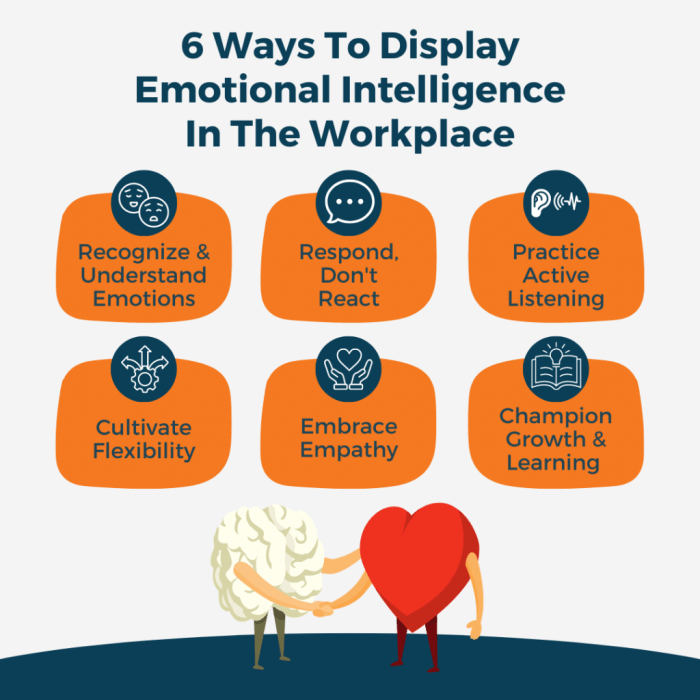

6 Super Effective Ways to Show Your Emotional Intelligence at Work

In today’s fast-paced work environment, it’s not just about what you know, but how you navigate the complex world of emotions. 6 super effective ways to show your emotional intelligence at work can help you build stronger relationships, achieve greater success, and thrive in a demanding workplace.

From mastering active listening to understanding and managing your own emotions, this guide provides practical strategies and insights to enhance your emotional intelligence and make a positive impact on your career.

Active Listening: The Foundation of Emotional Intelligence

In the fast-paced world of work, it’s easy to get caught up in our own thoughts and agendas. But truly effective communication requires more than just talking; it demands active listening. This fundamental skill forms the cornerstone of emotional intelligence, enabling us to build stronger relationships, resolve conflicts, and achieve shared goals.

The Importance of Active Listening in Professional Settings

Active listening is not simply hearing the words someone speaks. It’s about paying full attention to the speaker, understanding their perspective, and demonstrating empathy. In professional settings, this skill is invaluable for several reasons:

- Improved Communication:Active listening fosters clear communication by ensuring that messages are received and understood accurately. This reduces misunderstandings, improves collaboration, and enhances productivity.

- Enhanced Relationships:By showing genuine interest and understanding, active listeners create a sense of trust and connection. This strengthens relationships with colleagues, clients, and superiors, fostering a more positive and supportive work environment.

- Conflict Resolution:When conflicts arise, active listening helps to identify the root causes and find mutually acceptable solutions. By understanding the perspectives of all parties involved, individuals can navigate conflicts constructively and achieve positive outcomes.

- Increased Productivity:Active listening leads to better decision-making by ensuring that all relevant information is considered. This ultimately improves the quality of work and increases productivity.

Demonstrating Active Listening

Active listening is not a passive activity. It requires conscious effort and specific techniques to ensure that you are truly engaged with the speaker. Here are some practical tips for demonstrating active listening:

- Use Verbal Cues:Nodding your head, saying “uh-huh,” or “I see” shows that you are following the speaker’s train of thought and encourages them to continue.

- Maintain Eye Contact:Eye contact is a powerful way to convey attentiveness and respect. It also helps to keep you focused on the speaker and their message.

- Ask Clarifying Questions:Don’t be afraid to ask questions to ensure you understand the speaker’s meaning. This demonstrates your interest and helps to avoid misinterpretations.

- Summarize Key Points:Periodically summarize the speaker’s main points to confirm your understanding and ensure that you are on the same page.

- Avoid Interruptions:Allow the speaker to finish their thoughts without interrupting. This shows respect and allows for a more complete and accurate understanding of their message.

