How a Last-Minute Lobbying Blitz Watered Down a Climate Bill Tax

How a last minute lobbying blitz watered down a climate bill tax – How a last-minute lobbying blitz watered down a climate bill tax takes center stage in a story of political influence and environmental compromise. This recent event highlights the power of well-funded lobbyists to shape legislation, even when it comes to issues as critical as climate change.

The bill, initially designed to incentivize sustainable practices and curb emissions, faced fierce opposition from powerful industries that stood to lose from the proposed tax provisions.

The lobbying campaign involved a sophisticated strategy of public relations, political pressure, and targeted messaging. Lobbyists argued that the tax would harm the economy, leading to job losses and higher energy costs for consumers. This narrative resonated with some politicians and segments of the public, ultimately leading to significant concessions in the bill’s final version.

The Climate Bill and its Tax Provisions

The climate bill, aiming to curb greenhouse gas emissions and combat climate change, included a range of tax provisions designed to incentivize environmentally friendly practices and discourage carbon-intensive activities. These provisions were intended to play a significant role in achieving the bill’s overall goals.

Tax Provisions in the Climate Bill

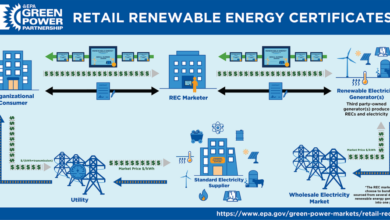

The climate bill’s tax provisions aimed to promote the adoption of renewable energy sources, enhance energy efficiency, and reduce reliance on fossil fuels.

- Carbon Tax:A carbon tax was levied on the emissions of fossil fuels, such as coal, oil, and natural gas, increasing the cost of using these fuels and encouraging a shift towards cleaner alternatives. The tax was designed to be revenue-neutral, meaning that the revenue generated from the tax would be used to offset other taxes or fund climate-related initiatives.

It’s frustrating to see how a last minute lobbying blitz can water down a climate bill tax, especially when it feels like we’re all in this together. Sometimes, it’s nice to escape the complexities of the world and treat yourself to a delicious meal at a place like the Idle Rocks, Cornwall’s best kept culinary secret , where the focus is on fresh, local ingredients and a relaxed atmosphere.

But the reality is, we can’t just ignore the impact of these lobbying efforts on our future. It’s a constant reminder that we need to stay informed and keep pushing for change.

- Tax Credits for Renewable Energy:The bill provided tax credits for the installation and operation of renewable energy sources, including solar, wind, geothermal, and hydropower. These credits were intended to make renewable energy more affordable and encourage investment in these technologies.

- Tax Deductions for Energy Efficiency Improvements:The bill offered tax deductions for businesses and individuals who made energy efficiency improvements to their buildings, homes, and equipment. These deductions aimed to reduce energy consumption and lower greenhouse gas emissions.

- Tax Incentives for Electric Vehicles:The bill included tax incentives for the purchase of electric vehicles, promoting the adoption of these zero-emission vehicles and reducing reliance on gasoline-powered cars.

The Lobbying Blitz

The eleventh hour lobbying campaign against the climate bill’s tax provisions was a fierce battle fought by powerful industry groups determined to protect their interests. This last-minute effort involved a complex web of tactics, arguments, and political maneuvering, leaving a lasting impact on the final legislation.

It’s frustrating to see how a last-minute lobbying blitz watered down a climate bill tax, leaving us with a weaker commitment to tackling climate change. Meanwhile, the NHS is exploring innovative solutions like using drones to fly blood samples around London to avoid traffic, as reported in this article.

While this initiative is promising, it highlights the stark contrast between our approach to public health and our inaction on climate change. We need to prioritize the planet’s health just as diligently as we do our own.

Key Players Involved in the Lobbying Efforts

The lobbying campaign involved a diverse cast of players, each with their own vested interests and strategies.

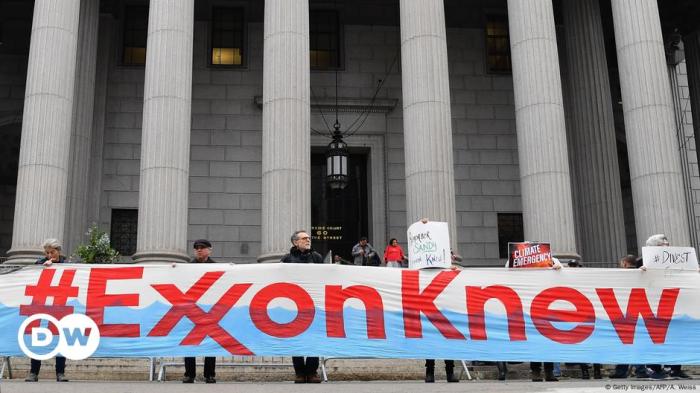

- Fossil Fuel Industry:Major oil, gas, and coal companies, including ExxonMobil, Chevron, and Peabody Energy, played a leading role in the lobbying effort. These companies heavily invested in lobbying efforts to weaken the bill’s tax provisions, fearing potential financial losses and regulatory burdens.

