The Fed Is Cooling the Economy, But Stocks Are Hot: What Gives?

The fed is cooling down the economy but stocks are hot what gives – The Fed Is Cooling the Economy, But Stocks Are Hot: What Gives? It’s a question on everyone’s mind right now. The Federal Reserve is actively trying to cool down the economy by raising interest rates, but the stock market is defying expectations and continuing to climb.

What’s driving this disconnect? Is the market simply ignoring the Fed’s actions, or are investors seeing something the Fed isn’t?

There are several potential explanations for this seemingly contradictory behavior. The Fed’s actions are designed to curb inflation by slowing down economic growth. This typically leads to a cooling stock market, as investors become more cautious about the future. However, the current situation is more complex.

Investor sentiment remains high, fueled by strong corporate earnings and expectations of continued economic growth. The stock market is also reacting to the Fed’s actions, anticipating that the Fed will eventually pivot back to a more accommodative policy.

The Fed’s Actions and Their Impact: The Fed Is Cooling Down The Economy But Stocks Are Hot What Gives

The Federal Reserve (Fed), the central bank of the United States, plays a crucial role in managing the nation’s economy. One of its primary tools is monetary policy, which involves adjusting interest rates and the money supply to influence economic activity.

Currently, the Fed is actively trying to cool down the economy, aiming to curb inflation and achieve sustainable growth.

The Fed’s Current Monetary Policy

The Fed’s current monetary policy is characterized by a series of interest rate hikes and quantitative tightening. The goal is to increase borrowing costs for businesses and consumers, thereby slowing down economic activity and reducing inflationary pressures.

It’s wild how the Fed is trying to cool down the economy, yet the stock market is on fire. Maybe it’s because everyone is just too busy jamming out to Fireboy DML’s new track “Adedamola”, which just hit number one on the charts, according to this article.

Perhaps the market is simply ignoring the Fed’s warnings and riding the wave of good vibes. Who knows, maybe the economy will be booming again soon, fueled by the power of good music.

Measures Taken by the Fed to Cool Down the Economy

The Fed has implemented several measures to cool down the economy:

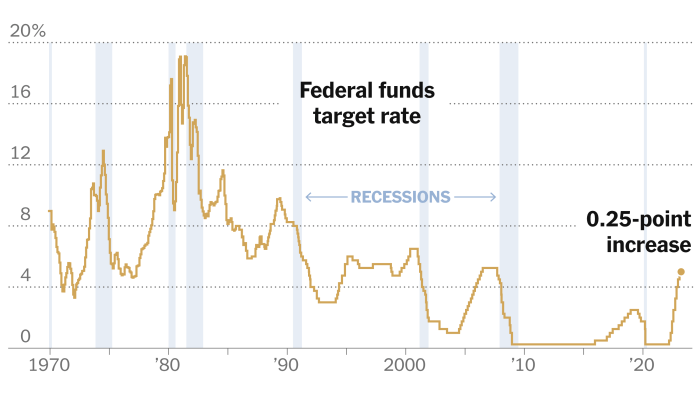

- Raising Interest Rates:The Fed has increased the federal funds rate, the target rate for overnight borrowing between banks, several times since early 2022. These increases have led to higher interest rates on loans, mortgages, and credit cards, making it more expensive for businesses and consumers to borrow money.

- Quantitative Tightening:The Fed is also reducing its holdings of Treasury bonds and mortgage-backed securities. This process, known as quantitative tightening, reduces the money supply in the economy, further tightening financial conditions.

Historical Relationship Between Fed Actions and Economic Growth

Historically, the Fed’s actions have had a significant impact on economic growth. When the Fed lowers interest rates and expands the money supply, it typically stimulates economic activity, leading to increased borrowing, investment, and consumer spending. Conversely, when the Fed raises interest rates and tightens monetary policy, it tends to slow down economic growth, as borrowing becomes more expensive and businesses and consumers become more cautious about spending.

Stock Market Performance

The stock market has been on a tear in recent months, defying expectations of a slowdown amid rising interest rates and economic uncertainty. This seemingly paradoxical performance has left many investors puzzled, prompting questions about the underlying factors driving this surge.

