The Inflation Numbers Are Bad, But How Bad Are They?

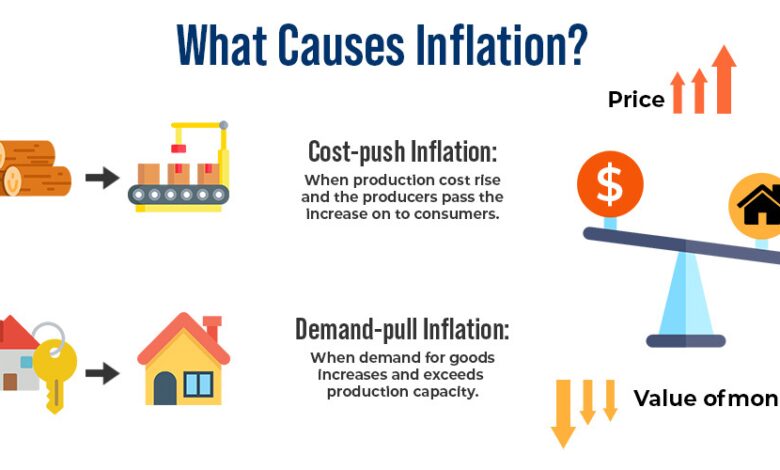

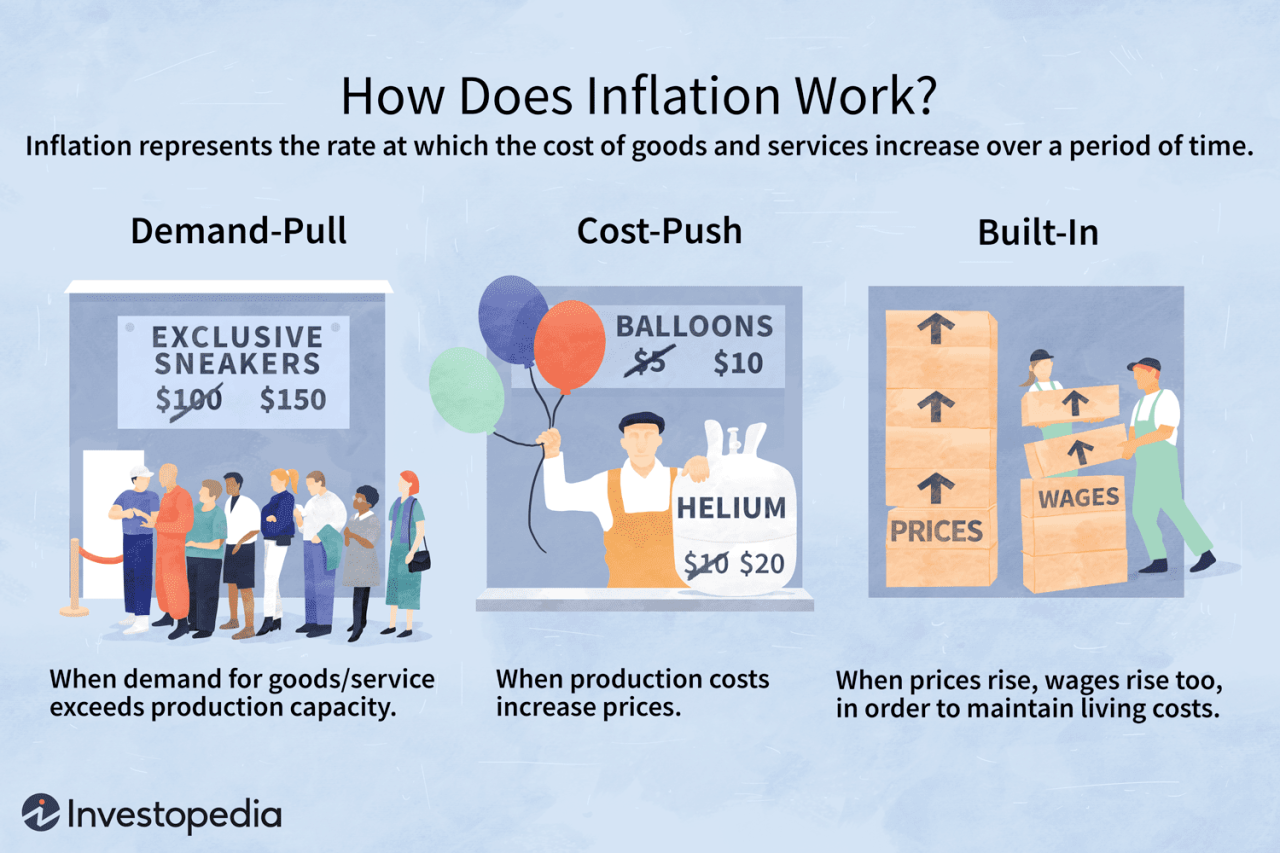

The inflation numbers are bad but how bad are they – The inflation numbers are bad, but how bad are they? This question is on everyone’s mind as prices continue to rise at an alarming rate. Inflation is a complex economic phenomenon with a variety of causes and consequences, and understanding its nuances is crucial for making informed decisions about our finances and our future.

This article will delve into the intricacies of inflation, examining its current state, its historical context, and its potential impact on our lives. We will explore the factors driving inflation, analyze the tools policymakers have to address it, and discuss the outlook for inflation in the years to come.

By understanding the forces at play, we can better navigate the challenges of a high-inflation environment.

