Senate Votes on Inflation Reduction Act: A Rama Approaching?

Senate enters vote a rama as the inflation reduction act comes closer to being passed – Senate enters vote-a-rama as the Inflation Reduction Act comes closer to being passed, marking a pivotal moment in American politics. The bill, designed to tackle inflation, climate change, and healthcare costs, has sparked intense debate and a flurry of amendments.

With both parties vying for victory, the Senate floor is expected to be a battleground for the next few days.

The Inflation Reduction Act aims to reduce the federal deficit by $300 billion, primarily through higher taxes on corporations and wealthy individuals. It also invests billions in clean energy and renewable energy sources, aiming to reduce greenhouse gas emissions and combat climate change.

The bill further seeks to lower prescription drug costs for seniors and extend subsidies for health insurance under the Affordable Care Act.

The Senate Vote: Senate Enters Vote A Rama As The Inflation Reduction Act Comes Closer To Being Passed

The Senate vote on the Inflation Reduction Act was a pivotal moment in American politics, marking a significant step towards enacting a comprehensive climate and healthcare agenda. The legislation, a key priority for the Biden administration, faced intense scrutiny and partisan opposition, making the Senate vote a high-stakes battle.

Key Provisions of the Inflation Reduction Act

The Inflation Reduction Act is a multifaceted piece of legislation encompassing a wide range of policies aimed at addressing climate change, lowering healthcare costs, and reducing the federal deficit.

- Climate Change:The Act invests heavily in clean energy technologies, renewable energy sources, and electric vehicle production. It offers tax credits and incentives for individuals and businesses to adopt sustainable practices, aiming to reduce greenhouse gas emissions and combat climate change.

- Healthcare:The Act extends Affordable Care Act subsidies, making healthcare more affordable for millions of Americans. It also caps the cost of insulin for Medicare beneficiaries at $35 per month, providing significant relief to individuals with diabetes.

- Federal Deficit:The Act aims to reduce the federal deficit by raising taxes on corporations and wealthy individuals. It includes a 15% minimum tax on large corporations and a 1% excise tax on stock buybacks, aiming to ensure that corporations pay their fair share.

The Senate is gearing up for a vote-a-rama as the Inflation Reduction Act inches closer to becoming law. It’s a high-stakes game of political chess, with both sides pulling out all the stops. Meanwhile, across the pond, England’s stand-in captain, Harry Brook, has a chance to prove his mettle as he leads his team against Australia.

While the political drama unfolds in Washington, the cricketing world will be watching Brook’s every move. It’s fascinating to see how different arenas of leadership play out, whether it’s on the field or in the halls of power. Back to the Inflation Reduction Act, the outcome of this vote-a-rama could have significant implications for the US economy, making it a pivotal moment in American politics.

Arguments for and Against the Inflation Reduction Act

The Inflation Reduction Act has generated significant debate, with proponents and opponents advancing compelling arguments.

The Senate is in a flurry of activity as the Inflation Reduction Act inches closer to becoming law. It’s interesting to see how political debates often focus on domestic issues, while sometimes overlooking broader trends impacting global competitiveness. For example, former ARM CEO criticizes Britain for not holding onto its top tech firms , highlighting the importance of nurturing innovation and talent to remain at the forefront of technological advancements.

As the Senate debates the Inflation Reduction Act, perhaps it’s worth considering how to foster a more robust and competitive tech ecosystem in the US, ensuring we remain a global leader in the years to come.

- Arguments for:Supporters of the Act highlight its potential to address climate change, lower healthcare costs, and reduce the federal deficit. They argue that the investments in clean energy and renewable energy sources will create jobs, stimulate economic growth, and enhance national security.

They also emphasize the importance of extending Affordable Care Act subsidies and capping insulin costs to improve access to affordable healthcare for millions of Americans. Additionally, they argue that the Act’s tax provisions will promote fairness and ensure that corporations and wealthy individuals contribute their fair share to the economy.

The Senate is in a frenzy as the Inflation Reduction Act inches closer to passage, with the vote-a-rama in full swing. While the focus is on climate change and healthcare, there’s another ripple effect worth noting: student debt relief is modestly credit positive for colleges, according to Moody’s.

