Pound Rockets to Two-Year High After BoE Rate Decision

Pound rockets to more than two year high after boe rate decision – Pound Rockets to Two-Year High After BoE Rate Decision: The British pound surged to its highest level in over two years following the Bank of England’s (BoE) latest interest rate decision. This unexpected move has sent shockwaves through the financial markets and sparked widespread debate about the future direction of the UK economy.

The BoE’s decision to raise rates, defying expectations of a pause, signals a strong commitment to combatting persistent inflation, a trend that has plagued the UK and many other countries. This bold move reflects a delicate balancing act for the BoE, as they navigate the tightrope between taming inflation and supporting economic growth.

The pound’s dramatic rise is a testament to the market’s confidence in the BoE’s ability to rein in inflation. Investors are betting that the rate hike will help to curb rising prices, potentially boosting the pound’s value further. However, the impact of this decision on the broader economy remains to be seen.

While a stronger pound can be beneficial for consumers, it could also hurt exporters and businesses operating in a globalized market. The BoE’s decision is a significant turning point in the UK’s economic landscape, and its ramifications will be felt for months to come.

The Pound’s Rise: Pound Rockets To More Than Two Year High After Boe Rate Decision

The recent surge in the pound, pushing it to its highest level in over two years, has caught the attention of market analysts and investors alike. This move signifies a shift in sentiment towards the UK economy, reflecting a combination of factors, including the Bank of England’s (BoE) interest rate decision and broader global economic trends.

The Pound’s Historical Performance

The pound has experienced a turbulent journey in recent years, marked by periods of both strength and weakness. Following the 2016 Brexit referendum, the currency faced significant depreciation, plummeting to a multi-year low against the US dollar in 2020. This decline was attributed to a combination of factors, including uncertainty surrounding the UK’s future relationship with the European Union, concerns about the impact of Brexit on the economy, and the global economic slowdown triggered by the COVID-19 pandemic.

The pound rocketed to a two-year high after the Bank of England raised interest rates, signaling a vote of confidence in the UK economy. It’s not just the markets that are buzzing with excitement; sports fans are too, with the news that simply undeniable Indiana Fever star Caitlin Clark covers slam 252.

The UK’s economic resilience, coupled with exciting sports moments like this, makes for a positive outlook for the future.

Factors Contributing to the Pound’s Weakness

The pound’s weakness in the past can be attributed to several factors, including:

- Brexit Uncertainty:The prolonged negotiations surrounding the UK’s exit from the EU created significant uncertainty and volatility in the currency markets. Investors were wary of the potential economic and political consequences of Brexit, leading to a sell-off of the pound.

- Economic Slowdown:The global economic slowdown caused by the COVID-19 pandemic further dampened investor sentiment towards the UK economy. The pandemic led to widespread lockdowns, disruptions in supply chains, and a decline in economic activity, impacting the pound’s value.

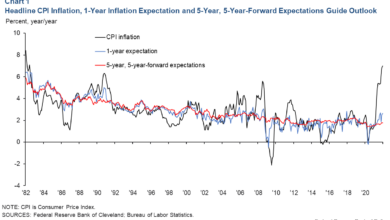

- Inflationary Pressures:Rising inflation in the UK, driven by factors such as supply chain disruptions and increased energy prices, eroded the purchasing power of the pound and put pressure on the BoE to raise interest rates.

Significance of the Two-Year High, Pound rockets to more than two year high after boe rate decision

The recent surge in the pound, pushing it to a two-year high, is significant for several reasons:

- BoE Rate Hike:The BoE’s decision to raise interest rates, in line with expectations, has boosted investor confidence in the UK economy. Higher interest rates make the pound more attractive to foreign investors, as they offer a higher return on investment.

- Improved Economic Outlook:Despite ongoing challenges, the UK economy is showing signs of recovery. The services sector, which accounts for a significant portion of the UK economy, has shown resilience in recent months, contributing to the pound’s rise.

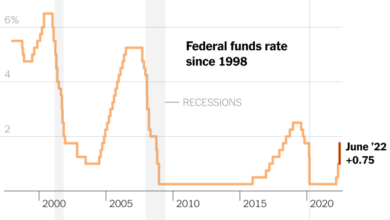

- Global Economic Trends:The recent strengthening of the US dollar, driven by the Federal Reserve’s aggressive rate hikes, has also indirectly benefited the pound. The US dollar’s strength has made the pound more competitive against other currencies, leading to an increase in demand.

The Bank of England’s Rate Decision

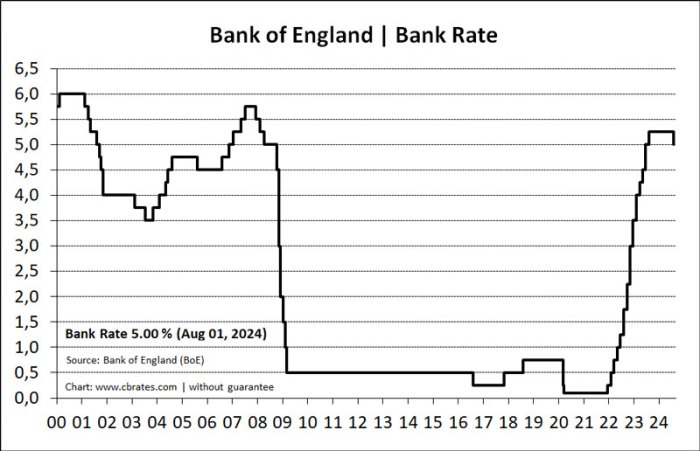

The Bank of England’s Monetary Policy Committee (MPC) made a significant decision on interest rates, raising them by 0.5 percentage points to 5.0%, marking the 14th consecutive increase since December 2021. This decision reflects the MPC’s ongoing efforts to combat stubbornly high inflation, which has been a persistent challenge for the UK economy.