Impact of Inflation: The Inflation Numbers Are Bad But How Bad Are They

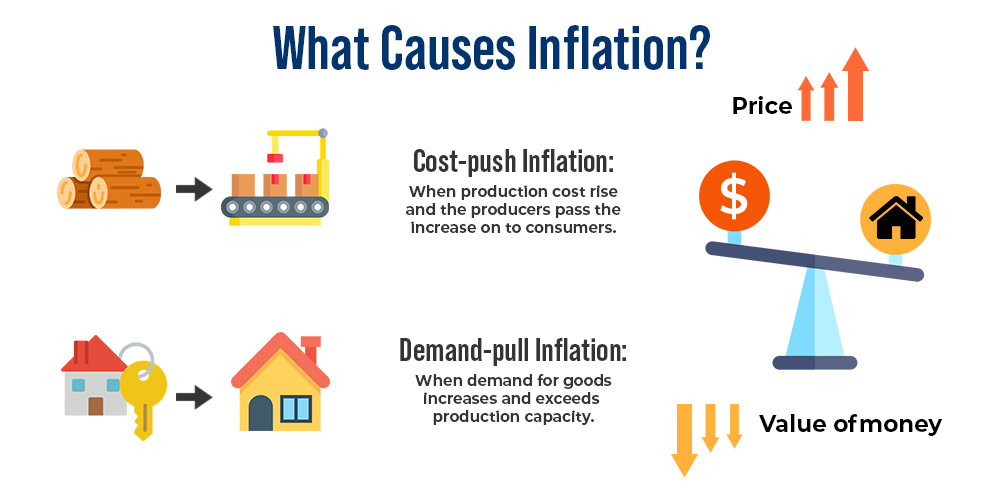

Inflation, the persistent increase in the general price level of goods and services, has far-reaching consequences for individuals, businesses, and the overall economy. Understanding the impact of inflation is crucial for navigating its effects and mitigating potential risks.

Impact on Consumers

Inflation directly impacts consumers’ purchasing power. As prices rise, the value of money decreases, meaning consumers can buy fewer goods and services with the same amount of money. This erosion of purchasing power can lead to a decline in living standards, especially for low-income households that spend a larger proportion of their income on essential goods.

For example, a 10% inflation rate means that a basket of goods that cost $100 a year ago now costs $110. This means consumers have to spend more to maintain their previous standard of living.

