Third World Debt and Disaster Recovery: A Complex Relationship

Third World Debt and Disaster Recovery sets the stage for a complex and often overlooked narrative. It’s a story about the burden of historical injustices, the struggle to recover from natural disasters, and the constant battle for sustainable development. Many developing countries are grappling with crippling debt, a legacy of colonial exploitation and neocolonial policies.

This debt burden can be a crippling obstacle to disaster recovery, making it even more challenging to rebuild and recover from natural disasters.

This blog explores the intertwined issues of debt and disaster recovery in developing countries, highlighting the challenges they face and the urgent need for international cooperation to address these critical issues. We’ll delve into the historical context of debt, the impact of debt on disaster recovery, and the various initiatives aimed at alleviating this burden.

We’ll also examine the role of international organizations in supporting recovery efforts and discuss future perspectives for a more sustainable and resilient future.

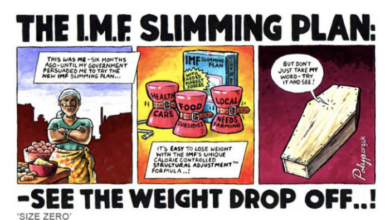

The Impact of Debt on Disaster Recovery

Natural disasters, such as earthquakes, hurricanes, and floods, can devastate communities and economies, leaving a trail of destruction and hardship. For developing countries already grappling with high levels of debt, the recovery process after a disaster becomes even more challenging.

The burden of debt can exacerbate the negative consequences of a disaster, hindering a country’s ability to rebuild and recover.

The crushing weight of third world debt often hinders disaster recovery efforts, leaving vulnerable populations in a perpetual cycle of poverty and hardship. It’s a stark reminder of the global power dynamics at play, where wealthier nations often prioritize their own interests, even when it comes to humanitarian crises.

This hypocrisy, which often fuels hatred and fuels the “war on terror,” further exacerbates the cycle of poverty and violence , making it even harder for developing countries to rebuild after disasters.

The Challenges Faced by Indebted Countries in Recovering from Natural Disasters

Debt obligations can significantly impede a country’s ability to respond effectively to a natural disaster. Countries with high debt levels often face limited access to financial resources, making it difficult to fund essential recovery efforts.

- Reduced Fiscal Space:Debt servicing obligations consume a substantial portion of government revenue, leaving little room for disaster-related expenditures. This limited fiscal space restricts the government’s capacity to allocate funds for rebuilding infrastructure, providing emergency relief, and supporting affected communities. For example, in the aftermath of the 2010 earthquake in Haiti, the country’s debt payments consumed a significant portion of its budget, limiting its ability to invest in reconstruction and recovery efforts.

The crushing weight of third world debt often hinders their ability to effectively recover from disasters. It’s a vicious cycle, and the situation is exacerbated by the global power dynamics that Chomsky eloquently discusses in his analysis of the world after September 11th, chomsky the world after sept 11.

This systemic inequality leaves developing nations vulnerable, forcing them to choose between paying back their debts and investing in disaster preparedness and resilience.

- Increased Borrowing Costs:The higher a country’s debt levels, the greater the risk perceived by lenders, leading to increased borrowing costs. This makes it more expensive for indebted countries to secure loans for disaster recovery, further straining their financial resources.

- Reduced Access to Development Assistance:International donors may be reluctant to provide assistance to heavily indebted countries, fearing that the aid will be used to repay debt rather than support recovery efforts. This can create a vicious cycle where debt hinders access to aid, which in turn hinders recovery and further exacerbates debt levels.

The Comparison of Recovery Processes

The recovery process of heavily indebted countries often contrasts sharply with that of countries with less debt. Countries with lower debt burdens have greater flexibility to allocate resources to disaster response and recovery. They can access concessional loans at lower interest rates, and they are more likely to attract foreign investment, which can help to stimulate economic growth and rebuild infrastructure.

- Faster Recovery:Countries with lower debt levels can mobilize resources more quickly to address immediate needs, such as providing food, water, and shelter to affected populations. They can also invest in long-term recovery projects, such as rebuilding infrastructure and supporting economic diversification, leading to a faster and more sustainable recovery.

Third world debt and disaster recovery are deeply intertwined. Often, these countries are already burdened by debt, leaving them vulnerable to economic shocks. A natural disaster can easily push them further into financial hardship, making it even harder to rebuild.

