Republicans Propose Student Loan Fix, Differing From Biden

Republicans push alternative to bidens student loan forgiveness plans – Republicans push alternative to Biden’s student loan forgiveness plans, setting the stage for a political battle over how to address the mounting student debt crisis. While President Biden’s plan aims to forgive up to $20,000 per borrower, Republicans have proposed a more targeted approach, focusing on affordability and accountability.

The debate centers on the role of the government in addressing student debt. Republicans argue that their plan, which emphasizes income-driven repayment plans and loan forgiveness for those who pursue certain professions, is more fiscally responsible and encourages individual responsibility.

Democrats, on the other hand, believe that Biden’s plan is necessary to provide immediate relief to struggling borrowers and stimulate the economy.

Biden’s Student Loan Forgiveness Plan

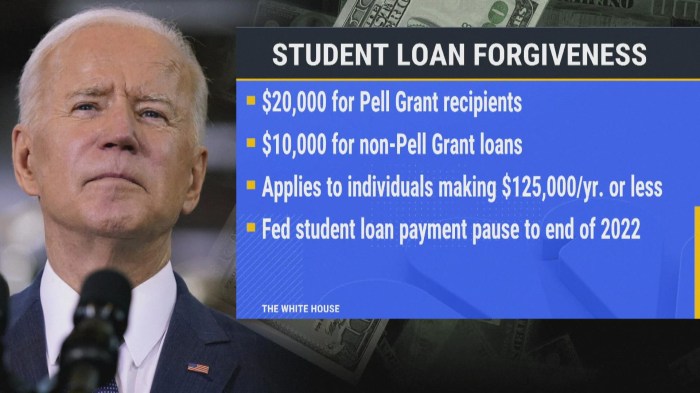

President Biden’s student loan forgiveness plan is a significant policy initiative aimed at alleviating the burden of student debt for millions of Americans. The plan proposes canceling a substantial amount of student loan debt for eligible borrowers, with the goal of making higher education more affordable and accessible.

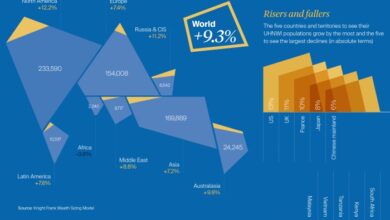

While Republicans push for alternative solutions to President Biden’s student loan forgiveness plans, positive economic news from the Asia-Pacific region offers a glimmer of hope. South Korea’s inflation rate hitting a 42-month low, as reported in this article , has boosted investor confidence, leading to a rise in regional markets.

This economic optimism might just influence the ongoing debate about student loan forgiveness, as lawmakers weigh the potential impact on the broader economy.

Eligibility Criteria and Forgiveness Amount

The eligibility criteria for Biden’s student loan forgiveness plan are based on income and the type of loan. The plan primarily targets borrowers with federal student loans, including those held by the Department of Education and the Federal Family Education Loan Program (FFELP).

The plan aims to forgive up to $20,000 in student loan debt for borrowers who meet certain income requirements. Specifically, borrowers earning less than $125,000 annually as individuals or less than $250,000 annually as a household are eligible for the maximum forgiveness amount.

Potential Benefits of Biden’s Plan

Biden’s student loan forgiveness plan is intended to provide significant benefits to borrowers and the overall economy.

While Republicans push for an alternative to Biden’s student loan forgiveness plans, the President has made strides in other areas. He recently signed the climate and health bill into law, a significant victory that addresses some of the nation’s most pressing issues.

This legislation tackles climate change and healthcare access , demonstrating a commitment to addressing critical concerns. However, the debate surrounding student loan forgiveness continues, highlighting the ongoing challenges in achieving economic goals across the board.

Reducing Student Debt Burdens

The plan aims to reduce the financial strain of student debt on millions of Americans. For many borrowers, student loans represent a substantial financial burden that can hinder their ability to save for retirement, purchase homes, and start families. By canceling a portion of their debt, the plan aims to free up borrowers’ financial resources, allowing them to invest in their future and contribute to the economy.

