Treasury Yields Rise as Investors Await Key US Inflation Data

Treasury yields rise as investors await key u s inflation data – Treasury yields rise as investors await key US inflation data takes center stage, a pivotal moment for the financial markets. This upcoming data release holds immense power to shape investor sentiment and potentially trigger significant shifts in treasury yields, the benchmark for borrowing costs across the economy.

The current state of treasury yields reflects a delicate balance between economic growth prospects and inflation concerns. Recent rises in yields indicate that investors are increasingly worried about the possibility of persistent inflation, prompting them to demand higher returns on their investments.

This upward trend in yields is particularly notable for longer-term maturities, suggesting that investors are anticipating a prolonged period of elevated inflation.

Treasury Yield Rise Context: Treasury Yields Rise As Investors Await Key U S Inflation Data

Treasury yields have been on the rise recently, as investors brace themselves for the release of key U.S. inflation data. This upward movement in yields reflects growing expectations that the Federal Reserve might continue its aggressive interest rate hikes to combat stubbornly high inflation.

The markets are on edge as we await the release of key U.S. inflation data, which will likely influence the Federal Reserve’s future monetary policy decisions. Meanwhile, the sports world is buzzing with excitement as Frances Tiafoe and Taylor Fritz advance to the US Open semifinals, and the 49ers get another star back, adding fuel to their NFL championship aspirations.

You can catch up on all the latest sports news and analysis at blognewstweets.com. Back to the economy, it’s a time of uncertainty as investors try to decipher the signals from the inflation data and what it means for interest rates and the broader financial landscape.

Treasury Yield Movements

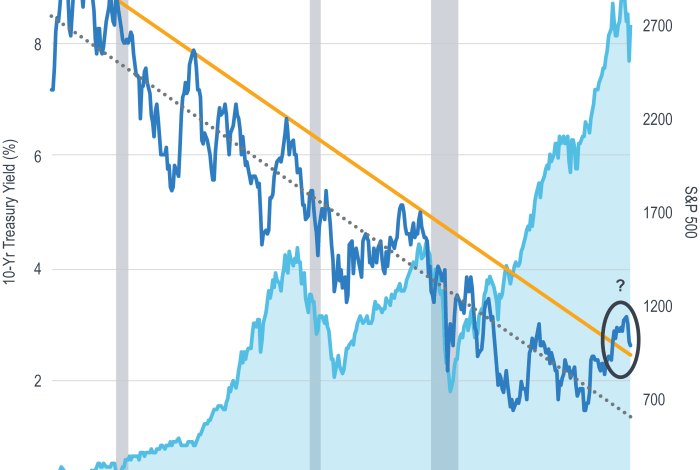

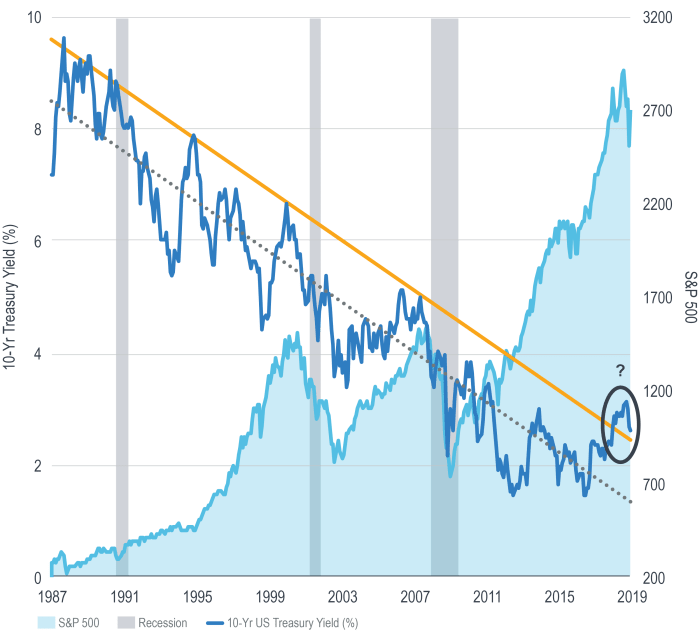

The recent rise in treasury yields has been particularly pronounced for longer-term maturities. For instance, the yield on the 10-year Treasury note has climbed above 4%, while the yield on the 30-year Treasury bond has surpassed 4.5%. These yields have been rising steadily in recent weeks, reflecting investor concerns about inflation and the potential for continued rate hikes.

With treasury yields rising as investors anxiously await the release of key U.S. inflation data, it’s easy to get caught up in the macro-economic landscape. But let’s not forget the thrill of the Champions League! Check out these expert picks and predictions for the upcoming matches, including Milan facing Liverpool and Real Madrid aiming for a hot start champions league expert picks predictions best bets milan face liverpool real madrid look for hot start.