Rationale for the Decision

The MPC’s decision to raise interest rates is primarily driven by the persistent pressure of inflation. The Consumer Prices Index (CPI) inflation, which measures the change in the prices of goods and services consumed by households, remained at 8.7% in May 2023, significantly above the Bank’s 2% target.

The pound rocketing to a two-year high after the Bank of England’s rate decision is a fascinating case study in the interplay of monetary policy and market sentiment. To understand the underlying forces at play, it’s helpful to consider the broader context of neoliberalism, a set of economic policies that prioritize free markets and deregulation.

This primer on neoliberalism can help shed light on how these principles shape global economic trends, including the recent surge in the pound. The BoE’s decision, while driven by inflation concerns, likely also reflects a commitment to these neoliberal principles, which may have contributed to the pound’s bullish performance.

The MPC’s decision aims to curb inflation by making borrowing more expensive, thereby discouraging spending and cooling down demand in the economy.

Potential Impact on the Economy

The impact of the rate decision on the UK economy is likely to be multifaceted. While higher interest rates can help to curb inflation, they also come with potential downsides. Increased borrowing costs can make it more challenging for businesses to invest and expand, potentially leading to slower economic growth.

The pound soared to its highest level in over two years after the Bank of England raised interest rates, a move that signaled confidence in the UK economy. It’s interesting to contrast this with the news that Congress has defunded the controversial Total Information Program , a move that suggests a shift in priorities and a potential decrease in government spending.

The pound’s surge highlights the impact of monetary policy on currency values, while the defunding of the program illustrates the political complexities that can influence economic decisions.

Higher mortgage rates can also put pressure on household budgets, leading to reduced consumer spending. The MPC will be carefully monitoring the impact of the rate decision on the economy and is prepared to adjust its policy stance if necessary.

Comparison to Previous Rate Decisions

This rate decision marks the 14th consecutive increase since December 2021, demonstrating the MPC’s persistent commitment to tackling inflation. However, the magnitude of the increase, 0.5 percentage points, is slightly smaller than the 0.75 percentage point increase seen in the previous two decisions.

This suggests that the MPC may be becoming more cautious in its approach, potentially indicating a recognition of the growing risks of a recession.

Market Reactions and Impact

The Bank of England’s decision to raise interest rates sent shockwaves through the financial markets. The pound sterling surged to its highest level in over two years, indicating investor confidence in the UK economy. This move had a ripple effect across various sectors, impacting businesses and consumers alike.

Impact on Different Sectors

The rate hike is expected to have a mixed impact on different sectors of the economy.

- Export-oriented businessesare likely to benefit from the stronger pound, as their products become more competitive in global markets. For example, manufacturers of cars and pharmaceuticals may see an increase in demand from overseas buyers.

- Import-dependent businesses, on the other hand, could face higher costs due to the strengthening pound, as imported goods become more expensive. This could lead to price increases for consumers, impacting businesses in sectors like retail and tourism.

- The housing marketcould see a cooling effect as higher interest rates make mortgages more expensive, potentially leading to a slowdown in house price growth. However, the impact on the housing market is complex and depends on factors such as the overall economic outlook and supply and demand dynamics.

- The financial services sectoris expected to benefit from the increased demand for lending and investment products, as businesses and individuals seek to capitalize on the stronger pound and higher interest rates.

Future Outlook and Implications

The recent surge in the pound, fueled by the Bank of England’s rate decision, has significant implications for the UK economy. While the immediate impact may be positive, the long-term effects are multifaceted and require careful consideration.

Impact on UK Economy

The pound’s rise can have a mixed impact on the UK economy. On the one hand, a stronger pound makes imports cheaper, potentially reducing inflation and increasing consumer spending power. This could boost economic activity and benefit businesses that rely on imported goods.

On the other hand, a strong pound can make UK exports more expensive, potentially harming businesses that rely on international sales. This could lead to a decrease in exports and impact economic growth. Additionally, a stronger pound can attract foreign investment, potentially boosting the UK’s economic performance.

Factors Influencing the Pound’s Future Trajectory

Several factors will influence the pound’s future trajectory, including:

- The Bank of England’s Monetary Policy:The Bank of England’s future rate decisions will play a crucial role in shaping the pound’s direction. If the Bank continues to raise interest rates, the pound could strengthen further, attracting investors seeking higher returns. Conversely, a pause or reversal in rate hikes could weaken the pound.

- UK Economic Performance:The UK’s economic performance, including growth, inflation, and unemployment, will also influence the pound. Strong economic data could boost investor confidence and strengthen the pound, while weak economic data could lead to a decline.

- Global Economic Conditions:Global economic conditions, such as growth prospects, interest rate policies in other major economies, and geopolitical events, can impact the pound. For instance, a global economic slowdown could lead to a weakening of the pound as investors seek safe haven currencies.

- Brexit Negotiations:The ongoing negotiations between the UK and the EU regarding trade and other post-Brexit issues could also influence the pound. Positive developments in these negotiations could strengthen the pound, while negative developments could weaken it.

Potential Risks and Opportunities

The current situation presents both risks and opportunities for the UK economy:

- Risks:

- A sharp appreciation of the pound could negatively impact export-oriented businesses, leading to job losses and reduced economic activity.

- The Bank of England’s aggressive rate hikes could stifle economic growth and lead to a recession.

- Geopolitical instability and global economic uncertainty could create volatility in the currency markets, potentially leading to a sharp depreciation of the pound.

- Opportunities:

- A stronger pound could attract foreign investment, boosting economic growth and creating jobs.

- Lower inflation due to cheaper imports could increase consumer spending and boost economic activity.

- The UK could benefit from increased trade with other countries as a result of a more competitive currency.