Boosting the Economy

Proponents of the plan argue that it will have a positive impact on the economy. By reducing student debt, borrowers will have more disposable income, which they can spend on goods and services, stimulating economic growth. Additionally, the plan is expected to increase consumer confidence, leading to increased spending and investment.

Potential Drawbacks of Biden’s Plan

While Biden’s student loan forgiveness plan has the potential to benefit many borrowers, it also faces criticism and concerns.

Cost of the Plan

One of the primary concerns regarding the plan is its cost. The estimated cost of the plan is substantial, and some argue that the government could allocate these funds to other priorities, such as infrastructure, healthcare, or education.

Potential for Unfairness

Another concern is the potential for unfairness. Critics argue that the plan unfairly benefits those who have already benefited from a college education, while those who did not attend college or who have already paid off their loans will not receive any benefit.

Impact on Future Borrowing

Some experts worry that the plan could discourage future borrowers from taking out loans, as they may expect similar forgiveness programs in the future. This could lead to a decrease in the availability of student loans and potentially increase the cost of borrowing for future students.

Republican Alternatives: Republicans Push Alternative To Bidens Student Loan Forgiveness Plans

While President Biden’s student loan forgiveness plan has garnered significant attention, Republicans have proposed alternative approaches to addressing student loan debt. These plans often emphasize affordability and accountability, focusing on individual responsibility and market-based solutions.

Republican Alternative Plan Features, Republicans push alternative to bidens student loan forgiveness plans

Republican proposals typically center around expanding access to income-driven repayment plans (IDRs), increasing transparency in loan terms, and promoting affordability through measures like simplifying the repayment process and increasing access to financial literacy resources.

- Expanded Income-Driven Repayment Plans:Republicans have advocated for expanding the availability and flexibility of IDRs. This approach allows borrowers to make monthly payments based on their income, with the potential for loan forgiveness after a set period of time, typically 20 or 25 years.

While Republicans are pushing for an alternative to Biden’s student loan forgiveness plans, news broke today that a top-level FBI agent under fire for his role in the Hunter Biden investigation has resigned. The agent, whose name has not been released, has been accused of bias in his handling of the case.

It remains to be seen how this development will impact the ongoing debate over student loan forgiveness.

Some Republican proposals have suggested streamlining the IDR process, making it easier for borrowers to enroll and manage their payments.

- Increased Transparency and Accountability:Republican plans often emphasize transparency in loan terms and accountability for borrowers. This may involve providing borrowers with clearer information about their loan options, repayment obligations, and interest rates. Some proposals also focus on holding institutions accountable for responsible lending practices and ensuring that borrowers understand the financial commitments they are making.

- Financial Literacy and Education:Republicans have highlighted the importance of financial literacy and education as a means of preventing future student loan debt crises. They have proposed initiatives to provide borrowers with tools and resources to make informed decisions about their education and financing options.

This could involve offering workshops, online resources, and educational programs to help borrowers understand the complexities of student loans and make responsible financial choices.

Potential Benefits of Republican Alternatives

- Focus on Affordability:Republican alternatives often emphasize affordability by expanding access to IDR plans and simplifying the repayment process. This approach aims to make student loan payments more manageable for borrowers, especially those with lower incomes.

- Emphasis on Individual Responsibility:Republican plans often promote individual responsibility by encouraging borrowers to make informed decisions about their education and financing choices. This includes providing access to financial literacy resources and promoting transparency in loan terms.

- Market-Based Solutions:Republican alternatives often focus on market-based solutions, such as encouraging competition among lenders and promoting transparency in loan terms. This approach aims to create a more competitive and consumer-friendly lending environment.

Potential Drawbacks of Republican Alternatives

- Limited Scope:Republican alternatives may offer less debt relief than President Biden’s plan, potentially leaving many borrowers with significant outstanding debt. For example, some Republican proposals focus on expanding IDR plans, which offer forgiveness after a lengthy repayment period, rather than providing outright loan forgiveness.

