Standard Chartered Bank Joins Metaverse: A New Era of Financial Services

Standard Chartered Bank joins metaverse, a move that’s sending ripples through the financial world. This isn’t just a publicity stunt; it’s a strategic play to tap into the immense potential of the metaverse and redefine the way we interact with financial services.

Imagine a world where you can manage your finances, invest in digital assets, and even access personalized banking experiences all within a virtual realm. Standard Chartered Bank is leading the charge, and their vision goes beyond just being present in the metaverse – they’re actively shaping its future.

This bold move signifies a shift in how financial institutions are approaching innovation. Standard Chartered Bank is leveraging the metaverse to enhance customer engagement, streamline transactions, and explore new avenues for growth. It’s a testament to the bank’s commitment to staying ahead of the curve and embracing the transformative power of technology.

Metaverse Applications for Financial Services

Standard Chartered Bank’s foray into the metaverse represents a significant move towards embracing innovative technologies to enhance its financial services offerings. By leveraging the immersive and interactive nature of the metaverse, the bank aims to create new avenues for customer engagement, streamline financial processes, and explore opportunities in the burgeoning digital asset landscape.

It’s fascinating to see Standard Chartered Bank embrace the metaverse, exploring new ways to connect with customers and build a virtual presence. While the bank is diving into the digital world, it’s a stark contrast to the real-world consequences of spreading misinformation, as seen in the Alex Jones damages trial regarding his false claims about the Sandy Hook shooting.

Perhaps this serves as a reminder that responsibility and truthfulness are essential, even in the virtual realm, as we navigate the evolving landscape of technology and its impact on society.

Virtual Banking

Virtual banking in the metaverse promises a more engaging and interactive experience for customers. Standard Chartered Bank plans to create virtual branches within the metaverse, providing customers with a 3D environment to interact with bank representatives, access financial information, and conduct transactions.

Standard Chartered Bank’s foray into the metaverse is a bold move, demonstrating their commitment to embracing cutting-edge technologies. While this news might sound exciting, it’s a reminder of the old adage “buy the rumour, sell the news,” as seen with Dogecoin’s recent price drop after its initial surge following Elon Musk’s acquisition of Twitter, as highlighted in this article buy the rumour sell the news dogecoin erases recent gains.

It will be interesting to see how Standard Chartered Bank navigates the evolving metaverse landscape and leverages its potential.

- Personalized Experiences:Virtual branches can be tailored to individual customer preferences, offering immersive experiences with personalized content and interactive elements. For example, customers could explore virtual branches designed to reflect their specific investment portfolios or access financial advice tailored to their needs.

- Enhanced Accessibility:The metaverse removes geographical limitations, allowing customers to access banking services from anywhere in the world, regardless of physical location. This can be particularly beneficial for individuals residing in remote areas or those who prefer virtual interactions.

- Interactive Learning:Virtual branches can host interactive workshops and educational sessions on financial topics, providing customers with a more engaging and accessible learning experience. For example, customers could participate in virtual financial literacy workshops or explore interactive simulations to understand investment strategies.

Digital Asset Management, Standard chartered bank joins metaverse

The metaverse presents a unique opportunity for Standard Chartered Bank to explore digital asset management services. The bank can leverage the metaverse’s decentralized nature to facilitate secure and transparent transactions involving digital assets.

- Virtual Asset Trading Platforms:Standard Chartered Bank can create virtual trading platforms within the metaverse, allowing customers to buy, sell, and manage digital assets in a secure and regulated environment. This platform could integrate with existing digital asset wallets, providing seamless access to trading opportunities.

- Tokenized Securities:The metaverse allows for the creation of tokenized securities, representing real-world assets such as stocks, bonds, and real estate. Standard Chartered Bank can explore offering tokenized securities within the metaverse, enabling fractional ownership and enhanced liquidity.

- Decentralized Finance (DeFi) Integration:The metaverse can serve as a platform for integrating decentralized finance (DeFi) services, providing customers with access to innovative lending, borrowing, and investment opportunities. Standard Chartered Bank can explore partnerships with DeFi platforms to offer these services within the metaverse.

