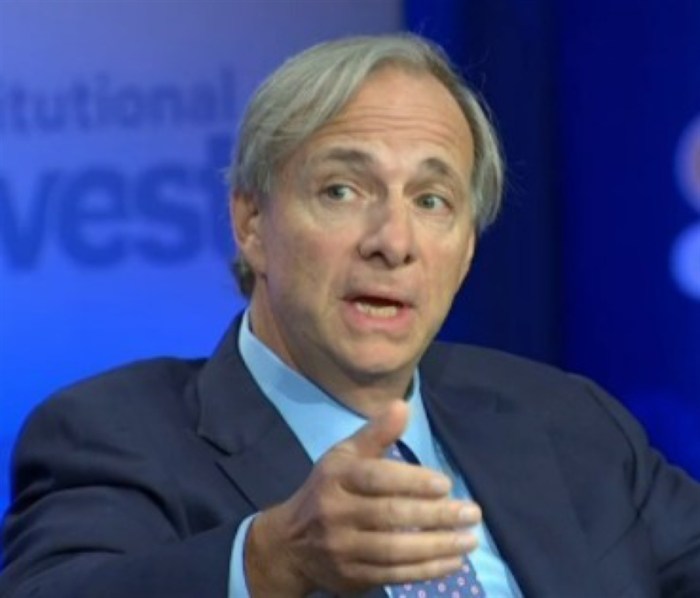

Ray Dalio Says Fed Faces Tough Balancing Act with High Debt

Ray dalio says the fed has a tough balancing act as the economy faces enormous amount of debt – Ray Dalio Says Fed Faces Tough Balancing Act with High Debt – the economy is facing a monumental challenge, and it’s one that has the legendary investor Ray Dalio deeply concerned. Dalio, known for his insightful economic commentary, believes the Federal Reserve (Fed) is caught in a precarious balancing act as it tries to navigate the treacherous waters of high debt levels, inflation, and economic growth.

The Fed’s actions will have far-reaching consequences for the global economy, and Dalio’s warnings are a stark reminder of the risks we face.

The Fed’s primary mandate is to maintain price stability and full employment. However, with the economy burdened by a staggering amount of debt, the Fed’s ability to achieve these goals is being tested like never before. Dalio argues that the Fed’s policies are pushing the economy toward a dangerous precipice, where inflation could spiral out of control and economic growth could stall.

Economic Impact of High Debt: Ray Dalio Says The Fed Has A Tough Balancing Act As The Economy Faces Enormous Amount Of Debt

High debt levels can have significant implications for economic growth and stability. When individuals, businesses, or governments accumulate excessive debt, it can lead to a range of challenges that can hinder economic progress and even trigger financial crises.

Ray Dalio’s warning about the Fed’s tightrope walk with debt is a stark reminder of the challenges facing the global economy. It’s a balancing act that’s just as precarious as the one Arsenal Women face in their Champions League qualifying match against BK Häcken, where they’ll need a strong comeback after a 1-0 loss in the first leg.

Just like the Fed, Arsenal needs to find the right balance between attack and defense to secure their spot in the next round. It’s a pressure-cooker situation, much like the one Dalio highlights with the Fed’s current position.

Impact on Economic Growth

High debt levels can negatively impact economic growth in several ways. When individuals and businesses are burdened with high debt, they may have less disposable income available for spending on goods and services, leading to lower consumer demand. This can slow down economic activity and reduce overall economic growth.

Ray Dalio’s recent comments about the Fed’s balancing act in the face of immense debt got me thinking about the economy’s precarious position. It’s like a tightrope walk, and one wrong step could send everything tumbling. Speaking of tightropes, I saw a photo of Shawn Mendes taking a quick dip in the ocean and then walking around the beach dripping wet – shawn mendes walks around beach dripping wet after quick dip – and it made me think about how even a small change in circumstances can have a big impact.

Just like the Fed, Shawn’s got to navigate the shifting sands of public opinion, trying to keep things balanced while dealing with the inevitable waves of scrutiny.

Furthermore, high debt can make it more difficult for businesses to invest and expand their operations. When businesses are struggling with debt repayments, they may be less willing to take on new projects or hire additional workers. This can limit economic growth potential and create a vicious cycle of low investment and slow growth.

Potential for a Debt Crisis

When debt levels become unsustainable, there is a risk of a debt crisis. A debt crisis occurs when a country or entity is unable to meet its debt obligations, leading to a financial meltdown. Debt crises can have devastating consequences for economies.

They can trigger financial instability, lead to currency depreciation, and cause widespread economic hardship. In extreme cases, debt crises can even lead to sovereign defaults, where a country is unable to repay its government debt.

Ray Dalio’s warning about the Fed’s balancing act in a debt-laden economy is a sobering reminder of the challenges we face. It’s a stark contrast to the extravagance offered in the latest Omaze prize draw, which features a luxurious house in Devon worth £2 million.

Omaze launches latest monthly prize draw with luxurious house in Devon worth 2m While it’s tempting to dream of such a win, Dalio’s insights highlight the need for responsible economic policies to navigate the complex landscape ahead.