This could potentially impact the financial landscape of higher education, even as the Senate grapples with the larger implications of the Inflation Reduction Act.

- Arguments against:Opponents of the Act raise concerns about its impact on the economy, arguing that the tax increases will stifle business growth and discourage investment. They also criticize the Act’s focus on climate change, claiming that it will lead to higher energy costs and harm consumers.

Additionally, they argue that the Act’s healthcare provisions will increase government spending and lead to higher healthcare costs in the long run.

Political Dynamics Surrounding the Vote, Senate enters vote a rama as the inflation reduction act comes closer to being passed

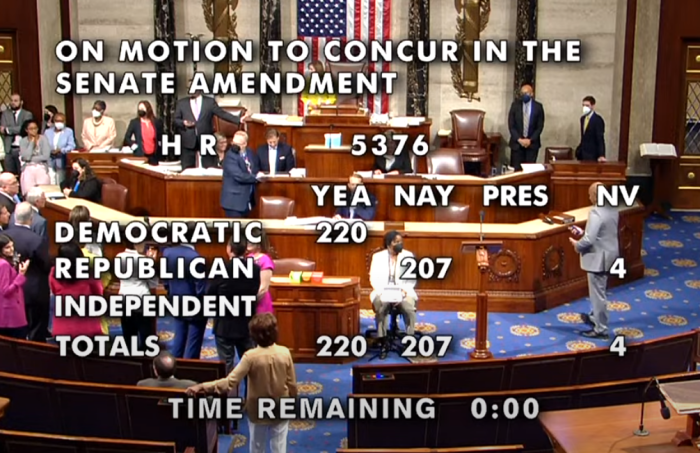

The Senate vote on the Inflation Reduction Act was marked by intense political maneuvering and partisan divisions. Democrats, united in their support for the legislation, faced a formidable challenge in securing the necessary votes to pass the Act. Republicans, largely opposed to the Act, employed various tactics to delay and derail its passage.

The vote ultimately hinged on the support of a handful of moderate Democrats, whose votes were crucial in securing the Act’s passage.

The Inflation Reduction Act

The Inflation Reduction Act (IRA) is a comprehensive piece of legislation passed by the US Congress in 2022. It aims to address multiple pressing issues, including climate change, healthcare costs, and the federal budget deficit. The act’s name reflects its primary goal of reducing inflation, which has been a significant concern for American households.

Climate Change Provisions

The IRA includes a significant investment in clean energy initiatives, aiming to reduce greenhouse gas emissions and promote a transition to a more sustainable economy. This includes:

- Tax credits for renewable energy sources such as solar and wind power, making these options more affordable for businesses and individuals.

- Funding for energy efficiency upgrades in homes and buildings, reducing energy consumption and lowering utility bills.

- Support for the development of clean energy technologies, including advanced nuclear power and carbon capture.

- Investments in electric vehicle infrastructure, such as charging stations, to encourage the adoption of electric vehicles.

These provisions aim to accelerate the shift away from fossil fuels and towards a cleaner energy future.

Healthcare Provisions

The IRA seeks to lower healthcare costs for Americans by:

- Extending Affordable Care Act (ACA) subsidies, making health insurance more affordable for millions of Americans.

- Allowing Medicare to negotiate drug prices for certain medications, potentially lowering drug costs for seniors.

- Imposing a cap on out-of-pocket prescription drug costs for Medicare beneficiaries.

These provisions are intended to improve access to affordable healthcare and reduce the financial burden of medical expenses.

Tax Provisions

The IRA includes a number of tax provisions designed to raise revenue and reduce the federal budget deficit. These include:

- A 15% minimum tax on large corporations, aimed at ensuring that profitable companies pay their fair share of taxes.

- Increased funding for the Internal Revenue Service (IRS) to improve tax enforcement and reduce tax avoidance.

- A new excise tax on stock buybacks, discouraging companies from using profits to repurchase shares instead of investing in growth or paying employees.

These provisions aim to address concerns about corporate tax avoidance and generate revenue to fund other priorities.

The Political Landscape

The Senate vote on the Inflation Reduction Act is not just a legislative event; it’s a significant moment in the ongoing political drama that defines the current US political landscape. The vote’s outcome will have profound implications for the upcoming midterm elections, potentially influencing the balance of power in Congress and shaping the national political discourse for years to come.

