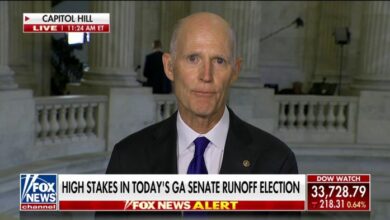

Rick Scotts Tax Plan: Raising Taxes on 40% of Americans

Rick Scott leads Senate Republicans to doom with plan to raise taxes on 40 of americans, a proposal that has sparked intense debate and raised concerns about its potential impact on the economy and the lives of everyday Americans. The plan, Artikeld by the former Florida governor and Republican Senator, seeks to overhaul the US tax code, with a particular focus on raising taxes for individuals and corporations.

At the heart of the controversy lies Scott’s proposal to eliminate the current tax code and replace it with a system where all Americans, regardless of income level, would be required to pay some form of federal income tax.

This radical shift has ignited fierce opposition, with critics arguing that it would disproportionately burden low- and middle-income households, while offering significant tax breaks to the wealthiest Americans.

The potential consequences of this tax plan are far-reaching, with experts warning of potential economic fallout, including a slowdown in consumer spending, job losses, and a widening of the income gap. The plan’s impact on government revenue is also a major concern, with some analysts predicting that it could lead to substantial budget deficits and cuts to essential government programs.

The political landscape is also being reshaped by this proposal, with Democrats vehemently opposing the plan and Republicans grappling with the implications of a tax overhaul that could potentially alienate a significant portion of their base.

Political Implications

Rick Scott’s proposal to raise taxes on 40 million Americans has sparked intense political debate and carries significant implications for the upcoming elections. This plan, which aims to sunset all federal legislation after five years and require a supermajority vote for any new spending, has been met with fierce opposition from Democrats and even some Republicans.

Rick Scott’s plan to raise taxes on 40% of Americans is a recipe for disaster. It’s a stark reminder that prioritizing short-term gains over long-term societal well-being can be detrimental. This begs the question: how can we ensure that corporations prioritize the needs of all stakeholders, not just shareholders?

It’s crucial to implement robust strategies for corporate social responsibility (CSR) that truly benefit society. If we fail to do so, policies like Scott’s will continue to erode public trust and exacerbate existing inequalities.

Motivations and Impact on Elections

The proposal’s primary motivation is likely to appeal to the Republican Party’s conservative base, who often advocate for smaller government and lower taxes. By targeting federal spending and requiring supermajority votes, Scott aims to constrain government growth and reduce the national debt.

However, the plan’s potential impact on the upcoming elections is complex and multifaceted.

- Increased Polarization:The proposal is likely to further polarize the political landscape, as Democrats fiercely oppose its implications for social programs and government services. This increased polarization could mobilize both parties’ bases, leading to higher voter turnout but also potentially exacerbating existing divisions within society.

- Swing Voters:The plan’s impact on swing voters, who often determine the outcome of elections, is uncertain. While some may be attracted to the idea of lower taxes and reduced government spending, others may be concerned about the potential cuts to social programs and the impact on essential services.

Rick Scott’s plan to raise taxes on 40% of Americans is a recipe for disaster, and it’s clear that he’s out of touch with the realities of everyday life. Meanwhile, President Biden is visiting the Port of Los Angeles, highlighting the global nature of inflation and the need for a comprehensive approach to address it.

Scott’s tax plan would only exacerbate the economic challenges we face, further burdening working families and businesses at a time when we need to be focused on solutions, not more problems.

This could make it challenging for either party to secure a decisive victory.

- Impact on Congressional Races:The proposal could significantly influence congressional races, particularly in districts where voters are closely divided. Candidates may be forced to take a strong stance on the plan, potentially alienating moderate voters who are not firmly aligned with either party. This could lead to a more polarized and unpredictable election cycle.

Comparison with Existing Tax Policies

Rick Scott’s proposal contrasts sharply with the existing tax policies of both the Democratic and Republican parties. While the Republican Party generally favors lower taxes and less government intervention, Scott’s plan goes further by proposing a complete sunset of all federal legislation and requiring a supermajority vote for any new spending.

