Democrats Eye Major Shift in Corporate Tax Structure

Democrats eye a major shift in how corporations are taxed – Democrats Eye Major Shift in Corporate Tax Structure, a proposal that could drastically alter the landscape of American business. This shift, driven by a desire for greater equity and a more robust social safety net, aims to change how corporations contribute to the nation’s financial well-being.

At the heart of this debate lies a fundamental question: should corporations, the engines of economic growth, shoulder a greater share of the tax burden, or are the current structures sufficient?

The proposed changes, which have sparked heated discussions among policymakers, economists, and industry leaders, aim to address concerns about corporate tax avoidance and the widening gap between the wealthy and the rest of society. This shift, if implemented, could have far-reaching consequences for businesses of all sizes, impacting everything from investment decisions to job creation.

The Current Corporate Tax Landscape

The US corporate tax system is a complex web of rules and regulations, designed to raise revenue and influence economic activity. It impacts businesses of all sizes, from small startups to multinational corporations. Understanding the current landscape is crucial for businesses and policymakers alike.

Corporate Tax Rate and Deductions

The US corporate tax rate is currently 21%, a significant decrease from the 35% rate that existed before the Tax Cuts and Jobs Act (TCJA) of 2017. This reduction was intended to boost economic growth by making US businesses more competitive globally.

Besides the base rate, businesses can utilize various deductions and credits to reduce their tax liability. These include deductions for expenses such as salaries, rent, and depreciation, as well as credits for investment in research and development or energy-efficient technologies.

The availability and specific details of these deductions and credits can vary depending on the industry and business structure.

Impact of the Tax Cuts and Jobs Act of 2017

The TCJA significantly reshaped the corporate tax landscape. It lowered the corporate tax rate, introduced a new international tax regime, and made changes to depreciation rules and other deductions. The act aimed to stimulate economic growth by reducing the tax burden on corporations and encouraging investment.While the TCJA did lead to a decrease in corporate tax revenue, its impact on economic growth is still debated.

Some argue that the lower tax rate spurred investment and job creation, while others contend that the benefits were limited and primarily benefited shareholders. The long-term economic effects of the TCJA are still unfolding and require further analysis.

Arguments for and Against the Current System

Proponents of the current system argue that it promotes economic growth by incentivizing businesses to invest and expand. They also point to the fact that the US corporate tax rate is now more competitive with other developed countries, making US businesses more attractive to foreign investors.

Opponents argue that the current system is unfair, as it allows corporations to avoid paying taxes through loopholes and deductions. They also argue that the TCJA disproportionately benefited wealthy shareholders and did little to address income inequality. The debate over the current system is likely to continue as policymakers grapple with balancing the need for revenue with the desire to promote economic growth and fairness.

Proposed Changes to Corporate Taxation

Democrats have proposed significant changes to the way corporations are taxed in the United States, aiming to increase revenue, address income inequality, and encourage responsible corporate behavior. These proposals have sparked debate, with supporters arguing for greater fairness and accountability, while opponents express concerns about potential economic consequences.

Key Proposals

The Democrats’ proposed changes to corporate taxation encompass several key areas, including:

- Raising the Corporate Tax Rate:A central proposal is to increase the federal corporate tax rate from the current 21% to a higher level, potentially 25% or even 28%. This would directly increase tax revenue from corporations, which could be used to fund social programs or reduce the federal deficit.

- Closing Tax Loopholes:Democrats aim to close loopholes and deductions that allow corporations to avoid paying taxes, such as deductions for executive compensation and interest expenses. By eliminating these loopholes, the government could generate more revenue and ensure that corporations pay their fair share.

Democrats are pushing for a major overhaul of how corporations are taxed, aiming to shift the burden away from individual taxpayers and onto large businesses. This is a complex issue with far-reaching implications, and it’s interesting to see how it aligns with the current political climate in Europe, where tensions are running high between the EU and the UK.

