Free Economics Curriculum: Understanding Inflation and Recession

Poptential free economics curriculum adds content to explain todays inflation recession woes – Free Economics Curriculum: Understanding Inflation and Recession sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. In today’s world, it’s hard to escape the headlines about inflation and recession.

These economic concepts, often shrouded in jargon, directly impact our daily lives. This curriculum aims to demystify these terms, providing a comprehensive understanding of their causes, consequences, and potential solutions.

We’ll explore how inflation affects the purchasing power of individuals, the challenges businesses face during periods of high inflation and recession, and how different income groups are impacted. We’ll delve into the role of government policy in addressing these economic woes, examining the tools available to combat inflation and recession.

This curriculum will also explore key economic principles and concepts, such as supply and demand, interest rates, and government spending, providing a solid foundation for understanding the complexities of inflation and recession. Finally, we’ll offer practical strategies for individuals and businesses to navigate these economic challenges, emphasizing the importance of financial literacy and budgeting.

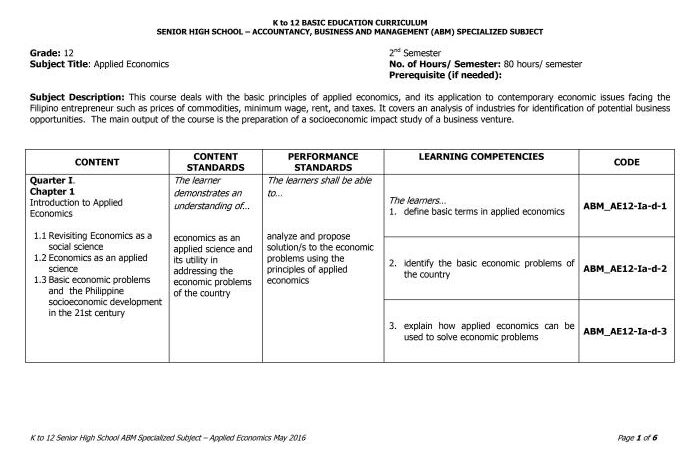

Economic Principles and Concepts Relevant to Inflation and Recession: Poptential Free Economics Curriculum Adds Content To Explain Todays Inflation Recession Woes

This section delves into fundamental economic principles and concepts that are crucial for understanding inflation and recession. We will explore how supply and demand dynamics influence price levels, the role of interest rates in managing economic fluctuations, and the impact of government policies on economic activity.

Supply and Demand and Inflation

The interplay of supply and demand is a cornerstone of economics and plays a pivotal role in determining price levels. When demand for goods and services exceeds supply, prices tend to rise, leading to inflation. Conversely, when supply outpaces demand, prices tend to fall, potentially leading to deflation.For example, consider the global oil market.

If there is a disruption in oil production, such as a geopolitical conflict or a natural disaster, the supply of oil decreases. At the same time, demand for oil remains relatively stable, leading to higher oil prices. This increase in oil prices can then cascade through the economy, impacting the prices of various goods and services that rely on oil as an input.

Interest Rates and Economic Management, Poptential free economics curriculum adds content to explain todays inflation recession woes

Central banks, such as the Federal Reserve in the United States, utilize interest rates as a key tool to manage inflation and recessionary pressures. By adjusting interest rates, central banks aim to influence borrowing costs, investment levels, and overall economic activity.When inflation is high, central banks typically raise interest rates.

This makes borrowing more expensive for businesses and consumers, discouraging spending and potentially slowing down economic growth. Conversely, during periods of recession, central banks may lower interest rates to encourage borrowing and stimulate economic activity.

Government Spending and Taxation

Government spending and taxation policies can significantly influence economic activity. Increased government spending can stimulate demand and boost economic growth, especially during recessions. For example, infrastructure projects, social programs, and tax cuts can inject money into the economy and create jobs.However, excessive government spending can also lead to inflation if it is not matched by increased productivity or if it crowds out private investment.

Taxation, on the other hand, can have both stimulative and restrictive effects on the economy. Tax cuts can increase disposable income and encourage spending, while tax increases can reduce disposable income and potentially dampen economic activity.

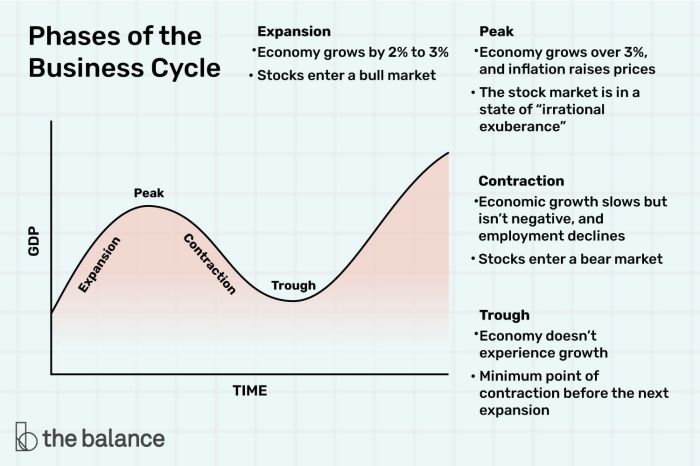

Key Economic Indicators

Several economic indicators are closely monitored to assess inflation and recessionary pressures. These indicators provide insights into the health of the economy and help policymakers make informed decisions.

