Six Fearsome Economic Challenges Family Businesses Face

Six fearsome economic challenges family business owners can face down – this isn’t a phrase that evokes images of idyllic family dinners and shared success stories. It speaks to the harsh realities that can threaten the very foundation of these businesses, from navigating complex succession planning to weathering economic storms.

The world of family businesses is a unique one, steeped in tradition, personal relationships, and a shared sense of ownership. But these very strengths can also become obstacles, leading to conflicts and unforeseen challenges. This is where understanding the six fearsome economic challenges becomes crucial – not to discourage but to equip family business owners with the knowledge and strategies to overcome them and thrive.

Succession Planning

Succession planning is a critical aspect of any family business, but it’s particularly crucial for ensuring long-term stability and growth. It involves the process of identifying, developing, and preparing future leaders to take over the reins of the business, ideally when the current generation is ready to step aside.

This process can be complex, often involving delicate family dynamics and emotional considerations.

Challenges of Transitioning Ownership and Leadership

Transitioning ownership and leadership within a family business can be a challenging process, fraught with potential conflicts and disagreements. Family members may have different visions for the future of the business, leading to disputes over strategic direction, financial management, and the role of family members in the organization.

The potential for resentment and mistrust can arise, particularly if the transition process is not handled carefully and transparently.

Navigating the six fearsome economic challenges family business owners can face down requires resilience and strategic thinking. From managing rising costs to adapting to shifting consumer preferences, these challenges can feel overwhelming. It’s interesting to note that despite these economic headwinds, Hawaii is the happiest state in America, with California and Florida not even making the top 10.

Perhaps there’s a lesson to be learned about finding happiness amidst economic challenges, a lesson that family business owners could find useful in facing down their own unique struggles.

Potential for Family Conflicts and Disagreements

Family businesses are often characterized by close personal relationships, which can make succession planning a sensitive and emotionally charged issue. Disagreements can arise over a variety of factors, including:

- Differing expectations and aspirations:Family members may have different ideas about the future of the business, its growth trajectory, and the role of family members in the organization. This can lead to conflicts over strategic direction, investment decisions, and the distribution of profits.

- Competition among family members:Sibling rivalry or competition between generations can create tensions and undermine collaboration. This can manifest in disputes over leadership positions, decision-making power, and financial rewards.

- Lack of clarity and communication:A lack of clear communication about succession plans can create confusion and uncertainty among family members, leading to misunderstandings and resentment. Open and honest discussions are essential to avoid ambiguity and prevent surprises.

- Emotional attachments:Family businesses often carry significant emotional weight, making it difficult for family members to detach from their roles and relinquish control. This can create resistance to change and make it challenging to implement succession plans.

Strategies for Ensuring a Smooth and Successful Transition

To mitigate these challenges and ensure a smooth and successful transition, family businesses should implement a well-defined succession plan that addresses key considerations, such as:

- Clear communication:Open and transparent communication is essential for building trust and understanding among family members. This involves discussing the succession plan openly, addressing concerns, and seeking input from all stakeholders.

- Professional guidance:Seeking advice from external professionals, such as lawyers, accountants, and business consultants, can provide objective perspectives and help navigate complex legal and financial issues. They can also facilitate discussions and mediate disagreements among family members.

- Family council:Establishing a family council or advisory board can provide a structured forum for family members to discuss business matters, resolve conflicts, and make informed decisions. This can help maintain a sense of unity and collaboration within the family business.

- Succession plan document:A written succession plan document outlining the process, timelines, and responsibilities can provide clarity and transparency. This document should be reviewed and updated regularly to reflect changes in the business, family dynamics, and legal requirements.

- Training and development:Providing training and development opportunities for potential successors can ensure they are adequately prepared to take on leadership roles. This can include mentorship programs, leadership training, and exposure to different aspects of the business.

Financial Management

Financial management in a family business is a delicate balancing act, requiring careful planning and execution to ensure long-term stability and growth. The intricacies of managing finances in this context are often amplified by the intertwining of personal and business finances, which can lead to potential conflicts of interest and financial instability.

Separating Personal and Business Finances

Maintaining a clear separation between personal and business finances is crucial for both legal and financial reasons. This separation allows for accurate accounting, improved financial decision-making, and protection of personal assets. Here are some steps to achieve this separation:

- Establish Separate Bank Accounts:Create dedicated accounts for business transactions and personal expenses. This separation ensures that business funds are not used for personal expenses and vice versa.