Examples of Active Listening in Action

Active listening can transform communication in a variety of work situations. Here are some examples:

- During a Team Meeting:When a colleague shares their ideas, actively listening by nodding, asking clarifying questions, and summarizing their points demonstrates your support and encourages open dialogue.

- In a Client Meeting:By actively listening to client concerns, you can identify their needs and tailor your solutions accordingly. This builds trust and strengthens the client relationship.

- During a Performance Review:Actively listening to your manager’s feedback allows you to understand their perspective and develop a plan for improvement. This demonstrates your commitment to professional growth and strengthens your relationship with your supervisor.

Empathy: 6 Super Effective Ways To Show Your Emotional Intelligence At Work

Empathy is the ability to understand and share the feelings of another person. It’s a crucial component of emotional intelligence, especially in the workplace. Empathy helps us build stronger connections with colleagues, fostering collaboration and understanding, leading to more productive and fulfilling work environments.

Understanding and Sharing Perspectives

Empathy allows us to see things from another person’s perspective, even if we don’t agree with them. This helps us understand their motivations, feelings, and concerns, creating a foundation for effective communication and collaboration.

Building strong emotional intelligence in the workplace can be a powerful tool, allowing you to connect with colleagues, understand different perspectives, and navigate difficult situations effectively. It’s a skill that can be cultivated, just like any other. For example, active listening and empathy can be practiced, and being able to read the room and adjust your communication style accordingly can be honed.

Sometimes, however, even the most emotionally intelligent individuals can find themselves facing unfair situations, like the case of Crosley Green, who was recently returned to prison for a crime he says he didn’t commit – you can read more about his story here.

Developing emotional intelligence can help us navigate these challenging moments with grace and resilience, and ultimately contribute to a more empathetic and understanding work environment.

Demonstrating Empathy in the Workplace

Here are some specific examples of how to demonstrate empathy in the workplace:

- Acknowledge colleagues’ emotions:Pay attention to nonverbal cues like body language and tone of voice. If someone seems stressed or upset, acknowledge their feelings and offer support. For example, “I noticed you seem a bit stressed today. Is there anything I can help you with?”

- Offer support:Be there for your colleagues when they need it. This could involve offering practical assistance, listening without judgment, or simply being a supportive presence. For example, if a colleague is facing a personal challenge, offer to help them with a task or provide a listening ear.

- Consider different viewpoints:When engaging in discussions or decision-making processes, actively listen to and consider different perspectives. Even if you disagree with a colleague’s opinion, try to understand their reasoning and acknowledge their contributions.

Resolving Conflicts Effectively, 6 super effective ways to show your emotional intelligence at work

Empathy plays a vital role in conflict resolution. By understanding the perspectives and emotions of all parties involved, we can approach conflicts with a more constructive mindset.

“Empathy allows us to see the world through another person’s eyes, which can help us understand their motivations and feelings, even if we don’t agree with them.”

Empathy helps us avoid making assumptions and fosters a more collaborative approach to conflict resolution. By actively listening, acknowledging emotions, and seeking common ground, we can work towards mutually acceptable solutions.

Understanding and managing your emotions is crucial for success in any workplace. Whether it’s being empathetic towards colleagues or calmly handling stressful situations, emotional intelligence plays a key role. Just like how England’s white-ball captain, Jos Buttler, is in a race to be fit for the upcoming T20 series against Australia jos buttler england white ball captain in race to be fit for englands t20 series against australia , it’s essential to be emotionally fit to navigate the complexities of the professional world.

So, cultivating emotional intelligence can truly give you an edge, allowing you to excel in your career.

Self-Awareness

Self-awareness is the foundation of emotional intelligence. It’s the ability to recognize your own emotions, understand their impact on your thoughts and behaviors, and how they affect those around you. It’s like having an internal compass that guides you through the complexities of the workplace.

Managing Stress and Making Informed Decisions

Self-awareness plays a crucial role in managing stress and making informed decisions. By understanding your emotional triggers, you can anticipate stressful situations and develop strategies to cope with them effectively. For example, if you know that tight deadlines tend to make you anxious, you can proactively prioritize tasks, communicate your needs, and seek support from colleagues.

This proactive approach helps you stay calm under pressure and make sound decisions even when faced with challenging situations.

Navigating the complexities of the workplace requires more than just technical skills. Emotional intelligence is key, and understanding the nuances of how to show it can make all the difference. One powerful way is to be empathetic and genuinely care about your colleagues, a skill that’s particularly important when considering news like irans morality police will not bother women president says.