- Focus on Individual Responsibility:While emphasizing individual responsibility is important, some critics argue that it may not address systemic issues contributing to student loan debt, such as rising college costs and limited access to affordable higher education.

- Potential for Higher Interest Rates:Republican alternatives may encourage a more competitive lending environment, but this could lead to higher interest rates for borrowers, increasing the overall cost of borrowing.

Political and Economic Context

The debate surrounding student loan forgiveness is deeply intertwined with the political landscape, highlighting a partisan divide and the influence of special interest groups. Additionally, the economic implications of such a policy are vast, affecting the federal budget and potentially impacting the overall economy.

Political Climate

The issue of student loan forgiveness has become a significant political battleground, with Democrats generally supporting some form of relief and Republicans largely opposed. This divide is rooted in differing ideological perspectives on the role of government and the responsibility of individuals for their debt.

- Democratic Perspective:Democrats often argue that student loan forgiveness is necessary to address systemic inequities in access to higher education and to alleviate the financial burden on borrowers, particularly those from disadvantaged backgrounds. They view it as a way to boost the economy by freeing up disposable income for borrowers, stimulating consumer spending, and promoting economic mobility.

- Republican Perspective:Republicans, on the other hand, tend to oppose student loan forgiveness, arguing that it is unfair to those who have already paid off their loans or chose not to pursue higher education. They often contend that such policies are fiscally irresponsible and discourage personal responsibility.

Additionally, they highlight the potential for moral hazard, where individuals may be less incentivized to make responsible financial decisions if they anticipate future forgiveness.

Special interest groups also play a significant role in shaping the political landscape. For instance, organizations representing higher education institutions often advocate for policies that make college more affordable, which may include student loan forgiveness. Conversely, groups representing taxpayers may oppose such policies, arguing that they place an undue burden on those who did not benefit from higher education.

Economic Impact

The economic impact of student loan forgiveness is a complex and multifaceted issue, with potential benefits and drawbacks.

- Potential Benefits:Proponents argue that student loan forgiveness could stimulate the economy by increasing consumer spending and boosting aggregate demand. They also point to the potential for increased economic mobility, as borrowers are freed from the burden of debt and can invest in their futures.

Additionally, they contend that it could reduce financial stress and improve mental health outcomes for borrowers.

- Potential Drawbacks:Critics argue that student loan forgiveness could lead to higher interest rates for future borrowers, as lenders would need to account for the risk of future forgiveness. They also worry about the potential for moral hazard, where individuals may be less incentivized to make responsible financial decisions if they anticipate future forgiveness.

Furthermore, they highlight the significant cost to the federal budget, which could potentially lead to higher taxes or cuts to other government programs.

Biden’s Plan vs. Republican Alternatives

Biden’s plan to forgive up to $20,000 in student loan debt for eligible borrowers has faced significant criticism from Republicans, who argue that it is too expensive and unfair.

- Biden’s Plan:Biden’s plan is designed to provide relief to lower- and middle-income borrowers, particularly those who attended public colleges or historically Black colleges and universities (HBCUs). It is estimated to cost the federal government hundreds of billions of dollars, and its economic impact is subject to debate.

- Republican Alternatives:Republican alternatives to student loan forgiveness often focus on increasing access to affordable higher education, such as through expanding income-based repayment plans or providing tax credits for tuition expenses. They also advocate for policies that promote financial literacy and responsible borrowing practices.

The political feasibility and economic impact of these approaches vary. Biden’s plan is likely to face significant legal challenges and may be difficult to implement without bipartisan support. Republican alternatives, while potentially more politically feasible, may not provide the same level of immediate relief to borrowers and may require longer-term investments in higher education affordability.

Public Opinion and Impact

Public opinion on student loan forgiveness is complex and divided, with varying levels of support for different approaches. The issue has become a focal point in American politics, with significant implications for individuals, higher education, and the economy.

Public Opinion on Student Loan Forgiveness

Public opinion surveys reveal a diverse range of views on student loan forgiveness. A 2023 poll by the Pew Research Center found that 62% of Americans support some form of student loan forgiveness, while 37% oppose it. However, there is considerable variation in support based on demographics and political affiliation.

