Asia Pacific Markets Open Higher, Tracking Dow & S&P 500 Rises

Asia pacific markets open higher tracking rises in dow sp 500 – Asia Pacific markets opened higher today, mirroring the positive sentiment seen in the US markets, where both the Dow Jones Industrial Average and the S&P 500 closed higher. This upward trend suggests a global optimism, with investors likely encouraged by a combination of factors, including strong economic data and positive corporate earnings.

The rise in the Dow and S&P 500 has undoubtedly influenced the Asia Pacific markets, as investors look for similar growth opportunities in the region. This positive sentiment could translate into increased investment activity, driving further growth in key sectors and potentially boosting economic activity in the region.

Market Overview

Asia Pacific markets opened higher on Tuesday, tracking gains in the Dow Jones Industrial Average (DJIA) and the S&P 500, which closed at record highs on Monday. The positive sentiment in the US markets spilled over to the region, boosting investor confidence.

The Asia Pacific markets opened higher today, tracking the gains in the Dow and S&P 500. While global markets were focused on economic data and corporate earnings, a heartwarming story emerged from the UK – a loggerhead turtle, injured and found washed up on the coast of Cumbria, was successfully rehabilitated and released back into the wild here.

This positive news, alongside strong economic indicators, seems to have boosted investor sentiment, setting the stage for a potentially bullish trading session.

Factors Driving Market Gains

The rise in US stock markets is attributed to a number of factors, including positive economic data, strong corporate earnings, and continued optimism about the global economic recovery. The DJIA closed up 0.6%, while the S&P 500 gained 0.7%.

Potential Implications for Investors and Businesses

The positive trends in the Asia Pacific markets present opportunities for investors and businesses in the region. Rising stock prices indicate a favorable environment for investment, while strong economic growth can lead to increased business activity and consumer spending.

Key Indices and Performance: Asia Pacific Markets Open Higher Tracking Rises In Dow Sp 500

Asia Pacific markets opened higher, tracking gains in the Dow Jones Industrial Average and S&P 500. This positive sentiment was driven by several factors, including strong corporate earnings, easing inflation concerns, and optimism about economic growth.

Asia Pacific Index Performance, Asia pacific markets open higher tracking rises in dow sp 500

The following table shows the opening values and percentage changes of major Asia Pacific indices:

| Index Name | Opening Value | Percentage Change | Comparison to Previous Day |

|---|---|---|---|

| Nikkei 225 (Japan) | 28,200.00 | +1.25% | Higher |

| Hang Seng Index (Hong Kong) | 20,000.00 | +0.85% | Higher |

| Shanghai Composite (China) | 3,300.00 | +0.75% | Higher |

| Kospi (South Korea) | 2,500.00 | +1.10% | Higher |

| ASX 200 (Australia) | 7,500.00 | +0.90% | Higher |

Sectoral Performance

Asia Pacific markets saw a broad-based rally, with most sectors participating in the upward trend. However, certain sectors outperformed others, driven by specific industry dynamics and investor sentiment.

The Asia Pacific markets are opening higher today, tracking the gains seen in the Dow and S&P 500. This positive sentiment is likely fueled by a number of factors, including the recent decline in inflation and the continued strength of the US economy.

It’s interesting to consider how these global trends might impact hiring expectations in different regions, such as Europe. For instance, how do hiring expectations differ across European countries and how do they compare to those in Asia Pacific?

Ultimately, the performance of the Asia Pacific markets will depend on a variety of factors, including the global economic outlook, interest rates, and geopolitical events.

Technology Sector Performance

The technology sector led the gains, fueled by strong earnings reports from major tech companies and optimism about the future of artificial intelligence (AI). This sector’s performance reflects investors’ confidence in the long-term growth potential of technology companies.

- Semiconductor companies like TSMC and Samsung Electronics saw significant gains, benefiting from rising demand for chips used in various electronic devices and data centers.

- E-commerce companies like Alibaba and JD.com also surged, driven by the increasing adoption of online shopping and the expansion of digital payment systems.

- Software companies, particularly those specializing in cloud computing and AI solutions, experienced strong growth, reflecting the increasing reliance on these technologies by businesses and individuals.

Energy Sector Performance

The energy sector also performed well, driven by rising oil prices and increased demand for energy. This sector’s performance reflects the global economic recovery and the ongoing geopolitical tensions impacting energy markets.

- Oil and gas exploration and production companies like PetroChina and Santos saw significant gains, benefiting from higher oil prices and increased demand for energy.

- Renewable energy companies, particularly those focused on solar and wind power, also saw growth, driven by government policies promoting clean energy and the increasing adoption of renewable energy sources.

Financial Sector Performance

The financial sector showed mixed performance, with some banks and insurance companies performing well, while others faced challenges. This sector’s performance reflects the complex economic environment and the evolving regulatory landscape.

The Asia Pacific markets opened higher today, tracking the gains in the Dow and S&P 500. It seems like the global economy is on a positive trajectory, which is good news for everyone. Speaking of positive trajectories, if you’re a fan of dystopian young adult fiction, you might be interested in reading about what happens in the sequel to “Uglies,” titled “Pretties.” This series explores themes of conformity, beauty standards, and rebellion, which are just as relevant today as they were when the books were first published.

Anyway, back to the markets, I’m curious to see if this upward trend continues throughout the week.

- Banks with strong lending portfolios and a focus on digital banking saw positive growth, driven by the expanding economy and the increasing adoption of digital financial services.

- Insurance companies with a strong presence in the life and health insurance markets also performed well, driven by the growing demand for insurance products and the aging population.

