Tax Avoidance and Havens: Undermining Democracy

Tax avoidance and havens undermining democracy is a pressing issue that demands our attention. It’s not just about money; it’s about the very fabric of our societies. When corporations and wealthy individuals find ways to dodge their fair share of taxes, it weakens our governments’ ability to fund essential services, create a level playing field for businesses, and ultimately, uphold the principles of fairness and equality that are fundamental to democracy.

The consequences of tax avoidance and havens are far-reaching, affecting everyone from the poorest to the wealthiest. It erodes public trust in institutions, creates an uneven playing field for businesses, and undermines the ability of governments to address critical issues like poverty, healthcare, and education.

It’s a complex issue with no easy solutions, but it’s one that we must confront head-on if we want to protect our democratic values and build a more just and equitable world.

The Economic Impact of Tax Avoidance and Havens: Tax Avoidance And Havens Undermining Democracy

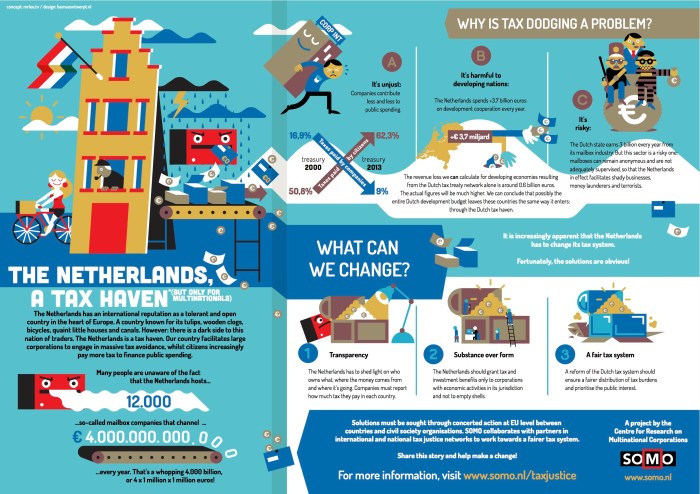

Tax avoidance and havens have a significant and detrimental impact on national economies, impacting public services, creating unfair competition, and hindering economic growth. These practices, often employed by multinational corporations and wealthy individuals, involve exploiting loopholes in tax laws to minimize tax liabilities, often in countries where they generate significant profits.

Loss of Tax Revenue and Its Impact on Public Services

Tax avoidance and havens result in substantial revenue losses for governments. These lost funds could be used to finance essential public services, such as healthcare, education, and infrastructure. For instance, a 2018 study by the Tax Justice Network estimated that developing countries lose an estimated $170 billion annually due to tax avoidance.

This revenue shortfall can lead to:

- Reduced funding for public services, leading to longer waiting times for healthcare, overcrowded schools, and inadequate infrastructure.

- Increased public debt as governments struggle to compensate for lost revenue.

- Cuts to social welfare programs, impacting vulnerable populations.

Unfair Competition and Economic Distortion, Tax avoidance and havens undermining democracy

Tax avoidance and havens create an uneven playing field for businesses and individuals, as those who engage in these practices have a competitive advantage. This unfair competition can lead to:

- Lower tax burdens for those who avoid taxes, while others must bear a heavier share of the tax burden.

- Distortion of market forces as companies with lower tax liabilities can undercut competitors with higher tax burdens.

- Erosion of trust in the tax system, as individuals and businesses perceive that the system is unfair and biased towards those who can afford to avoid taxes.

Examples of Countries Affected by Tax Avoidance and Havens

Numerous countries have been significantly affected by tax avoidance and havens. For example:

- Developing countries:Tax avoidance and havens disproportionately impact developing countries, which often rely heavily on tax revenue for development. They are particularly vulnerable to tax avoidance by multinational corporations that exploit their weak tax systems and lack of resources to enforce tax laws.

- The United States:The U.S. government estimates that it loses billions of dollars annually due to corporate tax avoidance. This revenue loss has contributed to the increasing national debt and has forced cuts to public programs.

- European Union:The EU has taken steps to address tax avoidance, but it remains a significant challenge. Tax avoidance by multinational corporations operating within the EU has resulted in substantial revenue losses for member states.

Tax avoidance and havens weaken democracy by siphoning away resources that could be used for public services. This kind of financial manipulation often comes at the expense of the most vulnerable, who rely on government programs. It’s a vicious cycle, as the same countries that exploit these loopholes also often engage in practices like food aid as dumping , further harming developing nations and perpetuating a system of inequality.

Ultimately, the fight for a more just and equitable world requires tackling both tax havens and the exploitative practices that undermine fair trade and development.

It’s a vicious cycle: tax avoidance and havens weaken democracies by siphoning funds that could be used for public services and social programs. This financial instability often fuels instability and conflict, as seen in the way the US contributes directly to armed conflicts around the world , often exacerbating existing problems.

This, in turn, further undermines democracy and creates a breeding ground for corruption and inequality. Breaking this cycle requires a concerted effort to crack down on tax havens and promote transparency in global finance.

Tax avoidance and havens erode the very foundation of democracy by creating an uneven playing field, where the wealthy and powerful escape their fair share of responsibility. These practices often fuel inequality and undermine public services, leading to widespread discontent and social unrest, as seen in the IMF and World Bank protests in Washington D.C.

It’s crucial to address these issues head-on, promoting transparency and accountability in global finance, to ensure a more just and equitable future for all.