- Maintain Distinct Financial Records:Keep meticulous records for both personal and business finances. This includes separate bank statements, invoices, receipts, and financial reports.

- Formalize Agreements:Implement clear agreements, such as shareholder agreements and loan agreements, to define financial responsibilities and ownership structures.

- Consult with Professionals:Seek guidance from accountants, financial advisors, and lawyers to ensure proper financial management practices are implemented.

“Separating personal and business finances is essential for maintaining clarity and financial stability in a family business. By establishing distinct accounts, maintaining separate records, and formalizing agreements, family business owners can protect their personal assets and ensure responsible financial management.”

Competition: Six Fearsome Economic Challenges Family Business Owners Can Face Down

Family businesses, despite their strong foundations and unique advantages, often face fierce competition from both established corporations and agile startups. This competitive landscape poses significant challenges that require strategic planning and adaptation to ensure long-term success.

Analyzing the Competitive Landscape

The competitive landscape for family businesses can be segmented into two main categories: larger corporations and startups.Larger corporations often possess significant resources, economies of scale, and established brand recognition, allowing them to dominate market share and exert pricing pressure. Startups, on the other hand, are characterized by their agility, innovative approaches, and ability to quickly adapt to market changes.

Challenges from Larger Corporations

- Pricing Pressure:Larger corporations can leverage their economies of scale to offer lower prices, making it difficult for family businesses to compete on price alone.

- Marketing Reach:Corporations have extensive marketing budgets and established brand recognition, making it challenging for family businesses to reach a wider audience.

- Distribution Networks:Corporations often have well-established distribution networks, giving them an advantage in reaching consumers and retailers.

Challenges from Startups

- Innovation and Agility:Startups are often at the forefront of innovation, introducing new products and services that can disrupt established markets.

- Customer Focus:Startups are known for their customer-centric approach, often tailoring their offerings to meet specific customer needs and preferences.

- Digital Marketing Expertise:Startups are typically adept at utilizing digital marketing channels to reach target audiences and build brand awareness.

Strengths and Weaknesses of Family Businesses

Family businesses have unique strengths and weaknesses compared to their competitors. Understanding these aspects is crucial for developing a competitive strategy.

Navigating the turbulent waters of the economy can be a daunting task for any business owner, but for family businesses, the stakes are even higher. From generational transitions to succession planning, these enterprises face unique challenges. But amidst these economic storms, a little escape might be just what you need.

If you’re looking for an offbeat European holiday, this island has its own rules, language, and vodka , offering a truly unique experience. Back to the business world, however, family businesses must also contend with issues like competition, market fluctuations, and technological advancements.

The ability to adapt and innovate is crucial to their survival and success.

Strengths

- Long-Term Vision:Family businesses often have a long-term vision, prioritizing sustainability and building a legacy for future generations.

- Strong Values and Culture:Family businesses are known for their strong values and culture, fostering a sense of community and shared purpose.

- Customer Relationships:Family businesses often build strong relationships with their customers, based on trust, personalized service, and a commitment to quality.

- Flexibility and Adaptability:Family businesses can often adapt quickly to changing market conditions, leveraging their smaller size and nimbleness.

Weaknesses

- Limited Resources:Family businesses may have limited financial resources compared to larger corporations, hindering their ability to invest in growth and innovation.

- Succession Planning Challenges:Family businesses can face challenges in succession planning, ensuring smooth transitions and maintaining the family’s control.

- Potential for Conflict:Family dynamics can sometimes lead to conflicts and disagreements, affecting business decisions and performance.

Staying Competitive and Adapting to Changing Market Dynamics

Family businesses need to develop strategies to address the challenges posed by competition and adapt to changing market dynamics.

Navigating the choppy waters of economic uncertainty can be a real test for family business owners, who face down a gauntlet of challenges like rising costs, changing consumer habits, and fierce competition. Sometimes, it’s refreshing to step away from the boardroom and consider something completely different, like the news that perspective a live action pac man movie is in the works we have questions.

Of course, even with a dose of pop culture, the reality remains that those six fearsome economic challenges will still be there when family business owners return to their desks.

Key Strategies

- Focus on Niche Markets:Family businesses can leverage their strengths by focusing on niche markets where they can differentiate themselves from larger competitors.

- Embrace Technology:Investing in technology can help family businesses streamline operations, improve efficiency, and enhance customer experiences.

