. It’s a stark contrast to the recent news of a Columbia graduate student brutally beaten in Manhattan, with his mother struggling for answers.

While BYD’s focus on innovation is admirable, it’s crucial to remember that the well-being of their workforce is paramount. Perhaps this is a lesson that even seasoned investors like Buffett and Munger could learn from.

Potential Concerns Regarding BYD

While BYD’s success in the EV market is undeniable, it’s essential to acknowledge potential risks and challenges that could impact its future trajectory. These concerns encompass various aspects, including intense competition, regulatory hurdles, and the ever-evolving landscape of the EV industry.

Competitive Pressure from Other EV Manufacturers

BYD faces fierce competition from established automakers like Tesla, Volkswagen, and General Motors, as well as rising Chinese competitors like Nio and Xpeng. These companies are aggressively investing in research and development, expanding their product lines, and aggressively pursuing market share.

- Price Wars:Competition in the EV market often leads to price wars, which can erode profit margins. BYD, like other EV manufacturers, needs to carefully balance pricing strategies to remain competitive while maintaining profitability.

- Technological Advancement:The EV industry is characterized by rapid technological advancements. BYD needs to continuously innovate and improve its battery technology, charging infrastructure, and vehicle features to stay ahead of the competition.

- Brand Recognition:Building a strong brand in a global market takes time and effort. BYD, while well-known in China, needs to enhance its brand recognition and appeal to international consumers.

Regulatory and Environmental Concerns

The EV industry is subject to stringent regulations and environmental concerns that can significantly impact operations. BYD, like all EV manufacturers, needs to navigate these complexities effectively.

- Battery Recycling and Sustainability:The environmental impact of battery production and disposal is a growing concern. BYD needs to demonstrate its commitment to sustainable practices and responsible battery recycling.

- Government Incentives and Subsidies:Many governments offer incentives and subsidies to promote EV adoption. Changes in these policies could affect BYD’s profitability and market competitiveness.

- Safety Regulations:Stringent safety regulations for EVs are constantly evolving. BYD must ensure its vehicles meet the highest safety standards and address any concerns regarding battery fires or other safety hazards.

Buffett and Munger’s Perspective on BYD

Warren Buffett and Charlie Munger, renowned investors and the minds behind Berkshire Hathaway, have a unique perspective on BYD. Their investment in the Chinese electric vehicle and battery manufacturer reflects their keen understanding of the evolving global landscape and the potential of disruptive technologies.

Reasons for Initial Investment

Buffett and Munger’s initial investment in BYD was driven by a confluence of factors. They saw the company’s potential in the rapidly growing electric vehicle market, driven by increasing concerns about climate change and the desire for cleaner transportation solutions.

They also recognized BYD’s unique position as a vertically integrated manufacturer, controlling the entire value chain from battery production to vehicle assembly. This vertical integration provides cost advantages and control over key components, giving BYD a competitive edge. Furthermore, BYD’s strong leadership and focus on innovation were key factors in their investment decision.

Buffett and Munger, known for their astute investments, saw a problem with BYD: their reliance on a single market. This reminded me of a recent article I read titled Will the Pro-Abortion Rights Billionaires Please Stand Up? , which discussed the importance of diverse perspectives and support in challenging times.

Just as BYD needs to diversify its market, the pro-choice movement needs a wider range of voices and resources to continue its fight. Ultimately, both situations highlight the importance of strategic planning and diverse support to navigate challenges and achieve success.

Investment Thesis and Long-Term Potential

Buffett and Munger’s investment thesis for BYD rests on the belief that the company is well-positioned to capitalize on the long-term growth of the electric vehicle market. They see BYD’s commitment to sustainability, its technological prowess, and its expanding global presence as key drivers of its future success.

The company’s innovative battery technology, which includes its Blade Battery, has been widely praised for its safety and performance, further bolstering its competitive advantage. They believe that BYD’s focus on both electric vehicles and electric buses positions it to be a leader in the transition to a cleaner transportation future.

Concerns and Reservations

While optimistic about BYD’s long-term potential, Buffett and Munger have acknowledged certain concerns. The company’s exposure to the Chinese market, with its inherent risks and uncertainties, is a significant factor. They also acknowledge the intense competition in the electric vehicle market, both from established players and emerging startups.

The potential for regulatory changes and government policies to impact BYD’s operations is another concern.

BYD’s Performance and Future Outlook: Analysis Did Buffett And Munger See Byds One Problem

BYD, a Chinese multinational conglomerate, has established itself as a leading player in the electric vehicle (EV) industry, with a focus on sustainable transportation solutions. Its impressive financial performance and innovative technological advancements have propelled it to the forefront of the EV market, attracting the attention of renowned investors like Warren Buffett and Charlie Munger.

To gain a comprehensive understanding of BYD’s potential for continued success, we will delve into its financial performance, technological innovations, and future prospects.

BYD’s Financial Performance and Growth

BYD’s financial performance reflects its robust growth trajectory. Its revenue has consistently surged, driven by strong demand for its EVs and other products.

- In 2022, BYD’s revenue reached approximately $39.5 billion, representing a substantial increase from $20.6 billion in 2021.

- The company’s net profit also saw significant growth, rising from $1.7 billion in 2021 to $3.2 billion in 2022.

This consistent growth underscores BYD’s ability to capitalize on the burgeoning EV market and its strategic expansion into other segments.

BYD’s Technological Advancements

BYD’s commitment to innovation has propelled it to the forefront of EV technology. The company has made significant strides in developing and implementing cutting-edge technologies that enhance the performance, efficiency, and sustainability of its vehicles.

- BYD is a pioneer in the development of blade batteries, a revolutionary battery technology that offers higher energy density and improved safety compared to traditional lithium-ion batteries.

- The company has also made significant advancements in electric motors, power electronics, and autonomous driving technologies, further solidifying its position as a technological leader in the EV sector.

Future Prospects of BYD

BYD’s future prospects appear promising, driven by several factors.

- The global demand for EVs is expected to continue its upward trajectory, providing a favorable market environment for BYD’s growth.

- BYD’s commitment to research and development, coupled with its robust financial performance, will enable it to continue investing in innovative technologies and expand its product portfolio.

- The company’s strategic focus on expanding its global presence, particularly in emerging markets, will provide access to new customer segments and drive further growth.

BYD’s strong financial performance, innovative technological advancements, and strategic expansion plans position it well for continued success in the evolving EV landscape.

Wrap-Up

While BYD’s success is undeniable, the question of whether Buffett and Munger saw a potential problem remains a subject of debate. Their investment philosophy, emphasizing value and long-term potential, likely factored in the challenges BYD faces. Whether they saw a specific issue or simply considered it a risk inherent in any growth company, the future of BYD is still unfolding.

One thing is certain: the story of BYD, its impressive growth, and the investment insights of Buffett and Munger will continue to captivate the investment world.