Retirement Savings: When and How to Start

Retirement savings when and how to start – Retirement savings: when and how to start? It’s a question that crosses everyone’s mind at some point, and it’s a crucial one. The earlier you begin, the better. Not only does starting early allow you to take advantage of the magic of compound interest, but it also gives you time to recover from any market fluctuations and reach your retirement goals.

Retirement planning is a marathon, not a sprint. It’s about making consistent contributions, making smart investment decisions, and adjusting your strategy as needed. The good news is, it’s never too late to start, and there are resources available to help you navigate this journey.

Understanding Retirement Savings

Retirement savings are crucial for ensuring financial security during your golden years. It’s a long-term financial plan that allows you to accumulate funds to support your lifestyle after you stop working.

The Importance of Starting Early

Starting early with retirement savings is crucial because of the power of compounding. Compounding allows your investments to grow exponentially over time. This means that your earnings from your investments generate further earnings, leading to significant growth. The earlier you start, the more time your money has to grow, maximizing your retirement savings.

The Power of Compound Interest

Compound interest is the interest earned on both the principal amount and the accumulated interest. It’s often referred to as “interest on interest.”

For example, if you invest $10,000 at a 7% annual return, after one year you will have earned $700 in interest. In the second year, you will earn interest on both the original $10,000 and the $700 interest earned in the first year. This compounding effect continues year after year, leading to significant growth.

Retirement savings can seem daunting, but starting early is key. Even small contributions can grow significantly over time, especially if you understand the power of compound interest. A recent article in the science of coaching teachers edsurge news highlighted the importance of ongoing professional development for educators, a factor that can significantly impact their earning potential and, ultimately, their retirement savings.

The earlier you begin saving, the more time your money has to work for you, so don’t delay – start building your retirement nest egg today!

This demonstrates how the earlier you start, the more time your investments have to grow exponentially.

Retirement Savings Goals and Timelines

Retirement savings goals are personalized based on your individual needs and desired lifestyle. They are influenced by factors such as:

- Desired retirement age

- Expected expenses in retirement

- Current income and savings

- Investment risk tolerance

Retirement timelines are typically long-term, often spanning decades. It’s important to set realistic goals and timelines to guide your savings strategy.

For example, if you plan to retire at age 65 and expect to live for another 20 years in retirement, you’ll need to save enough to cover your expenses for those 20 years.

Types of Retirement Accounts

There are various retirement accounts available, each with its own rules and benefits:

- 401(k): Offered by employers, allowing pre-tax contributions to be deducted from your paycheck and invested in a variety of options. The employer may also offer a matching contribution, increasing your savings.

- Traditional IRA: Allows pre-tax contributions, with tax-deferred growth and withdrawals taxed in retirement.

- Roth IRA: Allows after-tax contributions, with tax-free growth and withdrawals in retirement.

Determining Your Savings Needs

Knowing how much you’ll need in retirement is crucial to achieving your financial goals. To determine your savings needs, consider your desired lifestyle, potential expenses, and the impact of inflation.

Calculating Retirement Income Needs

To estimate your retirement income needs, consider your current spending habits and adjust them for your desired lifestyle in retirement. You may choose to maintain your current spending level, reduce expenses, or increase them to accommodate new activities.

- Current Spending:Start by tracking your current expenses for a year. This will give you a realistic baseline for your spending habits.

- Retirement Lifestyle:Consider how your spending might change in retirement. For example, you may spend less on commuting and work-related expenses but more on travel and leisure.

- Adjustments:Once you’ve considered your desired retirement lifestyle, adjust your current spending accordingly. This could involve reducing expenses, such as dining out less frequently, or increasing expenses for travel and hobbies.

Impact of Inflation on Retirement Savings Goals

Inflation erodes the purchasing power of your savings over time. It’s crucial to factor in inflation when calculating your retirement income needs.

“A 3% annual inflation rate means that your $100,000 in savings today will have the same purchasing power as $53,671 in 20 years.”