- Build Strong Brand Identity:Developing a strong brand identity can help family businesses stand out from the competition and attract loyal customers.

- Foster Innovation:Encouraging innovation and exploring new product and service offerings can help family businesses stay ahead of the curve.

- Strategic Partnerships:Collaborating with other businesses or organizations can help family businesses access new markets, resources, and expertise.

- Embrace Digital Marketing:Utilizing digital marketing channels can help family businesses reach wider audiences and build brand awareness.

- Prioritize Customer Experience:Delivering exceptional customer experiences can build loyalty and drive repeat business.

Economic Downturns

Economic downturns, or recessions, are a common occurrence in the business cycle. Family businesses are particularly vulnerable to these economic shocks due to their often-limited resources and reliance on local markets. A recession can significantly impact a family business’s revenue, profitability, and overall sustainability.

Impact of Economic Downturns on Family Businesses

Economic downturns can have a profound impact on family businesses, leading to decreased demand for products and services, reduced consumer spending, and increased competition. These factors can result in lower sales, reduced profits, and even business closures.

- Decreased Demand: During a recession, consumers tend to cut back on discretionary spending, leading to a decline in demand for non-essential goods and services. This can significantly impact family businesses that rely on consumer spending.

- Reduced Consumer Spending: As unemployment rises and incomes fall, consumers have less disposable income, leading to reduced spending on goods and services. This can negatively impact family businesses that rely on consumer spending.

- Increased Competition: During economic downturns, businesses may become more competitive, as they try to maintain market share and profitability. This can put pressure on family businesses to lower prices, reduce costs, or offer new products and services, which can be challenging for smaller businesses.

Strategies for Mitigating the Risks Associated with Economic Volatility

To mitigate the risks associated with economic volatility, family businesses can implement several strategies:

- Diversify Revenue Streams: By diversifying revenue streams, family businesses can reduce their dependence on any single product or service, making them less vulnerable to economic downturns. For example, a restaurant could offer catering services or online ordering options to supplement its dine-in business.

- Build a Strong Financial Cushion: A strong financial cushion can help family businesses weather economic storms. This can be achieved through careful budgeting, cash flow management, and setting aside a reserve fund for emergencies.

- Develop a Flexible Business Model: Adaptability is crucial in a volatile economy. Family businesses can develop a flexible business model that allows them to adjust their operations quickly to changing market conditions. This may involve exploring new markets, developing new products or services, or optimizing their operations to reduce costs.

Creating a Plan for Managing Cash Flow and Resources

Effective cash flow management is essential for family businesses, especially during challenging economic times. Here are some key steps to consider:

- Forecast Cash Flow: Regularly forecast cash flow to identify potential shortfalls or surpluses. This can help businesses make informed decisions about spending, investing, and borrowing.

- Manage Accounts Receivable: Implement efficient processes for collecting payments from customers to ensure a steady stream of cash flow. This may involve offering incentives for early payment or using collection agencies to recover overdue invoices.

- Optimize Inventory: Carefully manage inventory levels to avoid overstocking, which can tie up valuable cash. Implement inventory management systems that track stock levels and predict demand to minimize waste.

- Negotiate with Suppliers: During economic downturns, family businesses may need to negotiate with suppliers to obtain more favorable payment terms or lower prices. This can help improve cash flow and reduce costs.

Regulation and Compliance

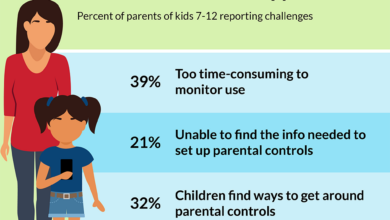

Navigating the legal and regulatory landscape is a constant challenge for family businesses. From labor laws and environmental regulations to tax codes and data privacy requirements, the complexities of compliance can be overwhelming. This challenge becomes even more pronounced as businesses grow and expand their operations.

Common Compliance Challenges and Their Impact

Compliance challenges can have significant repercussions for family businesses. Failure to comply with regulations can result in fines, penalties, and even legal action. Furthermore, it can damage the company’s reputation, erode customer trust, and disrupt business operations. Understanding and addressing these challenges is crucial for ensuring long-term success.

Here are some common compliance challenges family businesses face:

- Employment Laws:Family businesses must comply with federal, state, and local labor laws, including those related to minimum wage, overtime, workplace safety, non-discrimination, and employee benefits. Failure to comply can result in costly lawsuits and reputational damage.