These situations highlight the need for understanding and compassion, and by practicing empathy, we can build stronger, more supportive work environments. And that’s just one of the six super effective ways to show your emotional intelligence at work.

Common Emotional Triggers and Strategies for Managing Them

Identifying common emotional triggers is a crucial step in managing your emotions effectively. These triggers can be internal, such as personal anxieties or insecurities, or external, such as workplace conflicts or challenging deadlines. Recognizing these triggers allows you to anticipate potential emotional responses and develop coping mechanisms.

- Identify your triggers:Pay attention to situations or interactions that typically lead to strong emotional reactions. Keep a journal or use a self-reflection app to track your emotions and the circumstances that trigger them. This will help you understand your patterns and develop strategies for managing your reactions.

- Practice mindfulness:Mindfulness techniques, such as meditation or deep breathing exercises, can help you become more aware of your emotions in the moment. By observing your emotions without judgment, you can gain control over your reactions and prevent them from escalating into negative behaviors.

- Seek support:Don’t hesitate to reach out to a trusted colleague, mentor, or friend for support when dealing with emotional challenges. Talking about your feelings can help you gain perspective and develop strategies for managing them effectively.

Enhancing Leadership Skills and Communication Effectiveness

Self-awareness is essential for effective leadership. Leaders who are self-aware are better able to understand their strengths and weaknesses, inspire and motivate others, and create a positive and productive work environment. They are also more adept at communicating effectively, as they can adjust their communication style to suit the needs of their audience.

- Empathy:Self-awareness allows you to empathize with others. By understanding your own emotions, you can better recognize and understand the emotions of others. This empathy enables you to build stronger relationships, resolve conflicts effectively, and motivate your team members.

- Feedback:Self-aware individuals are open to feedback, both positive and constructive. They understand that feedback is an opportunity for growth and development, and they use it to improve their performance and leadership skills. They also give constructive feedback to their team members, fostering a culture of continuous improvement.

- Emotional regulation:Self-aware leaders are better at regulating their emotions. They can remain calm and composed even in challenging situations, setting a positive example for their team members. They can also recognize when their emotions are impacting their decision-making and take steps to manage them effectively.

Self-Regulation

In the fast-paced and demanding world of work, maintaining emotional composure is paramount. Self-regulation, the ability to manage your emotions effectively, is a crucial skill for navigating workplace challenges and achieving success. It allows you to respond to situations with calm and composure, fostering positive relationships, enhancing productivity, and promoting a healthy work environment.

Benefits of Emotional Regulation

Effective emotional regulation yields significant benefits in the workplace. By controlling your emotions, you can improve your focus, reduce conflict, and enhance your resilience.

- Improved Focus:When you are emotionally regulated, you are better able to concentrate on your tasks. Uncontrolled emotions, such as anger or anxiety, can distract you and make it difficult to focus. By managing your emotions, you can create a calmer and more productive work environment.

- Reduced Conflict:Uncontrolled emotions can lead to conflict with colleagues, clients, and supervisors. By regulating your emotions, you can communicate effectively and avoid escalating conflicts. This fosters a more harmonious and collaborative work environment.

- Increased Resilience:Emotional regulation allows you to bounce back from setbacks and challenges more effectively. When faced with stressful situations, you can remain calm and composed, allowing you to think clearly and find solutions. This increased resilience can lead to greater job satisfaction and career success.

Techniques for Managing Strong Emotions

Managing strong emotions requires a conscious effort and the development of effective techniques. Here are some practical strategies to help you regulate your emotions in the workplace:

- Deep Breathing:Deep breathing exercises can quickly calm your nervous system and reduce feelings of stress and anxiety. When you feel overwhelmed, take a few deep breaths, inhaling slowly through your nose and exhaling slowly through your mouth. This simple technique can help you regain control of your emotions and focus.

- Mindfulness Exercises:Mindfulness involves paying attention to the present moment without judgment. Practicing mindfulness exercises, such as meditation or focusing on your senses, can help you become more aware of your emotions and develop a greater ability to manage them. Regular mindfulness practice can enhance your emotional regulation skills over time.