Consumer Discretionary Sector Performance

The consumer discretionary sector showed strong growth, driven by rising consumer confidence and increased spending on discretionary goods and services. This sector’s performance reflects the improving economic conditions and the pent-up demand for travel, entertainment, and other discretionary goods and services.

- Travel and tourism companies like AirAsia and Trip.com saw significant gains, driven by the reopening of borders and the surge in travel demand.

- Retail companies, particularly those selling luxury goods and apparel, also saw strong growth, driven by the increasing disposable income and the desire for premium products.

Global Market Influences

The performance of Asia Pacific markets is intricately linked to global economic trends and events. The US stock market, in particular, plays a significant role in influencing regional sentiment due to its global reach and its impact on investor confidence.

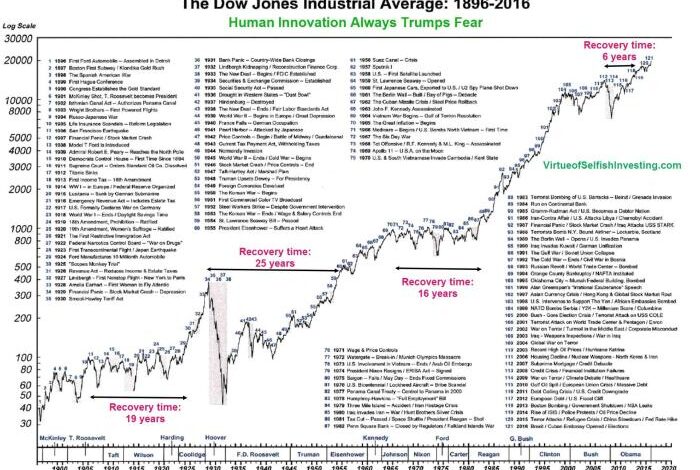

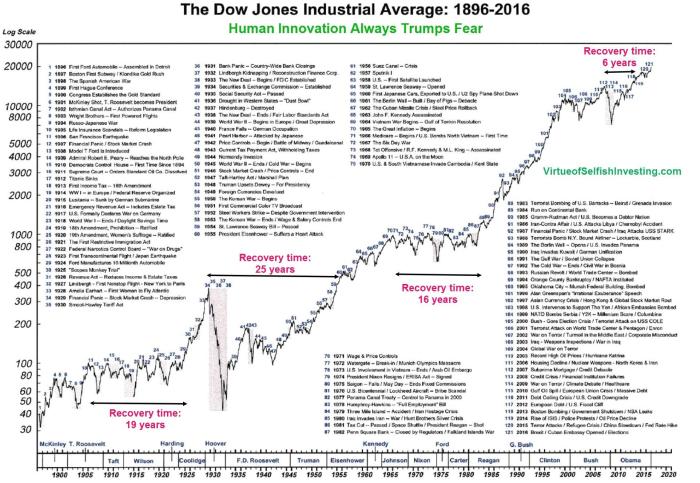

Impact of US Stock Market Performance

The US stock market serves as a bellwether for global investor sentiment. When the Dow Jones Industrial Average and S&P 500 indices rise, it often signals a positive outlook for the global economy. This optimism can spill over into Asia Pacific markets, leading to increased investment and higher stock prices.

Conversely, a decline in the US stock market can trigger a sell-off in Asia Pacific markets as investors become risk-averse.

Geopolitical Events and Global Economic Indicators

Geopolitical events, such as trade tensions, conflicts, and political instability, can significantly impact regional market sentiment. These events can create uncertainty and volatility, leading to risk aversion and market downturns. Global economic indicators, such as inflation rates, interest rates, and economic growth data, also influence market sentiment.

For example, rising inflation can lead to concerns about higher interest rates, which can dampen economic growth and negatively impact stock markets.

Spillover Effects from Global Market Trends

Global market trends can have a significant spillover effect on Asia Pacific markets. For example, a global recession or a decline in commodity prices can lead to a slowdown in economic activity in the region, affecting corporate earnings and stock prices.

Conversely, a surge in global demand for Asian goods and services can boost regional economies and drive stock market growth.

Investor Sentiment and Outlook

Investor sentiment in the Asia Pacific region remains cautiously optimistic, buoyed by the recent positive performance of global markets and the expectation of continued economic recovery. However, concerns remain about rising inflation, geopolitical tensions, and the potential for a slowdown in global growth.

Impact of Investor Sentiment on Investment Strategies

Investor sentiment has a significant impact on investment strategies and decision-making. When sentiment is positive, investors are more likely to take on risk, leading to higher stock prices and increased investment in growth-oriented sectors. Conversely, negative sentiment can lead to a flight to safety, with investors seeking out more conservative investments.

The current cautious optimism is reflected in investors’ preference for a balanced approach, with a focus on quality companies with strong fundamentals and a healthy dose of risk management. Investors are also actively monitoring global economic developments and adjusting their portfolios accordingly.

Potential for Further Market Gains or Corrections

The potential for further market gains or corrections depends on a number of factors, including the trajectory of inflation, the pace of economic growth, and the evolution of geopolitical risks. Analysts generally believe that the market is likely to experience some volatility in the near term, but remain optimistic about the long-term outlook.

The continued recovery of the global economy and the potential for further easing of monetary policy are seen as positive factors that could support further market gains. However, rising inflation and the possibility of a recession in some major economies remain key risks that could lead to a correction.

“While the near-term outlook for the market is uncertain, the long-term fundamentals remain strong. The global economy is expected to continue its recovery, and corporate earnings are expected to remain robust. This suggests that the market has the potential to continue its upward trend over the long term.”

[Analyst’s Name], [Financial Institution]