What Could the Inflation Reduction Act Mean for You?

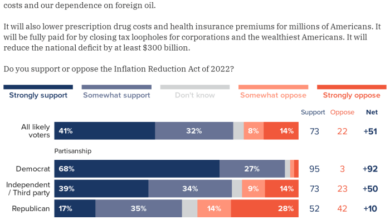

What could the Inflation Reduction Act mean for you? This landmark legislation, passed in 2022, aims to tackle inflation, lower energy costs, and improve healthcare access. It’s a complex piece of legislation with far-reaching implications for individuals, businesses, and the economy as a whole.

The Act covers a wide range of topics, including energy, healthcare, and taxes. It includes provisions to incentivize renewable energy development, lower prescription drug costs, and provide tax credits for individuals and businesses. But with so many moving parts, it can be challenging to understand how this Act will affect your daily life.

Understanding the Inflation Reduction Act

The Inflation Reduction Act of 2022, signed into law by President Biden in August 2022, is a comprehensive piece of legislation aimed at addressing multiple pressing issues, including climate change, healthcare costs, and the federal budget deficit. The Act is designed to reduce inflation and promote economic growth by investing in clean energy, lowering prescription drug costs, and raising taxes on corporations.

Energy Provisions

The Act includes significant investments in clean energy technologies and infrastructure. These provisions are designed to reduce greenhouse gas emissions, create jobs in the renewable energy sector, and lower energy costs for consumers.

- Tax Credits for Renewable Energy:The Act extends and expands tax credits for solar, wind, geothermal, and other renewable energy sources. These tax credits incentivize businesses and individuals to invest in clean energy technologies, leading to increased adoption and reduced reliance on fossil fuels.

- Clean Energy Manufacturing Investments:The Act provides funding for domestic manufacturing of clean energy technologies, such as solar panels, wind turbines, and electric vehicle batteries. This investment is intended to create jobs and reduce reliance on foreign supply chains.

- Electric Vehicle Tax Credits:The Act extends and expands tax credits for the purchase of new electric vehicles. These tax credits aim to boost demand for electric vehicles, accelerating the transition to a cleaner transportation sector.

Healthcare Provisions

The Act includes provisions designed to lower healthcare costs for millions of Americans, particularly those with pre-existing conditions and seniors.

- Negotiation of Prescription Drug Prices:The Act allows Medicare to negotiate prices for certain prescription drugs, which is expected to lead to lower costs for seniors and taxpayers. This provision is a significant step towards addressing the high cost of prescription drugs in the United States.

- Extension of Affordable Care Act Subsidies:The Act extends and expands subsidies for Affordable Care Act health insurance plans. This will help millions of Americans afford health insurance and prevent them from losing coverage.

- Cap on Out-of-Pocket Insulin Costs:The Act caps out-of-pocket insulin costs for Medicare beneficiaries at $35 per month. This provision is intended to provide relief to millions of Americans who struggle to afford their insulin.

Tax Provisions

The Act includes a number of tax provisions designed to raise revenue and reduce the federal budget deficit. These provisions primarily target corporations and high-income earners.

- Minimum Corporate Tax:The Act imposes a 15% minimum tax on corporations with annual profits exceeding $1 billion. This provision is intended to ensure that large corporations pay their fair share of taxes.

- Increased IRS Enforcement:The Act provides funding to increase IRS enforcement, which is expected to lead to increased tax revenue. This funding will be used to hire more IRS agents and improve the agency’s ability to audit wealthy individuals and corporations.

- Excise Tax on Stock Buybacks:The Act imposes a 1% excise tax on corporate stock buybacks. This provision is intended to discourage corporations from using their profits to buy back their own stock instead of investing in their businesses or employees.

Impact on Energy Costs: What Could The Inflation Reduction Act Mean For You

The Inflation Reduction Act (IRA) aims to lower energy costs for individuals and businesses while promoting clean energy development. It achieves this through various provisions, including tax credits, rebates, and investments in renewable energy infrastructure. These measures are designed to make clean energy more affordable and accessible, ultimately reducing reliance on fossil fuels and potentially impacting energy prices.

Impact on Renewable Energy Development

The IRA provides significant financial incentives for the development and deployment of renewable energy technologies, including solar, wind, geothermal, and hydropower.

- The Act offers tax credits for the production of clean energy, making it more financially attractive for businesses to invest in renewable energy projects.

- It provides tax credits for individuals who install solar panels on their homes, making solar energy more affordable for residential consumers.

- The IRA also includes funding for research and development of advanced clean energy technologies, supporting innovation and driving down costs in the long term.

These incentives are expected to accelerate the transition to clean energy, boosting renewable energy development and creating new jobs in the clean energy sector.