- Taking Breaks:When you feel stressed or overwhelmed, it’s important to take breaks to recharge. Step away from your work, go for a walk, or engage in a relaxing activity. Taking regular breaks can help you avoid burnout and maintain emotional balance.

Enhancing Your Ability to Handle Challenging Situations

Self-regulation plays a critical role in handling challenging situations calmly and professionally. When you are emotionally regulated, you can:

- Think Clearly:You can assess the situation objectively and make informed decisions without being swayed by emotional impulses.

- Communicate Effectively:You can express yourself clearly and respectfully, even when dealing with difficult people or situations.

- Maintain Professionalism:You can remain composed and avoid reacting in ways that could damage your reputation or relationships.

Motivation

Motivation is the driving force behind our actions, and it plays a crucial role in achieving our goals, both personally and professionally. It is the internal state that propels us to act, persevere, and strive for excellence. Emotional intelligence plays a vital role in both motivating ourselves and inspiring others.

Understanding the Connection

Emotional intelligence enhances our ability to understand and manage our own emotions, as well as those of others. This understanding allows us to tap into our intrinsic motivations and recognize what drives others. By being aware of our emotions, we can identify what motivates us and what demotivates us.

Similarly, by understanding the emotions of others, we can better connect with them and inspire them to reach their full potential.

Motivating Yourself

- Setting Clear Goals:When we have clear goals, we know what we are working towards and how our efforts contribute to the bigger picture. Clear goals provide direction and purpose, fueling our motivation.

- Positive Reinforcement:Recognizing and celebrating our accomplishments, no matter how small, can boost our motivation. Positive reinforcement reinforces our efforts and encourages us to continue striving for excellence.

- Fostering a Sense of Purpose:Connecting our work to a larger purpose or mission can significantly enhance our motivation. When we believe in the value of our work and see its impact, we are more likely to feel inspired and engaged.

Motivating Others

- Empathy:Understanding the emotions and motivations of others is crucial for inspiring them. By empathizing with their needs and challenges, we can tailor our approach to motivate them effectively.

- Positive Feedback:Providing specific and constructive feedback can help others understand their strengths and areas for improvement. Positive feedback acknowledges their efforts and encourages them to grow.

- Empowerment:Giving others the autonomy and resources to make decisions and take ownership of their work can foster a sense of purpose and responsibility, boosting their motivation.

Creating a Positive Work Environment

Emotional intelligence can significantly contribute to creating a positive and productive work environment. By fostering open communication, empathy, and a sense of community, we can create a space where people feel valued, supported, and motivated to do their best work.

Building Relationships

In the professional realm, success often hinges on the strength of your relationships. Building and maintaining positive connections with colleagues, clients, and stakeholders is crucial for achieving shared goals, fostering collaboration, and navigating challenges effectively. Emotional intelligence plays a pivotal role in this process, enabling you to understand and manage your own emotions while also recognizing and responding to the emotions of others.

Demonstrating Emotional Intelligence in Interactions

Emotional intelligence is not merely about being friendly or charismatic; it’s about using your emotional awareness and understanding to navigate interactions with empathy, tact, and authenticity. Here are a few examples of how to demonstrate emotional intelligence in your interactions with colleagues, clients, and stakeholders:

- Active Listening:Pay close attention to what others are saying, both verbally and nonverbally. This involves focusing on their words, tone of voice, and body language to grasp their true message and emotions. Active listening demonstrates respect, builds trust, and prevents misunderstandings.

- Empathy:Put yourself in the other person’s shoes to understand their perspective, feelings, and motivations. This doesn’t mean agreeing with them, but it involves acknowledging and validating their emotions. Empathy fosters understanding and creates a more collaborative environment.

- Respectful Communication:Choose your words carefully, avoiding accusatory or judgmental language. Focus on expressing your thoughts and feelings clearly and respectfully, even when discussing difficult topics. Respectful communication promotes open dialogue and avoids escalating conflicts.

- Conflict Resolution:When disagreements arise, approach them with a calm and constructive attitude. Seek to understand the root cause of the conflict and work collaboratively towards a mutually acceptable solution. Emotional intelligence helps you remain objective, listen attentively, and find common ground.

- Positive Reinforcement:Acknowledge and appreciate the contributions of others. Offer genuine praise and encouragement to boost morale and foster a positive work environment. Positive reinforcement strengthens relationships and motivates individuals to perform at their best.