Will CrowdStrike Extend Its Earnings Streak?

Will CrowdStrike extend its streak of topping earnings views? This question has been on the minds of investors and cybersecurity enthusiasts alike, as the company continues to dominate the market with its innovative solutions. CrowdStrike’s recent performance has been nothing short of stellar, with impressive revenue growth, profitability, and earnings per share.

The company’s success can be attributed to several factors, including the increasing demand for cybersecurity solutions in a world increasingly reliant on technology, effective product innovation, and strategic acquisitions.

However, as CrowdStrike continues to grow, it faces new challenges and opportunities. Analysts are closely watching the company’s growth strategy, including its plans for product development, market expansion, and partnerships. The macroeconomic environment, including inflation and geopolitical uncertainty, could also impact CrowdStrike’s future performance.

CrowdStrike’s Recent Performance

CrowdStrike, a leading provider of cloud-native cybersecurity solutions, has consistently exceeded earnings expectations, demonstrating strong financial performance and solidifying its position in the rapidly growing cybersecurity market.

Financial Performance Highlights

CrowdStrike’s recent financial performance has been impressive, driven by a combination of factors, including robust demand for its cybersecurity solutions, successful product innovation, and strategic acquisitions.

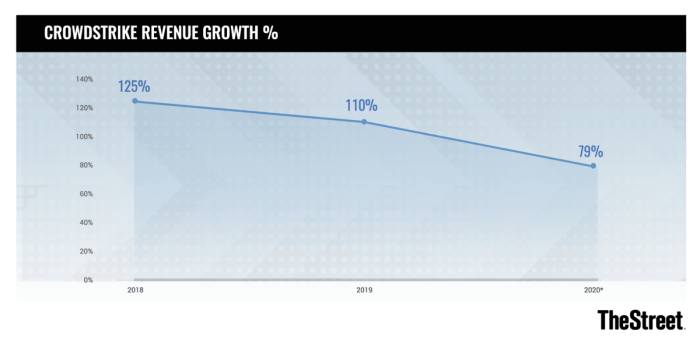

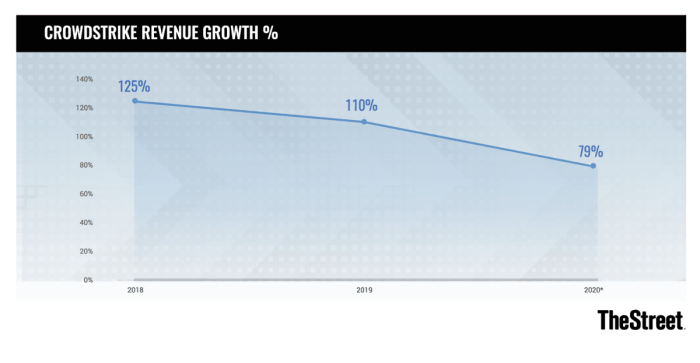

- Revenue Growth:CrowdStrike has consistently delivered strong revenue growth. In the second quarter of 2023, the company reported a 54% year-over-year increase in revenue, reaching $637.8 million. This sustained growth reflects the increasing adoption of its cloud-based platform and the growing demand for cybersecurity solutions across various industries.

It’s going to be interesting to see if CrowdStrike can keep its momentum going and extend its streak of exceeding earnings expectations. While the company’s focus is on cybersecurity, it’s hard to ignore the geopolitical tensions unfolding in the Middle East, where Israeli outpost settlers are rapidly seizing West Bank land.

This kind of instability can impact global markets and ultimately affect even tech companies like CrowdStrike, so it’ll be a factor to watch as we analyze their financial performance.

- Profitability:CrowdStrike has demonstrated impressive profitability, with its non-GAAP operating margin expanding to 29% in the second quarter of 2023. This improvement is attributed to the company’s efficient operating model and its ability to scale its business effectively.

- Earnings per Share (EPS):CrowdStrike’s earnings per share have also been consistently exceeding analysts’ expectations. In the second quarter of 2023, the company reported adjusted earnings per share of $0.62, surpassing analysts’ estimates by $0.12. This strong earnings performance reflects the company’s ability to drive revenue growth and manage expenses effectively.

Factors Contributing to CrowdStrike’s Success

Several factors have contributed to CrowdStrike’s remarkable financial performance.

- Market Demand for Cybersecurity Solutions:The cybersecurity market is experiencing rapid growth, driven by the increasing frequency and sophistication of cyberattacks. This growing demand has created a favorable environment for CrowdStrike, as organizations prioritize robust cybersecurity solutions to protect their critical data and systems.

- Effective Product Innovation:CrowdStrike has consistently invested in research and development, leading to the development of innovative cybersecurity solutions that meet the evolving needs of its customers. Its cloud-native platform, Falcon, offers a comprehensive suite of security capabilities, including endpoint protection, threat intelligence, and incident response.