Factors Driving Stock Market Performance

Several factors are contributing to the current stock market rally, including:

- Strong Corporate Earnings:Companies have continued to report strong earnings, indicating resilience in the face of economic headwinds. This has boosted investor confidence and fueled optimism about future growth prospects.

- Resilient Consumer Spending:Despite inflation, consumer spending has remained relatively robust, indicating a healthy economy and supporting corporate revenue growth. This positive trend has further fueled optimism among investors.

- Easing Inflation Concerns:Inflation has begun to moderate, albeit gradually, easing concerns about aggressive interest rate hikes and potential economic recession. This has created a more favorable environment for stock market growth.

- Investor Sentiment:Investor sentiment has shifted towards a more positive outlook, driven by the factors mentioned above. This has led to increased demand for stocks, pushing prices higher.

Comparison with Historical Trends

While the current stock market performance appears strong, it’s essential to compare it to historical trends to gain a better perspective. The current rally is occurring against a backdrop of rising interest rates and economic uncertainty, which are typically associated with market volatility and potential downturns.

The current stock market performance is deviating from historical trends, as it is outperforming expectations amidst economic challenges.

This deviation suggests that other factors, such as strong corporate earnings and resilient consumer spending, are outweighing the negative impact of rising interest rates and economic uncertainty. However, it’s crucial to note that these trends are subject to change, and any sudden shifts in the economic landscape could lead to a reversal in market performance.

The Disconnect Between the Economy and the Stock Market

The current economic climate presents a perplexing situation: the Federal Reserve is actively trying to cool down the economy, but the stock market is experiencing a surge. This apparent disconnect between economic fundamentals and stock market performance has sparked considerable debate and speculation.

Factors Contributing to the Disconnect, The fed is cooling down the economy but stocks are hot what gives

Several factors can contribute to the divergence between the economy and the stock market.

It’s a strange time in the markets, with the Fed aggressively raising interest rates to cool down the economy, yet stocks are still surging. Maybe investors are betting on a “soft landing,” or maybe they’re just ignoring the risks. Whatever the reason, it’s a reminder that the markets are often driven by emotion and speculation.

And sometimes, a little bit of political theater can throw a wrench into the works, like when President Biden turned the tables on Peter Doocy and smashed Fox’s Trump misinformation. It’s hard to say how this kind of back-and-forth will ultimately affect the markets, but it’s definitely something to keep in mind as we navigate these turbulent economic times.

- Investor Sentiment and Expectations:Stock market performance is heavily influenced by investor sentiment and expectations. Even if the economic outlook is uncertain, investors may be optimistic about future growth prospects, leading to a rise in stock prices. This optimism can be driven by factors like technological advancements, potential policy changes, or anticipation of corporate earnings.

It’s a wild ride out there! The Fed is trying to cool down the economy, but the stock market is still on fire. It’s almost like everyone’s ignoring the potential for a recession, maybe because they’re too busy watching the news about Israeli outpost settlers rapidly seizing West Bank land.

Whatever the reason, it’s clear that the markets are operating on a different set of rules these days, and it’s hard to predict what’s going to happen next.

- Market Liquidity:Abundant liquidity in the market can also contribute to higher stock prices. When there is a lot of cash available for investment, it can push up demand for stocks, even if underlying economic conditions are weak.

- Short-Term vs. Long-Term Views:Investors may have different time horizons for their investments. Some investors may focus on short-term gains, while others may have a longer-term perspective. This can lead to discrepancies between the stock market’s short-term performance and the longer-term economic outlook.

- Valuation Metrics:While the economy may be struggling, certain companies might still be performing well and experiencing strong earnings growth. This can drive up their stock prices, even if the overall market is subdued.

Potential Scenarios and Risks

The current economic landscape presents a complex mix of signals, with the Fed’s efforts to cool down the economy potentially leading to different outcomes for the stock market and the broader economy. It’s crucial to analyze potential scenarios and associated risks to navigate this uncertain environment.

Potential Scenarios

The future of the economy and the stock market hinges on several factors, including the Fed’s monetary policy, inflation, and global economic conditions. Let’s explore some potential scenarios:

- Soft Landing:The Fed successfully manages to slow inflation without triggering a recession. This scenario could see continued economic growth, albeit at a slower pace, with the stock market potentially experiencing moderate gains.