Will Breton’s final salvo rock von der Leyen’s boat even further , or will it be a mere ripple in the grand scheme of things? Only time will tell how these developments will ultimately affect the global economic landscape, and how they will shape the future of corporate taxation.

- Minimum Corporate Tax:Some proposals call for a minimum corporate tax, requiring corporations to pay a certain percentage of their profits in taxes, regardless of their reported income. This would prevent corporations from using accounting strategies to minimize their tax liability.

- Taxing Corporate Stock Buybacks:Democrats propose taxing corporate stock buybacks, which are purchases by a company of its own stock. This is seen as a way to discourage companies from using profits to boost share prices instead of investing in their businesses or paying employees higher wages.

Rationale and Potential Impacts

The rationale behind these proposals centers around the belief that corporations are not paying their fair share of taxes, contributing to income inequality and hindering investment in public goods.

- Increased Tax Revenue:Higher corporate tax rates and closing loopholes would generate more tax revenue, which could be used to fund essential services, such as education, healthcare, and infrastructure, or to reduce the national debt.

- Addressing Income Inequality:By requiring corporations to pay more in taxes, the government could redirect resources towards programs that benefit lower-income individuals and families, helping to address income inequality.

- Promoting Responsible Corporate Behavior:Taxing stock buybacks and closing loopholes could incentivize corporations to invest in their businesses, pay employees higher wages, and engage in more socially responsible practices.

- Economic Impacts:The potential economic impacts of these proposals are debated. Supporters argue that they would stimulate economic growth by increasing government revenue for investment and creating a fairer playing field for businesses. Opponents argue that higher taxes could discourage investment, lead to job losses, and harm economic competitiveness.

The Democrats’ proposed overhaul of corporate tax structures could have a significant impact on the economy, potentially affecting everything from the price of goods to the popularity of new ventures like NFL prop bets. While the potential changes are still being debated, one thing is certain: the way we think about corporate taxation is about to undergo a major shift, with ripple effects that could be felt across various sectors.

Comparison with the Current System

The proposed changes represent a significant departure from the current corporate tax system. The current system, enacted in 2017, lowered the corporate tax rate to 21% and included various deductions and loopholes. Critics argue that this system has led to a decrease in corporate tax revenue and has benefited large corporations at the expense of smaller businesses and individuals.The proposed changes aim to reverse these trends by increasing tax revenue, closing loopholes, and encouraging corporations to engage in more responsible practices.

However, the economic and social impacts of these changes remain uncertain and subject to ongoing debate.

Impact of Proposed Changes on Corporations: Democrats Eye A Major Shift In How Corporations Are Taxed

The proposed changes to corporate taxation are expected to have a significant impact on corporations of all sizes, particularly those operating in the United States and internationally. These changes aim to simplify the tax code, promote fairness, and encourage investment and job creation.

However, the impact of these changes on different types of corporations can vary significantly, leading to both opportunities and challenges.

Impact on Small Businesses

Small businesses, often the backbone of the US economy, are likely to experience a mixed bag of effects from the proposed changes. While the simplification of the tax code could reduce compliance costs and administrative burdens, the changes may also lead to higher effective tax rates for some small businesses, particularly those with limited deductions or credits.

The impact on profitability and investment will depend on the specific industry and business model.

Impact on Large Corporations

Large corporations, with their complex financial structures and international operations, are likely to face more significant adjustments under the proposed changes. The introduction of a minimum tax on global intangible low-taxed income (GILTI) could increase tax liabilities for multinational corporations that have shifted profits to low-tax jurisdictions.

However, the proposed changes may also provide incentives for corporations to invest in domestic operations and create jobs in the United States.

Impact on Multinational Corporations

Multinational corporations, with their global reach and complex tax structures, are likely to be most affected by the proposed changes. The GILTI tax, which targets profits earned overseas, could significantly impact the profitability of multinational corporations. The changes may also lead to increased scrutiny of transfer pricing practices, potentially impacting the allocation of profits among different subsidiaries.

