Skype Founders VC Firm Raises $1.24 Billion for European Tech

Skype founders vc firm raises 1 24 billion to back european tech startups – Skype Founders’ VC firm raises $1.24 billion to back European tech startups, marking a significant investment in the European tech ecosystem. This substantial fund, managed by the firm established by the founders of the iconic communication platform Skype, is set to fuel the growth of promising European startups.

This investment reflects the confidence in the potential of European tech, and it’s sure to have a ripple effect on the industry.

The founders of Skype, with their deep understanding of the tech industry, particularly in communication and collaboration technologies, are well-positioned to identify and support the next generation of European tech innovators. The fund’s focus on European startups highlights the region’s burgeoning tech scene, which has been attracting global attention for its innovation and talent.

The Skype Founders’ New Venture Capital Firm

The founders of Skype, Niklas Zennström and Janus Friis, have announced the launch of a new venture capital firm, Atomico, with a massive $1.24 billion fund dedicated to backing European tech startups. This move signifies their commitment to fostering innovation and supporting the growth of the European tech ecosystem.

The History of Skype and its Founders

Skype, the revolutionary voice and video communication platform, emerged from the vision and entrepreneurial spirit of Niklas Zennström and Janus Friis. Their journey began in 2003 when they co-founded the company, initially focused on providing peer-to-peer file sharing services. Recognizing the potential of internet-based communication, they pivoted to develop Skype, a software application that revolutionized communication by offering free voice and video calls over the internet.

Skype’s rapid adoption and global success propelled it to become a leading player in the communication industry. The company was acquired by eBay in 2005 for a staggering $2.6 billion, showcasing the immense value created by Zennström and Friis. However, their entrepreneurial journey didn’t end there.

In 2009, Skype was acquired by Microsoft for $8.5 billion, further solidifying their status as tech visionaries.

The Founders’ Experience and Expertise in the Tech Industry

Beyond their success with Skype, Zennström and Friis have extensive experience in the tech industry. They have a deep understanding of the challenges and opportunities presented by the rapidly evolving technological landscape. Their expertise spans areas such as communication technologies, software development, and building successful businesses in the digital world.

Their entrepreneurial journey has provided them with invaluable insights into the key ingredients for success in the tech industry, including:

- Identifying emerging trends and opportunities.

- Building and scaling innovative products and services.

- Attracting and nurturing talented teams.

- Navigating the complexities of the tech market.

The Motivation Behind the Venture Capital Firm

The founders’ decision to establish a venture capital firm focused on European tech startups stems from their belief in the potential of the region’s innovative ecosystem. They recognize the wealth of talent, entrepreneurial spirit, and technological advancements emerging from European startups.

Their motivation is driven by several factors:

- Supporting the European tech ecosystem:They aim to empower European entrepreneurs and provide them with the resources and guidance needed to build successful companies.

- Investing in the future of technology:They believe that Europe has the potential to become a global leader in technology, and they want to be a part of that journey.

- Leveraging their experience and expertise:They want to use their knowledge and experience to guide and mentor the next generation of tech entrepreneurs.

The Significance of the $1.24 Billion Fund

The Skype founders’ new venture capital firm’s $1.24 billion fund is a significant development for the European tech ecosystem. This substantial investment signifies a strong vote of confidence in the potential of European startups and could have a profound impact on the region’s innovation landscape.

Fund Size Compared to Other Venture Capital Firms in Europe

The $1.24 billion fund is a considerable amount, even by the standards of prominent venture capital firms operating in Europe. It is important to understand how this fund size compares to other major players in the European venture capital scene.

- Atomico:Founded by Skype co-founder Niklas Zennström, Atomico has raised a total of $2.3 billion across its various funds.

- Index Ventures:Another prominent European venture capital firm, Index Ventures has raised over $4.5 billion across its funds, focusing on early-stage investments in technology companies.

- Accel:With a global presence, Accel has a strong track record in Europe, having invested in companies like Spotify and Wise. The firm has raised over $10 billion across its funds.

While the Skype founders’ fund is smaller than some of these established players, it still represents a significant commitment to European tech. This large fund size positions the firm as a major player in the European venture capital landscape, allowing it to compete with established firms and attract promising startups.

The Skype founders’ VC firm raising €1.24 billion to back European tech startups is a huge boost for the region’s innovation ecosystem. This investment comes at a time when the EU is facing internal political turmoil, as seen in the recent debate over the Digital Markets Act.

It will be interesting to see how this investment landscape will be impacted by the ongoing political drama, especially considering the potential implications of the Digital Markets Act. Will Breton’s final salvo rock von der Leyen’s boat even further?