Healthcare Implications

The Inflation Reduction Act (IRA) aims to address healthcare costs, particularly for prescription drugs and health insurance premiums. The act includes provisions that aim to make medications more affordable and expand access to health insurance subsidies.

Prescription Drug Cost Reduction

The IRA introduces a number of measures aimed at reducing prescription drug costs. One key provision allows Medicare to negotiate drug prices for certain high-cost medications, potentially leading to lower prices for seniors and those with Medicare coverage. The act also caps out-of-pocket spending on prescription drugs for Medicare beneficiaries at $2,000 per year.

The potential impact of these provisions on prescription drug costs is significant. The Congressional Budget Office (CBO) estimates that the drug negotiation provision alone could save the government $100 billion over the next decade. However, the actual impact on drug prices and patient costs will depend on the specific drugs selected for negotiation and the negotiating strategy employed by Medicare.

The IRA also imposes penalties on drug manufacturers that raise prices faster than the rate of inflation. This provision aims to prevent pharmaceutical companies from excessively increasing drug prices and making medications less affordable for patients.

Expansion of Health Insurance Subsidies

The IRA extends and expands the Affordable Care Act (ACA) premium tax credits, making health insurance more affordable for millions of Americans. The act increases the amount of the tax credit available to individuals and families, and it eliminates the income limit for eligibility.

This means that more people will be eligible for subsidies, and those who are already receiving subsidies will receive more financial assistance.The expansion of health insurance subsidies is expected to have a significant impact on access to affordable healthcare. The CBO estimates that the extension and expansion of the tax credits will result in an additional 3 million Americans gaining health insurance coverage.

Additionally, the subsidies will help to reduce the cost of health insurance for millions of Americans, making it more affordable for individuals and families to access quality healthcare.

Potential Benefits and Drawbacks

The healthcare provisions of the IRA have the potential to provide significant benefits to Americans, including:

- Lower prescription drug costs for Medicare beneficiaries.

- Increased access to affordable health insurance through expanded tax credits.

- Reduced out-of-pocket spending on prescription drugs for Medicare beneficiaries.

However, there are also potential drawbacks to consider, such as:

- The drug negotiation process could be complex and time-consuming, potentially delaying the realization of lower drug prices.

- The penalties on drug manufacturers could lead to reduced investment in drug research and development, potentially slowing the pace of innovation.

- The expansion of tax credits could lead to higher premiums for some individuals and families, as insurers adjust their rates to reflect the increased subsidies.

The long-term impact of the IRA’s healthcare provisions remains to be seen. However, the act represents a significant effort to address the rising costs of healthcare and improve access to affordable care for Americans.

Tax and Investment Impacts

The Inflation Reduction Act (IRA) includes a range of provisions designed to influence corporate tax behavior, stimulate investment, and impact individual tax burdens. These provisions aim to address various economic objectives, including promoting clean energy, reducing healthcare costs, and addressing the national debt.The IRA’s tax and investment provisions are designed to incentivize certain types of economic activity while discouraging others.

They aim to shape the investment landscape and influence business decisions.

Corporate Tax Provisions

The IRA introduces a 15% minimum tax on corporations with annual revenue exceeding $1 billion. This provision seeks to ensure that large corporations pay a minimum level of tax, regardless of their reported profits. The minimum tax aims to prevent corporations from utilizing loopholes and tax avoidance strategies to minimize their tax obligations.

This provision is expected to raise substantial revenue for the government, contributing to the overall goal of reducing the deficit.

Investment Incentives, What could the inflation reduction act mean for you

The IRA offers various investment incentives, including tax credits and deductions, to encourage investments in clean energy technologies, renewable energy sources, and energy efficiency improvements. These incentives aim to accelerate the transition to a cleaner energy economy, reducing greenhouse gas emissions and promoting sustainable development.

- The IRA provides tax credits for the production and installation of solar panels, wind turbines, and other renewable energy technologies. These credits are designed to make renewable energy more affordable, encouraging businesses and individuals to adopt these technologies.

- The IRA also offers tax credits for energy efficiency upgrades, such as insulation, energy-efficient windows, and high-efficiency heating and cooling systems. These credits aim to reduce energy consumption and lower energy bills, both for businesses and homeowners.

- The Act provides tax incentives for the development and deployment of clean energy technologies, including electric vehicles, battery storage, and carbon capture and storage. These incentives are intended to accelerate the development and adoption of these technologies, contributing to a more sustainable energy future.

Individual Tax Credits

The IRA expands and extends several existing individual tax credits, including those related to healthcare, clean energy, and energy efficiency. These credits are designed to provide financial assistance to individuals and families, making it more affordable to access healthcare, adopt clean energy solutions, and improve energy efficiency in their homes.