Will CrowdStrike continue its impressive run of exceeding earnings expectations? It’s a question on the minds of many investors, and the answer could hinge on their ability to navigate the evolving cybersecurity landscape. It’s a challenge that echoes the pressure on England’s stand-in captain, Harry Brook, as he leads the team against Australia in a crucial series, a situation that legendary cricketer Nasser Hussain believes will test Brook’s leadership skills according to this recent article.

Both CrowdStrike and Brook face tough tests, but their success could be defined by their ability to adapt and overcome.

- Strategic Acquisitions:CrowdStrike has strategically acquired companies that complement its existing product portfolio and expand its reach in the cybersecurity market. These acquisitions have allowed the company to enhance its capabilities, enter new markets, and strengthen its competitive position.

Comparison with Competitors

CrowdStrike is competing with several other major players in the cybersecurity market, including companies like Palo Alto Networks, Fortinet, and Cisco.

- Strengths:CrowdStrike’s key strengths include its cloud-native platform, comprehensive product portfolio, strong brand reputation, and rapid innovation. The company’s focus on cloud security and its ability to adapt to the evolving threat landscape have positioned it as a leader in the market.

- Weaknesses:One potential weakness for CrowdStrike is its reliance on recurring subscription revenue. This model can make the company vulnerable to economic downturns, as customers may reduce their spending on cybersecurity solutions during challenging economic times.

Analyst Expectations and Market Sentiment

Analyst expectations and market sentiment surrounding CrowdStrike are crucial indicators of its future performance. Analysts play a vital role in shaping investor perceptions and influencing stock prices.

CrowdStrike’s impressive track record of exceeding earnings expectations is certainly something to watch. While the cybersecurity landscape is constantly evolving, their dedication to innovation and customer satisfaction suggests they’re well-positioned to continue this trend. It’s a stark contrast to the travel industry, where Transportation Secretary Pete Buttigieg has publicly declared this year’s travel disruptions unacceptable.

Read more about his statement here. It’s clear that in some sectors, consistent performance is paramount, while others grapple with unforeseen challenges. Only time will tell if CrowdStrike can maintain its momentum.

Analyst Consensus and Future Earnings Prospects

Analysts are generally optimistic about CrowdStrike’s future earnings prospects. Many analysts believe that CrowdStrike is well-positioned to continue its growth trajectory, driven by the increasing demand for cybersecurity solutions.

- A recent survey of analysts by FactSet revealed that the average price target for CrowdStrike stock is $200, representing a significant upside potential from its current trading price.

- Several analysts have upgraded their ratings on CrowdStrike stock, citing the company’s strong financial performance, expanding customer base, and competitive advantages.

Market Sentiment and Investor Confidence, Will crowdstrike extend its streak of topping earnings views

Market sentiment towards CrowdStrike remains positive, driven by the company’s consistent track record of exceeding earnings expectations, its strong growth prospects, and its dominant position in the endpoint security market.

- CrowdStrike’s stock price has been steadily rising over the past year, indicating strong investor confidence in the company’s future.

- The company’s high valuation, which reflects investor optimism about its growth potential, is further evidence of the positive market sentiment surrounding CrowdStrike.

Impact of Macroeconomic Factors

Macroeconomic factors, such as inflation and geopolitical uncertainty, can have a significant impact on CrowdStrike’s business.

- Inflation can lead to increased costs for CrowdStrike, potentially impacting its profitability.

- Geopolitical uncertainty can create a volatile environment for businesses, increasing the demand for cybersecurity solutions. This could benefit CrowdStrike, as organizations seek to protect themselves from cyberattacks.

CrowdStrike’s Growth Strategy: Will Crowdstrike Extend Its Streak Of Topping Earnings Views

CrowdStrike, a leading cybersecurity company, has achieved remarkable success in recent years, driven by its robust growth strategy. This strategy encompasses multiple key aspects, including product development, market expansion, and strategic partnerships. CrowdStrike’s ability to adapt and innovate has positioned it as a dominant force in the rapidly evolving cybersecurity landscape.

Product Development

CrowdStrike’s product development strategy is centered on delivering a comprehensive and integrated cybersecurity platform. This platform provides a wide range of capabilities, including endpoint protection, threat intelligence, cloud security, and incident response. The company focuses on continuous innovation, regularly introducing new features and functionalities to enhance its platform’s effectiveness.

This commitment to innovation has enabled CrowdStrike to stay ahead of emerging threats and meet the evolving needs of its customers.

- Falcon Platform:CrowdStrike’s flagship product, the Falcon platform, is a cloud-native, AI-powered endpoint protection platform. It offers real-time threat detection and response capabilities, enabling organizations to quickly identify and mitigate cyberattacks. The platform is designed to be highly scalable and adaptable, making it suitable for organizations of all sizes.

- Expanding Product Portfolio:CrowdStrike has expanded its product portfolio beyond endpoint protection to encompass a wider range of cybersecurity solutions. These include cloud workload protection, threat intelligence, and managed services. This diversification strategy allows CrowdStrike to address the growing needs of organizations seeking comprehensive cybersecurity solutions.