- Energy Trade Associations:Groups like the American Petroleum Institute (API) and the National Mining Association coordinated lobbying efforts on behalf of their member companies, amplifying the industry’s voice and influencing policymakers.

- Conservative Think Tanks:Organizations like the Heritage Foundation and the Cato Institute, known for their libertarian and free-market stances, provided intellectual and rhetorical support for the lobbying campaign, arguing against government intervention in the energy sector.

Arguments and Strategies Used by Lobbyists

Lobbyists employed a variety of arguments and strategies to influence the debate surrounding the climate bill’s tax provisions.

- Economic Concerns:Lobbyists argued that the tax provisions would harm the economy, leading to job losses and higher energy prices. They emphasized the importance of maintaining energy affordability and protecting the competitiveness of American businesses.

- Job Losses:Lobbyists claimed that the bill’s tax provisions would result in significant job losses in the energy sector, particularly in coal-producing regions. They used this argument to appeal to lawmakers concerned about local economic impacts.

- Unintended Consequences:Lobbyists argued that the bill’s tax provisions could lead to unintended consequences, such as increased reliance on foreign energy sources or a decline in domestic energy production.

- Public Relations Campaign:Lobbyists launched a public relations campaign to sway public opinion and generate political pressure on lawmakers. This involved releasing reports, organizing rallies, and spreading messages through social media and traditional media outlets.

Impact of the Lobbying Campaign

The eleventh-hour lobbying campaign had a significant impact on the final legislation.

- Weakened Tax Provisions:The lobbying efforts successfully weakened the tax provisions, leading to lower taxes on fossil fuel companies and a reduced impact on their operations. This outcome demonstrated the power of lobbying in shaping legislation.

- Public Opinion:The lobbying campaign, combined with a well-coordinated media strategy, successfully influenced public opinion on the climate bill. This shift in public perception made it more challenging for lawmakers to support strong climate policies.

- Political Pressure:The lobbying campaign created significant political pressure on lawmakers, leading to a more cautious approach to climate policy. This pressure stemmed from the fear of economic repercussions and potential electoral backlash.

The Impact of the Watering Down: How A Last Minute Lobbying Blitz Watered Down A Climate Bill Tax

The lobbying blitz succeeded in significantly weakening the climate bill’s tax provisions, potentially hindering its effectiveness in achieving climate change mitigation goals. The changes made to the tax provisions directly impact the financial incentives for businesses and individuals to adopt clean energy technologies and reduce their carbon footprint.

Changes Made to the Tax Provisions

The lobbying efforts resulted in several key changes to the tax provisions, which were originally designed to incentivize the transition to clean energy. These changes include:

- Reduced Tax Credits:The original bill offered generous tax credits for investments in renewable energy sources like solar and wind power. These credits were significantly reduced, making it less financially attractive for businesses and individuals to invest in these technologies.

- Shorter Credit Durations:The duration of the tax credits was shortened, further reducing their long-term appeal and making it less likely for investors to commit to long-term clean energy projects.

- Exemptions for Fossil Fuel Industries:The lobbying efforts resulted in exemptions for the fossil fuel industry from certain tax provisions, undermining the bill’s overall goal of reducing carbon emissions.

Potential Consequences of the Changes

The changes made to the tax provisions are likely to have significant consequences for the effectiveness of the climate bill. These consequences include:

- Slower Adoption of Clean Energy Technologies:The reduced tax credits and shorter credit durations will make it less financially attractive for businesses and individuals to invest in renewable energy technologies, potentially slowing down the adoption of clean energy solutions.

- Continued Reliance on Fossil Fuels:The exemptions for the fossil fuel industry will likely lead to continued reliance on fossil fuels, hindering efforts to reduce greenhouse gas emissions and combat climate change.

- Reduced Investment in Clean Energy Research and Development:The weakened tax incentives may discourage investment in clean energy research and development, slowing down the progress towards more advanced and efficient clean energy technologies.

Comparison of Original and Watered-Down Tax Provisions

The original tax provisions were designed to create a strong economic incentive for the transition to clean energy. They offered generous tax credits for a longer duration, making it financially advantageous for businesses and individuals to invest in renewable energy technologies.