Impact on Businesses

Inflation can present both challenges and opportunities for businesses. Rising input costs, such as raw materials, energy, and labor, can erode profit margins and make it more expensive to produce goods and services. Businesses may respond to inflation by raising prices to maintain profitability, but this can lead to a decrease in demand and sales.

Conversely, businesses with pricing power can benefit from inflation by passing on higher costs to consumers.

Impact on Savings, The inflation numbers are bad but how bad are they

Inflation erodes the value of savings over time. As prices rise, the real value of savings decreases. For example, if someone saves $1,000 at a time when inflation is 5%, the real value of their savings will be reduced to $950 after one year.

This loss of purchasing power can make it more challenging to achieve financial goals, such as retirement planning or purchasing a home.

Impact on Investment Decisions

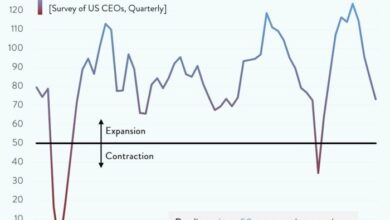

Inflation can significantly influence investment decisions. Investors need to consider the impact of inflation on the return on their investments. In periods of high inflation, investors may seek investments that offer a higher return to compensate for the erosion of purchasing power.

For example, investors may favor investments in real estate or commodities that tend to hold their value better during periods of inflation.

Impact on the Overall Economy

High inflation can destabilize the economy and lead to several negative consequences.

- Economic Instability:High inflation can create uncertainty and volatility in the economy, making it difficult for businesses to plan and invest. It can also lead to a decrease in consumer confidence and spending, which can further slow economic growth.

- Social Unrest:When inflation is high, it can lead to social unrest as people struggle to cope with rising prices and a decline in their standard of living. This can manifest in protests, strikes, and other forms of social upheaval.

- Reduced Investment:High inflation can discourage investment as businesses become more cautious about future profits. This can lead to slower economic growth and job creation.

- Distortion of Market Signals:Inflation can distort market signals, making it difficult for businesses to make sound investment decisions. For example, businesses may invest in projects that appear profitable in nominal terms but are not profitable when adjusted for inflation.

Summary

The current inflationary environment presents both challenges and opportunities. While rising prices can erode purchasing power and strain household budgets, they also create incentives for innovation and investment. By understanding the causes and consequences of inflation, we can make informed decisions that protect our financial well-being and position ourselves for success in the years to come.

It’s hard to ignore the rising cost of everything these days, and the inflation numbers are definitely a cause for concern. But when you’re trying to manage a budget, even small savings can make a difference. That’s why I decided to try out Freshly’s meal delivery service for a week to see if it could help me save some money on groceries and cooking time.

It’s amazing how even a small change like that can make a difference when you’re trying to stretch your budget further, especially in times like these.

Inflation numbers are bad, but it’s hard to know how bad they truly are. It’s like looking at a vintage Ralph Lauren sweater – it’s beautiful, but the price tag makes you wonder if it’s worth the investment. Maybe the brands we love need a revamp, just like our wallets need a break from the rising cost of living.

Read more about the changing landscape of iconic brands in this insightful article: death to lifestyle brands long live lifestyle brands lessons to take and departures to make in contemplating iconic brands like victorias secret and ralph lauren. Ultimately, inflation’s impact on our spending habits is a puzzle we’re all trying to solve.

It’s tough to ignore the inflation numbers, but sometimes it feels like they’re just numbers on a screen. It’s when you’re actually at the grocery store, staring at the price tag of a simple head of lettuce, that it really hits home.

That’s why I never go to the grocery store without these reusable cotton produce bags i never go to the grocery store without these reusable cotton produce bags – they’re a small step, but they help me feel a little bit more in control of my budget in these uncertain times.

Maybe it’s just me, but the little things make a difference, and maybe those little differences can add up to something bigger.