Read more here. Ultimately, this investment signals a strong belief in the future of European tech, and it will be fascinating to see how these startups leverage this funding to drive innovation and growth.

Impact on Growth and Development of European Tech Startups

This significant investment could have a substantial impact on the growth and development of European tech startups.

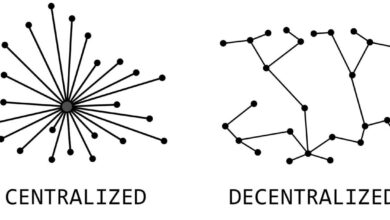

- Increased Funding Availability:The large fund size provides significant capital for startups seeking funding, potentially leading to increased competition for investment and driving up valuations. This could encourage more startups to emerge and scale their operations.

- Enhanced Startup Ecosystem:The founders’ expertise and network could contribute to a more robust and interconnected European tech ecosystem. Their experience in building successful global tech companies can provide valuable mentorship and guidance to startups, accelerating their growth and success.

- Attracting Talent:The presence of a large venture capital firm with a strong track record can attract top talent to European tech hubs, further strengthening the region’s innovation capacity.

This influx of capital can also lead to increased innovation and competition within the European tech sector, fostering a more dynamic and entrepreneurial environment.

It’s great to see the Skype founders’ VC firm pouring resources into European tech startups, but it’s a stark reminder that the world faces real challenges. The devastating impact of Typhoon Yagi in Myanmar, with the death toll doubling to 226 as reported here , underscores the need for global collaboration and support.

Hopefully, the investments in European tech will lead to innovations that can help address such crises in the future.

Focus on European Tech Startups: Skype Founders Vc Firm Raises 1 24 Billion To Back European Tech Startups

The Skype founders’ new venture capital firm is targeting a diverse range of sectors within European tech, recognizing the region’s burgeoning innovation ecosystem. Their focus on European startups stems from a belief in the region’s potential to produce groundbreaking companies and technologies that can compete on a global scale.

The Targeted Sectors, Skype founders vc firm raises 1 24 billion to back european tech startups

The venture capital firm is specifically interested in investing in European tech startups across various sectors, including:

- Fintech:The European fintech landscape is experiencing rapid growth, with companies developing innovative solutions for payments, lending, and investment management. The firm is particularly interested in startups leveraging artificial intelligence (AI) and blockchain technology to disrupt traditional financial services.

- Healthtech:Europe is home to a thriving healthtech ecosystem, with startups developing innovative solutions for healthcare delivery, diagnostics, and personalized medicine. The firm is keen on investing in startups leveraging AI, big data, and wearable technology to improve patient outcomes and healthcare efficiency.

The Skype founders’ VC firm, raising a whopping $1.24 billion to invest in European tech startups, is showing a clear interest in innovative solutions. This is a trend we’re seeing across the board, with even the NHS embracing cutting-edge technology like drones to streamline healthcare.

A new trial will see drones used to transport blood samples around London, avoiding traffic delays and ensuring faster delivery. This focus on efficiency and innovation aligns perfectly with the VC firm’s investment strategy, suggesting a bright future for European tech startups.

- Sustainability Tech:The focus on sustainability is driving innovation in Europe, with startups developing solutions for clean energy, sustainable agriculture, and resource management. The firm is interested in investing in startups leveraging technology to address environmental challenges and promote a more sustainable future.

- Artificial Intelligence (AI):Europe is a leader in AI research and development, with startups developing innovative applications in various sectors, including healthcare, finance, and transportation. The firm is interested in investing in startups leveraging AI to create new products and services that can transform industries.

The Rationale for Focusing on European Tech Startups

The rationale behind the focus on European tech startups is driven by several key factors:

- Strong Talent Pool:Europe boasts a highly skilled workforce with a strong foundation in science, technology, engineering, and mathematics (STEM). This talent pool provides a fertile ground for innovation and the development of cutting-edge technologies.

- Government Support:European governments are actively promoting innovation and entrepreneurship through various initiatives, including funding programs, tax incentives, and regulatory frameworks. This supportive environment fosters a thriving startup ecosystem.

- Growing Market:The European Union is the world’s largest single market, providing a vast customer base for tech startups. This market access allows European startups to scale their businesses rapidly and reach a global audience.

- Innovation Hubs:Europe is home to several thriving tech hubs, such as London, Berlin, Amsterdam, and Stockholm, which provide a conducive environment for startups to connect with investors, mentors, and other entrepreneurs.

Challenges and Opportunities Faced by European Tech Startups

European tech startups face several challenges, including:

- Funding:While venture capital investment in Europe has increased significantly in recent years, it still lags behind the United States. This can make it difficult for European startups to secure the funding they need to grow and scale their businesses.