This approach was expected to significantly accelerate the adoption of clean energy and contribute to achieving ambitious climate change mitigation goals.The watered-down version of the tax provisions significantly weakens these incentives. The reduced tax credits and shorter credit durations make it less financially attractive for businesses and individuals to invest in clean energy, potentially slowing down the transition to a cleaner energy future.

It’s disheartening to see how a last-minute lobbying blitz can water down a climate bill tax, especially when it’s so crucial for our planet’s future. It reminds me of how Selena Gomez had the perfect reaction to losing an Emmy because she practiced – she still showed grace and composure even though she didn’t win.

We need to remember that even when things don’t go our way, it’s important to keep fighting for what we believe in, just like Selena did. It’s clear that this fight for a stronger climate bill tax is far from over, and we need to keep advocating for change.

The Broader Implications

The last-minute lobbying blitz that watered down the climate bill’s tax provisions has significant broader implications for climate policy and public trust. This event raises concerns about the influence of special interests on environmental legislation and the potential for undermining efforts to address climate change.

The Impact on Climate Policy

The watering down of the climate bill’s tax provisions demonstrates the influence of powerful lobbies in shaping environmental policy. This influence can lead to a weakening of regulations and a slower transition to a sustainable future. The weakened tax provisions could make it more difficult to incentivize clean energy investments and reduce emissions.

The Impact on Public Trust, How a last minute lobbying blitz watered down a climate bill tax

The lobbying effort that resulted in the weakened climate bill raises concerns about the transparency and accountability of the legislative process. The public may lose trust in the government’s commitment to addressing climate change if they perceive that special interests are unduly influencing policy decisions.

This loss of trust can hinder public support for climate action and make it more challenging to implement effective policies.

Potential Benefits and Drawbacks of the Watered-Down Climate Bill

The following table presents a balanced overview of the potential benefits and drawbacks of the watered-down climate bill:| Benefit | Drawback ||—|—|| Reduced opposition from certain industries, potentially leading to a more politically viable bill. | Weaker incentives for clean energy investments, leading to slower progress on emissions reduction.

|| Increased likelihood of the bill passing into law. | Potential for reduced public trust in the government’s commitment to climate action. || Some progress towards climate goals, even if limited. | May send a signal that climate change is not a top priority, discouraging further action.

|

“We cannot afford to let special interests derail our efforts to address climate change. We need strong policies that protect our environment and our future.”

[Prominent Figure in the Climate Change Debate]

The Future of Climate Legislation

The recent lobbying blitz that watered down the climate bill tax serves as a stark reminder of the formidable challenges facing climate legislation. While the bill’s passage was a victory, the compromises made highlight the need for more robust strategies to protect climate policies from special interest influence.

Lessons Learned from the Lobbying Effort

This lobbying effort provides valuable lessons for future climate legislation. First, it underscores the importance of early and proactive engagement with stakeholders. Building broad coalitions and anticipating potential opposition are crucial to effectively counter lobbying efforts. Second, the episode highlights the need for transparent and accountable legislative processes.

Public scrutiny and media attention can deter lobbying attempts that seek to undermine climate goals. Finally, it emphasizes the importance of developing strong public support for climate action. A well-informed and engaged public can serve as a powerful force in advocating for robust climate policies.

Strategies to Prevent Similar Lobbying Efforts

Several strategies can be employed to prevent similar lobbying efforts from undermining climate policy.

- Strengthening Lobbying Disclosure Requirements:Requiring more comprehensive and timely disclosure of lobbying activities can shed light on the influence of special interests and increase public accountability.

- Establishing Independent Oversight Committees:Creating independent committees to review and assess the impact of lobbying on climate legislation can provide an objective perspective and identify potential conflicts of interest.

- Promoting Public Education and Engagement:Educating the public about the science of climate change and the benefits of climate action can empower citizens to advocate for strong climate policies and hold their elected officials accountable.

- Building Broad Coalitions:Forming diverse coalitions that include environmental groups, businesses, labor unions, and faith-based organizations can amplify the voice of climate advocates and make it more difficult for special interests to exert undue influence.

Examples of Successful Climate Legislation

Several examples of successful climate legislation demonstrate the effectiveness of strategies to overcome lobbying pressures. The passage of the Clean Air Act in 1970, which established comprehensive air quality standards, was a result of a strong public outcry and a bipartisan coalition of lawmakers.

The Clean Power Plan, implemented under the Obama administration, was another significant step in addressing climate change, despite fierce opposition from the fossil fuel industry. The success of these initiatives underscores the importance of building public support, mobilizing diverse coalitions, and navigating legislative processes strategically.