Back to the markets, we’ll see how the inflation data impacts the trajectory of treasury yields, but for now, let the beautiful game take center stage!

Historical Context of Treasury Yields

Treasury yields have historically fluctuated based on a number of factors, including economic growth, inflation, and monetary policy. When the economy is strong and inflation is rising, investors typically demand higher yields to compensate for the risk of inflation eroding the value of their investments.

Conversely, when the economy is weak and inflation is low, investors are willing to accept lower yields.

Treasury yields are often seen as a barometer of investor sentiment and expectations for the future of the economy.

Impact of Inflation on Treasury Yields, Treasury yields rise as investors await key u s inflation data

Inflation plays a significant role in determining treasury yields. When inflation is high, investors demand higher yields to compensate for the eroding purchasing power of their investments. This is because inflation reduces the real return on fixed-income investments, such as Treasury bonds.

Relationship Between Treasury Yields and Interest Rates

Treasury yields are closely tied to interest rates set by the Federal Reserve. When the Fed raises interest rates, it becomes more expensive for borrowers to obtain loans, which can lead to a slowdown in economic activity. In anticipation of such a slowdown, investors may demand higher yields on Treasury bonds, as they seek to preserve the value of their investments.

Impact of Inflation Data

The upcoming release of US inflation data is a pivotal event for the bond market, as it will likely influence the direction of Treasury yields. Inflation plays a significant role in shaping investor sentiment and the Federal Reserve’s monetary policy decisions, both of which directly impact bond yields.

Relationship Between Inflation and Treasury Yields

Inflation and Treasury yields have an inverse relationship. When inflation rises, investors demand higher yields on Treasury bonds to compensate for the eroding purchasing power of their investments. Conversely, when inflation falls, Treasury yields tend to decline as investors are content with lower returns due to a less inflationary environment.

This inverse relationship is driven by the principle of risk-free return, as Treasury bonds are considered a safe haven asset.

Potential Scenarios for Treasury Yields

The impact of inflation data on Treasury yields depends on the actual figures released and how they compare to market expectations. Here are some potential scenarios:

Higher-than-Expected Inflation

If the inflation data comes in higher than anticipated, it could trigger a surge in Treasury yields. Investors might demand higher yields to compensate for the accelerated erosion of their investment value due to higher inflation. This could lead to a sell-off in bonds, pushing yields upward.

Lower-than-Expected Inflation

Conversely, if the inflation data comes in lower than expected, it could lead to a decline in Treasury yields. Investors might become less concerned about inflation eroding their investment value, prompting them to accept lower yields. This could lead to a buying spree in bonds, driving yields downward.

Meeting Expectations

If the inflation data meets market expectations, Treasury yields might experience relatively little movement. Investors might be content with the existing yields, and the bond market could remain relatively stable.

The impact of inflation data on Treasury yields is a complex interplay of market expectations, investor sentiment, and the Federal Reserve’s policy stance.

Investor Sentiment and Behavior

The recent rise in Treasury yields has been fueled by investor anxieties surrounding inflation. As the market awaits key U.S. inflation data, investors are grappling with the potential impact of persistent price pressures on their portfolios.

Investor Sentiment and Expectations

The current investor sentiment is characterized by a mix of caution and anticipation. Many investors are concerned about the possibility of a prolonged period of high inflation, which could erode the purchasing power of their investments and lead to higher interest rates.

However, there is also a sense of hope that the recent decline in inflation may signal a turning point, leading to a more favorable economic environment.

Portfolio Adjustments

In response to the elevated inflation concerns, investors are adjusting their portfolios to mitigate potential risks. Many are shifting their allocations towards assets that are expected to perform well in an inflationary environment, such as commodities, real estate, and value stocks.

Some investors are also seeking shelter in assets like Treasury bonds, which are considered safe havens during periods of market volatility.

Historical Comparisons

The current market situation bears some resemblance to previous periods of high inflation, such as the 1970s and early 1980s. During those times, investors also faced significant uncertainty and volatility. However, there are also important differences. For example, the Federal Reserve’s commitment to controlling inflation is stronger today than it was in the past.

Additionally, the global economy is more interconnected now, which could make it more difficult for the U.S. to manage inflation on its own.

The markets are on edge, watching closely as treasury yields rise in anticipation of the key US inflation data release. While investors are focused on the economic landscape, it’s important to remember that the world is a complex place. Pope Francis’s ambitious Asia Pacific tour highlights the interconnectedness of global issues, reminding us that financial markets are just one facet of a broader human experience.

Ultimately, navigating these complexities requires a balanced perspective, recognizing the significance of both economic indicators and global events like this papal tour.