These changes are intended to prevent multinational corporations from shifting profits to low-tax jurisdictions, encouraging them to invest and create jobs in the United States.

The Democrats are proposing a major shift in how corporations are taxed, aiming to close loopholes and increase revenue. While this debate heats up, a different kind of drama is unfolding on reality TV: 90 Day Fiancé’s Big Ed is engaged to a fan he met at a signing! Read more about this unexpected engagement.

It seems that even amidst serious political discussions, love can still find a way! Back to the corporate tax debate, it’ll be interesting to see how this plays out and what impact it has on the economy.

Impact of Proposed Changes on the Economy

The potential economic effects of proposed changes to corporate taxation are multifaceted and far-reaching, impacting various aspects of the economy, including GDP growth, inflation, and unemployment. These changes also have implications for government revenue and spending, as well as the distribution of wealth and income across different segments of society.

Impact on GDP Growth

The impact of proposed changes on GDP growth depends on the specific nature of the changes. For example, lowering corporate tax rates could potentially stimulate investment and economic activity, leading to higher GDP growth. Conversely, increasing corporate taxes could discourage investment and slow down economic growth.

The relationship between corporate tax rates and GDP growth is complex and can be influenced by various factors, including the overall economic environment, the level of government spending, and the availability of credit.

Impact on Inflation

The impact of proposed changes on inflation is also dependent on the specific nature of the changes. Lowering corporate tax rates could lead to increased corporate profits, which could be passed on to consumers in the form of higher prices, leading to inflation.

Conversely, increasing corporate taxes could lead to higher prices for consumers, as corporations pass on the cost of higher taxes to consumers.

However, the impact of corporate tax changes on inflation is likely to be relatively small compared to other factors, such as changes in energy prices, wages, and interest rates.

Impact on Unemployment

The impact of proposed changes on unemployment is also uncertain and depends on the specific nature of the changes. Lowering corporate tax rates could lead to increased investment and job creation, reducing unemployment. Conversely, increasing corporate taxes could lead to job losses as businesses reduce their operations to offset the higher tax burden.

The relationship between corporate tax rates and unemployment is complex and can be influenced by various factors, including the overall economic environment, the level of government spending, and the availability of credit.

Impact on Government Revenue and Spending

Proposed changes to corporate taxation can significantly impact government revenue and spending. Lowering corporate tax rates could lead to a decrease in government revenue, potentially necessitating cuts in government spending or an increase in other taxes. Conversely, increasing corporate taxes could lead to an increase in government revenue, potentially allowing for increased government spending or a reduction in other taxes.

The impact of corporate tax changes on government revenue and spending is dependent on the specific nature of the changes, the overall economic environment, and the government’s fiscal policy.

Distributional Effects of Proposed Changes

Proposed changes to corporate taxation can have significant distributional effects, impacting different income groups and sectors of the economy. Lowering corporate tax rates could benefit shareholders and high-income earners, while increasing corporate taxes could disproportionately impact low- and middle-income earners.

The impact of corporate tax changes on income inequality is complex and can be influenced by various factors, including the overall economic environment, the level of government spending, and the availability of credit.

Political and Social Implications

The proposed changes to corporate taxation are likely to have significant political and social implications. These changes could lead to heated partisan debates and potential gridlock in Congress, while also impacting income inequality and social mobility.

