Private VAT Hike Pushes Parents of SEND Pupils to the Breaking Point

Parents of send pupils at breaking point over private vat hike – Private VAT Hike Pushes Parents of SEND Pupils to the Breaking Point, a title that starkly reflects the current anxieties of many families. The recent increase in Value Added Tax (VAT) on private school fees has sparked a firestorm of discontent among parents, particularly those with children with special educational needs (SEND).

This financial burden is not only a significant strain on household budgets but also raises serious concerns about accessibility and inclusivity in education.

The VAT hike directly translates to higher school fees, pushing many families to their financial limits. Parents are grappling with the added expense, feeling overwhelmed by the pressure to provide their children with a quality education. This financial strain can lead to immense stress and anxiety, impacting the well-being of both parents and children.

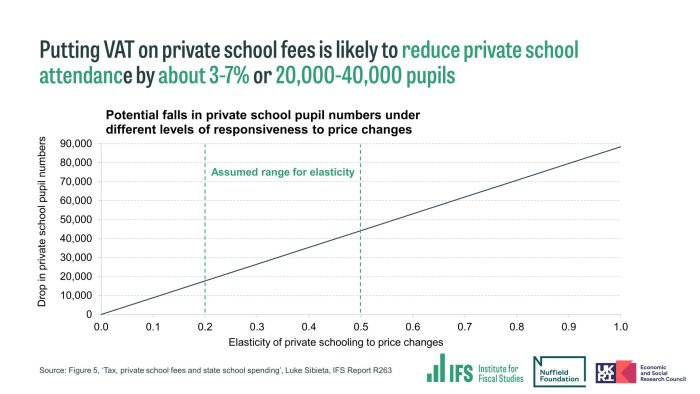

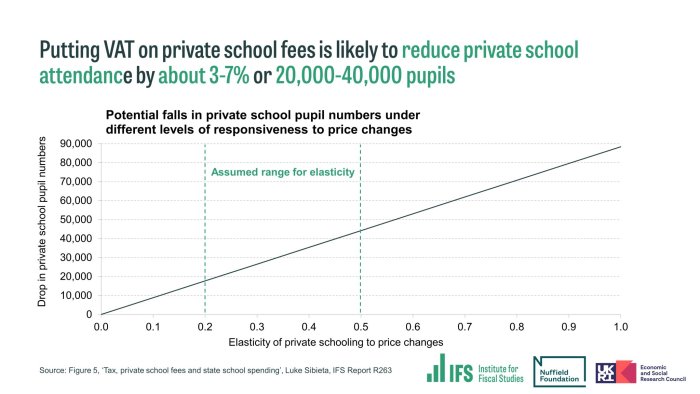

The increased cost of private education may also force families to reconsider their options, potentially leading to a decline in enrollment at private schools. This, in turn, could impact the financial sustainability of these institutions and their ability to offer specialized support for SEND students.

The Impact of the VAT Hike on Private School Fees: Parents Of Send Pupils At Breaking Point Over Private Vat Hike

The recent increase in Value-Added Tax (VAT) has had a significant impact on the cost of private education, placing a heavy financial burden on parents. This increase has directly affected private school fees, making it more expensive for families to access quality education for their children.

The Financial Burden on Parents

The VAT hike has directly translated into higher school fees, as private schools are required to charge VAT on their services. This increase has significantly impacted the financial strain on parents, particularly those already struggling to afford private education. The added expense can be a substantial burden, forcing families to make difficult financial decisions and potentially jeopardizing their ability to provide their children with the education they desire.

Accessibility to Private Education, Parents of send pupils at breaking point over private vat hike

The increase in private school fees due to the VAT hike has raised concerns about the accessibility of private education for families. The higher fees may make it challenging for families with limited financial resources to afford private education, potentially widening the gap in educational opportunities between different socioeconomic groups.

For example, a family previously paying £10,000 per year for private education may now face an additional £1,000 in fees due to the VAT hike, representing a 10% increase in their overall educational expenses. This added financial burden can significantly impact their ability to afford private education, especially for families already struggling to make ends meet.

Parental Concerns and Frustration

The recent VAT hike on private school fees has ignited a firestorm of discontent among parents, raising serious concerns about the affordability and accessibility of quality education for their children. The financial burden of this increase has created a wave of anxiety and frustration, leaving many families grappling with difficult choices and questioning the future of their children’s education.

The Impact of Increased Fees on Family Finances

The sharp increase in private school fees has placed a significant strain on family budgets. Parents are now faced with the daunting prospect of having to allocate a larger portion of their income to education, potentially impacting their ability to meet other essential expenses.

The rise in fees has forced many families to re-evaluate their financial priorities, potentially leading to cutbacks in other areas of their spending, such as leisure activities, travel, or savings for retirement.

This financial pressure can lead to stress and anxiety, as parents grapple with the challenge of balancing their financial obligations with their desire to provide the best possible education for their children.

The Emotional Toll on Parents

Beyond the financial strain, the VAT hike has also taken an emotional toll on parents. The feeling of being priced out of quality education can be deeply disheartening, especially for families who have invested significant resources in their children’s schooling.

Many parents feel a sense of betrayal and disappointment, as they grapple with the perception that the government is not prioritizing education or supporting families who are striving to provide their children with a quality education.

The fear of having to make difficult choices, such as transferring their children to less desirable schools or withdrawing them from extracurricular activities, can lead to feelings of guilt and inadequacy.

The Potential for Increased Stress and Pressure

The financial pressure associated with the VAT hike can also contribute to increased stress and pressure on parents. This can manifest in various ways, such as:

- Increased arguments and tension within the familyas parents struggle to manage their finances and meet their children’s needs.

- Difficulty concentrating at workas parents are preoccupied with their financial worries.

- Deterioration in mental and physical healthas parents experience stress-related symptoms like anxiety, insomnia, and fatigue.

In extreme cases, the stress and pressure associated with the VAT hike can lead to feelings of hopelessness and despair, impacting the overall well-being of parents and their families.

The anger amongst parents of SEND pupils is palpable, with many feeling pushed to their limits by the recent private VAT hike. It’s a stark reminder that we need to prioritize the well-being of our most vulnerable children, a sentiment echoed by the united nations on development issues , who emphasize the importance of inclusive education for all.

This crisis highlights the urgent need for government intervention to alleviate the financial burden on families and ensure SEND pupils receive the support they deserve.

It’s hard to believe that while parents of SEND pupils are at their breaking point over the private VAT hike, a story about an Iranian agent warning us of an impending al-Qaeda attack has been making headlines. It just goes to show that even in the midst of domestic turmoil, the world is a complex and unpredictable place.

The struggles of SEND families, however, shouldn’t be overshadowed. They deserve our attention and support, especially as they navigate the added financial burden of this VAT increase.

The anger amongst parents of SEND pupils over the private VAT hike is palpable. It’s a stark reminder that sometimes, even when the system seems designed to help, it can inadvertently cause more harm. It’s like the situation at Guantanamo Bay, where guantanamo maybe none of them are terrorists – the very act of detainment, regardless of intent, can be deeply damaging.

Ultimately, the burden of these decisions falls on those who are already struggling, and that’s simply not fair.