- Talent Competition:The global tech industry is facing a talent shortage, and European startups are competing with companies in the United States and Asia for skilled workers. This can make it challenging to attract and retain top talent.

- Competition:The European tech market is becoming increasingly competitive, with established companies and startups from other regions vying for market share. European startups need to differentiate themselves and offer unique value propositions to succeed.

Despite these challenges, European tech startups have significant opportunities:

- Growing Market Demand:The demand for tech solutions is increasing across all sectors in Europe, creating a favorable market environment for startups.

- Government Support:European governments are increasingly supporting tech startups through funding programs, tax incentives, and regulatory frameworks.

- Strong Ecosystem:Europe has a strong ecosystem of accelerators, incubators, and other support organizations that provide guidance and resources to startups.

Investment Strategy and Criteria

The Skype founders’ new venture capital firm, with its substantial $1.24 billion fund, has a clear investment strategy focused on identifying and nurturing promising European tech startups. This strategy is built upon a rigorous selection process and a comprehensive support system designed to help portfolio companies achieve their full potential.

Selection Criteria

The firm employs a multi-faceted approach to evaluating potential investments. The key criteria include:

- Market Size and Growth Potential:The firm prioritizes startups operating in large and rapidly growing markets with significant potential for disruption and scalability. For example, they might be interested in companies developing solutions for the burgeoning e-commerce sector, which is experiencing significant growth in Europe.

- Team Expertise and Execution Capabilities:The firm seeks out startups with strong founding teams possessing deep domain expertise, proven track records, and a strong understanding of the market they are targeting. The firm believes that a capable team is crucial for successful execution and navigating the challenges of building a successful business.

- Innovation Potential and Technological Differentiation:The firm is particularly drawn to startups with innovative technologies or business models that offer a distinct competitive advantage in their respective markets. They look for companies that are pushing boundaries and developing solutions that address unmet needs or solve existing problems in novel ways.

- Scalability and Go-to-Market Strategy:The firm assesses the potential for startups to scale their operations and expand their reach to new markets. A well-defined go-to-market strategy, including plans for customer acquisition, distribution, and marketing, is essential for long-term success.

Support for Portfolio Companies

The firm is committed to providing its portfolio companies with the resources and support they need to succeed. This includes:

- Mentorship and Guidance:The firm leverages the experience and expertise of its founders and partners to provide mentorship and guidance to portfolio companies. This includes strategic advice, operational support, and connections to relevant industry experts.

- Networking Opportunities:The firm facilitates connections between portfolio companies and potential investors, customers, partners, and other key stakeholders. This access to a broader network can be invaluable for startups seeking to expand their reach and build strategic partnerships.

- Financial Resources and Expertise:The firm provides not only capital but also access to financial expertise, including financial modeling, fundraising strategies, and investor relations support. This can help startups navigate the complexities of managing their finances and securing future funding rounds.

Impact on the European Tech Landscape

The Skype founders’ new venture capital firm’s massive $1.24 billion fund is poised to have a significant impact on the European tech landscape. This substantial investment will not only boost funding opportunities for startups but also foster a more robust and mature tech ecosystem in Europe.

Increased Funding Opportunities

The influx of capital will create a more competitive funding environment for European tech startups. This increased competition will lead to:

- Higher valuations:Startups with strong potential will be able to secure higher valuations, attracting more talent and resources.

- More funding rounds:Startups will have more opportunities to raise funds at various stages of their development, from seed to Series A and beyond.

- Greater access to capital:This fund will provide startups with a wider range of investors to choose from, increasing their chances of securing funding.

Growth and Maturity of the European Tech Ecosystem

The fund’s investment strategy, focused on European tech startups, will contribute to the growth and maturity of the European tech ecosystem in several ways:

- Attracting global talent:The increased funding will enable European startups to attract top talent from around the world, further strengthening their competitive edge.

- Encouraging innovation:The availability of capital will empower startups to invest in research and development, fostering innovation and driving technological advancements.

- Building a strong startup culture:The success of startups funded by this venture capital firm will serve as a catalyst for the development of a thriving startup culture in Europe, inspiring entrepreneurship and fostering a more supportive environment for tech businesses.

Long-Term Implications for Innovation, Job Creation, and Economic Development

This investment is likely to have a profound impact on innovation, job creation, and economic development in Europe in the long term:

- Boosting innovation:By supporting innovative startups, the fund will contribute to the development of new technologies and products, driving innovation across various sectors.

- Creating new jobs:As startups grow and scale, they will create new jobs in the tech sector and related industries, contributing to economic growth and employment opportunities.

- Strengthening the European economy:The success of these startups will enhance Europe’s competitiveness in the global tech market, strengthening its economic position and fostering sustainable growth.