Political Implications

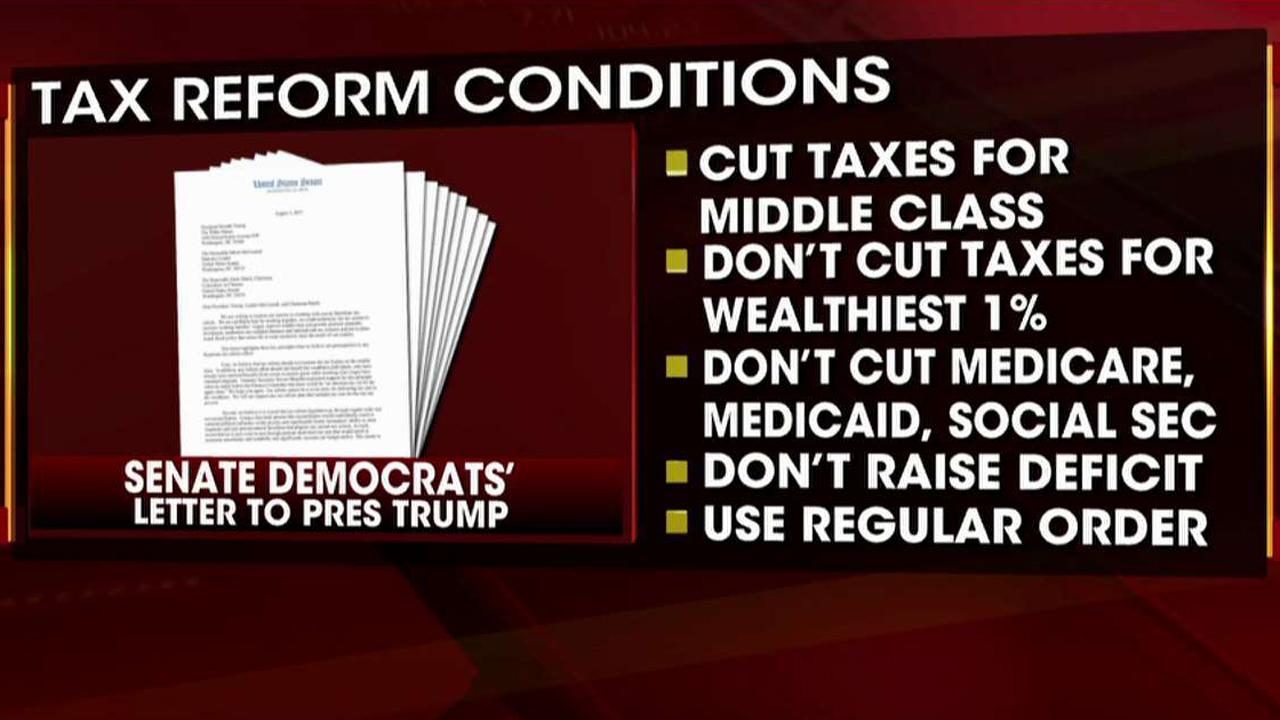

The proposed changes to corporate taxation are likely to be met with strong opposition from Republicans, who generally favor lower taxes for corporations. Democrats, on the other hand, are likely to support the changes, arguing that they will help to reduce income inequality and promote social mobility.

The potential for partisan gridlock is high, as both parties have strong stances on the issue. This could lead to delays in the implementation of the proposed changes, or even prevent them from being enacted altogether.

Social Implications, Democrats eye a major shift in how corporations are taxed

The proposed changes to corporate taxation could have a significant impact on income inequality and social mobility. Proponents of the changes argue that they will help to reduce income inequality by ensuring that corporations pay their fair share of taxes.

They also argue that the changes will promote social mobility by providing more resources for education and job training programs.Opponents of the changes argue that they will harm the economy by discouraging investment and job creation. They also argue that the changes will lead to higher prices for consumers.

Challenges and Opportunities for Policymakers

Policymakers face a number of challenges in implementing the proposed changes to corporate taxation. One challenge is to ensure that the changes are implemented in a way that is fair and equitable. Another challenge is to ensure that the changes do not harm the economy.Policymakers also have a number of opportunities to use the proposed changes to address important social and economic issues.

For example, they could use the revenue generated by the changes to fund programs that promote education, job training, and affordable healthcare. They could also use the changes to incentivize corporations to invest in sustainable practices.