Inflation-Proof Bond Paying 9.62%: How to Buy It

Perspective this inflation proof bond is paying 9 62 heres how to buy it – Inflation-Proof Bond Paying 9.62%: How to Buy It – In a world grappling with rising inflation, finding investments that can weather the storm and even thrive is a top priority. Enter inflation-proof bonds, offering a compelling 9.62% yield and a unique approach to safeguarding your wealth.

But what are these bonds, how do they work, and how can you get your hands on one? Let’s dive in and explore this exciting opportunity.

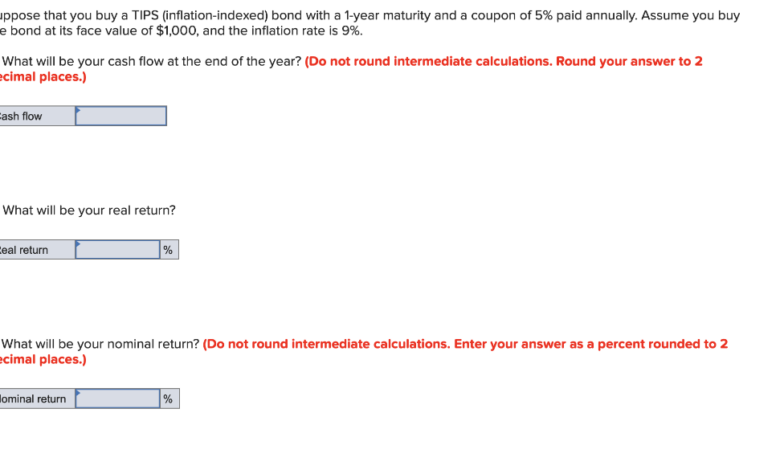

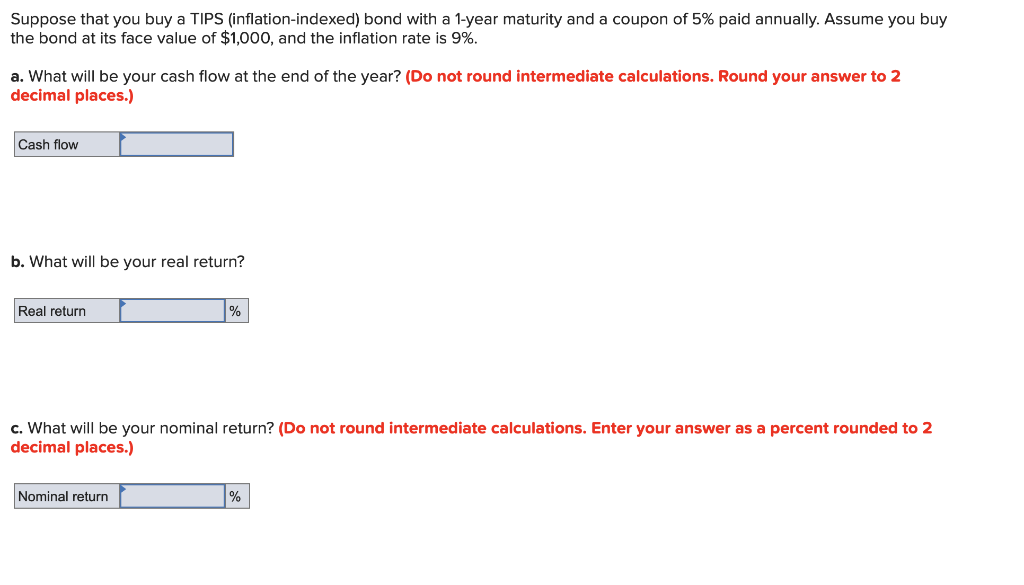

Inflation-proof bonds, also known as inflation-indexed bonds or TIPS (Treasury Inflation-Protected Securities), are designed to protect your investment from the eroding effects of inflation. Unlike traditional bonds, whose fixed interest payments lose value during inflationary periods, inflation-proof bonds adjust their principal value to keep pace with rising prices.