- Inflation Rate:Use a conservative inflation rate of 3% to 4% when calculating your retirement income needs.

- Time Value of Money:Inflation reduces the value of your savings over time, so you need to save more to maintain your desired standard of living.

- Retirement Planning Tools:Online retirement calculators can help you factor in inflation and determine how much you need to save.

Factors Influencing Retirement Income Needs

Several factors can significantly impact your retirement income needs, including healthcare costs and housing expenses.

Healthcare Costs

Healthcare costs are a major expense in retirement, and they tend to increase over time. Consider these factors:

- Medicare Coverage:Medicare provides health insurance for those aged 65 and older, but it doesn’t cover all medical expenses. You may need to purchase supplemental insurance or pay out-of-pocket for some services.

- Long-Term Care:Long-term care costs can be significant, especially if you need assisted living or nursing home care.

- Prescription Drugs:Prescription drug costs can be substantial, and Medicare doesn’t always cover all medications.

Housing Expenses

Housing expenses can be a significant portion of your retirement budget. Consider these factors:

- Downsizing:You may consider downsizing your home in retirement to reduce housing costs.

- Mortgage Payments:If you still have a mortgage in retirement, factor in those payments when calculating your income needs.

- Property Taxes and Maintenance:Remember to include property taxes and maintenance costs in your housing budget.

Personalized Retirement Savings Plan

Once you’ve determined your retirement income needs, you can create a personalized savings plan.

Retirement savings are a crucial part of financial planning, and the earlier you start, the better. It’s never too early to begin saving for your future, and there are many ways to do so. A great way to start is by understanding how to market your sustainability efforts, as it can lead to financial gains in the long run.

You can learn more about this by checking out 4 smart ways to market your sustainability efforts , which can help you attract more customers and investors who value environmentally conscious practices. By incorporating sustainability into your business model, you can not only make a positive impact on the environment but also secure a brighter financial future for yourself.

- Savings Goals:Set specific, measurable, achievable, relevant, and time-bound savings goals.

- Savings Rate:Determine how much you need to save each month or year to reach your goals.

- Investment Strategy:Choose an investment strategy that aligns with your risk tolerance and time horizon.

Choosing the Right Savings Strategy

Retirement savings strategies are crucial for securing your financial future. Choosing the right strategy involves understanding your risk tolerance, time horizon, and financial goals.

Comparing Investment Options

Different investment options offer varying levels of risk and potential returns. It’s essential to understand these differences to make informed decisions about your retirement savings.

- Stocks: Stocks represent ownership in companies. They generally offer higher potential returns but also carry higher risk. Stock prices can fluctuate significantly, making them suitable for investors with a longer time horizon and a higher risk tolerance.

- Bonds: Bonds are debt securities issued by companies or governments. They typically offer lower returns than stocks but also carry lower risk. Bonds are generally considered a more conservative investment option, suitable for investors seeking stability and income.

- Real Estate: Real estate investments involve owning property, such as residential homes, commercial buildings, or land. They can offer potential appreciation and rental income but also require significant capital and ongoing expenses. Real estate investments can be complex and require careful consideration.

Risk and Return Profiles

Here’s a table illustrating the risk and return profiles of various investment options:

| Investment Option | Risk Level | Return Potential |

|---|---|---|

| Stocks | High | High |

| Bonds | Medium | Medium |

| Real Estate | Medium to High | Medium to High |

| Cash | Low | Low |

Diversifying Investments

Diversification is a key principle in investing. It involves spreading your investments across different asset classes, industries, and geographical locations. Diversification helps mitigate risk by reducing the impact of any single investment’s performance on your overall portfolio.

- Asset Allocation: This involves determining the proportion of your portfolio allocated to different asset classes, such as stocks, bonds, and real estate. A well-diversified portfolio will typically include a mix of these asset classes, with the specific allocation depending on your risk tolerance, time horizon, and financial goals.