The Impact on the Midterm Elections

The Inflation Reduction Act has become a focal point for both Democrats and Republicans, with each party using it as a tool to mobilize their base and attract independent voters. For Democrats, the Act represents a major legislative victory, showcasing their commitment to addressing climate change, lowering healthcare costs, and tackling inflation.

They hope to leverage this success to counter the traditional midterm headwinds that often favor the party out of power. Republicans, on the other hand, have vehemently opposed the Act, arguing that it will lead to higher taxes, increased government spending, and exacerbate inflation.

They are using the Act as a rallying cry to energize their base and frame the upcoming elections as a referendum on President Biden’s economic policies.

The Positions of the Major Political Parties

The Inflation Reduction Act has starkly divided the two major political parties, reflecting their differing priorities and ideological stances.

- Democrats:Generally support the Act, emphasizing its benefits for climate change mitigation, healthcare affordability, and addressing inflation. They view it as a critical step towards achieving their policy goals and a testament to their ability to deliver on their promises.

- Republicans:Oppose the Act, arguing that it will increase taxes, fuel inflation, and expand the role of government. They see it as a wasteful spending bill that will harm the economy and burden future generations.

Key Political Players and Their Influence

Several key political players have played a significant role in shaping the debate surrounding the Inflation Reduction Act and influencing its passage.

- President Biden:The Act is a cornerstone of President Biden’s legislative agenda, and his support has been instrumental in securing its passage. He has used the Act as a platform to promote his economic policies and highlight his commitment to tackling climate change.

- Senate Majority Leader Chuck Schumer:Schumer has been a key architect of the Act, navigating the complex legislative process and securing the necessary votes to bring it to the floor. His leadership and strategic maneuvering have been crucial to the Act’s success.

- Senator Joe Manchin:Manchin’s support for the Act was critical, as his vote was needed to overcome Republican opposition. He played a pivotal role in negotiating the final version of the bill, ensuring that it addressed his concerns about inflation and energy security.

- Senator Kyrsten Sinema:Sinema’s vote was also crucial, as she joined Manchin in supporting the Act. Her decision to support the bill despite pressure from some members of her own party demonstrates the complex political dynamics at play.

Public Opinion and Impact

The Inflation Reduction Act (IRA) has generated significant public debate, with diverse opinions emerging from various demographics. This section delves into public sentiment surrounding the IRA, examining its potential impact on different groups and analyzing the social and economic implications it may carry.