This approach aligns with the views of the party’s most conservative wing but diverges from the more moderate Republicans who support a balance between fiscal responsibility and social programs.The Democratic Party, on the other hand, advocates for a more robust role for government in providing social services and addressing economic inequality.

Their tax policies typically focus on raising taxes on corporations and high-income earners to fund social programs and invest in infrastructure. While some Democrats may support certain aspects of Scott’s plan, such as reducing the national debt, their overall approach to taxation and government spending is fundamentally different.

Potential Ramifications for the Political Landscape

The ramifications of Rick Scott’s proposal for the political landscape are far-reaching and potentially transformative.

It’s hard to believe that Rick Scott, the same guy who wants to raise taxes on 40% of Americans, thinks he’s doing us a favor. It’s like watching those influencers who hype up crypto without disclosing their own financial ties – how influencers hype crypto without disclosing their financial ties – and then act surprised when people lose their shirts.

The whole thing just smacks of self-serving agendas, and it’s scary to think that this kind of reckless behavior is coming from someone in a position of power.

- Voter Sentiment:The plan’s impact on voter sentiment is likely to be mixed. Some voters may be attracted to the idea of lower taxes and reduced government spending, while others may be concerned about the potential cuts to social programs and the impact on essential services.

This could lead to a significant shift in voter sentiment, depending on the specific policies proposed and their perceived impact on individual voters.

- Balance of Power in Congress:The plan could significantly impact the balance of power in Congress. If it leads to a more polarized political landscape and increased voter turnout, it could potentially benefit one party over the other, depending on the specific issues that resonate with voters.

This could lead to a shift in the majority party in Congress or even a change in the presidency, depending on the outcome of the elections.

- Future of American Politics:The proposal’s impact on the future of American politics is uncertain but potentially significant. If it leads to a more polarized and gridlocked political system, it could make it more difficult for Congress to pass legislation and address pressing national issues.

This could further erode public trust in government and lead to a more dysfunctional political system.

Alternative Perspectives

While Rick Scott’s plan has garnered support from some Republicans, it has faced significant criticism from economists, Democrats, and even some within his own party. Critics argue that the plan’s focus on raising taxes on the majority of Americans, while simultaneously lowering taxes for corporations and the wealthy, will exacerbate income inequality and stifle economic growth.

Concerns about the Potential Economic and Social Consequences

Critics of Scott’s plan argue that raising taxes on the middle class and lower-income earners will reduce their disposable income, leading to decreased consumer spending and potentially slowing economic growth. They point to the potential for increased poverty and hardship among vulnerable populations, particularly those already struggling with rising costs of living.

Additionally, critics argue that the plan’s focus on tax cuts for corporations and the wealthy could further exacerbate income inequality, as the benefits of economic growth may not trickle down to the middle class and lower-income earners.

Alternative Tax Policies, Rick scott leads senate republicans to doom with plan to raise taxes on 40 of americans

Instead of Scott’s plan, critics advocate for alternative tax policies that promote economic growth and fairness. One common proposal is a progressive tax system where higher earners pay a larger share of taxes, while lower earners are shielded from significant tax burdens.

This approach aims to generate revenue for government programs while ensuring that the wealthy contribute a fair share. Another alternative is a consumption tax, such as a value-added tax (VAT), which taxes goods and services at each stage of production and consumption.

Proponents argue that a VAT can be more efficient than income taxes, as it is less susceptible to tax avoidance and can be used to fund essential government services. However, critics point to the potential for a VAT to disproportionately impact lower-income households, as they spend a larger percentage of their income on essential goods and services.

Comparing and Contrasting Tax Plans

The following table compares and contrasts the key features of Scott’s plan with alternative proposals, highlighting their potential impact on different income levels and the economy:| Plan | Impact on Lower-Income Earners | Impact on Middle-Income Earners | Impact on Higher-Income Earners | Potential Economic Impact ||—————————————-|—————————–|———————————|——————————–|—————————–|| Rick Scott’s Plan | Negative | Negative | Positive | Uncertain || Progressive Tax System | Positive | Positive | Negative | Potentially Positive || Value-Added Tax (VAT) | Uncertain | Uncertain | Uncertain | Potentially Positive |

“The proposed tax plan is a recipe for disaster. It will disproportionately burden the middle class and lower-income earners while providing tax breaks to the wealthy. This will exacerbate income inequality and stifle economic growth.”