- Industry Diversification: Investing in different sectors of the economy can further reduce risk. For example, investing in both technology and healthcare can help offset potential downturns in one industry.

- Geographic Diversification: Investing in companies or assets located in different countries can reduce exposure to specific regional economic risks.

Seeking Professional Financial Advice

Navigating retirement savings strategies can be complex. Seeking advice from a qualified financial advisor can be invaluable. A financial advisor can help you develop a personalized retirement savings plan, taking into account your individual circumstances, risk tolerance, and financial goals.

- Personalized Guidance: A financial advisor can provide tailored advice based on your specific needs and circumstances. They can help you choose the right investment options, allocate your assets appropriately, and adjust your strategy as needed over time.

- Objective Perspective: Financial advisors can provide an objective perspective, helping you avoid emotional decision-making that could jeopardize your retirement savings. They can also help you stay on track with your long-term financial goals.

Building Your Retirement Savings

Retirement savings are essential for securing your financial future. Starting early and contributing regularly can significantly impact your financial well-being in your later years. This section will guide you through the process of building your retirement savings, outlining different methods, strategies, and resources to help you reach your financial goals.

Retirement savings are a crucial aspect of financial planning, and the sooner you start, the better. It’s never too early to begin contributing to a 401(k) or IRA, and even small amounts can add up over time. It’s disheartening to see political actions like ron desantiss attack on disney obviously violates the first amendment , which erode the very principles that underpin a free and prosperous society.

Ultimately, securing your financial future requires a long-term perspective and a commitment to responsible investing, just as safeguarding our freedoms requires vigilance and unwavering support for the Constitution.

Starting Your Retirement Savings Journey

The first step in building your retirement savings is to start contributing as early as possible. Even small contributions can grow significantly over time due to compounding interest. Consider these steps:

- Determine your retirement goals.This includes defining your desired retirement lifestyle, estimated expenses, and the age you plan to retire.

- Set a realistic savings target.Based on your retirement goals, calculate the amount you need to save each year to reach your target.

- Choose a retirement savings plan.Select a plan that suits your needs and financial situation, such as a 401(k), Roth IRA, or traditional IRA.

- Start contributing regularly.Make automatic contributions to your retirement account to ensure consistent saving.

Methods for Contributing to Retirement Accounts

There are several ways to contribute to retirement accounts. Understanding the different options can help you choose the most suitable method for your situation:

- Employer-sponsored retirement plans:These plans, such as 401(k)s, offer tax advantages and often include employer matching contributions.

- Individual Retirement Accounts (IRAs):These accounts allow you to make pre-tax or after-tax contributions, depending on the type of IRA you choose.

- Automatic deductions:Setting up automatic deductions from your paycheck directly into your retirement account ensures consistent contributions.

Increasing Retirement Contributions Over Time

As your income grows, consider increasing your retirement contributions to maximize your savings potential. You can:

- Increase your contribution percentage gradually:Gradually increasing your contribution percentage over time can make saving feel less overwhelming.

- Take advantage of employer matching:If your employer offers matching contributions, contribute enough to maximize the match.

- Consider salary increases for retirement savings:When you receive a salary increase, allocate a portion of the increase to your retirement savings.

Tracking Your Retirement Savings Progress

Monitoring your retirement savings progress is crucial to ensure you are on track to reach your goals. You can:

- Use online calculators:Many online calculators can help you estimate your future retirement income based on your current savings and contributions.

- Review your account statements regularly:Regularly check your retirement account statements to track your balance, contributions, and investment performance.

- Consider professional financial advice:Consult a financial advisor to receive personalized guidance on retirement planning and investment strategies.

Managing Retirement Savings

Retirement savings require ongoing attention and management to ensure they grow effectively and meet your financial needs in retirement. Just like any other financial plan, it needs regular review and adjustments to account for changes in your life, financial goals, and market conditions.