Standard Chartered Bank’s foray into the metaverse is a fascinating move, showcasing the bank’s commitment to innovation. It reminds me of the recent article I read about Jared and Ivanka without the power or the masks , where the author explores the complexities of power dynamics and how they shift when individuals lose their positions of influence.

Similarly, Standard Chartered Bank’s metaverse venture is a bold move, positioning them at the forefront of a rapidly evolving financial landscape.

Customer Engagement

The metaverse’s immersive and interactive nature offers a powerful tool for customer engagement. Standard Chartered Bank can utilize the metaverse to create engaging experiences that foster stronger customer relationships.

- Virtual Events and Promotions:The metaverse allows for the creation of virtual events, such as conferences, webinars, and product launches, providing a more engaging and interactive experience for customers. Standard Chartered Bank can host virtual events within the metaverse to showcase its products and services, generate excitement, and connect with customers on a deeper level.

- Gamified Experiences:Standard Chartered Bank can create gamified experiences within the metaverse, allowing customers to earn rewards and engage with the bank’s services in a fun and interactive way. For example, customers could participate in financial literacy games or earn virtual rewards for completing financial tasks.

- Community Building:The metaverse can facilitate community building by creating virtual spaces for customers to connect, share ideas, and interact with bank representatives. Standard Chartered Bank can create virtual forums, chat rooms, and social spaces within the metaverse to foster a sense of community among its customers.

Comparison to Traditional Financial Service Delivery Models

The metaverse offers a significant departure from traditional financial service delivery models, providing a more immersive, interactive, and accessible experience for customers.

- Enhanced Customer Engagement:The metaverse allows for a more engaging and interactive experience, providing customers with a sense of presence and immersion. This can lead to increased customer satisfaction and loyalty.

- Global Reach:The metaverse removes geographical limitations, allowing customers to access financial services from anywhere in the world. This can expand the reach of Standard Chartered Bank to a wider audience.

- Cost Efficiency:Virtual branches and events can potentially reduce operational costs associated with physical infrastructure and traditional marketing campaigns.

- Innovation and Agility:The metaverse provides a platform for rapid innovation and experimentation, allowing Standard Chartered Bank to adapt to changing customer needs and market trends more effectively.

Technological Considerations

The metaverse is a complex and rapidly evolving technology, and its application in financial services presents unique challenges and opportunities. For Standard Chartered Bank to effectively operate within this environment, it needs to carefully consider the underlying technological infrastructure and the integration of various technologies, such as blockchain and virtual reality, into its existing systems.

Technological Infrastructure

A robust technological infrastructure is crucial for Standard Chartered Bank’s metaverse operations. This includes:

- High-performance computing: Processing complex transactions and supporting immersive virtual experiences requires powerful computing resources. Cloud-based solutions can provide the necessary scalability and flexibility.

- Secure and reliable network connectivity: The metaverse relies on a constant and stable internet connection to facilitate real-time interactions and data exchange. This is especially important for financial transactions, where latency can lead to errors and security breaches.

- Advanced data management and analytics: Collecting, analyzing, and utilizing data effectively is critical for understanding customer behavior, managing risk, and optimizing operations within the metaverse.

- Interoperability and standards: The metaverse is still in its early stages, and different platforms and technologies may not be compatible. Interoperability solutions are necessary to enable seamless data exchange and user experiences across various metaverse environments.

Integrating Blockchain and Virtual Reality

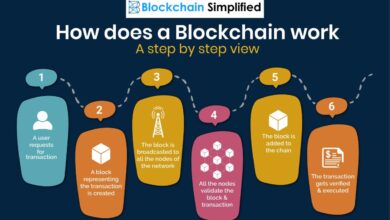

Blockchain technology can revolutionize financial services within the metaverse by providing a secure and transparent platform for transactions. It can facilitate:

- Decentralized finance (DeFi): Blockchain-based applications can offer alternative financial services, such as lending, borrowing, and trading, without the need for traditional intermediaries.

- Digital asset management: Cryptocurrencies and other digital assets can be securely stored and managed on blockchain platforms, providing greater control and transparency for users.