This means that your investment maintains its purchasing power, ensuring that your returns aren’t diminished by inflation.

Introduction to Inflation-Proof Bonds

Inflation-proof bonds, also known as inflation-indexed bonds or Treasury Inflation-Protected Securities (TIPS), are a type of fixed-income security designed to protect investors from the eroding effects of inflation. They offer a return that is adjusted based on the rate of inflation, ensuring that the real value of your investment remains intact.Inflation is the rate at which the prices of goods and services increase over time.

When inflation rises, the purchasing power of your money decreases. This means that you can buy fewer goods and services with the same amount of money. For example, if the inflation rate is 3%, a product that costs $100 today will cost $103 next year.

This erosion of purchasing power can significantly impact the value of your investments, particularly fixed-income investments like traditional bonds.Investing in inflation-proof bonds can help mitigate the risks associated with inflation. These bonds offer a return that is linked to inflation, meaning that their value increases along with the prices of goods and services.

This helps to preserve the real value of your investment, ensuring that you can still buy the same amount of goods and services in the future, even if inflation rises.

Benefits of Investing in Inflation-Proof Bonds

Inflation-proof bonds offer several advantages over traditional bonds, making them an attractive investment option for investors seeking to protect their portfolios from inflation.

- Protection from Inflation:Inflation-proof bonds provide a hedge against inflation, as their principal value is adjusted based on the rate of inflation. This helps to preserve the real value of your investment, ensuring that your purchasing power is not eroded by rising prices.

- Predictable Income:Inflation-proof bonds typically pay a fixed interest rate, providing investors with predictable income streams. This can be particularly beneficial for investors who rely on regular income from their investments.

- Reduced Interest Rate Risk:Unlike traditional bonds, inflation-proof bonds are less susceptible to interest rate risk. This is because their interest payments are adjusted based on inflation, so changes in interest rates have a smaller impact on their value.

The 9.62% Yield

A 9.62% yield on an inflation-proof bond is a truly remarkable figure, especially in the current market climate. This kind of return is unheard of in traditional fixed-income investments, where yields have been hovering near historic lows for years. This high yield is a testament to the unique structure of this bond and the current market conditions that make it so attractive to investors.

Factors Contributing to the High Yield

This high yield is a result of several key factors:* Inflation Protection:The bond’s principal and interest payments are linked to an inflation index, ensuring that your investment keeps pace with rising prices. This protection is particularly valuable in an environment of high and persistent inflation.

Long Maturity

The bond has a long maturity date, meaning that investors are locking in the high yield for an extended period. This longer timeframe allows the bond to generate a significant return over time.

Strong Issuer

The bond is issued by a financially sound and reputable entity, providing investors with a high degree of confidence in the bond’s ability to meet its obligations.

Market Demand

While we’re on the topic of financial news, it’s important to remember that investing isn’t just about finding the best returns, it’s also about managing risk. A recent allergy alert from Sweet Lorens Inc. regarding undeclared gluten in their products is a reminder that even seemingly unrelated events can impact our lives.

So, while that inflation-proof bond might be tempting, don’t forget to diversify your portfolio and stay informed about potential risks.

The current market environment is characterized by high demand for inflation-protected investments. This strong demand is driving up the prices of these bonds, leading to lower yields for new issues. The 9.62% yield is a reflection of the issuer’s ability to attract investors despite the current market conditions.

Comparison to Other Investment Options

The 9.62% yield on this inflation-proof bond compares favorably to other investment options available in the market:* Traditional Bonds:Traditional bonds, such as government bonds and corporate bonds, offer significantly lower yields than this inflation-proof bond. These bonds do not offer inflation protection, meaning that their returns can be eroded by rising prices.

Equities

Equities, such as stocks, offer the potential for higher returns than bonds. However, they also carry a higher level of risk. The 9.62% yield on this inflation-proof bond provides a more stable and predictable return than equities, making it an attractive option for risk-averse investors.