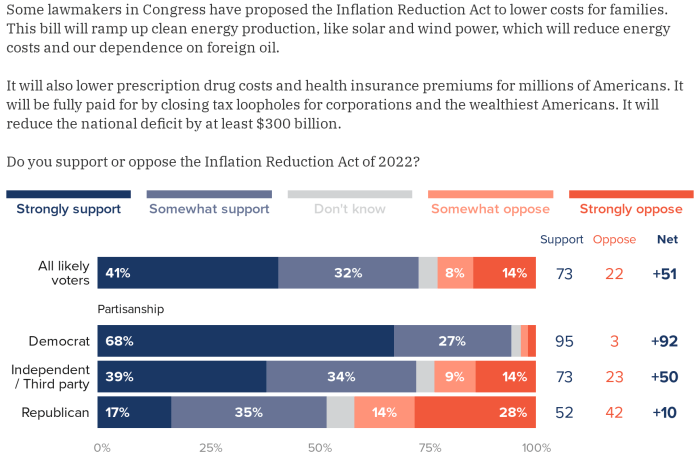

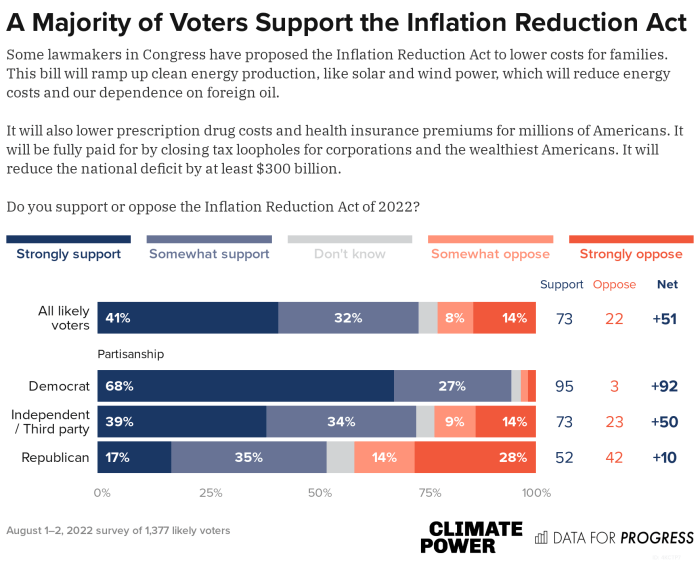

Public Opinion on the Inflation Reduction Act

Public opinion on the IRA is complex and multifaceted, with varying perspectives based on political affiliation, socioeconomic status, and personal priorities.

- Supporters:Advocates for the IRA generally hail from the Democratic Party and environmental groups, citing its potential to address climate change, lower healthcare costs, and promote economic growth. They believe the IRA’s investments in renewable energy, clean manufacturing, and healthcare subsidies will benefit the nation in the long term.

- Opponents:Critics of the IRA, primarily from the Republican Party and business organizations, argue that its tax increases and regulatory burdens will stifle economic growth, harm businesses, and ultimately increase inflation. They contend that the IRA’s focus on climate change and healthcare is misguided and will disproportionately impact certain industries and individuals.

- Mixed Opinions:A significant portion of the public holds mixed opinions on the IRA, recognizing its potential benefits but also expressing concerns about its impact on specific sectors or their personal finances. They may support certain provisions while opposing others, creating a nuanced and often complex understanding of the legislation.

Social and Economic Implications

The IRA is anticipated to have significant social and economic implications, potentially impacting various aspects of American life, including healthcare, education, and environmental protection.

- Healthcare:The IRA aims to lower prescription drug costs by allowing Medicare to negotiate drug prices and capping out-of-pocket expenses for seniors. This provision could benefit millions of Americans, particularly those with chronic conditions or limited incomes. However, some argue that price negotiations could hinder drug development and innovation, ultimately leading to fewer new treatments.

- Education:The IRA includes provisions to support clean energy jobs and investments in workforce development, which could indirectly impact education by creating new opportunities for students and workers. However, the specific impact on education is less direct than other areas, and its long-term benefits remain uncertain.

- Environmental Protection:The IRA’s core focus is on combating climate change through investments in renewable energy, electric vehicles, and energy efficiency. This could lead to cleaner air and water, reduced greenhouse gas emissions, and a more sustainable future. However, the effectiveness of these initiatives in achieving meaningful environmental goals remains to be seen, and some argue that the IRA’s measures may not be sufficient to address the magnitude of the climate crisis.

Challenges and Opportunities

Implementing the IRA effectively will present both challenges and opportunities.

- Challenges:One major challenge is ensuring the IRA’s provisions are implemented efficiently and effectively. This includes navigating bureaucratic hurdles, coordinating with various agencies, and addressing potential legal challenges. Additionally, the IRA’s ambitious goals may require significant coordination and cooperation between the government, private sector, and individual citizens.

- Opportunities:The IRA presents an opportunity to stimulate innovation and job creation in clean energy and healthcare sectors. By investing in research and development, supporting workforce training, and incentivizing private sector investment, the IRA could foster economic growth and create new opportunities for Americans.

Furthermore, the IRA’s focus on environmental protection could lead to a more sustainable future, reducing our reliance on fossil fuels and mitigating the effects of climate change.

Stakeholder Impact

The IRA’s potential benefits and drawbacks vary depending on the stakeholder group.

| Stakeholder | Benefits | Drawbacks |

|---|---|---|

| Businesses | – Tax credits for clean energy investments

|

– Increased regulatory burdens

|

| Consumers | – Lower prescription drug costs

|

– Potential for higher prices on some goods and services due to increased costs for businesses

|

| Environment | – Reduced greenhouse gas emissions

|

– Potential for unintended consequences of the IRA’s provisions

|