Regularly Reviewing and Adjusting Retirement Savings Plans

Regularly reviewing your retirement savings plan is essential to ensure it remains aligned with your evolving financial goals and circumstances.

- Review your savings goals:As your life circumstances change, so too might your retirement goals. You may need to adjust your savings goals to account for factors such as changes in your expected retirement age, desired lifestyle, or unexpected expenses.

- Evaluate your investment portfolio:Market conditions and your risk tolerance can shift over time. Re-evaluating your investment portfolio helps ensure your investments are still appropriate for your goals and risk appetite. This might involve adjusting the asset allocation or choosing different investment vehicles.

- Assess your contribution levels:Regularly review your contributions to your retirement accounts to ensure you are saving enough to reach your goals. This might involve increasing your contribution percentage as your income grows or adjusting it based on changes in your financial situation.

- Consider tax implications:Tax laws can change, and understanding how these changes affect your retirement savings is crucial. You may need to adjust your investment strategy or contribution levels to optimize your tax benefits.

Strategies for Managing Retirement Savings During Market Fluctuations, Retirement savings when and how to start

Market fluctuations are inevitable, and it’s important to have a plan to navigate them without jeopardizing your long-term retirement savings goals.

- Maintain a long-term perspective:Remember that retirement savings are designed for the long haul. Market downturns are temporary, and focusing on the long-term goal of retirement will help you weather short-term fluctuations.

- Diversify your portfolio:Diversifying your investments across different asset classes, such as stocks, bonds, and real estate, can help mitigate the impact of market volatility. This strategy spreads your risk across different investments, reducing the potential for significant losses.

- Consider dollar-cost averaging:This strategy involves investing a fixed amount of money at regular intervals, regardless of market conditions. This helps smooth out the impact of market fluctuations by buying more shares when prices are low and fewer shares when prices are high.

- Avoid panic selling:Selling investments during market downturns can lock in losses and hinder your long-term growth. Resist the urge to panic sell and instead, focus on your long-term financial goals.