- Environmental Regulations:Depending on the industry and location, businesses may face environmental regulations regarding waste disposal, emissions, and pollution control. Non-compliance can lead to fines, permits being revoked, and even criminal charges.

- Data Privacy and Security:In today’s digital age, businesses handle sensitive customer data. Compliance with data privacy regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), is essential. Breaches can result in significant fines and reputational damage.

- Tax Compliance:Family businesses need to comply with a complex web of tax regulations, including income tax, payroll tax, sales tax, and property tax. Failure to comply can lead to audits, penalties, and even criminal prosecution.

- Antitrust Laws:Family businesses must be mindful of antitrust laws, particularly if they operate in a concentrated market. Violations can result in hefty fines and potential legal action.

Staying Informed and Ensuring Compliance, Six fearsome economic challenges family business owners can face down

Staying informed about relevant regulations and ensuring compliance is an ongoing process. Family businesses can implement the following strategies:

- Develop a Compliance Program:A comprehensive compliance program should be established, outlining policies, procedures, and training programs to ensure adherence to all applicable laws and regulations. This program should be reviewed and updated regularly to reflect changes in legislation.

- Appoint a Compliance Officer:Designating a compliance officer responsible for overseeing compliance efforts can streamline the process and ensure accountability. This individual should have a strong understanding of relevant laws and regulations and be able to provide guidance to employees.

- Train Employees:All employees should receive regular training on relevant compliance requirements, including ethical conduct, data privacy, and anti-discrimination policies. This training should be tailored to their specific roles and responsibilities.

- Utilize Technology:Leveraging compliance software and tools can help automate tasks, track compliance deadlines, and provide alerts for potential issues. This can free up time for more strategic compliance initiatives.

- Seek Professional Advice:Consulting with legal and accounting professionals specializing in compliance can provide valuable guidance and support. They can help businesses navigate complex regulations and ensure they are meeting all requirements.

Technological Advancements

The rapid pace of technological advancements presents both opportunities and challenges for family businesses. While these innovations can help streamline operations, enhance customer experiences, and drive growth, they also require significant investment, adaptation, and a willingness to embrace change.

Challenges of Embracing Technology

The adoption of new technologies can be daunting for family businesses, particularly those with established processes and a reluctance to disrupt the status quo. The challenges include:

- Cost of Implementation:Implementing new technologies often involves substantial upfront investments in hardware, software, training, and ongoing maintenance. This can be a significant barrier for businesses with limited resources.

- Resistance to Change:Long-standing family businesses may be resistant to adopting new technologies due to familiarity with existing methods and concerns about disrupting established workflows. Overcoming this resistance requires effective communication, training, and a clear demonstration of the benefits of technology.

- Skill Gaps:Integrating new technologies requires a workforce with the necessary skills and knowledge. This can be a challenge for businesses that lack the resources or expertise to train employees or hire skilled professionals.

- Cybersecurity Threats:As businesses become increasingly reliant on technology, they become more vulnerable to cyberattacks. Protecting sensitive data and systems requires robust cybersecurity measures, which can be costly and complex to implement.

Strategies for Embracing Technology

To thrive in a digital age, family businesses must embrace technology and leverage its potential for growth. Here are some key strategies:

- Develop a Technology Strategy:Start by defining a clear technology strategy that aligns with the business’s overall goals. This strategy should Artikel the technologies to be adopted, the timeline for implementation, and the resources required.

- Invest in Training and Development:Equip employees with the skills and knowledge necessary to effectively utilize new technologies. This can involve in-house training programs, online courses, or partnerships with educational institutions.

- Embrace Cloud Computing:Cloud-based solutions offer scalability, cost-effectiveness, and accessibility, making them ideal for family businesses. By migrating to the cloud, businesses can access powerful tools and applications without significant upfront investments.

- Leverage Data Analytics:Data analytics can provide valuable insights into customer behavior, market trends, and operational efficiency. By harnessing the power of data, businesses can make informed decisions, optimize processes, and improve customer satisfaction.

- Adopt Automation:Automation technologies can streamline repetitive tasks, freeing up employees to focus on more strategic activities. This can increase efficiency, reduce costs, and improve productivity.

- Prioritize Cybersecurity:Implement robust cybersecurity measures to protect sensitive data and systems from cyberattacks. This includes using strong passwords, regularly updating software, and investing in security solutions.