Debt Levels and Economic Performance of Different Countries, Ray dalio says the fed has a tough balancing act as the economy faces enormous amount of debt

The following table compares the debt levels of different countries and their economic performance:

| Country | Public Debt (% of GDP) | GDP Growth Rate (2022) |

|---|---|---|

| United States | 127.7% | 2.1% |

| Japan | 263.8% | 1.9% |

| China | 78.9% | 3.0% |

| Germany | 70.2% | 1.8% |

| India | 89.4% | 8.7% |

While high debt levels can have a negative impact on economic growth, it’s important to note that the relationship between debt and growth is complex. In some cases, debt can be used to finance productive investments that can boost economic activity.

However, it is crucial to ensure that debt levels are sustainable and managed responsibly to avoid potential risks to economic stability.

Inflation and Interest Rates

The relationship between inflation and interest rates is a crucial aspect of macroeconomic management. The Federal Reserve (Fed), the central bank of the United States, plays a critical role in managing this relationship to maintain a stable and healthy economy.

The Relationship Between Inflation and Interest Rates

Inflation refers to the general increase in the prices of goods and services over time. Interest rates represent the cost of borrowing money. The Fed influences interest rates through various monetary policy tools, and these rates, in turn, impact inflation.

The relationship between inflation and interest rates is generally inverse. When inflation rises, the Fed typically raises interest rates to curb spending and cool down the economy. Conversely, when inflation is low or falling, the Fed may lower interest rates to stimulate borrowing and economic growth.

Higher interest rates make borrowing more expensive, discouraging businesses from investing and consumers from spending. This reduced demand can help to control inflation.

The Fed’s Strategies for Controlling Inflation

The Fed utilizes several strategies to manage inflation:* Setting the Federal Funds Rate:The Fed sets the target range for the federal funds rate, which is the interest rate at which banks lend reserves to each other overnight. This rate serves as a benchmark for other interest rates in the economy.

Open Market Operations

The Fed buys or sells U.S. Treasury securities in the open market to influence the money supply. Buying securities injects money into the economy, lowering interest rates, while selling securities removes money, raising interest rates.

Reserve Requirements

The Fed sets the minimum amount of reserves that banks must hold against deposits. By adjusting these requirements, the Fed can influence the amount of money available for lending.

Impact of Interest Rate Levels on Businesses and Consumers

Interest rate levels significantly impact businesses and consumers:* Businesses:

Higher interest rates

Increase the cost of borrowing for businesses, making it more expensive to invest in expansion, equipment, or new projects. This can slow down economic growth.

Lower interest rates

Encourage businesses to borrow and invest, leading to increased economic activity and job creation.

Consumers

Higher interest rates

Make it more expensive to borrow for consumers, leading to reduced spending on big-ticket items like cars and homes.

Lower interest rates

Encourage consumers to borrow and spend, stimulating demand and boosting the economy.

The Future of the Economy

Ray Dalio’s statement about the Fed’s balancing act highlights the complexities facing the global economy. With high debt levels, inflation, and rising interest rates, navigating the future requires a careful assessment of potential economic scenarios.

Potential Economic Scenarios

The future of the economy is uncertain, and several scenarios are possible, each with different implications for investors and businesses.

- Soft Landing:This scenario involves a gradual slowdown in economic growth, with inflation gradually returning to target levels. The Fed successfully manages interest rate hikes, avoiding a recession. This scenario would be beneficial for businesses and investors, allowing for continued growth and stability.

- Recession:A recession is characterized by a significant decline in economic activity, leading to job losses and reduced consumer spending. This scenario could occur if the Fed raises interest rates too aggressively, leading to a sharp slowdown in economic growth.

- Stagflation:This scenario involves high inflation and slow economic growth, leading to a stagnant economy. It can occur when supply chain disruptions and other factors continue to push up prices, while weak demand hinders economic growth.

- Debt Crisis:This scenario involves a situation where governments and businesses struggle to repay their debts, leading to financial instability and potentially a global recession. It could occur if interest rates rise significantly, making it more expensive for borrowers to service their debt.

Implications for Investors and Businesses

The potential economic scenarios have significant implications for investors and businesses.

- Investors:Investors need to be aware of the risks associated with each scenario and adjust their portfolios accordingly. For example, in a recessionary scenario, investors may consider shifting their investments towards defensive sectors like healthcare and consumer staples.

- Businesses:Businesses need to closely monitor economic conditions and adjust their operations to navigate the challenges ahead. For example, businesses may need to implement cost-cutting measures or adjust their pricing strategies to remain competitive in a slowing economy.

Strategies for Navigating Economic Challenges

Navigating the economic challenges ahead requires a proactive approach.

- Diversification:Diversifying investments across different asset classes and sectors can help mitigate risk and potentially generate returns in various economic scenarios.

- Risk Management:Businesses and investors need to carefully assess and manage their risk exposures, including debt levels, currency fluctuations, and geopolitical uncertainties.

- Flexibility:Businesses and investors need to be flexible and adaptable to changing economic conditions, adjusting their strategies and operations as needed.

- Long-Term Perspective:Maintaining a long-term perspective is crucial, as short-term market fluctuations can be volatile. Investors and businesses should focus on their long-term goals and strategies.