Real Estate

Real estate can be a good investment, but it can also be illiquid and require significant capital. The 9.62% yield on this inflation-proof bond offers a more liquid and accessible alternative to real estate.

While we’re on the topic of financial security, it’s worth noting the recent shakeup at the University of Michigan, with the appointment of Santa Ono as the new president, following the ouster of Mark Schlissel. u of michigan picks santa ono as new president months after ouster of mark schlissel This kind of change can impact the institution’s long-term financial stability, making it even more crucial to consider securing your own future with inflation-proof investments.

That’s why I’m still excited about that 9.62% bond I mentioned earlier, and I’m happy to share how to get your hands on it!

How Inflation-Proof Bonds Work

Inflation-proof bonds, also known as inflation-linked bonds or index-linked bonds, are designed to protect investors from the eroding effects of inflation. These bonds offer a return that adjusts with inflation, ensuring that the purchasing power of your investment remains intact over time.

Inflation-proof bonds work by linking their principal value and interest payments to a specific inflation index. This means that as the cost of living rises, the bond’s value and interest payments increase proportionally, effectively safeguarding your investment from inflation’s impact.

Types of Inflation-Proof Bonds, Perspective this inflation proof bond is paying 9 62 heres how to buy it

Inflation-proof bonds come in various forms, each with its unique characteristics and features. Here are some common types:

- Treasury Inflation-Protected Securities (TIPS): Issued by the U.S. Treasury, TIPS are a popular type of inflation-proof bond. Their principal value adjusts with the Consumer Price Index (CPI), ensuring that the bond’s value keeps pace with inflation.

- Index-Linked Gilts: These bonds are issued by the UK government and are linked to the Retail Prices Index (RPI), a measure of inflation in the UK. Like TIPS, their principal value and interest payments adjust with inflation.

- Inflation-Linked Corporate Bonds: These bonds are issued by corporations and are designed to protect investors from inflation. They typically link their principal value and interest payments to a specific inflation index, similar to government-issued inflation-proof bonds.

The Process of Buying Inflation-Proof Bonds

Investing in inflation-proof bonds can be a strategic move to protect your portfolio against rising prices. Understanding the process of buying these bonds is crucial to ensure a smooth and successful investment experience.The process of purchasing inflation-proof bonds involves several steps, including choosing a reputable platform or intermediary, carefully considering your investment strategy, and understanding the specific terms of the bond.

Choosing a Platform or Intermediary

The platform or intermediary you choose will play a significant role in your bond buying experience. You need to select a reputable and reliable platform that offers a transparent and secure environment for your investments.

- Online Brokerage Platforms:Many online brokerage platforms offer a wide selection of inflation-proof bonds, providing access to a diverse range of investment options. These platforms often have user-friendly interfaces and tools for research and analysis, enabling you to make informed decisions.

- Financial Advisors:Financial advisors can provide personalized guidance and tailored investment recommendations based on your individual financial goals and risk tolerance. They can help you navigate the complexities of inflation-proof bonds and identify the most suitable options for your portfolio.

- Banks and Credit Unions:Some banks and credit unions offer inflation-proof bonds as part of their investment services. They may provide access to a limited selection of bonds but offer a level of familiarity and convenience for existing customers.

Investment Strategy Considerations

Choosing the right investment strategy is crucial for maximizing your returns and mitigating potential risks. You should consider several factors when deciding how to invest in inflation-proof bonds.

- Investment Horizon:The length of time you plan to hold the bonds is a key factor. Longer-term investments may offer higher potential returns but also carry more risk. Consider your investment horizon and choose bonds that align with your time frame.

- Risk Tolerance:Your comfort level with risk is essential. Inflation-proof bonds generally offer lower returns than traditional bonds, but they provide protection against inflation. Determine your risk tolerance and choose bonds that match your comfort level.

- Diversification:Diversifying your investment portfolio across different asset classes, including inflation-proof bonds, can help reduce overall risk. Consider incorporating inflation-proof bonds into your portfolio alongside other investments like stocks and real estate.