- The IRA expands the premium tax credits for health insurance, making it more affordable for low- and middle-income families to obtain health insurance coverage. This provision is expected to reduce the number of uninsured individuals and families, improving access to healthcare.

- The IRA extends and expands the tax credit for purchasing electric vehicles. This credit aims to make electric vehicles more affordable, encouraging individuals to adopt these vehicles and reducing greenhouse gas emissions from transportation.

- The IRA also offers tax credits for energy efficiency improvements in homes, such as insulation, energy-efficient windows, and heat pumps. These credits aim to reduce energy consumption and lower energy bills for homeowners, contributing to both energy savings and environmental sustainability.

The Inflation Reduction Act is a complex piece of legislation with potential impacts on various aspects of our lives. While it’s important to delve into the specifics, it’s also worth considering the small, yet impactful changes happening elsewhere. For example, google just made a very small change to one of its most useful features its not just for power users , making it easier for everyone to navigate information.

Understanding these subtle shifts, alongside the larger implications of the Inflation Reduction Act, can help us navigate the evolving landscape of our everyday lives.

Impact on Investment Decisions and Economic Growth

The IRA’s tax and investment provisions are expected to influence investment decisions across various sectors, potentially impacting economic growth. The Act’s incentives for clean energy technologies and renewable energy sources are likely to attract investment in these sectors, leading to job creation and technological innovation.

The IRA’s investment incentives are expected to stimulate economic growth in sectors related to clean energy, renewable energy, and energy efficiency, creating new jobs and promoting innovation.

For example, the tax credits for electric vehicle purchases are expected to boost demand for these vehicles, stimulating production and creating jobs in the automotive and battery industries. Similarly, the incentives for renewable energy technologies are expected to attract investment in solar, wind, and other renewable energy projects, leading to job creation in these sectors and promoting the transition to a cleaner energy economy.The IRA’s tax and investment provisions are expected to have a significant impact on businesses, investors, and individuals, influencing their investment decisions and shaping the future of the economy.

The Act’s focus on clean energy, healthcare, and reducing the national debt is likely to drive investments in these areas, contributing to economic growth and sustainability.

Potential Benefits for Individuals

The Inflation Reduction Act (IRA) aims to address various economic challenges, including rising costs, by offering a range of benefits for individuals. These benefits can potentially lead to financial relief, improved access to healthcare, and a more sustainable future.

Lower Energy Costs

The IRA includes provisions designed to reduce energy costs for individuals, particularly for those who rely heavily on fossil fuels for heating and transportation. These provisions aim to achieve this by:

- Offering tax credits for the purchase of energy-efficient appliances, such as heat pumps, electric vehicles, and solar panels. These credits can significantly offset the initial cost of these investments, making them more accessible to a wider range of individuals.

For example, a homeowner who installs a new heat pump could receive a tax credit of up to $2,000, making the investment more attractive.

- Providing financial assistance for energy efficiency upgrades to homes. This assistance can help homeowners reduce their energy consumption and save money on their utility bills. For instance, a family in a drafty home could receive a grant to insulate their attic and windows, leading to lower heating costs in the winter.

The Inflation Reduction Act could mean lower energy costs and healthcare premiums for many Americans, but it also raises questions about its long-term impact on the economy. As we navigate these changes, it’s important to consider the broader global context, like the analysis in analysis chinas demographics spell decline not domination , which suggests that China’s demographic shift may create challenges for its future economic growth.

Ultimately, understanding these global trends is crucial to fully grasp the implications of the Inflation Reduction Act for individuals and the nation as a whole.

- Investing in renewable energy infrastructure, such as solar and wind farms. This investment can help reduce reliance on fossil fuels and lower electricity prices for consumers. For example, the construction of new solar farms can create jobs and lower the cost of solar energy, making it more affordable for individuals to switch to clean energy.

The Inflation Reduction Act is a big deal, with potential impacts on everything from healthcare to energy costs. While it might not directly address your need for a top-notch espresso machine, if you’re looking for a more budget-friendly way to get that caffeine kick, you might want to check out this article about moka pots.

But ultimately, the Inflation Reduction Act could mean lower bills and more financial freedom for you, which is always a good thing, no matter how you get your coffee fix.

Improved Access to Affordable Healthcare

The IRA includes provisions that aim to improve access to affordable healthcare for individuals, particularly those with chronic illnesses or who are struggling to afford their prescription drugs. These provisions aim to achieve this by:

- Extending the Affordable Care Act’s premium tax credits, making health insurance more affordable for millions of Americans. These tax credits can help individuals pay for their health insurance premiums, reducing the financial burden of healthcare. For example, a family earning $60,000 per year could receive a tax credit of up to $1,000 per year, significantly reducing their monthly health insurance premiums.