- R&D Investment:CrowdStrike invests heavily in research and development (R&D) to drive product innovation. The company employs a team of highly skilled cybersecurity professionals who are dedicated to developing cutting-edge technologies. This R&D focus is critical to CrowdStrike’s ability to stay ahead of the curve in the rapidly evolving cybersecurity landscape.

Market Expansion

CrowdStrike’s market expansion strategy focuses on expanding its global reach and penetrating new market segments. The company has established a strong presence in key markets worldwide, including North America, Europe, and Asia-Pacific. CrowdStrike’s global expansion efforts are supported by its strategic partnerships with leading technology providers and system integrators.

- Geographic Expansion:CrowdStrike has expanded its geographic footprint to serve a wider customer base. The company has established offices and data centers in key regions around the world. This global expansion strategy enables CrowdStrike to meet the cybersecurity needs of organizations operating in different markets.

- Vertical Market Focus:CrowdStrike has identified specific vertical markets, such as healthcare, financial services, and government, as key growth areas. The company has developed tailored solutions to address the unique cybersecurity challenges faced by organizations in these sectors. This vertical market focus allows CrowdStrike to provide specialized solutions that meet the specific needs of its customers.

- Strategic Acquisitions:CrowdStrike has strategically acquired companies with complementary technologies and expertise. These acquisitions have allowed the company to expand its product portfolio, enter new markets, and enhance its overall capabilities. For example, CrowdStrike’s acquisition of Humio in 2021 strengthened its cloud security and observability capabilities.

Partnerships

CrowdStrike’s partnership strategy is focused on building strategic alliances with technology providers, system integrators, and managed service providers. These partnerships enable CrowdStrike to expand its reach, enhance its product offerings, and provide comprehensive cybersecurity solutions to its customers.

- Technology Partnerships:CrowdStrike partners with leading technology providers, such as Microsoft, Amazon Web Services (AWS), and Google Cloud Platform (GCP). These partnerships allow CrowdStrike to integrate its solutions with other technologies, providing seamless cybersecurity protection across different platforms.

- System Integrator Partnerships:CrowdStrike collaborates with system integrators to deliver customized cybersecurity solutions to its customers. These partnerships enable CrowdStrike to leverage the expertise of system integrators in deploying and managing its solutions. This collaboration allows CrowdStrike to provide comprehensive and tailored cybersecurity services to its customers.

- Managed Service Provider Partnerships:CrowdStrike works with managed service providers (MSPs) to offer its solutions as part of broader cybersecurity services. These partnerships allow CrowdStrike to reach a wider customer base and provide managed cybersecurity services to organizations that prefer a subscription-based model.

Key Factors to Watch

CrowdStrike’s consistent outperformance in earnings has fueled investor confidence. However, several factors could influence the company’s ability to sustain this trend. Analyzing these key factors is crucial for understanding CrowdStrike’s future trajectory and its potential to continue exceeding expectations.

Emerging Cybersecurity Threats and Technological Advancements

The ever-evolving landscape of cybersecurity threats presents both opportunities and challenges for CrowdStrike. As attackers become more sophisticated, CrowdStrike needs to continuously innovate and adapt its solutions.

- The Rise of Ransomware:The increasing prevalence of ransomware attacks, such as the recent Conti and REvil attacks, highlights the growing need for robust endpoint security solutions. CrowdStrike’s ability to effectively detect and respond to these threats will be critical in maintaining its market share.

- The Growing Threat of Nation-State Actors:Advanced persistent threats (APTs) orchestrated by nation-state actors are becoming increasingly sophisticated. CrowdStrike’s Falcon platform needs to be able to counter these threats with advanced threat intelligence and proactive defense capabilities.

- The Rise of Cloud-Based Attacks:The shift towards cloud computing has created new attack vectors for cybercriminals. CrowdStrike’s ability to secure cloud environments and protect sensitive data will be essential for its continued success.

CrowdStrike’s Continued Innovation and Product Development

Maintaining a competitive edge in the cybersecurity industry requires continuous innovation and product development. CrowdStrike’s commitment to research and development is crucial for staying ahead of the curve.

- Expanding Product Portfolio:CrowdStrike’s recent acquisitions of Humio and Reposify demonstrate its commitment to expanding its product portfolio and addressing emerging security challenges. These acquisitions have strengthened CrowdStrike’s capabilities in log management, threat intelligence, and cloud security.

- Artificial Intelligence and Machine Learning:CrowdStrike’s use of AI and ML is a key differentiator. These technologies enable the Falcon platform to proactively identify and respond to threats, reducing the burden on security teams. CrowdStrike needs to continue investing in AI and ML research to stay ahead of the competition.

- Integration and Partnerships:CrowdStrike’s ability to integrate its solutions with other security platforms and technologies is essential for providing comprehensive protection. Strong partnerships with leading security vendors will be crucial for expanding its reach and enhancing its capabilities.