- Recession:The Fed’s aggressive rate hikes lead to a contraction in economic activity, resulting in a recession. This scenario could significantly impact corporate earnings and lead to a stock market correction.

- Stagflation:The economy experiences both high inflation and slow growth, creating a challenging environment for businesses and investors. This scenario could lead to increased market volatility and potentially lower returns for investors.

- Inflation Remains Elevated:Inflation remains stubbornly high despite the Fed’s efforts, forcing the central bank to continue raising interest rates. This scenario could lead to a more aggressive tightening cycle, potentially pushing the economy into a recession.

Risks Associated with the Current Economic Environment

The current economic environment presents several risks that investors and businesses need to be aware of:

- Recession:A recession is a significant risk, as the Fed’s aggressive rate hikes aim to curb inflation, which could lead to a slowdown in economic activity. A recession could impact corporate earnings and lead to a decline in stock prices.

- Inflation:High inflation continues to erode purchasing power and increases the cost of doing business. If inflation remains elevated, it could force the Fed to continue raising interest rates, potentially leading to a recession.

- Market Volatility:The stock market is already experiencing significant volatility due to the uncertain economic outlook. This volatility could increase if the Fed’s actions lead to a recession or if inflation remains high.

- Geopolitical Risks:Geopolitical tensions, such as the war in Ukraine, can disrupt global supply chains and impact economic growth. These tensions can contribute to market volatility and uncertainty.

Implications for Investors and Businesses

Understanding potential scenarios and risks is crucial for investors and businesses to make informed decisions.

- Investors:Investors should consider diversifying their portfolios to mitigate risk and adjust their investment strategies based on the evolving economic landscape.

- Businesses:Businesses need to monitor economic indicators and adjust their operations to navigate potential challenges. They should also focus on managing costs and improving efficiency to maintain profitability in a potentially challenging environment.

Strategies for Investors

The current economic and market environment presents a unique challenge for investors. While the Federal Reserve is attempting to cool down the economy, the stock market remains hot. This disconnect raises questions about the future direction of both the economy and the stock market.

In this context, investors need to carefully consider their investment strategies and adjust them accordingly.

Diversification and Risk Management

Diversification and risk management are crucial in any investment portfolio, but they become even more important during periods of economic uncertainty. A diversified portfolio reduces the impact of any single investment on the overall portfolio’s performance. Risk management involves identifying and mitigating potential risks, such as market volatility, inflation, and interest rate changes.

- Asset Allocation:A well-balanced portfolio should include a mix of assets, such as stocks, bonds, real estate, and commodities. The allocation should be based on the investor’s risk tolerance, investment goals, and time horizon. For example, a younger investor with a longer time horizon might allocate a larger portion of their portfolio to stocks, while an older investor nearing retirement might prefer a more conservative allocation with a higher proportion of bonds.

- Investment Strategy:Investors should consider various investment strategies to manage risk. These strategies include value investing, growth investing, and index investing. Value investing focuses on undervalued companies with strong fundamentals, while growth investing targets companies with high growth potential. Index investing involves investing in a basket of securities that track a specific market index, such as the S&P 500.

- Rebalancing:Regularly rebalancing the portfolio helps ensure that the asset allocation remains in line with the investor’s goals and risk tolerance. This involves selling some assets that have outperformed and buying assets that have underperformed to maintain the desired asset allocation.

Adjusting Investment Strategies

Investors should adjust their strategies based on the current economic and market conditions.

- Short-Term Volatility:Investors should be prepared for short-term market volatility, especially during periods of economic uncertainty. It is important to avoid making impulsive decisions based on short-term market fluctuations.

- Long-Term Perspective:Despite the current economic and market challenges, investors should maintain a long-term perspective. It is crucial to focus on long-term investment goals and avoid getting caught up in short-term market noise.

- Seeking Professional Advice:Investors who are unsure about their investment strategy or risk tolerance should consider seeking professional advice from a qualified financial advisor. A financial advisor can help develop a personalized investment plan that aligns with the investor’s individual needs and goals.