Understanding the Terms of the Bond

Before purchasing any inflation-proof bond, it is crucial to carefully review the terms and conditions. This will ensure you understand the bond’s specific features, including the interest rate, maturity date, and any associated fees.

- Interest Rate:The interest rate determines the amount of interest you will earn on your investment. Inflation-proof bonds typically offer a fixed interest rate that adjusts with inflation, providing protection against rising prices.

- Maturity Date:The maturity date is the date when the bond will reach its full value and you will receive your principal back. Consider your investment horizon and choose bonds with maturity dates that align with your financial goals.

- Fees:Some bonds may have associated fees, such as brokerage fees or transaction fees. Understand these fees before making your investment decision.

Risks and Considerations: Perspective This Inflation Proof Bond Is Paying 9 62 Heres How To Buy It

While inflation-proof bonds offer a compelling opportunity to protect your savings from inflation, it’s crucial to understand the potential risks and factors that could impact their performance. By acknowledging these risks and implementing appropriate strategies, you can make informed investment decisions and potentially maximize your returns.

Potential Risks

Understanding the potential risks associated with inflation-proof bonds is crucial for making informed investment decisions. Here are some key considerations:

- Interest Rate Risk:Like traditional bonds, inflation-proof bonds are sensitive to interest rate fluctuations. If interest rates rise, the value of existing bonds may decline, as investors demand higher yields for new bonds. This risk is mitigated by the inflation-linked feature, which adjusts the bond’s principal and interest payments to keep pace with inflation.

However, the bond’s yield may not keep up with rising interest rates, potentially leading to a loss in value.

- Inflation Uncertainty:The effectiveness of inflation-proof bonds hinges on the accuracy of inflation forecasts. If inflation turns out to be higher than expected, the bond’s principal and interest payments may not fully compensate for the erosion of purchasing power. Conversely, if inflation is lower than anticipated, the bond’s return may be limited.

While exploring ways to protect my savings from inflation, I stumbled upon a bond offering a hefty 9.62% return. It’s a tempting prospect, especially with all the economic uncertainty lately. But even with these financial considerations, I can’t help but take a moment to remember culinary icons like Diana Kennedy, whose influence on the food world continues to inspire generations the food world remembers the one and only diana kennedy.

Perhaps a balanced portfolio, combining financial investments with a healthy dose of cultural appreciation, is the best way to navigate these uncertain times.

- Credit Risk:Inflation-proof bonds issued by governments or corporations carry a credit risk, which refers to the possibility of the issuer defaulting on its obligations. This risk is generally lower for government-issued bonds, but it’s still a factor to consider, particularly for corporate bonds.

- Liquidity Risk:Inflation-proof bonds may have lower liquidity than traditional bonds, meaning they may be harder to sell quickly at a fair price. This is especially true for bonds with longer maturities or those issued by smaller companies.

Strategies for Mitigating Risks

To mitigate the risks associated with inflation-proof bonds, consider the following strategies:

- Diversification:Diversifying your investment portfolio across different asset classes, including stocks, real estate, and other fixed-income securities, can help reduce the overall risk.

- Shorten Maturities:Investing in bonds with shorter maturities can minimize interest rate risk, as they are less sensitive to interest rate changes.

- Focus on High-Quality Issuers:Investing in bonds issued by governments or reputable corporations with strong credit ratings can help reduce credit risk.

- Consider Inflation-Linked ETFs:Exchange-traded funds (ETFs) that track inflation-linked bond indices offer diversification and liquidity benefits.

- Consult with a Financial Advisor:Seeking professional financial advice can help you develop a personalized investment strategy that aligns with your risk tolerance and financial goals.

Investment Strategies and Recommendations

Investing in inflation-proof bonds can be a strategic move to protect your portfolio against rising prices and generate steady returns. This section will explore various investment strategies and recommendations to help you incorporate these bonds into your portfolio effectively.