- Improved transparency and traceability: Blockchain’s immutable ledger can provide a complete audit trail of transactions, enhancing trust and accountability within the financial system.

Virtual reality (VR) can enhance the customer experience and create new opportunities for financial services. VR can be used to:

- Create immersive banking experiences: Customers can interact with virtual bank branches, access financial information, and conduct transactions in a more engaging and interactive environment.

- Develop innovative financial education tools: VR can be used to create interactive simulations that teach users about financial concepts and products in a more engaging and accessible way.

- Facilitate remote collaboration and training: VR can enable employees to collaborate and receive training in a virtual environment, regardless of their physical location.

Security and Regulatory Considerations

Operating in the metaverse presents unique security and regulatory challenges for financial institutions. Key considerations include:

- Data privacy and security: Protecting sensitive customer data in the metaverse is paramount. Robust security measures, including encryption, access controls, and regular audits, are essential.

- Anti-money laundering (AML) and know your customer (KYC) compliance: Financial institutions must ensure compliance with AML and KYC regulations within the metaverse, which may require new approaches to identity verification and transaction monitoring.

- Cybersecurity threats: The metaverse is a new and evolving landscape, and financial institutions must be prepared for emerging cybersecurity threats, such as phishing scams, malware attacks, and data breaches.

- Regulatory uncertainty: The regulatory framework for financial services in the metaverse is still developing. Financial institutions need to stay informed about evolving regulations and adapt their operations accordingly.

Industry Impact and Future Trends: Standard Chartered Bank Joins Metaverse

Standard Chartered Bank’s foray into the metaverse represents a significant step forward in the integration of financial services with emerging technologies. This move has implications for the banking industry as a whole, prompting other institutions to consider similar strategies and influencing the future trajectory of financial technology.

Comparison with Other Financial Institutions

Standard Chartered Bank’s metaverse initiatives are part of a growing trend among financial institutions exploring the potential of this emerging technology. While Standard Chartered Bank has focused on building virtual branches and offering metaverse-based financial services, other institutions are pursuing different strategies.

For instance, JPMorgan Chase has established a virtual lounge in Decentraland, while HSBC has launched a virtual branch in The Sandbox. These initiatives demonstrate the diverse ways in which financial institutions are embracing the metaverse, each tailored to their specific goals and target audiences.

Timeline of Future Developments

The intersection of finance and the metaverse is expected to evolve rapidly in the coming years, with significant developments anticipated across various aspects of the financial ecosystem.

- 2023-2024:Increased adoption of metaverse platforms by financial institutions, with a focus on virtual branches, events, and customer engagement experiences.

- 2025-2026:Emergence of metaverse-specific financial products and services, such as virtual asset management, decentralized finance (DeFi) solutions, and metaverse-based insurance.

- 2027-2028:Integration of blockchain technology and other distributed ledger technologies into the metaverse, enabling secure and transparent financial transactions.

- 2029-2030:Maturation of regulatory frameworks for metaverse-based financial activities, fostering a more stable and secure environment for investors and consumers.

Long-Term Implications for the Banking Industry

Standard Chartered Bank’s metaverse strategy could have significant long-term implications for the banking industry. By embracing this technology, the bank is positioning itself to cater to the evolving needs of a digitally savvy customer base and to leverage the potential of the metaverse to offer innovative financial products and services.

“The metaverse presents a unique opportunity for financial institutions to reach new customers, enhance customer experiences, and explore new business models.”

David Roberts, CEO of Standard Chartered Bank.

The bank’s initiatives could inspire other institutions to adopt similar strategies, leading to a more dynamic and innovative financial landscape. Moreover, the development of metaverse-specific financial products and services could reshape the way consumers interact with banks, potentially leading to greater financial inclusion and accessibility.

Final Conclusion

Standard Chartered Bank’s foray into the metaverse is more than just a headline-grabbing move. It’s a strategic decision that positions the bank at the forefront of a financial revolution. By embracing the metaverse, Standard Chartered Bank is not only creating a more immersive and engaging experience for its customers, but it’s also paving the way for a future where the lines between the physical and digital worlds blur, opening up a world of possibilities for financial services.