- Support for Forgiveness:A majority of Democrats (84%) and a significant portion of Independents (56%) support student loan forgiveness. However, only 36% of Republicans favor forgiveness.

- Specific Approaches:Public opinion on specific approaches to student loan forgiveness is also varied. Some favor targeted forgiveness for low-income borrowers or those in specific professions, while others support broad-based forgiveness for all borrowers.

Impact on Different Demographic Groups

Student loan forgiveness could have a significant impact on different demographic groups, potentially reducing financial burdens and improving economic opportunities.

- Young Adults:Student loan debt is a major financial burden for many young adults, often delaying major life decisions such as homeownership or starting a family. Forgiveness could alleviate this burden and boost their financial stability.

- Low-Income Borrowers:Low-income borrowers disproportionately carry student loan debt and face higher interest rates. Forgiveness could provide significant financial relief and enhance their ability to build wealth.

- Minority Groups:Minority borrowers are more likely to take on student loan debt and face higher interest rates. Forgiveness could address racial disparities in access to higher education and economic opportunities.

Long-Term Implications

The long-term implications of student loan forgiveness are complex and subject to debate.

- Higher Education:Forgiveness could lead to increased demand for higher education, potentially putting pressure on institutions to raise tuition rates. However, it could also incentivize colleges to make education more affordable and accessible.

- Labor Market:Forgiveness could increase consumer spending and boost economic growth. It could also encourage individuals to pursue careers that are less financially lucrative but socially valuable, such as teaching or social work.

- Economy:The economic impact of student loan forgiveness is uncertain and depends on various factors, such as the scale of forgiveness and the way it is implemented. Some argue that it could lead to higher inflation, while others believe it could stimulate economic growth.

Future of Student Loan Policy

The debate surrounding student loan forgiveness has highlighted the need for a long-term solution to the growing issue of student debt and higher education affordability. While the Biden administration’s plan and Republican alternatives offer different approaches, both recognize the urgency of addressing this complex issue.

This section examines the potential for compromise, explores future challenges, and identifies opportunities for improving student loan policy.

Comparison of Key Features

The following table compares the key features of Biden’s plan and Republican alternatives:

| Feature | Biden’s Plan | Republican Alternatives |

|---|---|---|

| Eligibility Criteria | Individuals earning less than $125,000 annually or households earning less than $250,000 annually. | Varying proposals, some focusing on income-based repayment plans, others on expanding access to Pell Grants or simplifying loan repayment options. |

| Forgiveness Amounts | Up to $20,000 for Pell Grant recipients and up to $10,000 for other borrowers. | No specific forgiveness amounts proposed, but some alternatives focus on reducing loan balances over time through income-driven repayment programs. |

| Cost Estimates | Estimated to cost approximately $400 billion over ten years. | Cost estimates vary depending on the specific proposal, but generally lower than Biden’s plan. |

Potential for Compromise and Bipartisan Solutions

The potential for compromise and bipartisan solutions on student loan policy exists, although reaching agreement may be challenging. Some areas of potential consensus include:

- Expanding access to income-driven repayment plans to make loan repayment more manageable for borrowers.

- Simplifying the loan repayment process and providing clearer information to borrowers.

- Investing in affordable higher education options, such as community colleges and technical schools.

Future Challenges and Opportunities

The future of student loan policy presents both challenges and opportunities.

- Rising Costs of Higher Education:Continued increases in tuition and fees pose a significant challenge to affordability. Finding ways to control costs and make higher education more accessible to a wider range of students is crucial.

- Changing Labor Market:The evolving job market requires individuals to acquire new skills and knowledge. Student loan policy should be flexible enough to support lifelong learning and career transitions.

- Data and Transparency:Improving data collection and transparency regarding student loan outcomes, such as default rates and employment outcomes, is essential for informed policymaking.

- Equity and Access:Addressing disparities in access to higher education and student loan outcomes for underserved communities is critical. Policies should ensure that all students have an equal opportunity to succeed.