The Asian financial crisis of 1997-98, debt and the global economic crisis of 19979899 , highlighted the interconnectedness of global economies and the devastating consequences of financial instability for developing nations. This underscores the importance of sustainable development strategies and international cooperation in supporting vulnerable countries during times of crisis.

- Reduced Vulnerability:Countries with lower debt levels are better positioned to invest in disaster preparedness measures, such as strengthening infrastructure, developing early warning systems, and promoting community resilience. This proactive approach can help to mitigate the impact of future disasters and reduce the need for extensive recovery efforts.

Debt Obligations Hinder Access to Resources and Investment for Disaster Preparedness and Response

Debt obligations can also hinder a country’s ability to invest in disaster preparedness and response measures. This is because resources are often diverted to debt servicing, leaving limited funds for preventative measures.

- Limited Investment in Disaster Preparedness:Countries with high debt levels may have difficulty allocating funds for strengthening infrastructure, developing early warning systems, and training emergency response teams. This can leave them more vulnerable to the devastating effects of natural disasters.

- Reduced Access to Insurance:Debt obligations can make it difficult for countries to secure insurance coverage against natural disasters. Insurance companies may perceive indebted countries as higher risk, leading to higher premiums or limited availability of coverage. This lack of insurance can leave countries financially exposed to the costs of disasters.

Debt Relief and Recovery Initiatives

The burden of debt can significantly hinder a country’s ability to recover from disasters. Recognizing this, various international initiatives have been established to reduce debt burdens in developing countries, particularly those facing the added challenges of disaster recovery.

International Initiatives for Debt Relief, Third world debt and disaster recovery

Several international organizations and initiatives have been instrumental in providing debt relief to developing countries. These programs aim to reduce the financial strain on countries, allowing them to allocate resources towards disaster recovery and long-term development.

- The Heavily Indebted Poor Countries (HIPC) Initiative: Launched in 1996, the HIPC Initiative provides debt relief to the poorest and most indebted countries. It involves a comprehensive process of debt reduction, including debt cancellation and restructuring, with the goal of freeing up resources for poverty reduction and development.

- The Multilateral Debt Relief Initiative (MDRI): This initiative, launched in 2005, provided 100% debt cancellation for eligible HIPC countries’ debts to the International Monetary Fund (IMF), the World Bank, and the African Development Bank. It aimed to provide immediate and substantial debt relief to help countries achieve their development goals.

- The Paris Club: The Paris Club is a group of official creditors that provide debt relief to developing countries facing debt distress. They offer a range of options, including debt reschedulings, debt cancellation, and debt swaps. The Paris Club’s role in facilitating debt relief has been crucial in assisting countries in their recovery efforts.

Effectiveness of Debt Cancellation Programs

Debt cancellation programs have been shown to be effective in facilitating disaster recovery in developing countries. By reducing debt burdens, these programs free up resources that can be directed towards rebuilding infrastructure, providing humanitarian aid, and supporting economic recovery.

“Debt cancellation can play a crucial role in disaster recovery by reducing the financial strain on governments, allowing them to focus on rebuilding and supporting their citizens.”

World Bank

Examples of Successful Debt Relief Programs

Several examples demonstrate the positive impact of debt relief programs on disaster recovery efforts. For instance, after the 2010 earthquake in Haiti, the HIPC Initiative and MDRI played a significant role in reducing Haiti’s debt burden, allowing the country to focus on rebuilding and recovery.

Similarly, following the 2004 Indian Ocean tsunami, debt relief programs helped countries like Indonesia and Sri Lanka allocate resources towards disaster response and reconstruction.

Case Studies: Third World Debt And Disaster Recovery

The impact of debt on disaster recovery is best understood through real-world examples. This section examines case studies of countries that have faced both debt crises and natural disasters, highlighting the challenges they faced and the lessons learned.

Case Studies of Debt and Disaster Recovery

Examining case studies provides valuable insights into the interplay between debt burdens and disaster recovery efforts. The following table showcases several countries, their experiences with debt and disaster, and key takeaways.

| Country | Year of Disaster | Debt-to-GDP Ratio | Type of Disaster | Key Recovery Challenges | Success Factors |

|---|---|---|---|---|---|

| Pakistan | 2010 | 60% | Flooding |

|

|

| Philippines | 2013 | 45% | Typhoon Haiyan |

|

|

| Dominica | 2017 | 70% | Hurricane Maria |

|

|