[Name of Critic], Economist

“We need a tax system that is fair and promotes economic growth. A progressive tax system, where higher earners pay a larger share of taxes, is the best way to achieve this.”

[Name of Advocate], Progressive Policy Group

Historical Context: Rick Scott Leads Senate Republicans To Doom With Plan To Raise Taxes On 40 Of Americans

Rick Scott’s proposed tax plan, which aims to raise taxes on 40% of Americans, has sparked a heated debate, drawing comparisons to previous tax reforms throughout American history. To understand the potential implications of this plan, it’s crucial to examine the historical context of tax policy in the United States, exploring the evolution of tax systems and the role of political ideology in shaping them.

Tax Reforms in American History

The United States has witnessed numerous tax reforms throughout its history, each driven by a unique set of economic and political circumstances. These reforms have significantly shaped the nation’s economic landscape and social fabric.

- The first major tax reform occurred in 1913 with the passage of the Sixteenth Amendment, which authorized the federal government to levy an income tax. This marked a significant shift in the nation’s tax system, moving away from reliance on tariffs and excise taxes towards a more progressive system based on income.

- The 1930s, during the Great Depression, saw the introduction of a progressive income tax system with higher rates for wealthier individuals. This reform aimed to redistribute wealth and stimulate economic growth.

- The 1980s witnessed the implementation of supply-side economics under President Ronald Reagan, which emphasized tax cuts as a means to stimulate economic growth. The Economic Recovery Tax Act of 1981 reduced marginal tax rates and provided incentives for investment, though it also led to a significant increase in the national debt.

- The 1990s saw a focus on deficit reduction and tax simplification. The Omnibus Budget Reconciliation Act of 1990 increased taxes on upper-income earners and introduced a new income tax bracket. The Taxpayer Relief Act of 1997 reduced capital gains taxes and estate taxes.

- The Tax Cuts and Jobs Act of 2017, enacted under President Donald Trump, reduced corporate tax rates and lowered individual income tax rates. This reform aimed to stimulate economic growth and create jobs, but it also increased the national debt.

Evolution of Tax Systems

The evolution of the American tax system has been influenced by various factors, including economic conditions, political ideology, and societal values. The system has shifted from reliance on tariffs and excise taxes to a more progressive income tax system, with varying degrees of emphasis on redistribution and economic growth.

- Early Years:The early American tax system primarily relied on tariffs and excise taxes, with a limited role for direct taxation. This system favored the wealthy and landowners, as it placed a heavier burden on imports and specific goods.

- Progressive Era:The Progressive Era (late 19th and early 20th centuries) saw a growing movement for social and economic reform. This period witnessed the introduction of a progressive income tax system, aimed at redistributing wealth and reducing income inequality.

- Post-World War II:The post-World War II era witnessed a significant expansion of the federal government’s role in the economy. This led to a growth in social programs and a corresponding increase in income taxes to fund these programs.

- Neoliberal Era:The neoliberal era (1980s onwards) saw a shift towards supply-side economics, emphasizing tax cuts as a means to stimulate economic growth. This period witnessed a reduction in marginal tax rates and a focus on reducing government spending.

Role of Political Ideology

Political ideology has played a significant role in shaping tax policy in the United States. The debate over the role of government in the economy, the distribution of wealth, and the proper balance between individual liberty and social responsibility has shaped the design and implementation of tax systems.

“The tax system is a reflection of our values. It tells us what we believe is important, what we want to encourage, and what we want to discourage.”Former U.S. Treasury Secretary Lawrence Summers

Ending Remarks

Rick Scott’s tax plan stands as a stark example of the deep ideological divides that permeate American politics. The proposal, while championed by some as a necessary step towards a fairer and more efficient tax system, has been met with widespread criticism, with opponents arguing that it would exacerbate income inequality and undermine the economic security of millions of Americans.

The debate over Scott’s plan is likely to intensify in the coming months, with its potential impact on the 2024 election and the future of American tax policy hanging in the balance.