Sample Investment Portfolio

A well-balanced portfolio should incorporate a mix of assets to manage risk and maximize returns. Here’s a sample portfolio incorporating inflation-proof bonds:

- Inflation-Proof Bonds:20-30% of the portfolio. These bonds provide a hedge against inflation and offer a predictable stream of income.

- Equities:40-50% of the portfolio. Stocks offer the potential for higher returns but also carry more risk.

- Real Estate:10-20% of the portfolio. Real estate can provide diversification and potential appreciation, but it’s illiquid and can be affected by local market conditions.

- Commodities:5-10% of the portfolio. Commodities like gold and oil can serve as a hedge against inflation and economic uncertainty.

Strategies for Optimizing Investment Returns and Managing Risk

- Diversification:Spreading your investments across different asset classes helps reduce risk and improve overall portfolio performance.

- Rebalancing:Regularly adjusting your portfolio to maintain your desired asset allocation helps ensure you’re not overly exposed to any single asset class.

- Dollar-Cost Averaging:Investing a fixed amount of money at regular intervals, regardless of market fluctuations, can help reduce the impact of volatility.

- Long-Term Perspective:Inflation-proof bonds are designed for long-term investment. Avoid short-term trading and focus on holding these bonds for several years to benefit from their inflation protection.

Recommendations for Investors with Different Risk Tolerances and Goals

- Conservative Investors:These investors prioritize capital preservation and low risk. They can allocate a larger portion of their portfolio to inflation-proof bonds and other low-risk investments like high-quality corporate bonds.

- Moderate Investors:These investors seek a balance between risk and return. They can allocate a moderate portion of their portfolio to inflation-proof bonds, equities, and real estate.

- Aggressive Investors:These investors are willing to take on more risk for the potential of higher returns. They can allocate a larger portion of their portfolio to equities and other high-growth assets.

Conclusion

Inflation-proof bonds, also known as Treasury Inflation-Protected Securities (TIPS), offer a compelling solution for investors seeking to protect their investments from the eroding effects of inflation. By adjusting their principal value to reflect changes in the Consumer Price Index (CPI), TIPS ensure that your investment’s purchasing power remains intact, even in times of rising prices.The attractive 9.62% yield on these bonds represents a significant opportunity to earn a substantial return on your investment while mitigating inflation risk.

However, it is crucial to understand the intricacies of these instruments before making any investment decisions.

Key Takeaways

The key takeaways from our exploration of inflation-proof bonds include:

- Inflation protection:TIPS provide a hedge against inflation by adjusting their principal value based on the CPI.

- Potential for higher returns:The 9.62% yield offers the potential for substantial returns, especially in an inflationary environment.

- Government-backed security:TIPS are backed by the full faith and credit of the U.S. government, providing a level of security and stability.

- Long-term investment:TIPS are generally considered long-term investments, as their principal value is adjusted over time.

- Understanding the risks:While TIPS offer significant benefits, it’s essential to understand the potential risks associated with them, such as interest rate risk and potential for lower returns in a deflationary environment.

Further Research and Exploration

This discussion has provided a foundational understanding of inflation-proof bonds. However, it is essential to conduct further research and explore various aspects of these instruments before making any investment decisions.

- Explore different TIPS maturities:TIPS are available with varying maturities, ranging from short-term to long-term. Consider your investment horizon and risk tolerance when selecting a maturity.

- Compare TIPS to other investment options:Evaluate TIPS against other investment options, such as traditional bonds, stocks, and real estate, to determine the best fit for your portfolio.

- Consult with a financial advisor:Seek guidance from a qualified financial advisor who can assess your individual circumstances and provide personalized recommendations.

Last Point

The 9.62% yield offered by these inflation-proof bonds is a compelling incentive for investors seeking to protect their capital and potentially grow their wealth. While the market is always subject to fluctuations, the potential benefits of inflation-proof bonds are significant.

By understanding the mechanisms behind these bonds and navigating the investment process thoughtfully, you can position yourself to capitalize on this unique opportunity and build a more resilient investment portfolio.