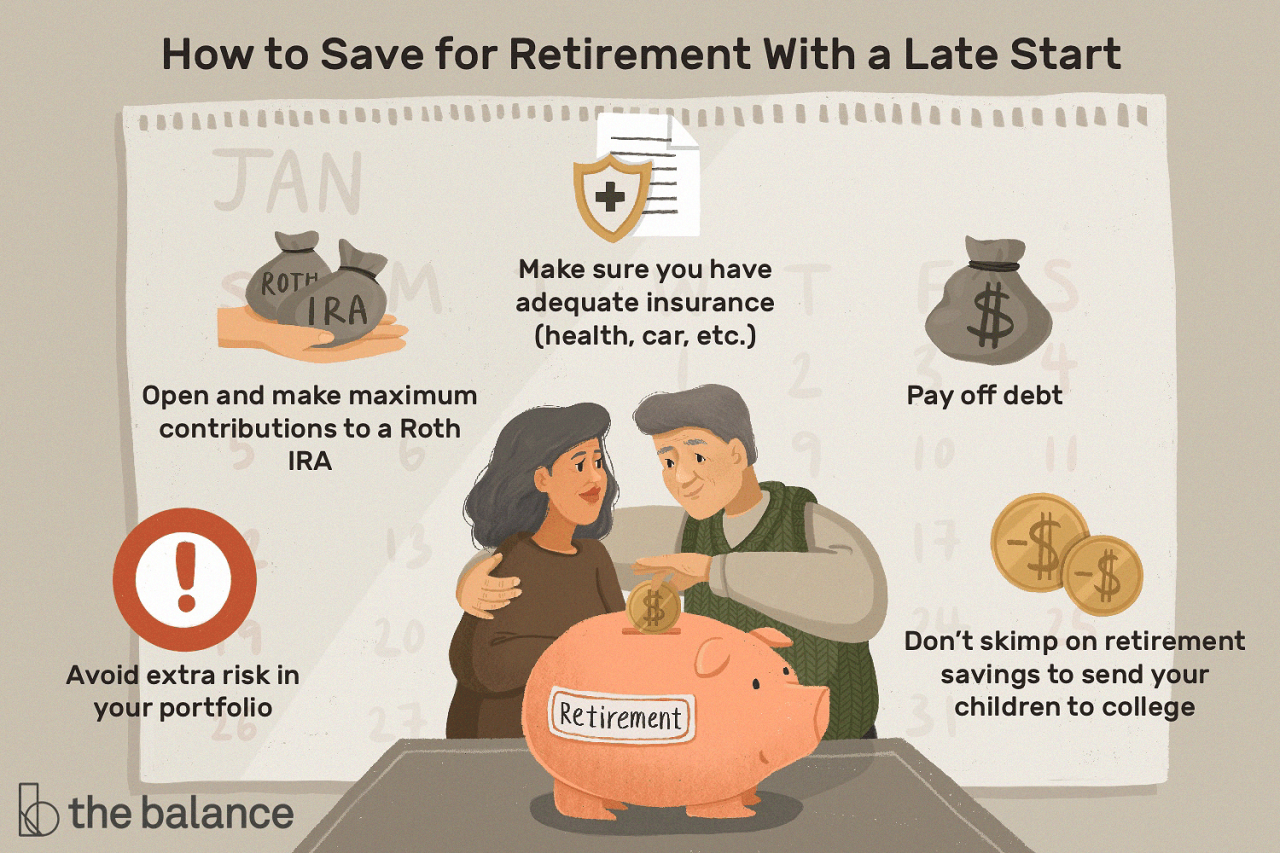

Common Retirement Savings Mistakes to Avoid

Many common mistakes can derail your retirement savings journey. Understanding these mistakes can help you avoid them and stay on track.

- Procrastination:The earlier you start saving, the more time your money has to grow. Delaying retirement savings can significantly impact your overall financial well-being in retirement.

- Not saving enough:Many individuals underestimate the amount of money they need to save for retirement. Aim for a savings rate that aligns with your financial goals and lifestyle aspirations.

- Withdrawing from retirement accounts early:Withdrawing funds from your retirement accounts before retirement can result in significant tax penalties and reduce your overall savings. Avoid these withdrawals unless absolutely necessary.

- Investing too conservatively or aggressively:Your investment strategy should be aligned with your risk tolerance and time horizon. Investing too conservatively might not generate enough growth, while investing too aggressively can expose you to unnecessary risk.

- Ignoring inflation:Inflation erodes the purchasing power of your savings over time. Ensure your savings are growing at a rate that outpaces inflation to maintain their value.

Withdrawing Retirement Funds During Retirement

When you reach retirement, you’ll need to develop a strategy for withdrawing your retirement funds to support your lifestyle and financial needs.

- Determine your withdrawal rate:The withdrawal rate is the percentage of your retirement savings you withdraw each year. A common guideline is to withdraw around 4% annually, but this can vary based on your individual circumstances.

- Consider required minimum distributions (RMDs):Traditional IRA and 401(k) accounts have required minimum distributions (RMDs) that you must start taking once you reach a certain age (usually 72). Failing to meet these requirements can result in significant tax penalties.

- Manage taxes:Withdrawals from traditional retirement accounts are generally taxed as ordinary income. Consider tax-efficient withdrawal strategies to minimize your tax liability.

- Develop a spending plan:Create a realistic budget for your retirement years to ensure you are spending your retirement savings wisely. This budget should account for essential expenses, healthcare costs, and discretionary spending.

Final Review: Retirement Savings When And How To Start

Retirement savings are a vital part of your financial future. By understanding the importance of starting early, planning for your needs, and choosing the right investment strategy, you can set yourself up for a comfortable and fulfilling retirement. Remember, it’s a journey, and there are resources and tools available to help you along the way.

So, take the first step today and start building your retirement savings!