| Indicator | Description |

|---|---|

| Consumer Price Index (CPI) | Measures the average change over time in the prices paid by urban consumers for a basket of consumer goods and services. |

| Producer Price Index (PPI) | Measures the average change over time in the selling prices received by domestic producers for their output. |

| Gross Domestic Product (GDP) | Represents the total value of goods and services produced within a country’s borders in a given period. |

| Unemployment Rate | The percentage of the labor force that is unemployed and actively seeking employment. |

| Inflation Rate | The percentage change in the price level over a specific period. |

| Interest Rates | The cost of borrowing money. |

Strategies for Individuals and Businesses to Navigate Inflation and Recession

Navigating periods of high inflation and recession can be challenging, but with careful planning and strategic adjustments, individuals and businesses can mitigate the negative impacts and emerge stronger. This section provides practical tips and strategies for managing finances, adapting operations, and fostering financial literacy to navigate these economic headwinds.

Strategies for Individuals

Understanding personal finances and implementing effective budgeting strategies are crucial during times of economic uncertainty. These strategies help individuals manage their spending, prioritize essential expenses, and build financial resilience.

- Create and Stick to a Budget:Tracking income and expenses helps identify areas where spending can be reduced or adjusted. By prioritizing essential needs and reducing discretionary spending, individuals can stretch their budgets further.

- Explore Cost-Saving Opportunities:Finding ways to reduce daily expenses can significantly impact overall spending. This includes negotiating bills, exploring alternative transportation options, and taking advantage of discounts and promotions.

- Build an Emergency Fund:Having a readily accessible emergency fund provides a safety net for unexpected expenses or income disruptions. Aim to save at least 3-6 months of living expenses in a high-yield savings account.

- Review and Refinance Debt:High-interest debt can strain finances during a recession. Exploring options like debt consolidation or refinancing can lower monthly payments and free up cash flow.

- Diversify Income Sources:Generating multiple income streams provides financial security during economic downturns. Consider exploring part-time work, freelancing, or investing in passive income opportunities.

Strategies for Businesses

Businesses face unique challenges during recessions, including reduced demand, supply chain disruptions, and increased costs. Implementing strategic adjustments can help businesses weather the storm and position themselves for growth in the future.

- Optimize Operations and Reduce Costs:Streamlining processes, automating tasks, and negotiating with suppliers can help reduce operating costs. Implementing energy efficiency measures and exploring alternative supply chain options can also contribute to cost savings.

- Focus on Core Products and Services:During recessions, businesses should prioritize their core products and services that generate the most revenue. This allows for efficient allocation of resources and avoids unnecessary expenditures.

- Explore New Market Opportunities:Identifying new markets or expanding into existing ones can help businesses diversify their revenue streams and mitigate the impact of a recession. This can involve developing new products or services or targeting new customer segments.

- Enhance Customer Service and Retention:Retaining existing customers is crucial during economic downturns. Businesses should prioritize excellent customer service, loyalty programs, and personalized communication to build stronger relationships and retain customers.

- Embrace Technology and Innovation:Investing in technology and innovation can help businesses streamline operations, improve efficiency, and enhance customer experiences. This can include adopting new software, automating tasks, or developing innovative products or services.

Financial Literacy and Budgeting

Financial literacy is essential for navigating economic downturns. Understanding personal finances, budgeting effectively, and making informed financial decisions can help individuals and businesses weather economic storms.

- Develop a Budget:Creating and sticking to a budget is a fundamental step in managing finances. It helps individuals track income and expenses, identify areas for savings, and prioritize essential needs.

- Learn about Investing:Understanding basic investment concepts can help individuals grow their wealth over time. Investing in diversified portfolios can provide returns and mitigate risks associated with market fluctuations.

- Seek Financial Advice:Consulting with a financial advisor can provide personalized guidance and support in managing finances, especially during challenging economic periods.

Successful Strategies from Past Recessions

History provides valuable insights into successful strategies employed by individuals and businesses during past recessions.

- During the 2008 Financial Crisis,many individuals focused on reducing debt, building emergency funds, and diversifying income sources. Businesses adapted by cutting costs, exploring new markets, and focusing on customer retention.

- The 1980s recessionsaw businesses prioritize efficiency and innovation, while individuals sought out part-time work and relied on their savings.

I’ve been thinking a lot about how a free economics curriculum could help people understand the current economic climate. It’s not just about inflation and recession, but also the global factors at play. For example, what’s stalling China’s stock market recovery according to KraneShares CIO has huge implications for the world economy.

Understanding these global trends is crucial to grasping the full picture of today’s economic woes and finding solutions.

While I’m trying to wrap my head around the complexities of inflation and recession, it’s nice to escape with some good old-fashioned sports news. The US Open is heating up with Frances Tiafoe and Taylor Fritz advancing to the semifinals, while the 49ers are getting another star back – all great news to distract from the economic woes! Check out the latest on the US Open and NFL.

But back to economics, I’m hoping that potential free curriculum will shed some light on these challenging times.

It’s fascinating how a free economics curriculum could help us understand the complexities of today’s inflation and recession. Maybe it could even shed light on the nostalgic trend of ’90s fashion that’s making a comeback, like Old Navy’s recent “94 Reissue” collection, which features a limited-edition drop of iconic ’90s styles.

Perhaps these trends are linked, showing how economic shifts can influence cultural preferences and consumer behavior.