US Economy Shrunk Faster Than Expected in First Quarter

U s economy shrank at 1 5 rate in the first quarter more than initially estimated – The US economy shrank at a 1.5% rate in the first quarter, more than initially estimated, according to the Bureau of Economic Analysis. This contraction, fueled by a decline in consumer spending and business investment, has raised concerns about a potential recession.

While the economy had shown signs of resilience in recent months, the latest figures suggest that the path to recovery may be more challenging than previously anticipated.

This contraction is a significant development that warrants closer examination. It highlights the ongoing economic challenges facing the US, including rising inflation, supply chain disruptions, and the lingering effects of the pandemic. Understanding the contributing factors, the impact on key sectors, and the policy responses is crucial for navigating this uncertain economic landscape.

Future Outlook

The US economy’s contraction in the first quarter of 2023, larger than initially estimated, raises concerns about the future economic trajectory. While the contraction was driven by factors like inventory adjustments and declining consumer spending, the question remains: will the US economy rebound or enter a recession?

The news that the U.S. economy shrank at a 1.5% rate in the first quarter, more than initially estimated, is definitely concerning. But amidst economic uncertainty, it’s important to remember that we have control over our own mindset. A Harvard researcher suggests that two simple mindset changes can help prevent a midlife crisis, 2 simple mindset changes that can prevent a midlife crisis according to a harvard researcher , which can be incredibly valuable during times of economic stress.

By focusing on our own growth and well-being, we can navigate these challenges with resilience and find new opportunities even when the economy seems to be shrinking.

Inflation and Interest Rates

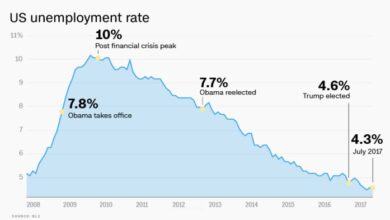

Inflation remains a significant factor influencing the US economy. The Federal Reserve has been aggressively raising interest rates to combat inflation, but the effects are still being felt. High inflation erodes purchasing power, leading to decreased consumer spending. The Fed’s interest rate hikes also increase borrowing costs for businesses, potentially slowing investment and economic growth.

The US economy shrank at a 1.5% rate in the first quarter, more than initially estimated, which is a worrying sign for the country’s economic health. This contraction, coupled with the rising political tensions fueled by christian nationalism on the rise in some GOP campaigns , paints a picture of a nation grappling with economic instability and ideological divisions.

Whether these issues will converge to create a larger crisis remains to be seen, but the current state of affairs is undoubtedly concerning for the future of the US economy.

Geopolitical Risks

The ongoing war in Ukraine, along with escalating tensions between the US and China, contribute to economic uncertainty. These geopolitical risks disrupt supply chains, drive up energy prices, and create volatility in financial markets. The impact of these risks on the US economy is difficult to predict but could significantly influence its future trajectory.

Potential for a Recession

The possibility of a recession in the US economy is a significant concern. A recession is generally defined as two consecutive quarters of negative economic growth. While the first quarter of 2023 saw a contraction, it is unclear whether the second quarter will follow suit.

Several factors could contribute to a recession, including persistent inflation, rising interest rates, and continued geopolitical uncertainty.

Implications for Businesses and Consumers

A recession would have significant implications for businesses and consumers. Businesses might face decreased demand for their products and services, leading to reduced profits and potential layoffs. Consumers would likely experience a decline in their purchasing power due to rising prices and potentially lower wages.

The US economy shrank at a 1.5% rate in the first quarter, more than initially estimated, a grim reminder of the headwinds facing our nation. It’s hard to ignore the growing sense of unease, especially when we see companies like State Farm, who once supported LGBTQ+ initiatives, back away from their commitments after facing pressure from conservative groups state farm drops support of lgbtq kids books after conservative furor.

This retreat, coupled with the shrinking economy, paints a picture of a country grappling with division and uncertainty. It’s a stark reminder that we need to find common ground and work together to address the challenges facing our nation.

The impact on businesses and consumers would depend on the severity and duration of the recession.

Global Context

The US economy’s contraction in the first quarter has significant implications for the global economy. The US is the world’s largest economy, and its performance has a ripple effect on other countries and regions. This contraction could lead to a slowdown in global economic growth, as well as increased volatility in financial markets.

Impact on the Global Economy, U s economy shrank at 1 5 rate in the first quarter more than initially estimated

The US economic contraction will likely have a negative impact on the global economy. The US is a major consumer of goods and services from around the world, and a slowdown in US demand will reduce demand for exports from other countries.

This could lead to a decline in economic activity in countries that rely heavily on exports to the US. Additionally, the contraction could lead to a decline in investment in the US, which could have a negative impact on global financial markets.

Spillover Effects on Other Countries and Regions

The US economic contraction is likely to have spillover effects on other countries and regions. For example, the contraction could lead to a decline in demand for oil and other commodities, which could have a negative impact on countries that are major producers of these commodities.

Additionally, the contraction could lead to a decline in tourism to the US, which could have a negative impact on countries that rely heavily on tourism revenue.

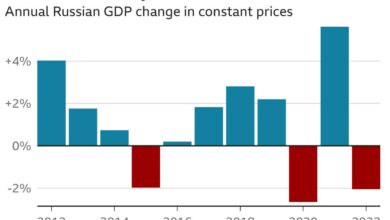

Comparison to Other Major Economies

The US economic performance is similar to that of other major economies. For example, the Eurozone economy also contracted in the first quarter of 2023. However, there are some differences in economic performance. For example, the US economy is more heavily reliant on consumer spending than the Eurozone economy, which is more reliant on exports.

This means that the US economy is more vulnerable to a decline in consumer confidence, while the Eurozone economy is more vulnerable to a decline in global trade.

Conclusion: U S Economy Shrank At 1 5 Rate In The First Quarter More Than Initially Estimated

The US economy’s contraction in the first quarter serves as a stark reminder of the fragility of economic growth in the face of persistent challenges. While the future outlook remains uncertain, understanding the underlying factors and policy responses is essential for informed decision-making.

Whether we are heading towards a recession or experiencing a temporary setback remains to be seen, but one thing is clear: the US economy is at a crossroads, and the choices made in the coming months will have a profound impact on its trajectory.