- Allowing Medicare to negotiate lower prices for prescription drugs. This provision can lead to lower costs for individuals who rely on Medicare for their prescription drug coverage. For instance, individuals with diabetes who rely on insulin could see a significant reduction in their out-of-pocket costs for this essential medication.

- Capping out-of-pocket spending for Medicare beneficiaries. This provision can help individuals with chronic illnesses avoid high out-of-pocket costs for their healthcare. For example, a senior with cancer could benefit from a cap on their out-of-pocket spending for their treatments, providing financial stability during a challenging time.

Tax Savings and Investment Opportunities

The IRA offers tax benefits for individuals, potentially leading to increased financial security and investment opportunities. These provisions aim to achieve this by:

- Expanding the child tax credit. This credit can provide significant financial relief to families with children, particularly low-income families. For example, a family with two children could receive a tax credit of up to $2,000 per child, providing additional financial support for their family’s needs.

- Offering tax credits for investments in clean energy technologies. These credits can encourage individuals to invest in renewable energy sources, such as solar panels or electric vehicles. For example, an individual who purchases an electric vehicle could receive a tax credit of up to $7,500, making the investment more attractive.

- Investing in research and development of new technologies. This investment can lead to the creation of new jobs and industries, boosting the economy and providing individuals with new investment opportunities. For example, investments in renewable energy research could lead to the development of new technologies that create jobs and reduce dependence on fossil fuels.

Potential Drawbacks for Individuals

While the Inflation Reduction Act aims to benefit individuals in various ways, it’s crucial to acknowledge potential drawbacks that could impact specific groups or sectors. The Act’s multifaceted nature and its implementation could lead to unintended consequences or uneven distribution of benefits.

Increased Costs for Certain Goods and Services

The Act’s provisions aimed at reducing greenhouse gas emissions could lead to increased costs for certain goods and services. For example, the expansion of renewable energy sources might increase the price of electricity in the short term, particularly for consumers reliant on fossil fuels.

The Act’s incentives for electric vehicles could also lead to higher prices for new and used vehicles, making it less affordable for some individuals.

Reduced Investment Opportunities

The Act’s tax provisions, including the 15% minimum tax on large corporations, could potentially reduce investment opportunities in certain sectors. Companies might be less inclined to invest in expansion or new projects if they anticipate higher tax burdens. This could affect job creation and economic growth, particularly in industries heavily reliant on investment capital.

Impact on Different Sectors of the Economy

The Act’s provisions could have varying impacts on different sectors of the economy. For example, the Act’s incentives for renewable energy could benefit companies involved in solar and wind power, while potentially impacting traditional energy companies. The Act’s healthcare provisions could also lead to changes in the healthcare industry, with potential implications for providers, insurers, and patients.

Disproportionate Benefits or Burdens

The Act’s provisions could disproportionately benefit or burden specific groups of individuals. For example, the Act’s tax credits for clean energy investments could benefit higher-income households who can afford to make such investments. The Act’s healthcare provisions could also lead to changes in the healthcare industry, with potential implications for providers, insurers, and patients.

Looking Ahead

The Inflation Reduction Act (IRA) represents a significant legislative effort to address multifaceted challenges facing the United States. Its long-term implications for the economy, environment, and society are far-reaching, with potential to shape the nation’s trajectory for years to come.

The Act’s success hinges on its ability to effectively implement its ambitious goals and navigate the complex realities of a dynamic economic and political landscape.

Long-Term Implications

The IRA’s impact extends beyond its immediate effects, shaping the long-term trajectory of the U.S. economy, environment, and society. Its provisions aimed at reducing greenhouse gas emissions could significantly alter the energy landscape, potentially leading to a shift towards renewable energy sources.

This shift could create new industries, jobs, and economic opportunities while reducing reliance on fossil fuels and mitigating climate change. However, the Act’s success in achieving these goals depends on factors such as technological advancements, market forces, and government policies.

Potential for Achieving Goals

The IRA’s success in achieving its stated goals of reducing inflation and promoting economic growth is subject to various factors. The Act’s provisions aimed at lowering healthcare costs and reducing energy prices could contribute to reducing inflationary pressures. However, the effectiveness of these measures depends on the interplay of complex economic forces and the broader economic environment.

Additionally, the Act’s investment in clean energy technologies could stimulate economic growth and create jobs, but these benefits may take time to materialize.

Challenges and Opportunities for Implementation

Implementing the IRA effectively presents both challenges and opportunities. The Act’s ambitious goals require careful planning and execution to ensure that its provisions are implemented efficiently and effectively. The Act’s success will also depend on the collaboration and coordination of various government agencies and stakeholders.

Furthermore, the Act’s implementation may face legal challenges and political opposition, which could hinder its progress.